3 Top Retail Sector Stocks for Dividend and Growth Investing

In times when the stock market fluctuates wildly and recession is likely, investors are becoming more concerned to preserve their net worth. There are several sectors of the economy, which is full of stocks that are less volatile compared to ones from other industries. This category includes such businesses as retail, consumer goods, Foods and Beverages, Healthcare, Utilities, and other sectors. In this article, we will cover the first category.

This line of the business tends to be more stable because in times of economic downturn people tend to prioritize essential needs over luxuries. During a crisis, consumers might give up expensive vacations, luxury cars, latest edition mobiles, or TVs. However, they still need to feed themselves and their families and also meet their hygiene needs. Consequently, people still go and spend a significant amount of money in supermarkets.

Obviously, the fact that the company operates in the retail sector does not necessarily mean that its stock will perform well and the firm will always reward its shareholders with consistently increasing dividends. So we will discuss 5 top stocks from this industry, which could be a very useful addition to any income or growth portfolio.

The first clear choice for this category is Walmart (WMT). The largest World retailer giant has a very respectable track record of steadily increasing dividend payments and stock price growth over the years. Costco Wholesale Corporation (COST) is the chain of warehouse clubs and at the same time the second-largest retailer across the globe. Finally, Kroger Company (KR) is another stock with decent dividend increases and steady capital appreciation. It also has some of the lowest Price to Earnings ratios as well, which might be interesting for value investors.

Best Retail Sector Stocks

Despite the defensive characteristics of Retail sectors, this does not mean that all such companies deliver results for shareholders. So here is the list of top 3 firms, which not only increased dividends steadily but their stocks have grown considerably over the years:

- Walmart (WMT)

- Costco Wholesale (COST)

- Kroger Company (KR)

Advantages of Investing in Retail Stocks

As mentioned before, in times of an economic downturn, investors are concerned to preserve their capital. Some financial experts suggest that one way to achieve this is to sell shares and invest the available funds in certificates of deposit or in treasuries. This might be a good way to preserve the principal and weather the storm during the economic downturn.

However, the problem with this approach is the near-zero interest rate environment. The average long term inflation in the US is 3%. So if investors build their entire portfolio on 0.1% to 2% returns, they are guaranteed they will eventually lose the purchasing power of their investments.

Fortunately, there is one alternative way to achieve this, without settling for potentially very low returns. Individuals can invest in so-called ‘defensive’ blue-chip stocks. So what is the meaning of this term? How stock can be ‘defensive’? Well, one of the perceived downsides of the stock market is that the asset prices tend to fluctuate wildly. So at all times, the principal amount is at risk. However, the degree of volatility is different among the stocks.

This is measured by ‘Beta’. If this indicator shows 1.00, this means that the security is fluctuating to the same degree as the rest of the index. Anything above this number makes the stock more volatile, the rest of the market. While the opposite is also true if the shares of a given company have a beta which is lower than 1.00, this suggests that it fluctuates less compared to its peers.

Besides some degree of protection against massive capital depreciation, those blue-chip retail stocks have a track record of consistently increasing the dividend rates for shareholders. This means that investors can still have a chance to have a stable and growing income, even in times of economic downturn.

Other Side of Coin

Obviously, there are no investments which do not have their own disadvantages as well. Firstly, despite relatively less volatility, the principal amount of investment is always at risk. Shares of retail companies can also fall significantly in times of recession or stock market crash. Consequently, in case of such events, investors might lose a significant portion of their net worth on paper. In many cases, they can recover from those losses if they do not immediately liquidate their investments. However, this requires a great deal of patience and it is not always guaranteed.

The second disadvantage of such stocks is that because of low beta, they typically tend to rise slower in times of a bull market, compared to their peers. So in booming times, other more volatile stocks in the banking sector may experience much higher capital appreciation. In some cases, companies with high beta stocks might go for larger dividend increases. This might be in sharp contrast to retail firms which might tend to be more moderate in hiking their payouts to shareholders.

Despite those drawbacks, many investors like defensive stocks, because in most cases the degree of their fall during bear markets is comparatively less dramatic than the rest of the market. So in a sense, this makes such securities, less risky in terms of preserving one’s net worth. Also, many blue cheap retail stocks also pay consistently increasing dividends. This is very attractive for those people looking for a stable and growing income.

