Best Forex Backtesting Software

People will always want to be able to predict the future. This has been a trait that passed down over centuries of generations of our existence. That curiosity is and has been expressed in a number of ways. These have included religious dogma, astrology, and astronomy, to now science. One of the smartest things that humans have done is to develop a scientific way of analyzing information, taking knowledge about the past activity to predict a probable future based on it. As our lives have evolved from hunter-gatherer cavemen lives, to agrarian societies, to industrialization and commerce, so has our need to predict the important factors that determine the quality of life. In this day and age, this involves being able to predict how prices will move, as the price of commodities or even foreign exchange are indicators of the health of economies and play an arguably direct role in the quality of life of human beings across the world who use either these commodities or currencies directly or indirectly.

The individuals who work directly in the financial world definitely have an interest in how to predict price movements across a variety of instruments like stocks, bonds, forex, commodities, and even metals like gold and silver. This is because their jobs are highly dependent on their ability to either take advantage of future price movements to make a profit, or to be able to predict price movements to effectively plan against and prevent loss of value in their investments. That is how the concept of Forex strategy tester was born.

The Forex Predictor

As this article focuses on how the significance of predictions and expectations is applied to forex experts and traders, then the logical direction is to focus on how this translates to these people. It is well known that the chances of a forex trader to succeed in the business consistently lie in his ability to identify price points or levels in the market where the price is most likely to reverse or bounce back from. He must use all of these to his advantage in order to make a profit. It can be achieved through a combination of various strategies, market pattern formation identification, and a variety of signals that the trader uses to determine these profit points for price movements. It is exactly how it was done several decades ago, people digging into the patterns on the existing market, conducting the fundamental analysis of it, and drawing conclusions. However, the advanced technology produced the backtesting software Forex traders can look up to, which does the same analysis, but in a more efficient and precise manner.

But the question begs, how does a trader know for certain if his strategy will be successful or not if it is the first time that he will be using it? Even if the trader is equipped with extensive knowledge of the market patterns, the success rates of strategies are very difficult to calculate for a person. Well, for most traditional forex traders that you encounter and pose this question to them, the answer will be through months of practice. This is where they will tell you that the most fool-proof way to test a strategy is to practice it religiously for a long period of time. They are not wrong, of course. This is the most fool-proof way of finding out if a strategy is profitable or not, but there is also another way. One that may not require the immense effort and time that manual backtesting actually requires. What we are talking about is of course forex strategy backtesting.

Forex strategy backtesting is one way for forex traders to get ahead by having a much easier method for predicting the success rate and efficiency of their strategies before losing money in a real live trading environment. Back in the 80s, traders were actually unconsciously developing what now is one of the most advanced technological features in the Forex market – the backtesting software. However, they would manually insert the figures, outcomes, and immense information in notes regarding the logs. Nowadays, the software does not require any intervention from the user’s side, other than choosing their strategies and products that they want to trade with.

FX Backtesting – How does it work?

The way that backtesting Forex software works, is that it helps traders by simulating the market conditions necessary to test your forex strategy, without actually having to spend the time and effort to do so manually. This is done through the software for backtesting that works alongside your trading platforms like MT4. How does it simulate the market conditions? Well, each type of software is unique and has its own way of doing things, but for the most part, they operate by using the historical price data of the forex market and applying your created strategy to these environments. You can set multiple indicators and components of the trade or your chosen strategy and the software would analyze the combination of it all and its success rate in real-life. This is particularly helpful because it allows a trader to test his strategy during specific past price events like huge price spikes or price tsunamis, so he would know just how strong his strategy is to stand up to these types of major financial events.

Now that being said, there is more than one Forex backtest software available widely on the market, ranging from free options to software that a trader can only obtain through payment. If you are thinking about spending money or not, we are certain that you still want to get a proper forex backtesting program that will satisfy your own unique trading needs at the end of the day.

The Best Forex Backtesting Software

Now labeling what is the best software for Forex backtesting is, is a matter that is based highly on opinion. And different traders are looking for different things in software like this that will meet their own unique needs. At the most basic, some traders are looking for free options over those that you have to pay for. For them, they would not see a paid program as the best available option.

The most popular programs are free software for Forex backtesting in combination with the software that the trader has to purchase to use.

The best Forex trading software option, and by far the most convenient to use is the strategy tester feature that comes with MT4 (Metatrader 4). The feature comes with the standard MT4 download, and so it is completely free and is already integrated into the platform itself. Most people consider automated trading to be more suitable rather than manual trading. Even though there are many factors that affect the choice, it still seems to be determined by personal preference.

The steps to use this ‘Tester’ feature are as followed:

- Download and install MT4 (if you haven’t already done so).

