What is Consumer Confidence Index and How Traders Can to Use It?

The Consumer Confidence Index (CCI) is one of the most important indicators for Forex trading. Obviously there are many other essential measures such as Gross Domestic Product (GDP), Consumer Price Index (CPI), and the Unemployment rate. However, the Consumer Confidence Index is different from all those indicators in a sense, that rather than only reporting on past economic activities, it is also a forward-looking measure.

Since 1967 the US Conference Board (CB) publishes this indicator on a regular basis. Consequently, it has more than 50 years’ worth of history. CB collects its data by interviewing 5,000 US households every single month. The survey includes questions about the past and future prospects of business conditions, employment, and household income.

The US Federal Reserve has a dual mandate of achieving price stability and full employment. Therefore, it does not target any specific level of CCI. However, this does not mean that the decisionmakers at the Federal Reserve simply ignore this indicator. The Consumer Confidence Index can very often give early warning signs of recession or alternatively clues about economic recovery. Therefore, it is not uncommon for the members of the Federal Reserve Board to take the latest CCI data into account during the decision-making process.

This is one of the main reasons why the latest US Consumer Confidence Index numbers can have major implications on USD-based pairs as well as the prices of commodities. The improving CCI numbers can certainly benefit the US dollar against other major currencies, while also putting some pressure on the prices of gold, silver, and oil. On the other hand, if the latest release of the US Consumer Confidence Index shows a notable decline, then it can easily lead to the depreciation of USD against its peers, while at the same time often boosting the prices of commodities.

In all fairness, it must be mentioned that trading CCI is not always as simple as it might seem. For example, if there is a global economic downturn than USD might not suffer much from the poor consumer confidence numbers. Also conversely, the US dollar might not benefit much from improving the Consumer Confidence Index, if many other countries’ economies are also performing very well. So this is something to keep in mind when CCI index.

Finally, the United States is not the only country that publishes consumer confidence numbers on a regular basis. Many other countries, including Germany, Canada, and the United Kingdom also publish those important measurements. However, each of those indicators is called different names and have their own specific measurement methods.

Basics of Consumer Confidence Index

So how does the US Conference Board measure the Consumer Confidence Index? Well, the entire process consists of asking households about their opinions on 5 subjects:

- Current business conditions

- Business conditions for the next 6 months

- Current employment conditions

- Employment conditions for the next 6 months

- Total family income for the next 6 months

The surveyed individuals have essentially three options to respond to those questions. Those include ‘Negative’, ‘Neutral’, or ‘Positive’. After interviewing 5,000 households across the USA, the Conference Board calculates the relative value of negative and positive answers. The benchmark year for this report is the year 1985, which has a value of 100.

Here there is an obvious question: Why did the authors of this measure have chosen this particular period as a measuring rod for all other publications? Well, it seems that they have intended to choose a year, during which the US economic performance was moderate.

This makes sense, since if the Conference Board has chosen boom year as a benchmark, then in the heavy majority of cases the CCI numbers would be much lower, so it would essentially understate the consumer confidence measure. On the other hand, if they have chosen a recession year, then most of the subsequent publications would have shown much higher numbers, which would overstate the consumer confidence level. So this was why they have chosen the middle ground to ensure better readability and accuracy of the index.

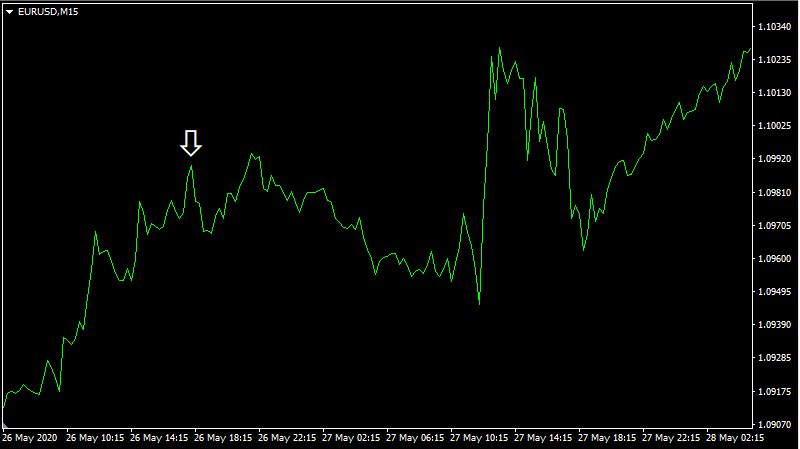

As mentioned before, the release of the actual Consumer Confidence Index report can have a significant impact on the exchange rates. For example, this 15-minute chart shows the price action of EUR/USD, before and after the publication of the US CCI:

This latest release took place on May 26, 2020. The previous report showed CCI at 85.7. At the same time, the analyst consensus stood at 88.0. When the actual release came out, the Consumer Confidence Index turned out to be at 86.6. So essentially, it was mixed news for the US economy. On the one hand, it showed a notable improvement over the previous month. However, it also did miss the analysts’ expectations.