Now let us discuss those top retail dividend stocks in more detail:

Walmart (WMT)

It is not surprising that we begin our list with Walmart incorporated (WMT). After all, this company is the world’s largest retailer with a market capitalization of $350 billion. According to the annual report of 2020, the annual revenue of the firm for the year has reached $524 billion. This is a significantly higher number than its major competitors in the world. This result was also 1.9% higher than a year ago.

The firm has also achieved $25 billion in operating cash flow and returned $11.8 billion to shareholders. This fiscal year was also significant for the company since it has added 6,100 new pickup and delivery locations across the globe. Finally, the firm also next day delivery from Walmart website, a service that is now available to 3/4 of the US population.

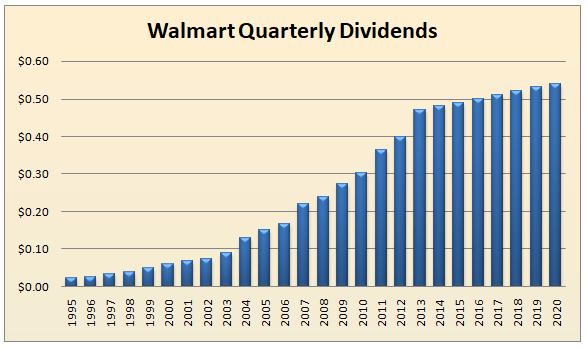

Another possible benefit of owning WMT stock might be its very solid history of consistently increasing dividend payments:

As we can see from the above chart the Walmart has increased dividends significantly over the last 25 years. Back in 1995, the rate of those quarterly payouts to shareholders was just 2.5 cents per share. It surpassed a 10 cents mark in 2004 and already exceeded 20 cents in 2007. After reaching 40 cents per share in 2012, the rate of dividend growth slowed significantly. However, despite that, Walmart consistently added a cent for each quarterly payment for 8 years. Nowadays, in 2020 the company pays the dividend of 54 cents per share with 3-month intervals.

How Walmart Compares to Other Global Retailers?

The mid-2010s were rather difficult not just for this US corporation, but for many other retailers across the globe. For example, Tesco PLC (TSCO) the UK supermarket with the largest market share in the Britan, suffered serious setbacks during this period. The company suspended dividend payments for 3 years and at one point event faced more than £6 billion in losses in a single year. Since then the firm steadily recovered and restored its profitability.

However, Tesco PLC was not the only one who suffered a downturn. Sainsbury PLC (SBRY) had also faced stagnating sales and financial difficulties during the same period. The firm’s management cut dividend 3 times, before restoring it to previous levels.

So objectively speaking, it is difficult to criticize Walmart management for the smaller pace of dividend increases. If anything, it speaks highly of the company, that it thought times when many of its peers across the world were reducing or even eliminating payouts to shareholders, the firm still managed to increase those payments by 4 cents per share every single year.

At the very height of COVID-19 concerns, back in the middle of February, Walmart has raised its quarterly dividend to 54 cents per share, 1.9% higher than a year ago.

The firm can be well-positioned to withstand the current economic downturn. Even at the hight of the lockdown period, consumers still spent significant amounts on their grocery purchases. So it might be very unlikely that any recession can change that.

Walmart Stock Price Performance and Other Valuations

WMT had its first major uptrend back in 1995 to 2000 when it has risen from $12 to $50 by the end of Millenium. This was followed by some sort of stagnation period for the next 11 years. However, during 2008-2009 the stock was quite resilient and stayed well above the $50 mark. After this period, Walmart shares had another major uptrend and nowadays they reached $123.

One remarkable fact about this stock was the absence of collapse in February 2020. As the COVID-19 concerned started to dominate the market, the heavy majority of Dow Jones Industrial Average and S&P 500 stocks collapsed, losing 10% to 50% of their value. However, WMT was a notable exception for this tendency and it held on to its recent gains quite well.

The Earnings per Share (EPS) of Walmart is $5.19. Consequently, the Price to Earnings ratio (P/E) is 123/5.19 = 23.7. In general, most investors consider stocks that have a P/E ratio above 20 as somewhat expensive. Finally, the current dividend yield is near 1.8%.