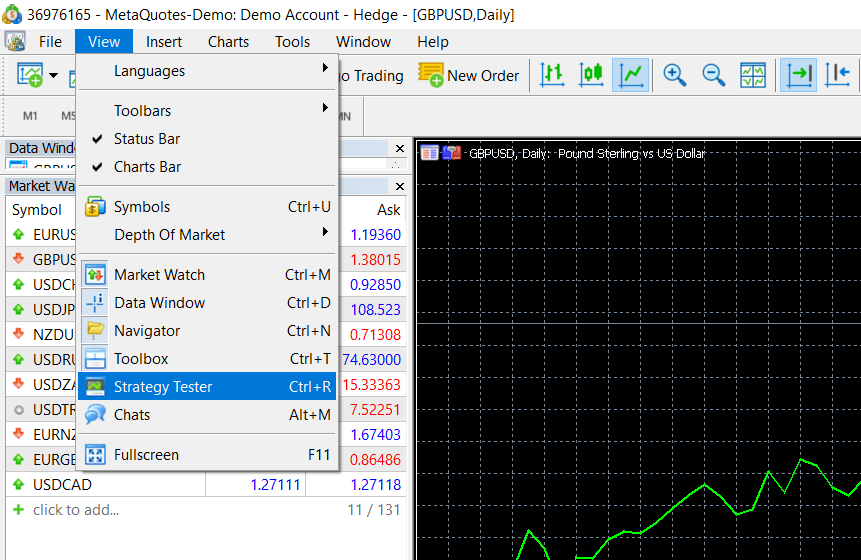

- Open the Main Menu, then go to View, then Strategy Tester.

- You may also go to Strategy Forex testing software, by using the Strategy Tester button in the standard toolbar, or press CTRL + R.

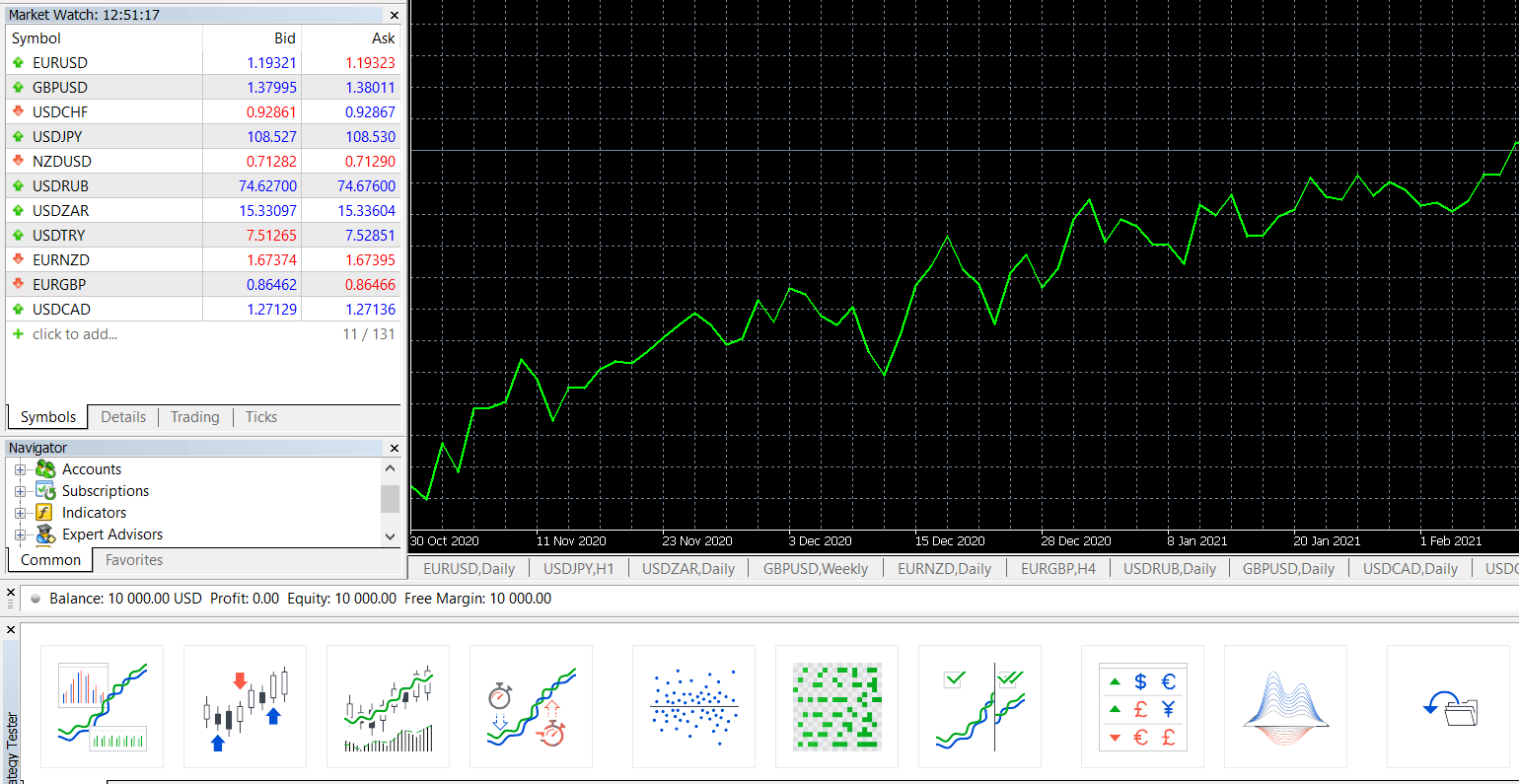

Upon first opening the Tester window, only two tab options will appear Settings and Journal. As the trader takes actions within the platform, then more tabs will appear. These extra tabs will give the trader several abilities, like being able to see the results of the trading strategy when tested on historical price data, graphs, and a detailed report of how the strategy performed. There are also optimization options that allow the trader to tweak his trading robot (automated trading software) in order to obtain the best profitability in its performance.

