12 Most Important Forex News Announcements and How to Trade Them

Every major Forex news website has an economic calendar. This is essentially a page, which lists all news releases during the week, which can affect the exchange rates. Not all of those announcements have a decisive impact on Forex, but there are those which are essential for measuring the economic performance of the given economy. Experienced professional traders and investors always pay attention to those news releases and try to use them for identifying profitable trading and investing opportunities. Here is the Full list of those Forex news announcements which have the most profound effect on the exchange rates:

- Central Bank Interest Rate Decisions

- Gross Domestic Product (GDP)

- Unemployment Rate

- Consumer Price Index (CPI)

- Non-Farm Payrolls (NFP)

- Initial Jobless Claims

- Retail Sales

- Budget Balance

- Trade Balance

- Consumer Confidence Index (CCI)

- Manufacturing Purchasing Managers Index (PMI)

- Home Sales

Traders and investors across the world usually classify those news releases as ‘bullish’ or ‘bearish’ news for the currency in question and then base their trading and investing around those conclusions.

This is not to say that other types of news pieces have no impact on the market. There are some announcements that might have more influence on some specific currencies, than others. However, those 12 types of news releases are universally important, regardless of the currency in question, so let us now go through each of them in more detail.

Central Bank Interest Rate Decisions

The interest rate decisions by the central banks can very often lead to a significant spike in volatility. In fact, the effects of those decisions can affect currency exchange rates for a very long time. This is because the monetary policy essentially determines the rate at which consumers can borrow money from commercial banks. At the same time, it also determines what percentage return one can receive on savings accounts and certificates of deposit.

Consequently, it is not surprising that when the central bank decides to hike rates, everything else being equal, it helps currency in question to appreciate. This is because traders and investors can earn higher returns, not only from savings accounts and certificates of deposit but also from carry trades as well.

On the other hand, rate cuts can have a very negative effect on the currency exchange rates, often leading to its depreciation. low-yielding currencies are not very attractive for investors and traders, consequently, they typically tend to lose ground against their peers.

One example of such scenario is illustrated on this daily EUR/USD Chart:

From 2013 to 2015 the ECB has cut rates repeatedly, reducing its key interest rate from 0.75% to 0%. Until Spring 2014, the EUR?USD did manage to stay strong, eventually going as far as reaching 1.39 level. However, as ECB kept reducing rates, it eventually took a toll on the exchange rate of the single currency. The tide finally turned against the Euro in April 2014, from this month until March 2015, the EUR/USD fell from 1.39 to 1.05. This means that just in a matter of 11 months the pair fell by 3,400 pips, which is quite a rate, even for such a volatile market as Forex.

Finally, one thing to note here, is that sometimes the interest rate decisions are already priced in the currency pairs, before their actual announcement. The reason behind this is that when the actual report comes out and it is all set and done, it might be too late to find any profitable opportunities. That is exactly why many traders try to guess the outcome of those meetings beforehand. Firstly they analyze the official mandates of the central banks. After taking this step, they look at other indicators, like the Consumer Price Index, Gross Domestic Product, and unemployment rate to get some idea about the most likely outcome of those meetings. This gives them an opportunity to enter the market at more reasonable prices and earn higher payouts in the process.

Gross Domestic Product (GDP)

One of the most popular and direct measures of the economic performance of a given country is the Gross Domestic Product (GDP). Simply speaking the indicator is intended to measure the value of all goods and services, produced in a given country for a quarter or a year. On economic calendars, it is mostly expressed as percentage change compared to the previous year. The report is published on a quarterly basis.

If the GDP for a given country falls for two consecutive quarters, then it is considered to be in a recession. This in turn, typically hurts currency exchange rates as well. On the other hand, a high rate of GDP growth is the most obvious sign of a strong economy. Therefore, the currencies of those nations very often tend to appreciate against their peers.

