3 Best Stocks to Buy in Consumer Goods Sector

In times of economic downturn and general uncertainty, many investors are looking to protect their capital as much as possible. Consumer goods stocks can be one place, where they can take refuge.

Due to the very nature of those businesses, the revenues of consumer goods companies mostly tend to stay stable in times of economic downturn. Those types of firms are also well-positioned to build customer loyalty to their brands, even during the recession. This seems very logical. Consumers, faced with reduced income, might give up purchasing expensive phones or watches, however, they are still likely to purchase their favorite food or hygiene brands. In the first case, customers have to spend thousands of dollars. On the other hand, people can get most of the everyday consumer goods for an extra $5 to $10. So it is much easier to come up with those amounts.

Obviously not all consumer goods companies are successful. So in this article, we will discuss just some examples of firms, which delivered value to shareholders over the years.

First on the list is Unilever (UL). In 2019, the Anglo-Dutch consumer goods giant owns such famous brands as Lipton, Dove, Rexona, Calve, Knorr, Persil, Clear, and many others.

Procter & Gamble Co (PG) is a famous American consumer goods company. The firm owns a wide range of personal care, home care, and hygiene products. Some of the famous brands include Ariel, Gillette, Pentene, and Fairy.

Finally, we have a Colgate-Palmolive Company (CL), an American consumer products company. As the name suggests, the firm is most famous for its two brands: Colgate and Palmolive. The company also owns dozens of other brands as well.

Top Consumer Goods Stocks

The last decade had been very difficult to pensions funds and income investors in general. In response to the 2008-2009 great recession, most of the central banks adopted near-zero rate policies. In the previous years, it was relatively easy to find savings accounts where savers could earn a 5% return. However, after the crisis, it became hard to find a certificate of deposit (CDs) which paid more than 1%. As the recovery of the global economy set in, some central banks, including the Federal Reserve started raising rates, at one point even reaching 2.5%.

However, as the COVID-19 pandemic and subsequent lockdowns damaged economic growth, many national banks simply reverted back to near-zero policy rates. As a result of those decisions, it because increasingly for investors to earn decent returns on their capital. However, one place individuals can earn a stable income is dividend-paying consumer goods stocks.

The reason behind this is the very defensive nature of such businesses. In times of recession and economic hardship consumers always try to cut back on spending. So the majority of the population might let go of expensive vacations or luxury products. However, they still need to meet their nutritional and hygiene needs. This gives consumer goods companies an opportunity to increase their revenues consistently over the years. More income also enables the management of those firms to increase dividends consistently. So those types of stocks might be very useful for building any time of serious income portfolio.

So here is the list of consumer goods companies which we will discuss in this article in more detail:

- Unilever (UL)

- Procter & Gamble Co (PG)

- Colgate-Palmolive Company (CL)

Unilever (UL)

The Anglo-Dutch consumer goods firm has posted €52 billion in revenue, 2% higher than a year earlier. The net profit has reached €6 billion, with underlying sales growth at 2.9%.

Unilever’s stock is listed in three exchanges: in Amsterdam with as Unilever NV (UNA) and is traded in Euros, in London as Unilever PLC (ULVR) trader in Pounds and in New York both as Unilever NV ADR (UN) and Unilever PLC ADR (UL). According to the official website, all of those shares have exactly the same economic value within the company and pay the same amount of dividends.

Unilever’s stock had quite a successful run during the second half of the 90s when its price more than doubled during this period. This company shares mostly moved sideways between 2000 and 2009. The price action during those years was mostly confined within €15 to €25 range. After 2009 the stock has risen steadily over the next 11 years. By February 2020, Unilever’s shares were trading near €55 mark.

At that time, the COVID-19 pandemic concerns led to a serious collapse in the stock market. However, compared to other securities the shares of the Anglo-Dutch consumer goods company had experienced only a modest decline. As of May 2020, the stock trades near €45 level.

