Top three most successful Forex traders ever

When most people think of success, they think of the wealthy. They usually think of giant mansions, sprawling estates, private jets, and more money than any normal person would be able to spend. In this way, we can say that there are many successful people around the world. In fact, there were 1,1810 billionaires across the world in 2016, and around 15 million, millionaires. If we are using monetary value as a measurement of success, then we can safely say that these are the most successful people in the world.

In the trading world, most successful forex traders work behind the scenes and away from the limelight, quietly building their profits. For a select few however, their exploits have gotten them fame. These individuals have helped shaped the financial world and the trading industry with their trading and life philosophies and long careers of high financial performance. The top five of them, have gained this position through the incredible feats that they have accomplished in their careers, and the level of impact that they have had in the financial industry. The top forex traders in the world are a special few, because it is said that over 90% of forex traders fail. This means that the approximate percentage of successful forex traders is a mere 10%. The list of successful forex traders that we are about to discuss, however ,surpasses this group. These are the elite of Forex trading world.

George Soros

Taking the number 30 on Forbes’ Ranking of Billionaires across the globe, George Soros is perhaps the most most successful forex trader on the planet. Born on August 12, 1930 in Budapest, Hungary, he escaped the Hungarian Nazi occupation and fled to England in 1947 during the second World War. There, he attended the London School of Economics after which he began his business career by working at merchant banks, before forming his first hedge fund, Double Eagle.

Taking the number 30 on Forbes’ Ranking of Billionaires across the globe, George Soros is perhaps the most most successful forex trader on the planet. Born on August 12, 1930 in Budapest, Hungary, he escaped the Hungarian Nazi occupation and fled to England in 1947 during the second World War. There, he attended the London School of Economics after which he began his business career by working at merchant banks, before forming his first hedge fund, Double Eagle.

Start trading with Forex.com today

With the profits from his first year from Double Eagle, he formed his second hedge fund, Soros Fund Management. His first hedge fund, Double Eagle, was renamed as the Quantum Fund, an organization that over its lifetime has amassed a whopping 24.9 Billion in assets under management. His second hedge fund, the Soros Fund Management has gone on to make profits of over $40 Billion in the last fifty years.

He garned fame as one of the most successful forex traders when he earned himself the title “The Man Who Broke the Bank of England”, after netting a profit of $1 billion after he short sold $10 billion USD worth of the British pound sterling in 1992. This made him one of the few profiteers in the UK financial crisis, Black Wednesday. This trade cemented his place as one of the greatest traders of our time, perhaps even the as best forex trader in the world.

Philosophy:

With a masters degree in Philosophy, George Soros broke the mould of how trading should be viewed, when he began to apply the Popper’s Theory of Reflexivity to the financial markets. Reflexivity is a social theory that speaks to the circular relationship cause and effect can have. (It means that cause and effect both affect one another). This innovative way of viewing the market, gave him clearer insights into true market vs fundamental value of securities, the price discrepancies between swapping and selling stock and the problems of asset bubbling where the price range of an asset in trading was actually quite different from the asset’s actual internal value.

With this insight, Soros adopted a way of trading as a short-term currency speculator who placed high leverage bets on the financial market direction. His hedge fund has famously used macroeconomic analysis to form a global macro trading strategy. The strategy makes primary use of his view that the market fundamentals are directly influenced by individuals (traders) and their irrational behaviour. It is his belief that this irrational behaviour is the cause of boom and busts (sell offs, or buy offs) which provide opportunities for financial investment. (This can be plainly seen in the way that he brought about the Black Wednesday in the UK).

Stanley Druckenmiller

Stanley Druckenmiller was born in Pennsylvania to a middle-class household in 1953. He began his investment career in 1977 at Pittsburgh National Bank where he quickly moved from trainee to head of equity research after only a year. Four years later, he formed his own company, Duquesne Capital Management. His track record skyrocketed thereafter when he was named head of the Dreyfus Fund and even worked for George Soros at the Quantum Fund, participating in the event that “Broke the Bank of England”. This feat, earned him fame, alongside George Soros, and this fame grew stronger after he was featured in the book “The New Market Wizards” which became a bestseller. He later retired in from the hedge fund in 2010, citing reasons that it was taking an emotional toll on him not being able to perform up to his own expectations. (Up until that point the hedge fund had been raking in an average of 30% return yearly, without losing years. During the time of his announcement the company was reportedly bringing in -5% in returns). The company did recover its losses eventually, and brought a small gain, after which he returned his client’s funds and closed the hedge fund, admitting that he was worn down from the stress of constantly trying to maintain his previous performances.