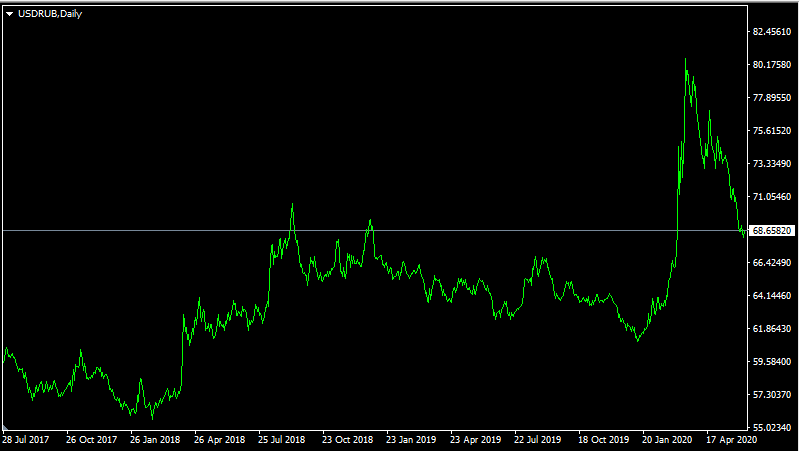

One example of this would be the price action in USD/RUB, which is depicted on this weekly chart:

From 2000 to 2008 Russia’s annual GDP growth rate mostly fluctuated between 5% to 10%. However, after the great recession, the economy never returned to such rates. Instead, since late 2012 Russian GDP growth was confined within a -2.5% to 2.5% range. The country has also experienced a recession from 2015 to 2016. During 2019, the growth rate only reached 1.3%, which is quite poor for even developed economies, not to mention the fact that for such a developing country like Russia, it is even worse.

As a result of this sustained poor economic performance, the Russian ruble lost ground against major currencies. As we can see from the chart above USD/RUB have experienced a great deal of fluctuation. Yet, it is also obvious the long term trend of Ruble depreciation is quite obvious, from July 2017 to June 2020, USD/RUB have risen from 58 to 68.65 level, representing more than 18% appreciation.

Unemployment Rate

The unemployment rate is another essential indicator for measuring the economic performance of a given country. This is intended to measure the percentage of unemployed people in the labor force. A heavy majority of central banks across the globe do not target any particular level of the unemployment rate. However, the policymakers might still take the latest numbers into account during the decision-making process.

However, one bank which explicitly targets some level of this indicator is the US Federal Reserve. According to its dual mandate, the aim of this institution is to achieve price stability and full employment. Now, despite its name, the latter term does not imply achieving a 0% unemployment rate. That would be very unrealistic and unsustainable. Many financial experts believe that the US Federal Reserve aims at a 5% unemployment rate, which is a much more realistic number.

The rising number of unemployed people does hurt the currency in question since it is an obvious sign of the weakening of the economy, as well as the wasted potential of the labor force of the country. At the same time, the falling unemployment rate tends to help currencies to appreciate against their peers since full employment can promote a higher rate of economic growth.

Consumer Price Index (CPI)

Obviously the central banks across the world do not just change their interest rates randomly. Most of them target some specific rate of inflation, typically ranging from 2% to 3%. The most popular indicator for measuring changes in price levels is the Consumer Price Index (CPI). It is essentially measured by keeping track of thousands of goods and services in a given country and coming up with annual percentage changes after applied different weights to each category.

Now, this indicator can have both short and long term implications for the exchange rates. Firstly, it is obvious that since central banks actively target inflation rates, if CPI rises above its intended target, then it is likely that the interest rates will go up and help the currency to appreciate. The opposite is also true. If an inflation rate of a given country falls much lower than the desired goal, the policymakers are likely to cut rates, weakening the currency in question.

However, this indicator also has a long term impact. If an inflation rate of a given currency stays lower than its peer, it tends to appreciate against other currencies over the years. This is according to the famous Purchasing Power Parity dynamics. Essentially, when a given country has a lower CPI rate, over time its goods and services become cheaper compared to other nations. As a result, they become more attractive to importers abroad. In order to import those goods and services, businesses have to buy local currency, which leads to its appreciation in the long term.

