Understanding the major currency pairs in Forex trading

In some circles, being with the most popular people or following the popular cultural trend can earn you the ridicule of others. There are people who try to avoid anything that is popular for this reason. Fortunately, in the financial markets, this type of behaviour is rare. I say rare, because there is a small community who avoid trading any financial instrument that is recognized as popular within the markets. Unlike with cultural trends however, the rejection to use these financial instruments is not because of the desire to be seen as not conforming but rather because these traders see the less traded financial instruments as a way to provide better financial opportunities. If this is true or not of course is debatable, and heavily dependent on which financial instruments you are trading.

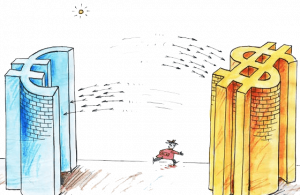

For the Forex market, arguably, it would be in the best interest for the trader to use the most popular options. This is because these popular traded currency pairs offer particular advantages that the others do not.

The Majors vs The Minors

In the current currency pairs list that the world uses, the foreign exchange market has divided the currencies on this list into groups. This categorization is key for helping new traders to navigate the best forex currency pairs to use to suit their unique needs.

The financial market has divided the list of currency pairs using the US dollar as the marker against other most exchanged currencies like the Euro, the Japanese Yen, the Canadian dollar, the British Pound sterling, the Australian dollar, the Swiss Franc and the New Zealand dollar. Please keep in mind that all the fx pairs that are considered the major currency pairs are the ones which have both the US dollar and one of the currency pairs that were previously listed.

These major currency pairs or majors as they are referred to are considered the most liquid currency pairs available in the forex market. This is one of the reasons why they are the most popular currency pairs used in the trading world. Another reason is because these fx currency pairs also have the lowest spread in the forex market. This is because the pairs that make up the majors are the ones which are the most heavily traded in the world, therefore many traders consider them the most reliable trading pairs to use in the market. On that note, the most heavily traded currency pair in the majors is the EUR/USD which has an estimated 30% of the volume in the foreign exchange market.

But what does all of this even mean? For those of you who are new to the financial market, you may completely clueless now. You may even be wondering what are currency pairs? Don’t worry, we have you covered.

What Does it All Mean? – currency pairs explained

When diving into the world of currency trading, the first thing that you should do is to make sure that you understand how the financial markets work. For understanding currency pairs, this first step is also crucial.

Within the forex market, with every transaction that is made, participants are literally buying one currency while also selling another. The reason that a person trades is because they wish to make a profit. They make a profit by making a buy or sell of a currency based on your belief that the value of one currency will weaken against the other currency. For instance, if you are trading the EUR/USD and you believe that the value of the Euro will weaken against the US dollar, then you would sell the Euro to buy the US dollar. If the price goes down, (and the value of the Euro decreases) then you would have made a profit.

In a currency pair, there are two parts. The currency on the left is referred to as the base currency. This is the currency that is used as the base of the transaction. For instance, if you were trading the GBP/USD, then you would be buying the British Pound if you placed a buy and selling the British Pound if you placed a sell. The currency to the right of the slash in a currency pair is called the quote currency. This is essential because it indicates to us how much the base currency is worth in relation to the quote currency. This is what is referred to as the exchange rate. Learning how to read currency pairs is of course essential in understanding exchange rates and appreciating their importance in Forex trading. When looking at an exchange rate we are looking at how much of the quote currency it takes to obtain 1 unit of the base currency.

If we look at the USD/CAD and the rate is 1.4537, then we are saying that it will take 1.45 Canadian dollars to buy $1 US dollar. This exchange does not stay the same. It changes constantly, and it is this change that traders use to their advantage to make themselves a profit. Essentially what a trader tries to do is to sell high and buy low. This means that a good Forex trader should look to place a sell when the price is high, so that when price goes down they make a profit. They should also look to buy when the price is low so they can make profits when the price moves up. (For the newbies: When placing a buy, we say that we are going long. When placing a sell we say we are going short.)

THE MAJORS |

|

EUR/USD |

|

GBP/USD |

|

AUD/USD |

|

NZD/USD |

|

USD/JPY |

|

USD/CAD |

|

USD/CHF |

The Almost Popular Ones – 2nd Best

Now, although to be considered the best currency pairs, the majors aren’t the only pairs that Forex traders feel comfortable doing their business in. For those who would find it inconvenient to use the US dollar in their transactions, find that the cross currency pairs are the perfect option for those traders who are still seeking fairly good volatility and liquidity. The crosses that consist of the the three major pairs (the British pound, the Euro and Yen), excluding the US dollar, are the most popular type of cross currency pairs. They are referred to as the minors.

One could argue that cross currency pairs were introduced in the financial market because before, you would have to convert currencies to US dollars before any transaction between other currencies could take place. The introduction of cross currency pairs like the minors, made these transactions much easier as brokers offer exchange rates between these pairs.

Like the majors, the popular currency pairs in the cross currencies are the minors, as they offer the most liquidity and the lowest spreads among cross currency pairs.

A list of the minors is below:

THE MINORS |

|

GBP/AUD |

|

GBP/CAD |

|

GBP/CHF |

|

EUR/AUD |

|

EUR/CAD |

|

EUR/CHF |

|

EUR/GBP |

|

EUR/NZD |

|

EUR/JPY |

|

GBP/JPY |

|

CAD/JPY |

|

CHF/JPY |

|

AUD/JPY |

|

CAD/JPY |

This list of currency pairs is only scratching the surface of the forex currency pairs that are available for a trader to use. This list is by no means all currency pairs that are available to traders, however it must be noted that these are the ones that most brokers offer to their clients. There is another group of currency pairs, that are as heavily traded as the other pairs. These are the exotic currency pairs.

The Exotics

While these are the least popular trading currency pairs that are used in the financial market, they do offer their own unique advantages that some traders find, meet their specific trading goals.

Unlike the common currency pairs, the exotic currency pairs are made from the currencies of developing countries, or from countries with small economies that do not have the same strength of influence as the countries with the major currency pairs do.

Trading these pairs come with its own sets of costs as many retail traders often find it expensive to trade exotic pairs. This cost is due to the lack of liquidity within the market, and the often large spreads between the exotic currency pairs. Because of this, they are often not the first choice for brokers to offer to their clients. So only a few brokers offer these currency pairs to their clients.

While there are the costs associated with using these currency pairs in trading transactions, for the trader who uses fundamental news and economic statistics to make trades, then exotic currency pairs may be an option. This is because certain small economies are especially susceptible to instability due to political influences, or the price of certain commodities that are essential for the health of their economies. Because these pairs are less liquid and more heavily influenced by fundamental news then technical analysis is less reliable in these markets. This also means that the markets for the exotic currency pairs tend to be choppy. For those who are more in tune with the inner workings of the economies of these countries, then it would be wise to trade these pairs. For the majority who do not have ready access to data of this nature, then it would be wise to stick to the major or minor currency pairs, as they tend to be more reliable.

So, What is a New Trader To Do?

The prospect of choosing which currency pairs to trade can be confusing for a new trader. This is particularly true, when they are faced with the different challenges and opportunities that each type of currency pair offers. The exotics offer new market share and a chance of dominating the smaller markets, the minors are both liquid and convenient for those who are doing business without the use of US dollars. For beginners, however, we recommend that they stick to the pairs that are the most tested. In this case, the best option for new traders are the majors. With this said, choosing the right currency pairs are only a small part of the formula needed to become a successful trader. One must remember that discipline, strategy and execution of a good trading plan are all important as well.

Comments (0 comment(s))