Philosophy:

Given that Druckenmiller worked under George Soros for a period of time (the highlight moment of his career in fact), it is therefore normal that they have similar methods in their investment approach. Druckenmiller uses the strategy of top-down investments, and was instrumental to the deed that made Soros famous as the “Man Who Broke the Bank of England”.

Unlike the usual investment advice that you will hear that diversification is the key to proper investment, Druckenmiller believed quite the opposite. He found his success using ‘concentrated bets’ on the market direction (similar to Soros’ strategy). Essentially he believed in placing all your eggs in one basket. This indicated that he took only the best market opportunities where he was more than certain to win the trade.

That being said, he believes that all traders should have an exit strategy. Yes, even the famous Black Wednesday trade had an exit strategy. Both Soros and Druckenmiller knew the amount that they could potentially lose before they made the trade – their profit of 12% from that year. That being said, Druckenmiller essentially trades like a sniper taking a shot. He believes that timing and good entry are everything, and the ability to be flexible if the market changes. It is this philosophy that has helped him to garner tremendous success during his career.

Bill Lipschutz

Born in 1956, Bill Lipschutz, one of the best forex traders, was raised in Farmingdale, New York. He attended Cornell University and received a Bachelor’s degree in Architecture from their fine arts programme, and also a Bachelor’s degree from the Johnsons School of Finance (also at Cornell). During his college years, he inherited money after his grandmother’s death, $12,000 worth of stock, which he liquidated. He began investing this money in his free time. He basically learned as much as he could about the financial markets from the library and used this information to turn the $12,000 into almost $250,000. This success was unfortunately short-lived, however, as one bad trading decision wiped out the entire risk capital. He used this as a learning opportunity, however, that he would apply to any investment that he would engage in, in the future.

Lipschutz began working for Salomon Brothers while studying for his MBA, after which he was put into the new foreign exchange department. He became a part of the team that the Salomon Brothers formed for their traders to learn currency trading, and it found them success.

Get you Forex.com trading account

The Salomon Brothers made great profits from Bill Lipschutz, as he became one of the five most successful forex traders in the world at the time. He was earning $300 million per year for the Salomon Brothers by 1985. He was the principal trader for the foreign exchange division from 1984 until he left in 1990, and was appointed a Director post at the company.

He opted for early retirement from Salomon Brothers, but came out of this retirement and has been working with the Hathersage Capital Management as Director of Portfolio Management since 1995.

Philosophy:

For his trading philosophy, Bill Lipschutz suggests taking things one trade at a time. Unlike other traders that encourage others to open two or three positions at a time, Lipschutz believes that time also plays an important risk factor in a trade because it limits the trader’s ability to take advantage of other opportunities. He believes that taking one position at a time allows a trader to gain consistency. He believes that “If more traders would sit on their hands 50% of the time, they would make more money”.

Because the longer a trade is open, the more it is vulnerable to outside forces, Lipschutz suggests ensuring that the reward is much higher than the risk you are taking for the trade. He suggests that a good risk-reward ratio for short term trades is 3:1 and that for long term trades look for a ratio of at least five to one, where your reward would be five times greater than your risk.

Bill also believes that having a passion for trading itself is the right way to approach forex trading. He believes that to be successful, a trader must stop focusing on earning money and rather, on perfecting the process. The profit will be a by-product of your success.

Andrew Krieger

Another one of the successful traders in forex is Andrew Krieger. He also made a fortune trading the major currency event, Black Wednesday. Known as one of the most aggressive currency traders, he joined Salomon Brothers after graduating from Wharton. He then moved to Banker’s Trust in 1986, where he established his reputation in the company as a top trader. Because of this, the company increased the capital limit that he traded to $700 million (where the typical limit was only $50 million). It was this that allowed him to be able to take full advantage of the Black Wednesday event, where he shorted the entire money supply of New Zealand (because of New Zealand’s small economy) and made off with a profit of about $300 million for the Banker’s Trust. He collected a relatively ‘small’ bonus of $3 million for his efforts, which prompted him to resign from the company and seek employment with George Soros.