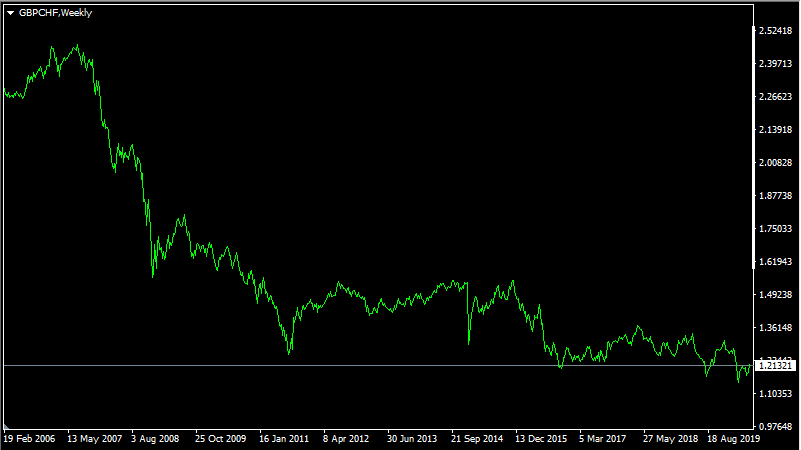

This is well-demonstrated on this weekly GBP/CHF chart:

During the last 25 years, the UK had an average inflation rate of 2.8%, when in Switzerland this indicator stood at 0.5%. Now, 2.3% differential might not seem that significant, however, when this trend persists for decades, it tends to add up.

As we can see from the above chart, during 2007 the GBP/CHF has reached 2.45, however, from this point there was downtrend which lasted for many years. By 2016, the rate already collapsed to 1.21. As the diagram shows, this was not the case of the one straight downward line, there was a significant fluctuation, with sometimes British currency regaining some of its losses. However, the overall result is quite clear: in 9 years, the pound lost more than 12,400 pips against the Swiss Franc. So the long term impact of the inflation rate differentials can have a very significant impact on the exchange rates.

Non-Farm Payrolls (NFP)

The Non-Farm Payrolls intends to measure the total number of employed people in the economy, with some expeditions. It does exclude workers from the agricultural sector, people serving in the military, as well as in intelligence agencies and employees of non-profit organizations.

A notable rise in job creation is a sign of a strong economy and can have a very positive impact on the exchange rates of USD, at the same time putting pressure on the prices of commodities, like gold, silver, and oil.

On the other hand, if the actual number of job creation is low or even negative, it can lead to depreciation of the US dollar. This can clearly point to the weakening of the American economy and also help commodity prices.

Initial Jobless Claims

Initial jobless claims is another important measure of unemployment. The report is published on a weekly basis by the US department of labor. The indicator shows the total number of people claiming the unemployment benefits for the first time.

The basic principle of trading after this announcement is similar to that of the unemployment rate. Fewer jobless claims are a sign of economic strength and support the USD. At the same time, a large expansion of this indicator might have a negative effect on the US dollar.

Consumer Confidence Index (CCI)

Consumer confidence measures are published not only in the United States but in other countries such as Germany, Canada, United Kingdom, and many others. In the US it is measured by the Conference Board. Every month, this organization conducts a survey of 5,000 households in the country, asking them about their business and employment conditions, as well as their total family income.

Improving Consumer Confidence Index (CCI) can be beneficial for the relevant currency. The reason behind this is that it is widely believed that as consumers become more confident, they are likely to spend more money on goods and services than before. Since consumption is the largest component of GDP, this tends to strengthen the local economy in the process.

On the other hand, the constant decline in CCI can be an early warning sign of an upcoming recession, as it happened both in 2001 and 2008. So it is pretty much a forward-looking indicator.

Retail Sales

The retail sales numbers are yet another major indicator of consumer confidence. However, here instead of asking for household opinions, the statisticians collect the actual data of household spending. Rising retail sales can be very beneficial for the economy since as mentioned before, increasing consumption tends to promote higher GDP growth. As a result, the currency in question tends to appreciate against its peers.

At the same time, poor retail sales might be another early important indicator of a future recession. As households spend less money, the revenue of businesses falls as well, leading to a cycle of economic contraction, reducing the GDP of the country in the process.