As we can see from the chart above, the EUR/USD first moved sideways, after the publication of the report, yet, eventually, by the end of the second day, the US dollar still made some gains, with the pair moving down by roughly 30 pips. Despite the setback, after 3 days the Euro regained all of its losses and even pushed upward above 1.1020 level. So as we can see from this example, the publication of the Consumer Confidence Index can trigger a period of elevated volatility.

CCI Index and US Economy

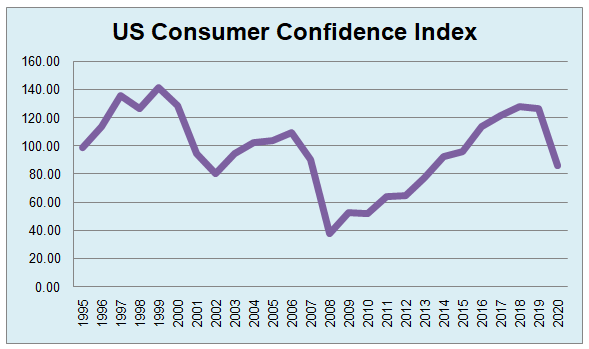

Many professional Forex traders and experienced investors do not base their decisions solely on one individual CCI report, but they also take into account the long term consumer confidence trends. When it comes to this measure, the United States economy has gone through several cycles during the last 25 years. In order to observe the CCI trends in the US since 1995, we can take a look at this chart:

As we can see from the diagram above, in 1995 the US CCI was very close to 100, which means that the consumer confidence levels during this period were very similar to the benchmark year of 1985. As the US economy improved, the indicator has made some notable gains eventually peaking at 140 by 1999. Interestingly enough, as of 2020, the index never returned to that level.

There was no recession in 2000, but the index has already started its decline, eventually dropping to 80 in 2002. During the subsequent years, it has recovered, eventually getting above 100. However, this was rather short-lived as the index collapsed to record low of 38 by 2008, at the hight of the great recession. The economic performance of the US and many other countries were quite poor in 2009, however by that time CCI has already started to make some incremental gains. However, it was not until 2016, when the Consumer Confidence Index managed to return to 100 level.

During the subsequent years, CCI improved further, eventually even surpassing 125 level by the end of 2019. This was the point, where some analysts would have expected for the index to go all the way up to 140, returning to 1999 highs, but it was not to be. The arrival of COVID-19 pandemic, subsequent lockdowns, and travel restrictions did tremendous damage to the US and the world economy in general. During March and April 2020 there was a substantial collapse in the consumer confidence levels, with the CCI going as low as 85.7. This means that 6 years’ worth of gains has been wiped out just in a matter of 3 months.

This is an essential characteristic of the Consumer Confidence Index. It typically rises slowly over the years and usually collapses quite swiftly during the periods of economic downturn. Here once again, the CCI has provided traders and investors with early signs of an economic downturn, 3 months before this was confirmed by the latest quarterly Gross Domestic Product figures in the US, showing a 5% contraction in the world’s largest economy.

Measuring Economic Performance by Consumer Confidence Index

As mentioned before, the latest report, showed the CCI regaining some ground, reaching 86.6. Now, this might not seem that significant, after all, increase by 0.9 might not seem as much of an improvement. However, if we return to our historical CCI chart, we can see that in 2008, the scale of the collapse in consumer confidence numbers was much larger. At one point it even fell below 40, instead of stabilizing near 85 level, as it is happening now.

There are many commentators and financial experts who wonder whether the economic downturn, caused by the outbreak of COVID-19 pandemic would be worse or better than the 2008 financial crisis. Obviously, at this stage, it is rather difficult to come up with decisive conclusions. However, if this reversal in CCI numbers proves to be the line in the sand and the index does not fall any further, than it might suggest that the current downturn might not be as strong as 12 years ago.