Bruce Kovner

Born in 1945 in Brooklyn, New York, Bruce Kovner, is the last of the top five forex traders in this list. He studied political economy at Harvard University and engaged in a number of activities like political campaigning, writing, and cab driving before discovering commodities trading. It was in 1977 that he made his first trade, a soybeans futures contract that he bought by borrowing against his own credit card. The trade realized a profit of about $40,000 but Kovner watched it decline to almost half that amount before deciding to sell the contract and close the trade. This taught him a valuable lesson in risk management that shaped him into the trader that he became.

During his eventual employment at Commodities Corporation, he reportedly made millions in profits for the firm, which bolstered his reputation as a cool-headed and objective trader. His successes led to him founding Caxton Associates in 1983, a fund that managed over $14 billion in its peak years and made him a notable name in the top 10 forex brokers in the world.

Philosophy:

Like previous traders on this list like Soros, Kovner also uses macroeconomic fundamentals to trade, however unlike the others he heavily uses technical analysis as a tool to execute his trades. He meticulously observes global economic reports, in order to determine information consensus that the market is not confirming on the charts. He then exploits this. He believes that technical analysis is a crucial component of any fundamental approach to trading, and is known for his ability to hold long trades with conviction. He is also a stickler for risk management and this includes always having predetermined stops on his trades. He firmly believes that a trader should be willing to make mistakes and to learn from them.

Start trading Forex with Forex.com

What Can We Learn

If you are asking yourself how to be a successful forex trader, after reading our review of successful forex traders, then look no further. If you really looked at the similarities of all these men then you would notice that the majority of them had some motivation other than making money to trade. It was this motivation that allowed them to stay disciplined and objective and to make the aggressive trading positions that no one else would have. They were passionate about what they did. They found it interesting and they worked on trading the right way. If we could learn a few things from them, it would the following:

-

Stay disciplined

A disciplined trader essentially leads to a confident trader, the one who knows what he wants and he is going to get it. The top 10 richest forex traders in the world were all surprisingly skilled at organizing and disciplining their trading goals and techniques. The mindset is indeed crucial and a trader in ideal circumstances should manage to develop the patience, ditch the impulsiveness and maintain the healthy attitude and commitment towards the goal. A disciplined trader will grow to learn how to react to both profit and loss while trading, minimizing the risk of hasty and thoughtless decisions. Instead of worrying over the past failures, disciplined traders put extra effort in analyzing and assessing their performance to see where did they go wrong and often succeeded in improving them.

-

Have a predetermined risk management strategy

Forex and trading in general always come with hard-to-calculate risk levels, which most of the time overwhelm both experienced and beginner traders. Knowing your point of return, so knowing when to walk away from the deal serves as the biggest defense against the major losses. All of the forex millionaires had their risk management strategy well developed, so that whenever they hit the risk limit they knew it was time to pull out. The best strategy is to maintain the same risk management strategy throughout the your trading career, meaning that if you promise to yourself to close your position at a 2-3% loss, you should stay loyal to the figure.

-

Be passionate about trading

To love whatever you are doing means that you put your best effort in accomplishing the prime outcomes in relation to it. One thing that richest forex traders in the worldhave in common is the passion towards trading and the passion is almost unconditional. No matter if you are profiting or losing at the given moment, your passion should be keeping you committed to your goals in the trading. It also helps you to set the healthy mindset, clears your fears and avoids you getting sidetracked. Forex trading is unpredictable and quite mind-boggling from time to time and it will test your nerves. Being passionate about trading will gradually make a responsible trader out of you.

-

Not to be afraid to get aggressive when needed

Quite often, people mistake the risk management strategy for remaining passive and overly laid-back in their trading decisions. While it might be true that with such attitude you are least likely to experience massive losses, you also leave yourself a very little chance of generating sizable profits. Looking at the top traders in the world, we can learn that all of them got rich by going aggressive at least once on their starting points in trading career. However, aggressive trading does not mean that you gamble with your finances and trust your luck to come out as a winner, the risk you are taking must be well examined, all of the dangers acknowledged and there should be a good chance of your predictions turning out to be true.

-

Be flexible and know when to take your losses

The bottom line to all the advice given above is to stay flexible and know when to take your losses. You should not overly limit yourself, you should not go crazy aggressive at any point of your trading experience, you should not spend days and weeks on deciding whether to invest in something or not and you should not embrace your losses over and over again. It’s all about finding a golden mean and trying different approaches to find the most suitable one to your trading personality. Learn more about the experiences of the biggest forex traders,see how they managed to stay passionate, stable, disciplined and aggressive from time to time and decide if their mindset could be applied to you, as well.

If we can learn these things properly, then we may just be one step closer to following their remarkable successes.

