Tickmill Review – Preferred broker of 150,000 traders

As a Forex trader, finding a decent brokerage firm with suitable trading conditions is not easy. There are a lot of options available, as more and more brokers establish on the market and offer various products, tools, and benefits. Identifying the best possible trading environment can take a lot of time. Especially, when traders have to find a reliable and experienced broker. That is where broker reviews come in handy. In this Review of Tickmill Forex Broker, we will cover and assess the features of the broker and display all of its aspects that are crucial for the traders to know.

Tickmill is a brand of the Tickmill Group, which unites multiple brokerage firms. The Tickmill Group holds license from the Seychelles Financial Services Authority (FSA). The company comprises a team of experienced traders that got involved in trading back in the 80s. That is why the company claims that it was built by traders for traders. At the moment, there are over 350,000 active accounts registered with the broker and the company employs over 200 professionals across the globe.

The brokerage firm provides over 80 different financial trading instruments and spreads as low as 0.0 pips. However, for some of the accounts, Tickmill charges a commission fee, as well. The execution speed of the orders is also quite competitive, 0.20 seconds on average and no requotes. Further convenience that adds up to the rest of the features of the broker is the freedom to choose any trading strategy, including EAS, hedging, and scalping. The clients’ funds are protected on segregated accounts with additional Negative Balance Protection and the broker operates with the top-tier banks only.

Awards and Regulations

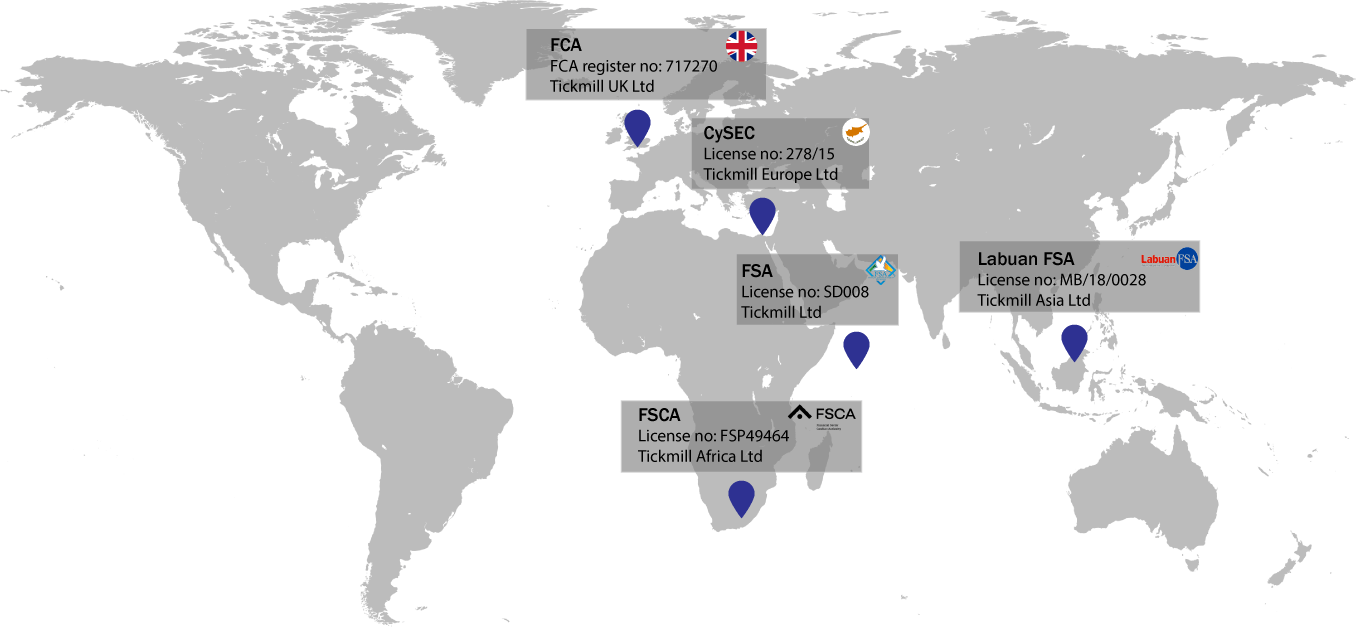

Tickmill Group member brokerage firms are regulated in the most reputable financial jurisdictions globally. The full list of the regulatory bodies and corresponding licenses of the Tickmill companies includes:

- Seychelles Financial Services Authority (FSA) – License no. SD008, Tickmill Ltd