At the same time, there is no guarantee that some new development would not lead to the consumer confidence indicator collapsing even further, so in order to come up with more accurate analysis, we need several more releases to confirm the pattern of recovery, rather than just one individual report.

How Can CCI Predict Recessions?

In our analysis, we have identified 3 points in history where the falling Consumer Confidence Index has predicted the upcoming economic downturn. So how does this measure have such an ability to make those predictions beforehand? Well, in order to answer this question, we need to take a look at the formula of the Gross Domestic Product.

The largest component of the index is household consumption, for example in the US, this section makes up roughly around 70% of the GDP. Since the Conference Board’s survey involves the interviewing of 5,000 American households, obviously the result would have a lot to say about this subject. So if CCI falls, then this indicates that consumers are losing confidence in the economy, as a result, they are more likely to spend and invest less and more focus on maximizing their savings.

Obviously, some households may not make any changes in their spending and investing habits. However, enough of them will do those things, which will have a major impact on the overall economy. Even a 5% to 10% reduction in consumer spending can have major repercussions for the long term economic growth.

The opposite is also true. If consumers feel more confident about the economy, they are more likely to spend and invest a larger portion of their income, which can be beneficial for the GDP growth as well.

The influence of the consumer confidence factor is not strictly limited to the consumption component of the GDP equation. There we also have an investment, which represents spending by businesses. If the private sector is faced with increasing falling consumer confidence than those companies are more likely to cut back on their expenditures and eventually even resort to layoffs. After all, it does not make much sense, to increase capital spending and hire more people, when less number of consumers are buying a firm’s goods and services.

On the other hand, if the business executives see rising consumer confidence, then they are more likely to invest more for the future development of their businesses. They might also decide to hire some additional staff in order to meet the growing needs of their client base. So as we can see the level of consumer confidence and the growth rate of GDP can be very closely intertwined.

The third component of the Gross Domestic Product is represented by government spending. Now, this is the one place where there is not a direct relationship between this level of expenditure and the Consumer Confidence Index. One reason here is that the level of government spending is very much depended upon the policy decisions, rather than based on some indicators. So for example, if CCI falls, it does not necessarily mean that in response the administration will cut their expenditure as well. Sometimes, it is quite the opposite, the government might increase spending drastically to offset some of the losses to the economy, caused by a reduction in the expenditures by households and businesses. This is exactly what happened during the 2008-2009 great recession in the US.

On the other hand, in times of high consumer confidence and a strong economy, the government might take an opportunity to reduce the budget deficit or even achieve a surplus and start paying down its debt, just like in the 2nd half of the 90s in the United States. There were also a number of Eurozone countries that followed the austerity measures, even during the EU sovereign debt crisis, to share up their finances and follow the budget guidelines. Therefore, there is no one universal rule on how the governments respond to different consumer confidence trends, it depends on the actual decisions of the policymakers.

Finally, we have a net experts category as the last component of the GDP. Actually, here the dynamics are quite the opposite of our first two examples. Rising consumer confidence typically leads people to import more goods and services from abroad, which can have a negative impact on the GDP, unless this surge is matched by the increasing number of exports. However, in the majority of countries, the net export category is relatively small, compared to Consumption and Investment components. Therefore, in times of rising consumer confidence, there is also a notable expansion of GDP as well.

What Makes Consumer Confidence Index Very Volatile?

Looking at the Consumer Confidence Index charts, we can notice that this indicator can be quite volatile. For example, we have seen the index collapsing from 130 to 85.7 just in a matter of 4 months. In a developing economy, it is very difficult to imagine the Gross Domestic Product tallying by 34% in such a short period of time, or alternatively the Consumer Price Index losing 1/3 of its value just in 120 day period. So, many traders might wonder what are the reasons behind this reality.

To answer this question, we have to keep in mind, that the entire indicator is based on opinions of households rather than on some objective data. For example, when it comes to tracking inflation, the main principle is very simple, if for example the basket of goods and services worth $1,000, now rises to $1,020, then there is approximately a 2% rise in the general price levels. Surely, there are of course so-called ‘hedonic adjustments’ and other factors, but to keep things simple, they at least they conform to some kind of formula rather than on individual opinion.

In the case of the Consumer Confidence Index, the essential principle is quite different. For example, consumers lost 5% of their income during the economic downturn. However, the proportion of negative responses might rise much higher, leading to the fall of CCI, not by 5% but 20%. It is a well-known fact, that consumers often tend to overstate changes in their economic conditions, therefore the higher volatility of CCI should not be so surprising.