How to get started in Forex trading

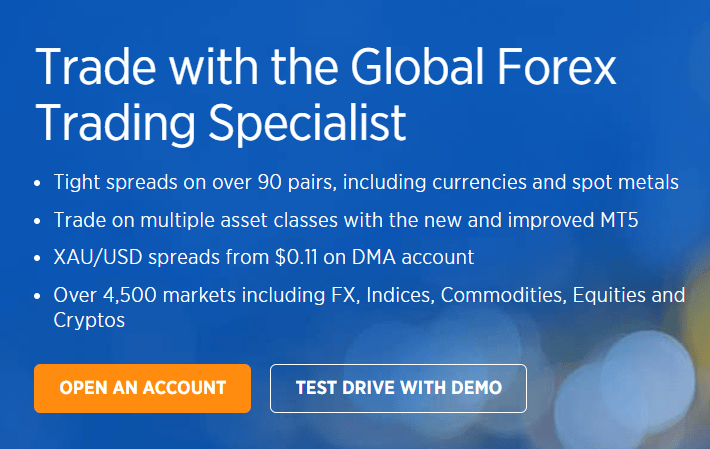

Getting started in Forex trading is something that a lot of people always imagine to be scary, complicated, and expensive. The reality is, however, none of this is really true, unless, you truly wish them to be. Entering the Forex industry as a trader can be arranged in a lot of different ways, including starting with no financial resources at all or with very little of them. The best way to get introduced to the market for newbies is to create a demo account, which will allow you to test the real experience with no risk of losing your money. However, if you are already familiar with the trading or you are ready to start right away, one of the best forex tradingplatforms – Forex.com can offer an extensively simplified registration for a real account. We will go through a step-by-step guide on how to open up a real trading account on forex.com below:

- The home page of forex.com gives two options for the new users – to open a new account and to do a test drive with a demo. To register a real account, click on “open an account”.