According to the 2019 annual report, the earnings per share of Unilever stands at €2.14. The current price to earnings ratio stands at 45/2.14 = 21.0. The current dividend yield is 3.6%. In the environment of near-zero interest rates, this seems quite an attractive return for any income portfolio. After all, nowadays it is practically impossible to find 3-month Certificates of Deposits which pays 3.6% per annum.

The beta of the stock is 0.51. So it is roughly only half as volatile than its peers on average.

How Effective Was Unilever for Its Shareholders?

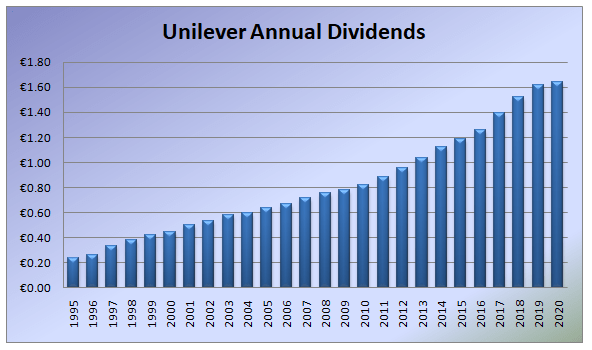

When it comes to dividends, the firm has quite a solid track record of returning money to shareholders. Obviously, in the US there are dozens of companies that managed to increase their quarterly payouts to their owners for decades. However, such a high degree of consistency is rather rare with the majority of European firms. However, Unilever is one company that delivered such results to shareholders for more than 25 years.

The Euro was finally introduced in 1999. However, if we use the conversion rate of the Dutch guide to the single currency, then in 1995 the firm paid to investors the equivalent of €0.23 per share in a year. Since then the company steadily increased its dividend payments. Even in times of 2008-2009 financial crisis, Unilever managed to reward its shareholders with increased payouts. By 2013, the total payments in the year have surpassed €1.00 per share. Nowadays, Unilever pays a quarterly dividend of €0.4104 per share, which adds up to €1.6416 per share in a year. This means that during the entire 25 year period, on average the company raised its dividend by 8.1%.

Another potential benefit to Unilever shareholders is that it determines its payments in Euros. By the time of official announcement then this rate is converted to Pounds for Unilever PLC shareholders and to US dollars for the owners of American Depositary Recipients. So investing in this company gives US-based investors an opportunity to introduce the element of currency diversification into their income portfolios. So if an American currency depreciates against the Euro, then US shareholders will receive higher dividends in US dollar terms.

Unilever shares can be a very decent source of income for investors. Also unlike some other companies, it is not too expensive and has a decent dividend yield.

Procter & Gamble Co (PG)

The American consumer goods giant boasts $67.7 billion in annual sales, according to the 2019 results. During this year, the firm also posted $5,5 billion in operating income.

PG stock has experienced impressive levels of capital appreciation. Back in 1990, one share of the company was worth approximately $8. 30 years later it has reached $126. Now, obviously, this was not the case of one straight line. The stock fell significantly both in 2001 and 2008 recessions. However, in each case, PG shares bounced back and after some time reached new highs. The arrival of the COVID-19 pandemic did make the stock cheaper. At one point PG fell below $100, but later by May 2020, it recovered to $115.

Some analysts point at the company’s P/E ratio of 60 to say that it is very overvalued. However, there is one important thing to keep in mind. This calculation is based on much-diminished EPS which the company had back in 2019. For three straight years from 2016 to 2018, the firm had Earnings per share was much higher, fluctuating between $3,49 to $3.69 range. So if PG manages to restore its profitability and increase EPS to even $3.50 it can change the picture dramatically. In this case, we will be dealing with a P/E ratio of 32.9. This is still considered above the fair valuation, but it is still far from being outrageously expensive.

The stock has a beta of 0.41. So PG is approximately 2.5 times less volatile, than the Dow Jones Industrial Average. This might be good news for those Procter & Gamble shareholders, which are concerned about preserving their capital. The reason behind this is that in times of economic downturn, such defensive stocks usually fall by much less than their peers.