Manufacturing Purchasing Managers Index (PMI)

Most major countries published their latest manufacturing numbers on a regular basis. In the US, this is measured by the Institute of Supply Management (ISM). This organization surveys top-level executives in more than 400 companies, revealing the latest trends in the manufacturing sector.

The index itself can be expressed as a number ranging from 0 to 100, with 50 representing the previous month levels. So if the latest PMI is at 55 that would mean a 10% expansion.

Expanding the manufacturing sector can certainly raise the total value of exported goods in the country. This in turn can promote higher economic growth and help the currency in question to appreciate against its peers.

On the other hand, the contraction in the manufacturing industry can significantly worsen the trade balance for the nation. This usually has an effect of reducing the level of GDP growth and leads to the depreciation of the currency.

Home Sales

Home sales numbers are the main indicator of the overall health of the real estate market. The regular monthly publications include two sets of reports: existing home and new home sales. The high rate of increase for this indicator can be a sign of strengthening the real estate market and that of better economic performance in general. This can certainly strengthen the exchange rate of a given currency.

At the same time, a significant decline in the number of home sales can be yet another sign of an upcoming economic downturn. We have already seen such a scenario developing back in 2008 when the decline in the housing market had a domino effect of putting many banks near bankruptcy, culminating in the great recession.

Trade Balance

Trade balance measures the difference between the total value of exports and imports within a given country. This represents one of the four main components of the Gross Domestic Product, therefore, it can have a significant impact on the rate of economic growth.

When the nation’s total value of exports exceeds that of imports, it is said that the country is running a trade surplus. This can have a significant effect on the exchange rates as well. Foreign individuals and companies who are interested in importing goods and services from the country, they first have to convert their funds to the local currency. Otherwise, they can not make those transactions. This creates a natural demand for the local currency, which tends to appreciate in the long term.

On the other hand, an expanding trade deficit can significantly reduce the economic growth of the nation, very often leading to a significant currency depreciation over the years.

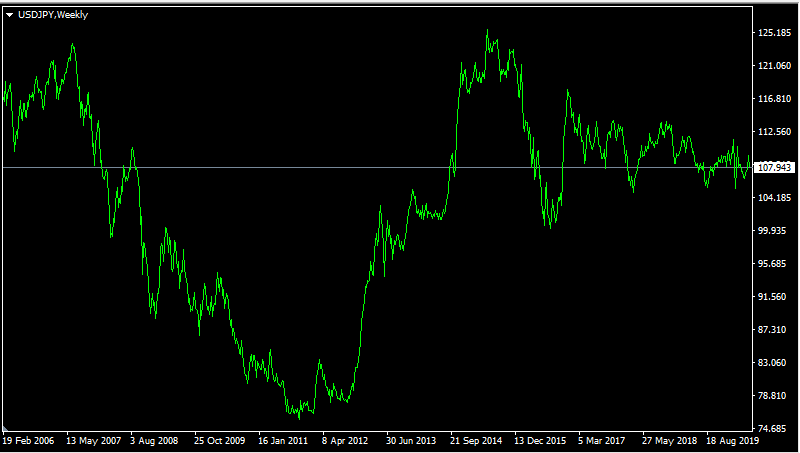

For a practical real-life example, we can check this weekly USD/JPY chart:

The long term price action of USD/JPY is very surprising. The Bank of Japan has kept record low-interest rates for decades, eventually lowering them firstly to 0.1% and later to -0.1%. Because of those policies, the Japanese yen became the favorite funding currency for carry trades. During the same period, the US Federal Funds rate fluctuated between 0.25% to 5.25% range. Also during the last two decades, the GDP growth rates in the US were much higher than in Japan.

So logically, the US dollar should have made massive gains against the Japanese yen over the years. As we can see from this chart, it did not happen. The USD/JPY pair fell from 120 to going as low as 76 by 2011. After some serious easing policies conducted by the Bank of Japan, the pair recovered, erasing all of those losses. However, this recovery was not permanent, as the USD starts to fall from 2016 and nowadays trading below 110, still struggling to overcome this level.