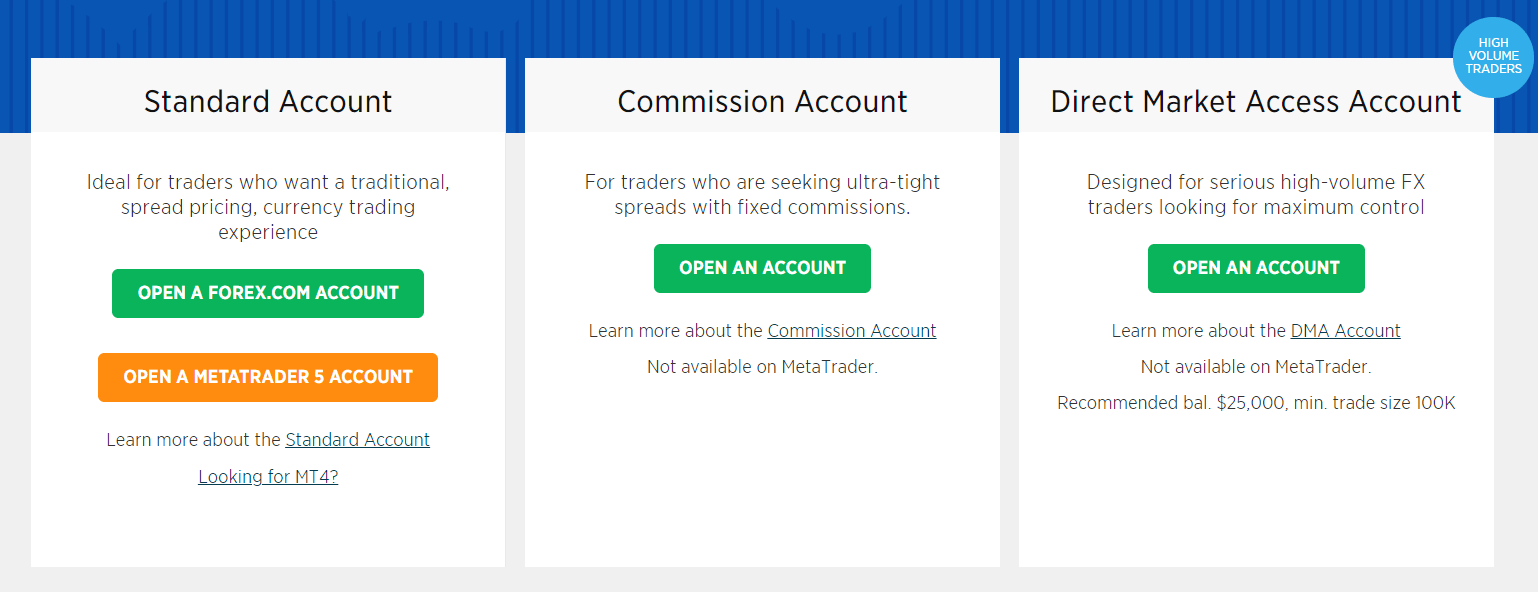

- The three different types of accounts will be displayed to choose among them. For beginners or intermediate traders with no specific goals to take trading to a further depth, Standard Account is the top choice. The standard account is a traditional trading account, with spread pricing and currency trading experience. In case, you are looking for tight spreads with fixed commissions then the Commissions Account is recommended. For serious, professional traders, Direct Market Access Account is the favorite choice, as it is designed especially for high-volume FX traders who wish to hold the maximum control over the trades. We start with opening a forex.com standard account.

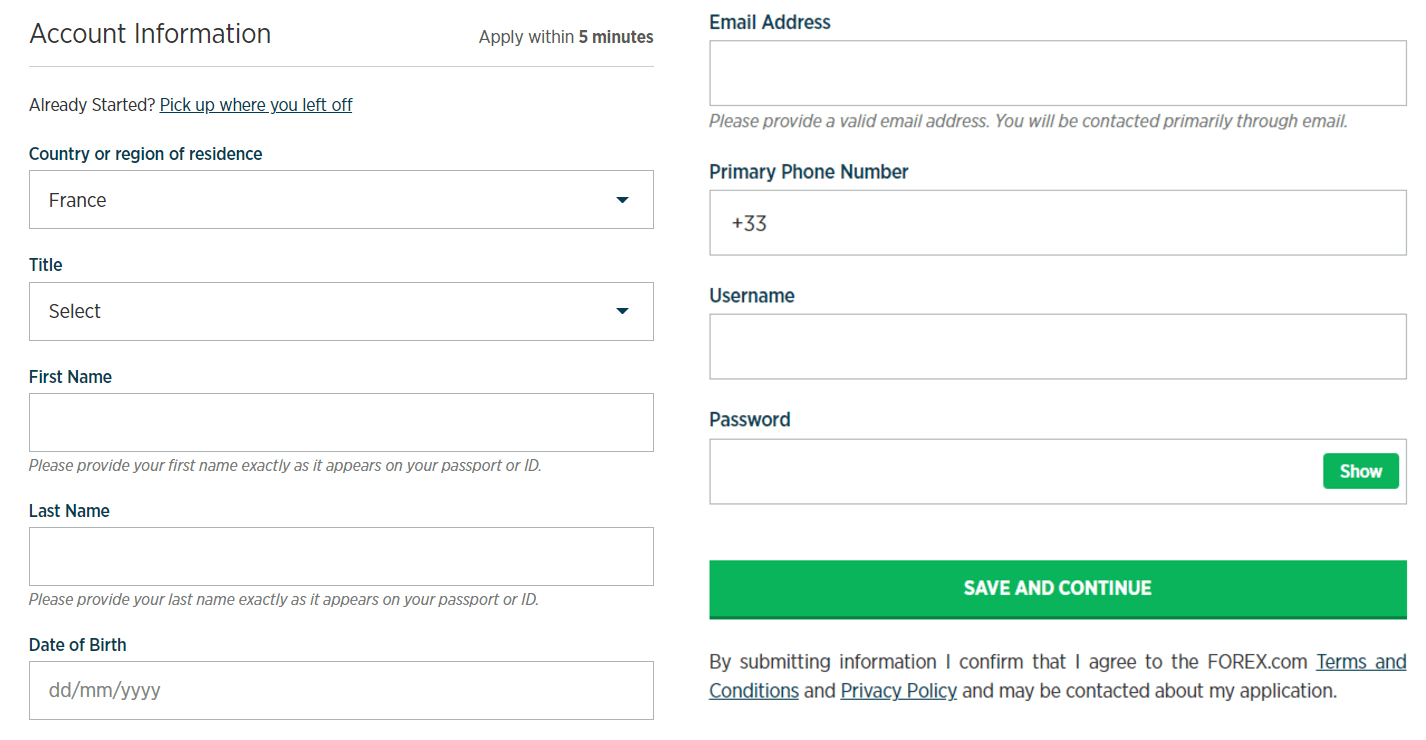

- To start with the registration at forex.com which is one of the favorite platforms for the best traders in the world, you will need to fill in the information regarding your personal data. The account information will ask you for your country or region of residence, your title, first and last names along with your date of birth. You will need to input your correct email address, as it will be the main contact for Forex.com, your primary phone number, and username and password.