- Financial Conduct Authority (FCA) – FCA Register no. 717270, Tickmill UK Ltd

- Cyprus Securities and Exchange Commission (CySEC) – License no. 278/15, Tickmill Europe Ltd

- Labuan Financial Services Authority (Labuan FSA) – License no. MB/18/0028, Tickmill Asia Ltd

- Financial Sector Conduct Authority (FSCA) – License no. FSP 49464, Tickmill South Africa (Pty) Ltd

All five regulatory authorities and institutions mentioned above represent one of the most reliable and recognized bodies across the world. The licenses from these regulatory sources guarantee the safety and security of the clients that trade with the brokers registered with any of them. However, they usually limit the offerings of the brokerage firms, as well. For instance, the brokers are no longer able to offer sky-high leverages to their clients due to regulatory restrictions.

Furthermore, the regulated broker is obliged to comply with all the necessary requirements of the regulating bodies, as well as the market standards. Correspondingly, Tickmill Forex broker goes through regular audits to ensure that the accounts of its traders are safe and are kept on segregated accounts.

Tickmill received numerous awards in multiple different nominations. The list of the awards acquired by the broker includes: #1 Broker for Commissions and Fees, Best Commodities Broker, Most Reliable Broker, Best Trading Conditions, Best Trading Experience, Best Forex Education Provider, Best Forex Execution Broker, Best CFD Broker Asia, Best Trading Platform Provider, Most Transparent Broker, Top CFD Broker, Most Trusted Broker in Europe and many more.

Trading Instruments

Tickmill offers various trading instruments within the financial sectors of Forex, bonds, Stock Indices and Oil, and Precious Metals. Each of the markets and individual products come with their own trading conditions. However, there are general conditions applicable to the groups of instruments that are described below.

Forex

Foreign Exchange, or Forex in short is the world’s largest market. Every day, the trade volume reaches 6.5 trillion US dollars. The market itself is overly volatile, that is why the convenient conditions for trading in Forex are extremely crucial. Tickmill offers over 60 currency pairs for traders with spreads from 0.0 pips and leverage up to 1:500. The average execution speed of orders is 0.20 seconds.

Stock Indices and Oil

Stock indices are groups of stocks that are tradable as a single instrument. Even though some of the investors will speculate on the volatility of a single asset price change, many prefer to go for groups of stocks. On the Tickmill trading platform, the users can access over the fourteen most popular indices. They can use the flexible leverage of up to 1:100 with significantly low spreads. All trading strategies are allowed.

Precious Metals

People always come back to precious metals as safe-haven assets that are increasingly popular during political and economic unrest. Where currencies and stocks might appear vulnerable to great losses during hard times, these metals retain their value. Spreads on Gold and Silver crosses start from 0.0 pip. The leverage for Precious Metals can go up to 1:500 with 0.20 seconds average execution speed.

Bonds

For bonds, there exists no central exchange for buying and selling them. As the bond market s an over-the-counter market, it is much larger than the stock market. Tickmill Forex broker offers EURBOBL, EURBUND, EURBUXL, and EURSCHA bonds for their traders with the spreads starting as low as 0.0 pip. The leverage on these products is 1:100 with special access to German bonds.

Trading Accounts

According to your trading style or trading strategy, you might look for different trading conditions. The best option to suit most of the clients; requirements and needs for the brokers are to offer multiple types of trading accounts. Tickmill designed three different account types with various elements. All three account types can have an option of a swap-free Islamic account. Furthermore, there are no limitations to trading strategies and all account holders are free to choose any strategy they like, including EAs, scalping, and hedging.

