FundedNext Forex prop firm review – Attractive conditions but questionable safety

FundedNext prop firm is a company that offers funded account challenges to retail traders. The firm was launched in 2021 which makes it pretty experienced in the industry. FundedNext offers up to 90% profit share and funded accounts of up to 200k USD. The firm has various add-ons where traders can buy additional features to make challenges easier, and does not impose any time limits during an evaluation challenge. FundedNext offers several funded account types to attract prop traders with different budgets and strategies.

In this FundedNext review, we are going to assess the firm’s critical features such as safety, rules, funded options, fees, assets, platforms, support, and much more. After reading this review, you will be able to determine whether FundedNext can be trusted.

Overall

FundedNext prop trading firm offers competitive fees from 32 dollars, and diverse funded accounts from 5k to 200k USD. Trading platforms are MT4, MT5, and cTrader and maximum leverage is up to 1:100. Assets include Forex pairs, indices, commodities, and cryptos. FundedNext safety is very questionable as there are many negative reviews on the FPA platform, indicating unethical conduct from the firm. Be extra cautious when dealing with this firm.

Pros & cons of FundedNext prop firm

Pros

- ✅ Wide range of affordable funded accounts, starting from as low as 32 USD

- ✅ A high-profit split of up to 95%

- ✅ Supports advanced trading platforms like MT4, MT5, and cTrader

- ✅ No time limits during the evaluation phase

Cons

- 🚫 There have been many negative reviews on the FPA platform, with traders reporting unethical practices

- 🚫 Relies on simulated funded accounts

- 🚫 There is no phone support available

- 🚫 Lacks comprehensive educational resources

Safety of FundedNext

FundedNext reviews are very negative on the FPA (ForexPeaceArmy) platform. Many traders indicate the firm suspending their accounts on claims that were not true. Traders who got approved to use EAs then were disqualified from using these EAs. There were multiple fake positive reviews from the firm’s partner manager IP from Bangladesh. FundedNext requested one of its traders to make positive reviews on various platforms, which is extremely unethical. Because of these facts, FundedNext is a highly untrustworthy prop trading firm, and we recommend our traders be extremely cautious with this firm and avoid opening and purchasing an account.

The situation is completely different on Trustpilot, where there are around 20k reviews and the majority of them are 5-star evaluations, giving the firm a 4.5 score. Despite this, the FPA evaluations are far more legitimate and important than Trstupilot. The firm only offers simulated funded accounts and traders do not get access to live accounts even after they get funded.

When it comes to experience, the firm has been around since 2021 which makes it very experienced in the prop trading space.

FundedNext Funding and maximum capital allocation

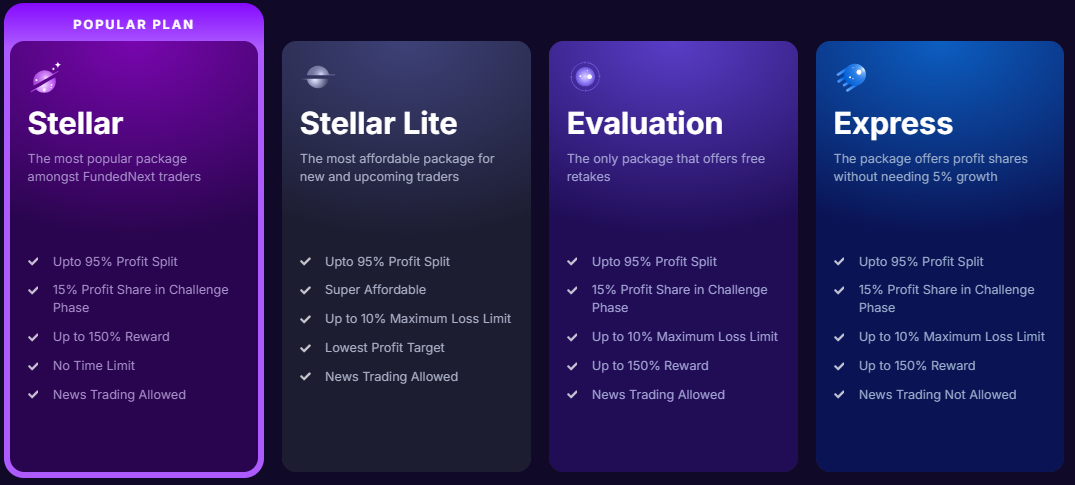

FundedNext funded programs are diverse and include 1-step and 2-step, which are competitive. There are several FundedNext accounts such as Stellar (1-step, and 2-step modes, Stellar Lite (only 2-step), Evaluation (2-step), and Express Plans (with consistency, and without consistency modes). There are no instant funding accounts, as all accounts require traders to hit certain profit targets either once or twice to get funded and trade for profits.

- The Stellar FundedNext funding challenge comes in three variants, Stellar 1-step, Stellar 2-step, and Stellar Lite 2-step accounts. Both Stellar 1-step and 2-step accounts have the same funding options of 6k, 15k, 25k, 50k, 100k, and 200k USD. The Stellar Lite 2-step account has different funding options such as 5k, 10k, 25k, 50k, and 100k USD amounts.

- The Evaluation Model FundedNext challenge is a 2-step account with funding options of 6k, 15k, 25k, 50k, 100k, and 200k USD.

- The FundedNext Express Model is a 1-step challenge that offers 6k, 15k, 25k, 50k, 100k, and 200k USD amounts.

The diversity of FundedNext accounts is very competitive in the prop trading scene, despite lacking instant challenge accounts. For 2-step accounts, traders have to hit profit turrets twice while maintaining a strong risk control to pass the challenge, the profit targets for phase 2 are around 4% which is also very competitive. If FundedNext did not have so many negative reviews on FPA, we might recommend it to our readers because of how many affordable options it offers.