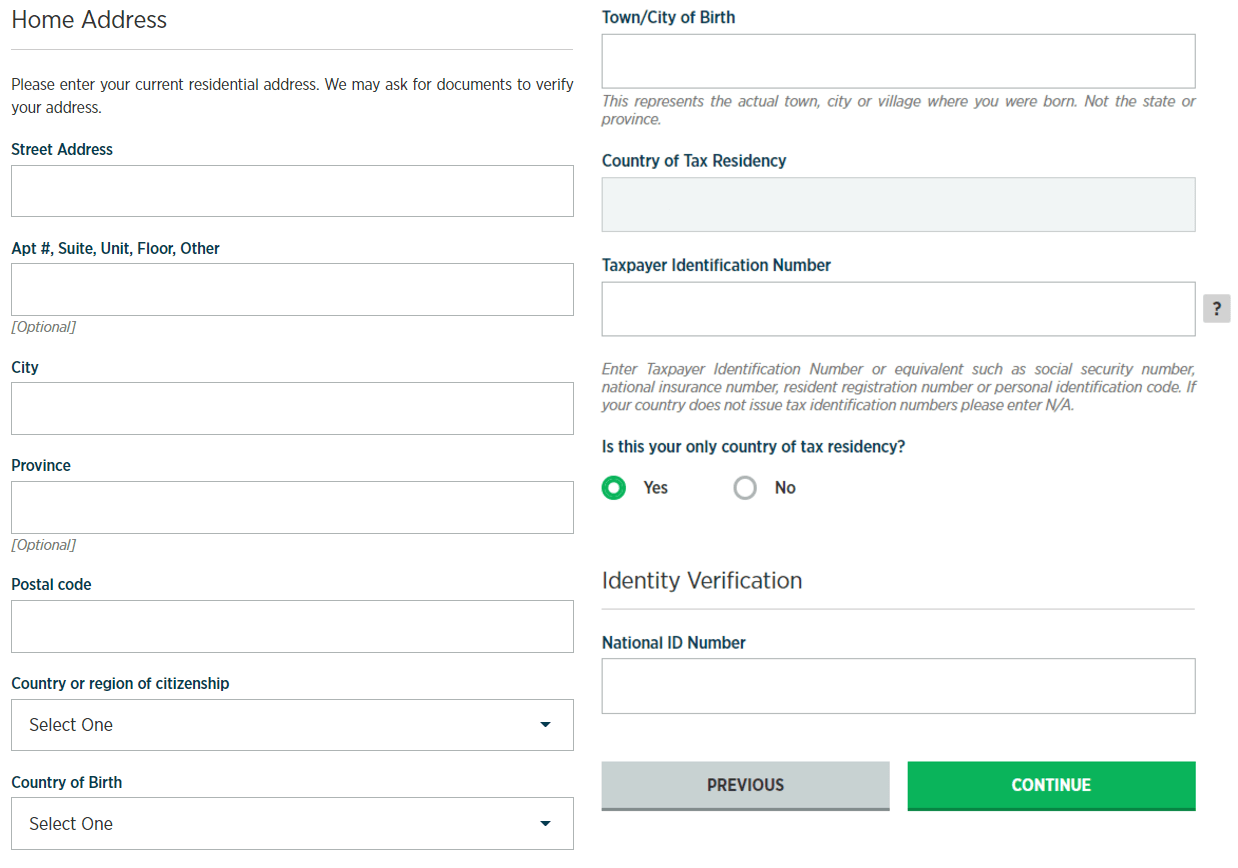

- After filling in the personal data information comes the residency and identification form. Type in your current residential address as they are given in your supporting documents, as Forex.com may ask you for the verification of the residency. Select your country or region of citizenship, country of birth, and Taxpayer Identification number if applicable, otherwise enter N/A. Also, provide the national ID Number and you are now a step away from obtaining the spot in the forex success stories.