Is Procter & Gamble Stock Useful for Income Portfolio?

The long term capital appreciation was not the only way PG shareholders have benefited over the years. The company has quite an impressive track record of increasing dividend payments. For example, back in 1995, the firm paid a quarterly payout of 10 cents per share to its owners. During the next 25 year period, on average, the firm hiked its payments by 8.6%.

By 2020, the quarterly dividend has reached 79.07 cents per share. It is indeed a great achievement to be able to raise the dividend by 6% in the midst of the COVID-19 pandemic. Because of financial challenges, many companies cut their payments to shareholders or eliminated it entirely. So in that regard, PG management has once more proven its reliability to investors. Finally, the current dividend yield of the stock is approximately 2.8%.

The firm released its most recent quarterly report back in April. According to the latest numbers, net sales have increased by 5%, compared to the year earlier. EPS has also risen by 8%. During the same period, the company also returned $900 million to its shareholders through its stock repurchase program. According to the report, the firm has sent $120 billion to its owners through dividend payments and share buybacks.

Despite being somewhat overvalued on P/E basis, the PG can be a valuable addition to any income orientated portfolio. The stock also demonstrated its long term growth potential, because of past history and also through the commitment of management for building shareholder value. PG shares are also less volatile than most of the other stocks in the market. This lets their investors hold on to most of their net worth even during the recession.

Colgate-Palmolive Company (CL)

The third company on our list is Colgate-Palmolive Company (CL). The firm has the largest market share in the world in toothpaste products. Interestingly, unlike the first two companies we discussed above, this firm also produces pet nutrition products. This category contributes to 16% of the firm’s net sales.

According to the annual report of 2019, the company has annual sales of $15.7 billion. So its annual revenue is significantly smaller than Unilever and Procter & Gamble. However, the firm has been quite effective for its owners. Just in 2019 alone, Colgate-Palmolive Company has returned $2.8 billion to its shareholders through dividends and share repurchases.

The stock of the company has appreciated notably over the years. At the beginning of the 90s decade, CL was trading just below $4. By 2008, it has risen to $40. The stock weather the storm of great recession rather well. At worst point CL fell to $30 but then recovered in a matter of months. By September 2009, the stock was back to pre-crisis levels. This uptrend continued for another 11 years. In February 2020 CL was trading at $76.

As a result of the COVID-19 pandemic, many stocks suffered serious corrections. However, in the case of Colgate-Palmolive shares, this decline was rather mild. By May 2020, CL trades near $69 level.

According to the latest figures, the earnings per share of the company stands at $2.93. Consequently, the price to earnings ratio is at 23.6. This might be slightly above the fair valuation, but it is very far from extremely overvalued levels. The beta of the stock is 0.59. So it is more volatile than Unilever and Procter & Gamble. However, it still fluctuates less than most of its peers.

Other Important Indicators of Colgate-Palmolive Stock

According to the 2019 annual report, the firm has 57 consecutive years of dividend increases. Back in 1995, the firm paid 10 cents per share to its investors on a quarterly basis. This amount has increased considerably over the years, including during the great recession. By 2020 CP pays a quarterly dividend of 44 cents per share. The average annual increase of those payouts is 6%. This is approximately 2% lower than Unilever and Procter & Gamble. However, it is still two times a larger percentage than the long term average US inflation. So over the years, the purchasing power of Colgate-Palmolive dividends increases substantially. The current dividend yield of CP is approximately 2.6%.

Despite the negative economic effects of the recent COVID-19 pandemic, the company revenue seems stable. According to the first-quarter results, net sales of the firm is up by 5.5%. During the same period Earnings per share has increased by 28%. Those indicators do demonstrate that the company might be in a good position to withstand an economic downturn. Even in financially challenging times, consumers still need to meet their hygiene needs and keep their homes clean.