The FundedNext scaling plan allows traders to increase their profit share from 80% by default to up to 90%. The plan allows traders to increase the maximum funding to up to 4 million dollars.

Assets of FundedNext

FundedNext prop trading assets include Forex currencies, commodities, indices, and cryptos. There are no stocks, futures, or any other asset types offered.

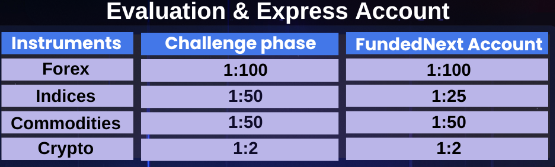

The leverage of the FundedNext challenge phase and funded phase sometimes differ depending on the funded account and asset class.

FundedNext Evaluation and Express accounts have the same leverage limits for both challenge and funded phases except for indices, which are 1:50 for the challenge and 1:25 for the funded phase. Forex pairs have up to 1:100, commodities have 1:50, and cryptos have 1:2.

Stellar 1-step accounts have 1:30 for FX, 1:5 for indices, 1:10 for commodities, and 1:2 for cryptos.

Stellar 2-step accounts allow 1:100 for FX, 1:20 for indices, 1:40 for commodities, and 1:2 for cryptos.

Stellar Lite funded challenges allow 1:100 leverage on Forex, 1:15 for indices, 1:25 on commodities, and 1:2 for cryptos.

As we can see, the leverage limits are the same for both the challenge phase and the funded phase, except for the Evaluation and Express indices.

FundedNext Trading rules and limitations

FundedNext rules are slightly different for each of their funded challenge types. Let’s briefly list all of them to better compare how strict they are.

Stellar 1-step challenge rules:

- Profit target – 10%

- Maximum daily loss – 3%

- Maximum overall drawdown – 6%

- Minimum trading days – 2

- News trading – Yes

Stellar 2-step challenge rules:

- Profit target – 8% (phase 1), 5% (phase 2)

- Maximum daily loss – 5%

- Maximum overall drawdown – 10%

- Minimum trading days – 5

- News trading – Yes

Stellar Lite challenge rules:

- Profit target – 8% (phase 1), 4% (phase 2)

- Maximum daily loss – 4%

- Maximum overall drawdown – 8%

- Minimum trading days – 5

- News trading – Yes

Evaluation Model 2-step challenge rules:

- Profit target – 10% (phase 1), 5% (phase 2)

- Maximum daily loss – 5%

- Maximum overall drawdown – 10%

- Minimum trading days – 5

- News trading – Yes

Express plan challenge rules:

- Profit target – 25%

- Maximum daily loss – 5%

- Maximum overall drawdown – 10%

- Minimum trading days – 10

- News trading – No

As we can see, FundedNext mainly offers daily risk and overall risk limits varying between 4-5% and 6-10%, which is pretty average for the prop trading industry. The same is true for profit targets, which are mostly at 10%, except for the Express plan requiring a huge 25% profit target.

FundedNext Fees

FundedNext fees are competitive and start from 32 dollars for its Express Lite 5k account.

Stellar 1-step challenge fees:

- Funded amount: 6,000 USD – one-time fee: 65 USD

- 15,000 USD – 129 USD

- 25,000 USD – 219 USD

- 50,000 USD – 329 USD

- 100,000 USD – 569 USD

- 200,000 USD – 1,099 USD

Stellar 2-step challenge fees:

- Funded amount: 6,000 USD – one-time fee:59 USD

- 15,000 USD – 119 USD

- 25,000 USD – 199 USD

- 50,000 USD – 299 USD

- 100,000 USD – 549 USD

- 200,000 USD – 999 USD

Stellar Lite challenge fees:

- Funded amount: 5,000 USD – one-time fee: 32 USD

- 10,000 USD – 59 USD

- 25,000 USD – 139 USD

- 50,000 USD – 229 USD

- 100,000 USD – 399 USD

Evaluation Model 2-step challenge fees:

- Funded amount: 6,000 USD – one-time fee: 49 USD

- 15,000 USD – 99 USD

- 25,000 USD – 199 USD

- 50,000 USD – 299 USD

- 100,000 USD – 549 USD

- 200,000 USD – 999 USD

Express plan challenge fees are exactly the same as the Evaluation model fees.

FundedNext free trial is available, which allows traders to check trading conditions before purchasing the challenge. However, the FundedNext free repeat is not available at the moment, which is a minor drawback.

Overall, the fees are super competitive for almost all FundedNext challenges.

FundedNext Platforms

FundedNext allows traders to access several advanced trading platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. cTrader platform can not be used to purchase and use 100k and 200k USD challenges, which is a downside. All of these platforms allow automated trading robots or EAs and advanced capabilities including custom indicators.

FundedNext Profit-Sharing

FundedNext profit split starts at 80% and traders can increase it up to 90% and 95%. Traders will have to either buy an add-on to achieve higher profit sharing or use a scaling plan.

Payouts should be processed within 24 hours and the minimum withdrawal amount is 100 USD. Traders have different tiers, and higher tiers can withdraw more often than lower ones. Generally, traders can withdraw their profits twice per month.

Education and trading tools at FundedNext

The firm lacks educational resources and there is only a trading blog. The blog mainly consists of interesting posts about financial trading and markets in general, but can not be used for educational purposes.

Customer Support at FundedNext

Customer support options at FundedNext include live chat and email options. There is also a messenger, but it is also a live chat. There is no phone support, which is a downside of this firm. Both the website and support are offered in several languages.