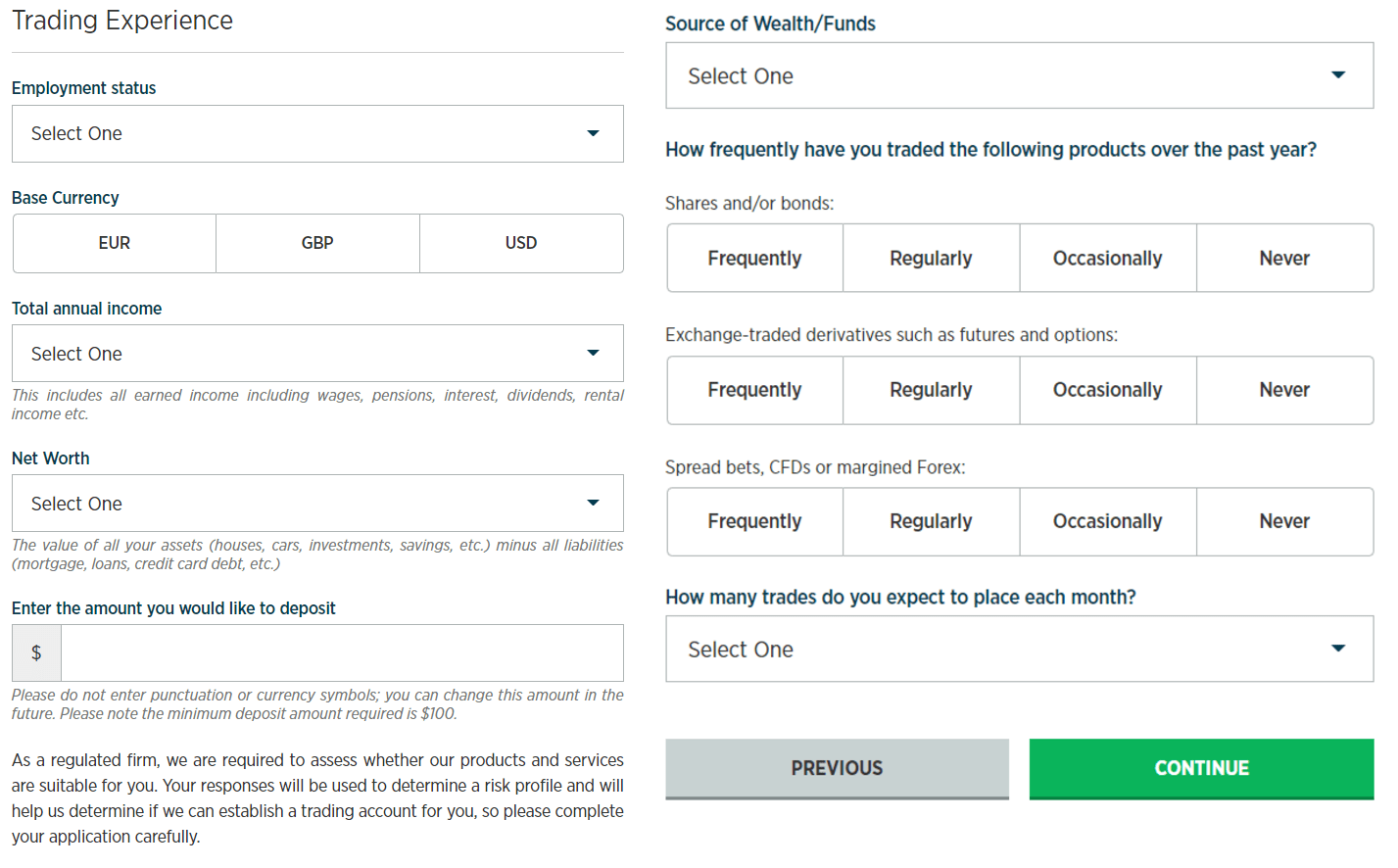

- The forex.com will ask for your trading experience, in order to decide on the best available service available to you depending on your level of knowledge. Start by entering your employment status. If employed, the website will ask you to provide the nature of the business, employer name, and the position held at the company. Choose your base currency, total annual income, and net worth. Write in the amount you would like to deposit on forex.com and the source of the funds. Please note that the minimum deposit required is $100. Indicate your experience and level of trading frequency, together with your expectation of how many trades you will be making per month.