CCI Measurements in Other Countries

Besides the US, there are many other countries that regularly publish reports about the consumption confidence levels in their nations. For example, in Germany, this indicator is measured by an organization known as ‘Growth from Knowledge’ and is called the ‘Consumer Climat Index’.

According to the GfK website, the questions in this survey include:

- Major Purchases

- The personal financial situation over the last 12 months

- The personal financial situation over the next 12 months

- The general economic situation over the last 12 months

- The general economic situation over the next 12 months

Unlike in the case of the US CCI, in Germany, the Consumer Climat Index can also be represented by the negative number in times of an economic downturn. Finally, in this survey, people are also asked to comment on their savings, however, it is only included in the report document itself and does not have any influence on the consumer confidence measurement.

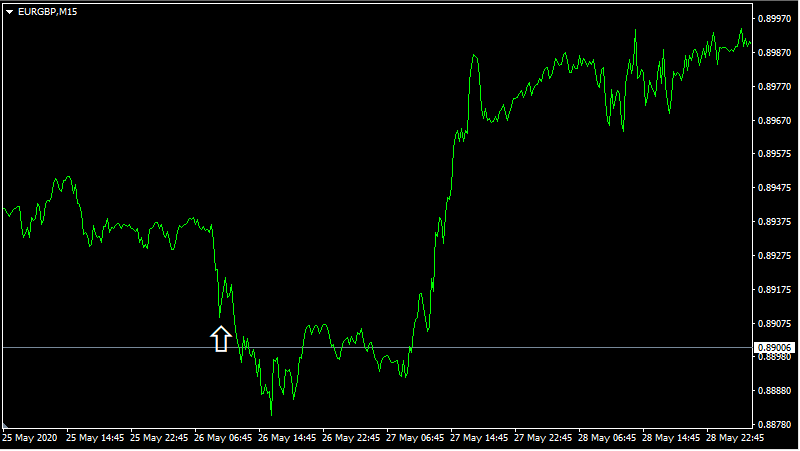

Just like in the case of the US, the German CCI can have a major impact on the exchange rates. This is shown in this 15-minute EUR/GBP chart, which shows the price developments before and after the release of the German consumer confidence numbers:

The latest report was released on May 26, 2020. Previously, the indicator stood at -23.1. The analyst consensus suggested the index to be at -18.3. The actual number stood at -18.9, so it was slightly lower than the forecast. However, here again, it was not such a piece of band news since it represented a significant improvement over the previous month.

As we can see from the chart above, initially the EUR/GBP pair fell slightly and then moved sideways for the rest of the day. However, from the next trading session, the Euro has made some substantial gains, eventually rising from 0.8890 level to 0.8990, gaining at least 100 pips in the process. It seems like that after the initial indecision, the market still favored the single currency, after digesting the improving consumer confidence picture in the region’s largest economy.

Trading Strategies with CCI Indicator

The logic behind the basics of CCI trading seems quite simple: traders buy the currencies which have improving consumer confidence and sell those who do not. However, as mentioned before, it is not only one report which matters, but the overall direction of the trend.

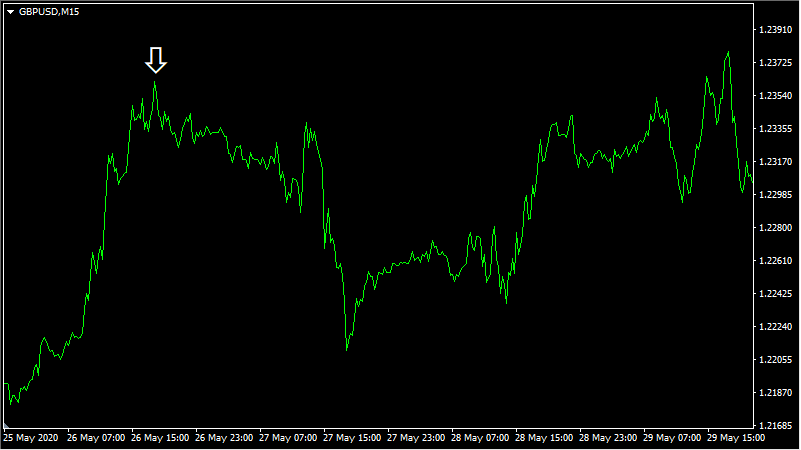

For example, as we have discussed before, the latest release of CCI data in the US has confined some modest improvements in consumer confidence. At the same, so far the consumer climate indicators in the UK are getting worse, with o far no bottom in sight. As a result, when the new US report came in, it did benefit the US dollar. This is well-illustrated on this 15-minute GBP/USD chart:

As we can see from the above, once the CCI report was published, the USD made some substantial gains, with GBP/USD falling from $1.2360 all the way down to $1.2210. During the subsequent days, the pound did recover from this decline. This is not surprising, because, by several measures, including the Purchasing Power Parity (PPP) metrics, the currency is oversold and is currently located deep into the undervalued territory.