The second popular forex strategy backtesting option available is a software called Forex Tester. There are multiple versions of this software, and it is the trader’s choice which version he finds best suited to him. Unlike the MetaTrader 4 Tester, this software is not a free option. Also unlike Metatrader 4, this option can also be used for manual trading as well as automated trading.

Unlike most other backtesting software, Forex Tester provides the trader with preformed strategies. The program comes with 10 manual strategies and 5 EAs (automated trading robots), as well as 16 years of historical price data and a risk calculation and money management table to help the trader to develop a successful money management strategy. With their money-back guarantee, this is an attractive option for those who are seeking the extra features and are willing to pay for it.

There are of course many other backtesting software options available, but there is a reason why these are the most popular ones among forex traders. They are the most available tools out there, and many traders are satisfied with the results that they get from them, free backtesting software Forex Tester for manual options and Metatrader 4 Tester for automated options. For those of you who wish to check out the options then you can do your research on the following and make your own decision of which would be most suited to your needs:

For manual trading:

- TradingView

- Metatrader

You would notice that I also included Metatrader in the manual option while stating before that this is more suited for automated trading. That is the truth, however, traders have used it for manual trading as well, but only by scrolling bar by bar, and noting how your strategy works bar by bar, and analyzing the data in Microsoft Excel. This is the same for TradingView.

For automated trading:

- Metatrader5

- Candlescanner

- Tradestation

Metatrader 5 is another Metatrader option that a trader can use and for many traders who solely use automated trading tools. The layout is a bit different than MT4 backtesting software and some traders report glitches with the MT5, but of course, each trader’s experience is unique and it is worth checking out.

Vigilance is Key

As with every aspect of trading, being thorough is essential for using any type of software for backtesting Forex, particularly for manual systems. It is recommended that alongside viewing the reports generated by this software, the users track their own results by noting the information for their systems in excel for the data to be analyzed at a later time. This is done so that helpful statistics about the performance of the strategy can be created at a later date for the benefit of the trader.

FAQ on Forex Backtesting Software

What is the best backtesting software?

If you are looking for the best free Forex backtesting software then the Forex Tester might be your first choice. Even though the software is not available for an unlimited period of time without any further payment required, the free trial period is more than enough to get accustomed to the backtesting software and decide if it is worth making an investment in it. Most of the completely free platforms that offer Forex backtesting will be much lower in quality than the premium software, that is why it is always recommended to go for the free trials offered by the valuable backtesting platforms.

How do you backtest Forex strategies?

There is nothing complicated behind using the backtesting software for the first time. Every best free Forex backtesting software is user-friendly and takes into account the fact that many of the users will be first-timers. There are only a few button clicks required before the program for backtesting Forex becomes available and active for the users. The very first step would be to download and install the trading platform, such as MetaTrader 4 or MetaTrader 5 if you are not using them already. Let’s assume that you have downloaded the MetaTrader 4, which automatically comes with the Forex tester software inbuilt within the platform. After downloading the MT, you will find the Strategy Tester in the main menu of the platform. The shortcut to Forex backtesting software free of any search in the menu is Ctrl + R. The program will require several options to be set up, such as an indicator or expert advisor, whereas the main difference lies in whether you are looking for something specific or you would like to test the combination of several various factors. Afterward, the symbol should be indicated, which is the securities of the interest, such as currency pairs, commodities, and few popular stock market indices, as well. Then users will be asked to choose the period to be analyzed. One day’s worth of data is a lot faster to load in the software rather than 10 or 20 years. Spread and optimization could also be determined by the user, which makes it more realistic, as brokers will often take spreads in real trading. At this stage, the options are set according to the user’s preferences and the software is ready to start testing. For more information check the custom guidelines for the specific platforms, as the instructions will vary for every best backtesting software.

Which is the best software for Forex trading?

The most famous and high-quality trading software for Forex is MetaTrader. Most of the top Forex brokers will come equipped with either MetaTrader 4 or MetaTrader 5, in the ideal case, they will offer both. MetaTrader platforms are free of charge whenever the trader registers with the broker and a lot of free indicators will come together with the platform. Most of the tools and indicators will be exclusively owned by these two software types. However, MetaTraders are mainly offered for PCs only and are not every device-compatible at this stage. If you are a US citizen, then signing up with Forex.com can be your top choice in order to test the trading platform even on the Demo account. You can also have access to the best backtesting software Forex market can offer.

Comments (0 comment(s))