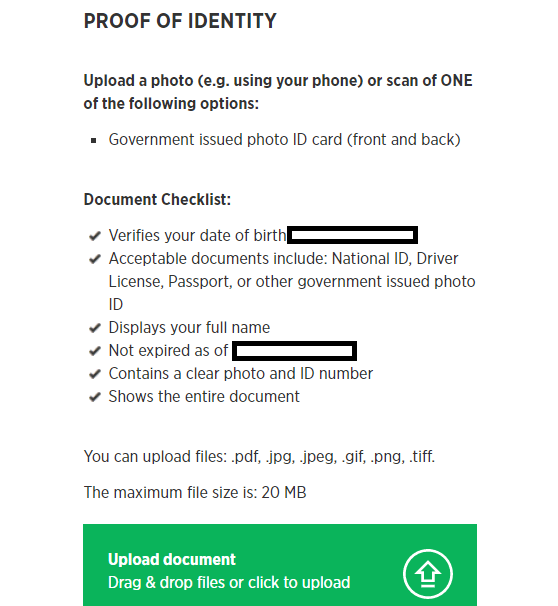

- You are all set! The website needs the verification of your identity, therefore it is required to provide your proof of identity. Upload a photo or scan the government-issued photo ID card, from both from and back sides. Upload the documents which satisfied the required document checklist and you are ready to start trading.

FAQ

It has been quite some time that the answer to the question of who is the best forex trader in the worldis George Soros. The man, who is frequently mentioned as the "man who broke the Bank of England" has been the best man in Forex trading history for at least two decades now and is unmatched in his strategies, mindset, and success even nowadays. He began as a Jewish boy of a poor background, surviving extreme hardships in his youth due to Anti-Semite prosecution prevailing in those times, entering the London School of Economics, and starting a career as a trader specializing in European stocks. Even though his career was full of success stories even before the 1990s, his triumph came in 1992. Despite the fact that 1992 was a tough year for many traders and Forex enthusiasts, Soros managed to pull out a historical bet and became a solid millionaire in a single night. He acknowledged the currency crisis dominating in the UK at that stage and bet an immense amount against British Pound (GBP) earning him a profit of a million that night. That was the exact same event that earned him his title of the man who broke the Bank of England and made him a respectable trader among the elite society of traders, as well as, the role model for many. George Soros is on the top of the list of the richest forex traders both currently and historically, with a net worth of 8.5 billion USD.

A runner-up in the marathon of the best and richest traders in Forex history is Bill Lipschutz. A man who similarly to the trading giant, George Soros, triumphed at the very end of the 20th century, began trading with his inheritance money of $12,000 and quickly turned it into hundreds of thousands of dollars, while still studying at the college. The story of Bill Lipschutz is highly motivational for the people planning to take up with Forex trading and he is also known to be quite a good instructor, leaving behind him hundreds of strategies and advice on how to succeed in trading in Forex.

The net worth of the best Forex trader out there - George Soros, is estimated to be around 8.5-10 billion USD nowadays. However, George Soros would be dominating the list with over 25 billion, if he did not donate the majority of his funds to charitable causes. The second man in the list of the best forex traders in the world is Bill Lipschutz with an estimated net worth of 8.3 billion, however, many sources claim that the man has much more of the net worth than we are aware of. Steve Cohen and Paul Tudor Jones, the two titans of the Forex have $14.6 and $7 billion net worths correspondingly.

Many of the famous Forex traders who are billionaires nowadays began trading with much little than you would have expected. The most popular story of Bill Lipschutz tells that Bill invested all of his inheritance money into Forex trading, which was around $12,000 at that time and it generated him the profits of hundreds of thousands of dollars. Bill Lipschutz was still studying at the college, however, his passion for Forex trading was immense and he never doubted his goals on penetrating the Forex market. Even more notable FX traders have started by working as low-income traders, gradually picking up on the experience, bringing immense profits to the companies that they worked with, and finally become successful individual traders themselves.

To start trading, surprisingly, any amount is enough. Fortunately, nowadays many of the leading brokers are offering services that allow the users to start trading with no deposit and deposit bonuses. No deposit bonus means that the user does not need to invest any of his or her personal financial funds, but rather a broker is crediting the money to your trading account. Whenever the client generates profits using the no deposit bonus to trade, the profits generated can be withdrawn any time, if few trading conditions are met. Usually, the brokers will allow withdrawal of profits if the minimum amount of trades have been made. The deposit bonus, on the other hand, requires a user to deposit the minimum amount to his or her real trading account and the additional money will be added to the account as a deposit bonus. Frequently, the deposit bonuses will be given as a proportional percentage amount of the initial deposit made. For example, a 30% deposit bonus would grant you an additional 30 USD in case of making a deposit of 100 USD. So, anyone can start off with little financial resources and pave their way towards top 10 forex traders.

Comments (0 comment(s))