One can not come up with a reasonable explanation for this, without acknowledging that there are some forces in play that have led to the yen’s incredible long term strength. One of those factors is Japan’s persistent trade surplus. Obviously there were periods when the balance sipped into the negative territory, however, overall it stayed on the positive side.

In comparison, the US runs a significant trade deficit, which in 2019 has even exceeded $616 billion. So this is one way to explain the persistent weakness of the USD/JPY exchange rates.

Budget Balance

Finally, we have budget balance reports. If the revenues of the state exceed the outlays, then it is said that the country is running a budget surplus. If on the other hand, government spending is higher than its income, then it is running a budget deficit. In order to cover this gap, the Majority of countries typically turn to borrow money, by issuing the interest-bearing bonds to attract potential investors.

Many developed countries in the world run the moderate budget deficit for many decades, without suffering from massive currency devaluations or debt crisis. However, if government spending gets out of control this can create several risks for the economy:

- Rapidly expanding government debt means that over time, countries will have to spend increasingly larger portions of their tax revenues on interest expenses, instead of using those amounts for healthcare, education, or welfare spending. The potential opportunity cost is not the only downside to this policy. In the long term, as those interest payments consumer larger percentages of government’s income, at one point it will become unsustainable to service those debts, bringing the solvency of the country into question.

- The second potential risk was well-illustrated during the EU sovereign debt crisis. When countries operate on the large budget deficits for decades at one point bond investors might suspect that the nation is not in a position to honor its obligations. This typically leads to rising yields and very often to the debt crisis. As a result, the governments are left with a difficult choice between accepting very painful budget cuts or defaulting on the liabilities. Each of those choices has its own downsides. Spending reductions are always unpopular with votes, while a default can destroy the credibility of the country, leading to the higher interest rates on bonds for decades to come.

- It is understandable that both of those options are very unappealing for the governments. Consequently, they are left with the third option: devaluation of the currency. This is like an incremental solution, which worked for many countries in the past. The problem is that by tolerating higher inflation rates, the government reduces the purchasing power of savings and incomes of its citizens. As a result, the currency in question tends to also depreciate against its peers in the Forex market.

On the other hand, running a very low budget deficit, or even achieving a budget surplus can be beneficial for the economy and by extension, for the currency in questions.

To illustrate this better, let us take a look at this weekly EUR/USD chart:

The US government had a budget surplus from 1998 to 2001. This is exactly the same period when the US dollar displayed a great deal of strength against other major currencies. As we can see from the chart above, during 2000 the exchange rate of EUR/USD was near 0.85. The strength of USD persisted in 2001 as well. However, as the US returned to running a budget deficit in 2002, its currency began to decline. This eventually culminated in the EUR/USD reaching 1.59 by 2008, as those deficits exceeded $1 trillion.

Eventually, There was a notable reduction in the US budget deficit, which even fell below $500 billion in 2014. The US dollar also made substantial gains against other currencies, with EUR/USD falling below 1.15.

For the sake of accuracy, here it must be mention that there were many factors at play during the long term developments of EUR/USD exchange rates, with the budget deficit being just one of them.

Essential Forex News Announcements – Key Takeaways

- There are many items on the economic calendars of brokers and Forex news websites, however, not all of them have the same effect on the exchange rates. There are at least 12 types of important announcements, which represent the essential measures of the economic performance for a given country. As a result, those news releases are typically accompanied by a significant degree of volatility on the market. The actual reaction of the market depends on several factors, including whether the latest announcement represents an improvement over the previous period and how do those numbers line up with the market expectations.

- After reading or listening to the economic announcements, many experienced traders and investors try to classify them as either ‘bearish’ or ‘bullish’ for the currency in question. This helps them to come up with better trading ideas and possibly even improve the percentage of winning trades.

- The actual market reaction is not always predictable. The outcome of some announcements, like interest rate decisions is already priced into the exchange rates before the publication of the relevant news release. This is because traders always try to guess the outcome of those policy meeting beforehand, in order to enter the market at more profitable points and maximize their returns.

Comments (0 comment(s))