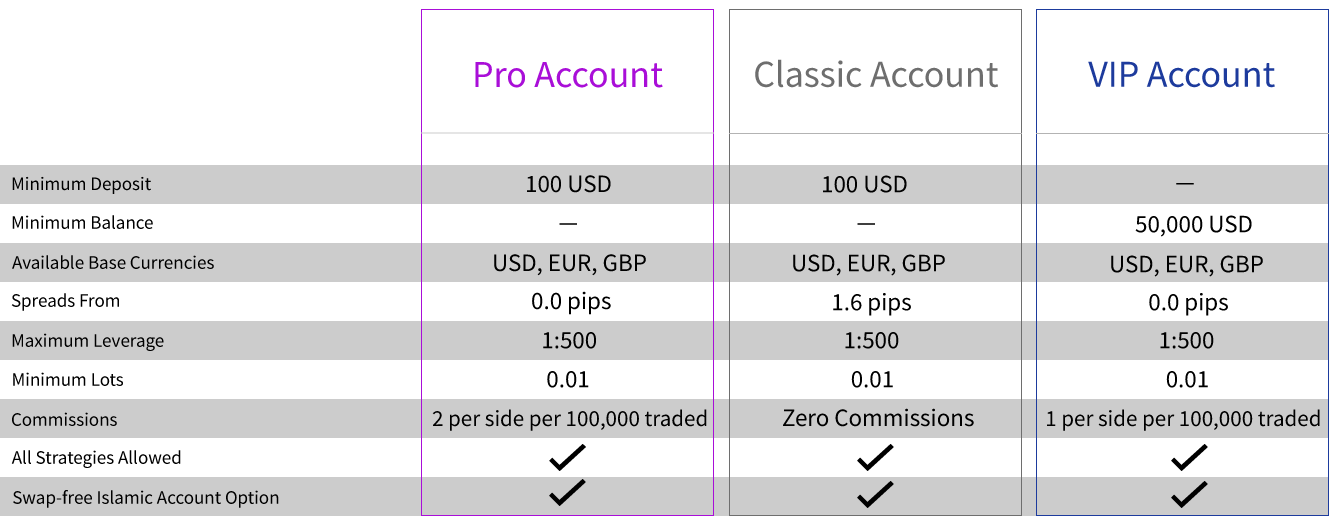

Classic Account

Classic Account suits the needs and demands of both newcomers and experienced traders. It offers optimal trading conditions and ultra-fast order execution. The variable spreads start from 1.6 pips and there are no commissions applicable to this account type. The maximum leverage for Classic account is 1:500. Available base currencies for this account is USD, EUR, and GBP. The minimum deposit requirement is 100 USD/EUR/GBP. The execution model is NDD with execution type of market execution. The average execution speed of orders is 0.20 seconds. Margin call and stop out levels are 100% and 30% respectively.

Pro Account

Pro account is specifically designed for professional traders who look for advanced features and optimal trading conditions. Traders have to pay a commission of only 2 currency units per side per lot (0.0020% notional) for the Pro account in the base currency of the trading instrument. Though many brokers do not allow placing stop and limit orders close to market prices Tickmill offers stop and limit levels for Pro account users at zero. The spreads start from 0.0 pip and leverage can go up to 1:500. The average execution speed of orders is 0.20 seconds with execution model NDD and market execution type. Margin call and stop out levels are 100% and 30% respectively.

VIP Account

VIP Account Tickmill rating is quite high due to the exclusive trading environment. This account type is best suitable for the high-volume traders looking for competitive pricing and extra benefits. The commission applicable to the account is one of the lowest offered worldwide by competitor brokers. The commission is 1 currency unit per side per lot (0.0010% notional) in the base currency of the trading instrument. The spreads start from 0.0 pip and the leverage is 1:500. The VIP Account holders need to hold the balance of 50,000 USD/EUR/GBP. The rest of the conditions are similar to Pro and Classic Account types.

Trading Conditions

Tickmill is dominating on market in several regions worldwide due to the highly competitive trading conditions that it provides to its customers. Its leverage levels are highly flexible with significantly tight spreads. The margin and swap indicators are also surprisingly convenient for traders. Additionally, the broker offers multiple payment solutions both for deposit and withdrawal for the trading account with Tickmill.

Leverage and Margin

It is agreed upon that the most fundamental concepts for traders are the uses of leverage and margin. Professional traders understand how the leverage determines the required margin and correspondingly choose the brokers with the most flexible leverage options. What leverage means is that it allows you to open much bigger positions than your initial balance and potentially earn larger profits. However, it also means that bigger positions pose higher risks of immense losses. Therefore, sometimes the brokers that offer 1:1000 leverage are better to avoid. Tickmill provides an optimal range of 1:500 leverage, which leaves a huge space for the winning benefits to the traders and at the same time does not impose the same risks as 1:1000 leverage. Furthermore, the margin requirement with Tickmill is only 0.2% on Forex products, 1% on stock indices and oil, as well as bonds, and 1:1 on Precious Metals.

Deposits and Withdrawals

Frequently, the payment methods are one of the determinant factors whether the trader will go for a specific broker or not. The abundance of options in payment solutions is obviously a considerable asset of any broker. Apart from numerous payment options displayed on the trading platform of Tickmill broker, it furthermore employs the Zero Fees Policy. The policy applies to all deposits starting from 5,000 USD or equivalent in other currencies that are processed in a single transaction by bank wire transfer. The company will cover the transaction fees up to 100 USD or equivalent in other currencies.