However, this tendency might persist for a while, until the EU trade deal is not resolved and the question Scottish independence referendum addressed as well. Losing a significant portion of its territory, including its oil reserves, coupled with high tariffs, imposed on its exports can have a devastating impact on the UK economy, potentially pushing the pound to the parity with the Euro and the US dollar. On the other hand, the settlement of those issues, without the breakout of the country and high tariff rates can help pound to have a relief rally and return back to PPP levels.

Imperfections of Consumer Confidence Index

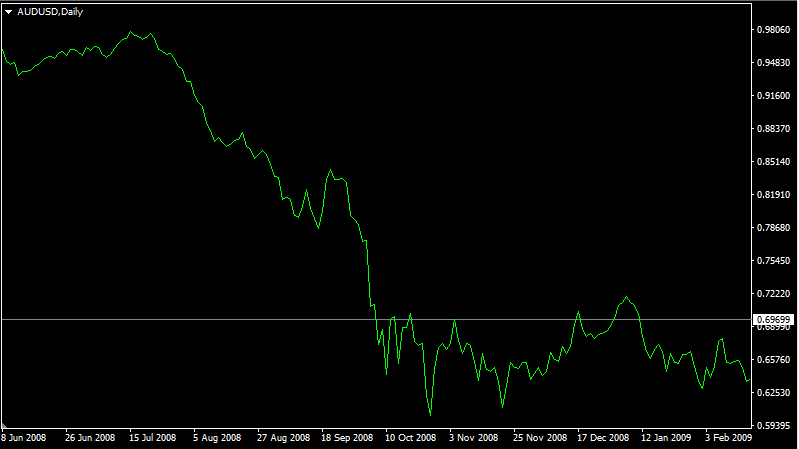

Just like all other economic indicators, the Consumer Confidence Index does have its imperfections. firstly, if consumer confidence in two given countries is in the same cycle it is difficult to make currency predictions. In order to see an example of such a scenario, we can take a look at this daily AUD/USD chart, which shows the price action of the pair just prior and after the great recession:

As mentioned before, during the 2008 crisis the US collapsed, at one point even going lower than 40. This would suggest that the American currency should have depreciated significantly. However, as we can see from this chart, USD made some serious gains, with AUD/USD falling from 0.98 to 0.63 and stabilized at this lower level for several months. However, here we have a benefit of high insight. During the summer of 2008, it was not at all clear, whether the US dollar would depreciate due to collapsing consumer confidence, or gain some group against its peers because of the global economic downturn.

Secondly, consumer confidence is measured differently across the globe. There are differences in the actual questions given to the household, as well as in calculation formulas. Therefore, comparing two such indicators might not always be apples to apple comparison, unlike in cases of Gross Domestic Product, Consumer Price Index, Unemployment rate, and others. Therefore the results of the direct comparison between the US Consumer Confidence Index and German GfK Consumer Climate Index might not be so accurate.

Trading with Consumer Confidence Index – Key Takeaways

- Consumer Confidence Index plays an important role in the Forex market. Improving CCI often signals the strengthening of the economy, which supports the exchange rate of the currency. At the same time, the decreasing consumer confidence can be easily followed by a recession, which everything else being equal can lead to currency depreciation.

- It is not just one individual CCI report that matters, but rather the direction of the overall trend. Due to several reasons, small changes in this indicator are quite common, even under the normal circumstances. However, a consistent and substantial decrease in CCI can be a sign of an upcoming recession, as happened in 2001, 2008, and 2020.

- Compared to other famous economic indicators, like the Gross Domestic Product (GDP) and Consumer Price Index (CPI), the Consumer Confidence Index (CCI) is much more volatile. Through its history, it has reached as low as 38 during the 2008 recession and reached an all-time high of 140 in 2000. One of the main reasons for this phenomenon is that the entire measure is based on the opinions of the households, rather than on an objective data. Consumers often have a tendency to overstate the changes in their economic conditions, hence the high volatility of the CCI.

Comments (0 comment(s))