Noor Capital PSC Forex broker review – Everything you need to know

Noor Capital PSC is a Forex and CFDs broker regulated and operating in the UAE and Abu Dhabi. The company also offers investment advice, asset management, and market insight updates to its institutional clients. Because of its heavy focus on institutional clients and investment-related services, the company absolutely fails to offer decent brokerage services for retail clients. Therefore, we advise our readers to exercise caution when dealing with this company.

In our Noor Capital PSC review, we will assess the broker’s trading conditions, safety, platforms, support, and more. So, let’s begin.

Noor Capital PSC Broker history

Noor Capital PSC is a regulated investment services provider and brokerage company. It is regulated by the Department of Economic Development Abu Dhabi, and the Securities and Commodities Authority (SCA). The company offers diverse services including global financial advisory, asset management, investment, and funds administration for institutional investors and clients. It also offers financial trading services and advanced trading platforms. However, as a financial brokerage firm, Noor Capital PSC falls terribly short as the majority of traders indicate terrible customer support services and bad trading conditions. The broker fails to respond to emails and it is a painful process to contact its support, making it difficult to trade with this broker. Despite its history starting from 2005, Noor Capital PSC has not learned much from this experience and its trading services are horrible.

Noor Capital PSC Accounts, deposits, and withdrawals

The broker also fails in transparency as it does not provide details about its trading account types and trading conditions. Noor Capital PSC only provides one live and one demo trading account and there are no options for low-spread accounts. This is a serious downside of the broker and makes it difficult to suggest this broker to anyone. Traders can select their accounts during registration, including trading assets and platforms. However, the spreads and all the other conditions are the same which is a drawback. Not offering 0 pips accounts, the broker effectively limits who can trade on its platforms. The minimum deposit for retail traders starts from 50 USD and the leverage is capped at 1:100.

Deposits and withdrawals

Noor Capital PSC only accepts bank cards and wire transfers for deposits and withdrawals, which is very disadvantageous. Traders can only use local UAE banks for wire transfers and the process is super lengthy. Bank cards require 30 min for processing for deposit which is also slow and withdrawals will take 1-5 business days. This is much worse processing time than what other reliable brokers offer and is not worth the time and effort to sign up with this broker.

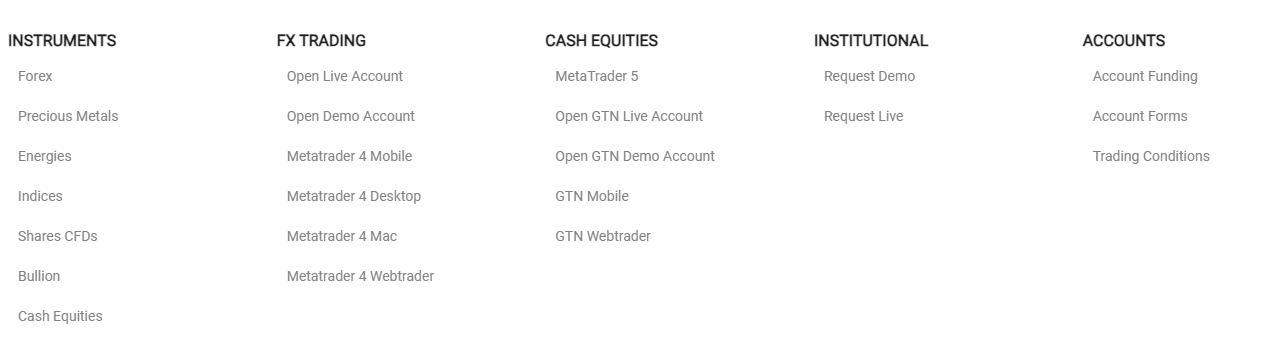

Noor Capital PSC Assets and Platforms

Noor Capital PSC allows access to more than 60 currency pairs for a maximum of 1:100 leverage. There are only 2 precious metals offered for 1:100 leverage from commodities and 2 energies with the same level of leverage. There are 9 popular indices offered for 1:100 leverage, and 70 share CFDs are offered from global financial markets. Offering only 70 shares for trading from such a big and experienced institution is very disadvantageous and indicates the broker is not focused on trading services. Shares trading incurs commissions of 0.02% per share traded which can get expensive when trading cheap stocks, making it difficult to make profits.

There are several trading platforms offered including MT5, MT4, and GTN trading platforms. Cash equities can only be traded on MT4 while CFDs are available on MT4, making the broker once again not consistent in its offerings. The GTN platform is designed for stock trading and is offered for all devices like other platforms. All these platforms are available on mobile devices to trade on the go.

Noor Capital PSC spreads and leverage

The broker is not brave enough to disclose its spreads and exact commissions unless the trader opens an account and starts trading, which is disappointing. The leverage is capped at 1:100 aligned with local regulations. The commission on shares is 0.002% per share traded limiting the profit potential for traders.

Noor Capital PSC education and support

When it comes to educational content the broker provides a mixed bag. There are no educational materials except for a trader glossary and video tutorials. These tutorials can be used for familiarizing yourself with platforms and services, while the glossary provides the basic language of financial trading and investing. The situation is better with trading and market analysis tools. Noor Capital PSC provides an economic calendar allowing traders to always monitor fundamental news releases, which is actually useful to ensure they are ready for increased volatility. There are trading signals but we doubt their accuracy, as they are generated automatically by software and the broker is not shining when it comes to designing useful products.

Customer support is where the Noor Capital PSC fails as a broker. There is no live chat and traders complain about difficulties to connect with the support. The email support option takes a long time and the response often is not quick. The hotline support is costly and not every retail trader wants to use it to contact the broker. Overall, Noor Capital PSC customer support is nowhere near the level of a reliable broker.

Noor Capital PSC review conclusion

Overall, Noor Capital PSC is a broker with a long history and focus on institutional clients and investment advisory services, but it struggles to provide adequate trading services for retail financial traders. The lack of transparency regarding trading conditions, high processing times for deposits and withdrawals, limited asset offerings, and poor customer support make it impossible to recommend this broker to our readers. Retail traders should consider these factors and be extremely cautious when dealing with Noor Capital PSC as a Forex and CFDs broker.

Comments (0 comment(s))