The minimum withdrawal amount for all payment solutions is 25 USD or equivalent. The payment options include bank wire transfer, Visa, Mastercard, Skrill, Neteller, Sticpay, FasaPay, UnionPay, NganLuong.vn, QIWI, and WebMoney. For most of the options deposit payment processing happens instantly, as for the withdrawals, the payments are processed within 1 working day.

Trading Platforms

The primary trading software employed by Tickmill is the MetaTrader 4 platform. The software was designed specifically for traders and the platform supported by the broker provides a highly customizable interface. Furthermore, it offers sophisticated order management allowing the traders to control the positions much quicker and more efficiently. The MetaTrader4 is a highly reputable software that is every trader’s favorite when it comes to trading Forex. It provides enhanced charting functionality along with the indicators and supports MQL language. For that reason, traders can simply program indicators and Expert Advisors to trade on Forex Market without any intervention from their side required.

However, as MetaTrader 4 software needs downloading and installation it needs further learning on how to function the platform. In order to simplify the matters for its customers, in Tickmill opinion webTrader was an easy solution. WebTrader is also supporting the MetaTrader 4, however, it is directly available in the browser of the user. The convenience of the platform comes from the fact that traders can access the system anywhere and anytime. The functionality, on the other hand, remains the same as in the downloadable version of the software. The data transmitted is securely encrypted and presents a reliable and intuitive interface.

Client Tools

Often, it is not only about the trading conditions but the dedication of the broker that attracts the attention of thousands of traders. In Tickmill’s case, the statement is absolutely true. Tickmill has put a significant effort into developing various client tools in order to enhance the trading experience. The tools include educational resources, such as webinars, tutorials, seminars, eBooks, infographics, Forex glossary, market insights, numerous analyses, Forex calculators and so much more.

Education

The webinars provided by the professional traders and financial experts are held in different languages. Every day, various topics are covered by famous and experienced figures in the trading industry that Tickmill traders can attend without any additional cost. Furthermore, the broker offers several eBooks on trading, Forex, and other investment markets in PDF version for downloading free of charge. Additionally, Tickmill holds global seminars on trading and relative topics, as well as allows its traders to participate in other international seminars. Numerous infographics are also available on the website that introduces popular events in financial markets, concepts, and other related material in an easy and entertaining way.

Promotions

Tickmill has a diverse portfolio of promotional programs. The portfolio includes trading contests, bonus programs, and even predictions that reward the traders with cash prizes. The broker announces trader of the month regularly. The trader of the month is identified according to the trader’s individual performance in trading. The skilled and top-performing clients are awarded a 1000 US dollars cash prize in order to acknowledge their remarkable achievement. The winner is decided according to the profit generated, but the initial deposit and risk management skills are also taken into account. There is no need for special registration to participate in the tournament, the players are automatically eligible to take part in the contest whenever they open a live account with Tickmill Forex broker.

Another campaign that the broker runs is an NFP Machine program, where traders have to rely on their intuition to grab a prize. The contest is held on a weekly basis. The rules are simple. Tickmill picks up a single trading instrument every week and challenges its traders to guess the price of the instrument on MetaTrader 4 platform at 16:00, immediately after 30 minutes from the NFP release. Those who hit the target perfectly receive as much as 500 US dollars on their trading accounts. If there is no one guessing the exact price, then the trader with the closest prediction earns a cash prize worth 200 US dollars.

The Forex welcome bonus is a popular concept among the best Forex brokers worldwide. Tickmill is no exception and it offers a 30 USD welcome bonus to the new registering users. A unique feature of the bonus program is that it is a no deposit bonus. It means that clients can start trading with free trading funds without any further requirement to make a deposit. So, simply opening a live trading account with the broker will grant free trading money in the amount of 30 US dollars. Any profits generated through trading with the bonus amount belong to the traders and can be withdrawn.

Final Thoughts on Tickmill

Tickmill is an award-winning brokerage firm and we think that mostly, the broker deserves the titles that it has earned. Despite the fact that the trading instruments offered by the broker are not much in comparison to most of the brokers, the conditions that they provide for the customers are indeed competitive and highly customer-centric. Furthermore, the client tools are a great way to enhance knowledge in trading matters and its significance cannot be ignored. The variety in the account types along with the optimal trading conditions provided is suitable to most of the trading strategies. The provision of multiple promotional campaigns adds up a lot of points to the rating of the broker, as well. Overall, Tickmill is a highly recommended brokerage service provider for every type of trader.

Comments (0 comment(s))