To sum up all those arguments, we can conclude that Colgate-Palmolive Stock can be a valuable addition to both income and growth portfolios. The company has a well-diversified portfolio of brands, ranging from personal and home care products to pet foods. The firm’s management has proven its commitment to shareholders, by spending billions of dollars in dividends and share buybacks. Unfortunately. this is not always the case with all large-cap firms. However, in the case of CL, we might have a stock that is well suited for long term investing strategy.

Investing in Consumer Goods Stocks – Key Takeaways

- In general, shares of Consumer goods companies are considered defensive stocks. This means that in time of economic downturn the typically tend to fall less than most of the other securities. The main reason behind this is that consumers always need nutritional and hygiene products, even in times of recession. Many people also become attached to their favorite brands and purchase them on a regular basis. Because of those reasons, those companies are able to steadily increase revenue and have enough cash to pay dividends to shareholders.

- Consumer goods stocks have a lower beta than the majority of other companies. This means that they fall by a smaller percentage during the bear markets, than other securities. This suits the interest of those investors who are worried about preserving the principal of their investments. The only downside to this is that in booming times those stocks might make smaller gains than the ones with higher beta.

- A significant number of blue-chip dividend-paying stocks in the consumer goods sector performed quite well during the recent stock market crash. Unlike those securities, which lost 50% or more of their value, their losses were very modest. This is obviously very good news for their investors. The only negative thing about this is that it is now difficult to find undervalued stocks in this industry. Still many consumer goods stocks are quite close to a fair price to earnings valuation. So there are still some opportunities in this sector for value investors.

FAQ: High-Quality Consumer Goods Stocks

How do consumer goods stocks differ from retail stocks?

There are some similarities between those 2 types of businesses. However, everything else being equal, the retail sector typically has a harder time maintaining its profitability. The reason behind this is quite simple. If a consumer goods company wants to expand in another country, all they have to do is to find several stores there, which are interested in purchasing the company’s products and then arrange for the transportation of goods. After some time the local customers might get accustomed to purchasing those products and become loyal to the brand.

On the other hand, the retail company first has to either purchase or rent large spaces to open new supermarkets. The firm also has to hire qualified staff to run daily operations at those stores. At the same time, the firm has to cover utility costs and other expenses. This can be a very risky step for a business to take. In some cases, it can go terribly wrong.

For example, Tesco, a famous British retailer tried to expand into the US market and opened Fresh&Easy in 2007. After 6 years of struggle and several disappointing results, the firm management decided to pull out of the US. The total cost of this failed venture was approximately £2 billion. Such large sums could have been used more effectively for expanding the local UK business. However, we do have a benefit of high insight. Back in 2007, it was difficult to foresee those failures.

So as we can see in many cases it is more difficult to run a retail business and maintain steadily increasing dividends, compared to consumer goods companies.

What are the tax rates on the dividends of the US, UK, and Dutch companies?

In the US the dividend income for local residents is taxed from 0 to 20%, depending on the amount. For single individuals or for married persons filing separately the first $38,600 is tax-free and there is a 15% tax above this amount and 25% for anything above $425,800.

For foreign investors, dividends are taxed at a 30% flat rate. However, several countries have treaties with the US, where this rate is reduced for their residents. For example, people residing in the UK are taxed at 15% instead of 30%.

In the UK for local residents, there is a £2,000 allowance per year for dividend income. Anything above this number is taxed from 7.5% to 38.1%, depending on the amount. Foreign investors are not taxed on dividends, received from UK companies. By 2020 Netherlands has canceled its 15% withholding tax on dividends for foreign investors.

Why some consumer goods stocks have high P/E ratios in 2020?

The main reason for the high P/E ratios of several consumer goods companies is that such stocks are in high demand. For example, those companies we discussed in this article have years of steady revenue growth. They maintained their dividends even in most financially challenging times. Also, they have a presence in more than 190 countries with a well-diversified portfolio of brands.

Finally, the recent COVID-19 pandemic did not have a massive negative impact on those businesses. People who mostly stayed home still needed daily nutrition and hygiene products to survive. Consequently, those firms were able to maintain their sales and their payouts to shareholders.

Comments (0 comment(s))