As for other indicators, the average beta of Walmart Incorporated (WMT) for the last 5 years is 0.32. This means that this WMT is 68% less volatile than the Dow Jones Industrial Average (DJIA) Index. This shows that this stock is defensive. In times of bear market, on average it losses much less of its value, then DJIA as a whole. So for example, if there is a recession and Dow Jones Industrial Average falls by 30%, then the Walmart and other defensive stocks may only lose 10%. So for those investors who want to earn higher returns on their savings and do not like high volatility, this stock might be a good option.

Clearly, Walmart can be considered as a very solid blue-chip stock with a decent history of capital appreciation and dividend increases. However, because of its current valuations, for some people, it might be preferable to wait for some pullbacks before buying, in order to get a better deal.

Costco Wholesale (COST)

Costco Wholesale (COST) is the second-largest retailer in the world, after Walmart. According to the annual report of 2019, the company has 785 warehouses across the world. This includes the US, Canada, Mexico, Japan, UK, France, Spain, Australia, South Korea, and Iceland. The latest addition to this list would be New Zealand, where Costco is planning to open a new warehouse in 2021. The company has a market capitalization of more than $136 billion.

One of the ways Costco earns money from is from customer subscriptions, which in 2020 costs $60 a year and allows an individual to shop at the store. Compared to the typical grocery stores, the company offers significantly lower wholesale prices on the goods. According to the annual reports, the average margin of cisco is near 11%. This is in sharp contrast to many traditional grocery stores, where margins are well above 20%.

The price of COST stock has risen steadily from 2003, increasing from $32 to $72 by 2008. Just like in the case of the majority of US stocks, the 2008 great recession reduced the price of security significantly, falling back to $42. Despite this setback, Costco shares recovered steadily and entered a new uptrend. By May 2020 the stock reached $310. Interestingly enough, the outbreak of COVID-19 pandemic and subsequent lockdown had very little effect on the performance of this security.

Costco Dividends and Stock Volatility

Since 2004 the firm started paying dividends, by that time the quarterly payment to shareholders was set at 10 cents a share. Throughout the subsequent years, the company increased its payouts steadily, including in 2008 and 2009 at the hight of the financial crisis. The latest dividend increase came in April 2020, when it was raised to 70 cents per share. So on average Cisco was raising its quarterly payments to shareholders by 13% per year. This is more than 4 times larger number than the long term US inflation Average of 3%.

The only downside to COST stock is its current valuation. The EPS stands at $8.45 and the P/E ratio is at 36.7. This indicator is quite high, but we should not forget that the company’s earnings are also expanding rapidly. During the last 4 years, the net income has risen by 54%. This on average represents 11.4% expansion per year.

Ideally, it would be best if COST had some sort of correction, in this case, investors would get an even better deal. However, on balance, this company might be a very good option for long term investing.

The beta of this stock is 0.70, notably higher than Walmart and some other retailers. This might be appealing for those wanting to invest in this industry and also tolerate higher volatility.

Kroger Company (KR)

Kroger company is the 5th largest retailer in the world and had $129.29 in revenue in 2019. According to the latest data, the company operates more than 2,750 supermarkets and multi-department stores across the world. The firm is also one of the largest private employers in the world.

The KR stock had two long uptrends in the past. For example, back in 1995, it was worth approximately $3. However, after 4 years of persistent appreciation, the Kroger shares have reached $16. This was followed by 4 years of stagnation and decline. However, the upward trend was resumed in 2003. The stock performed quite strongly during the financial crisis of 2008 and by December 2015 reached an all-time high of $41. Since then the stock became more volatile, mostly moving sideways, and nowadays in 2020, it trades near $34 mark.

The firm restored its dividend payments back in 2006, setting quarterly payments at 3.25 cents per share. This was followed by years of steady increases. By 2020, the quarterly dividends have reached 16 cents per share. This points to the fact, that the company on average has raised its payouts to shareholders by 12% per year. The beta of KR stands at 0.37, so it is much less volatile than the majority of its peers.

Another positive thing about this stock is its current valuations. The EPS of this company stands at $2.04, so the P/E ratio is 16.7. This shows that nowadays the stock is very reasonably priced and might even represent a decent undervalued opportunity.

Investing in Retail Stocks – Key Takeaways

- Stocks from the retail sector are attractive in the sense that the majority of them are less affected by the economic downturn, then in some other industries. In times of financial hardship people usually tend to priorities their basic necessities like food and hygiene products over luxuries and entertainment. Because of this retail sectors typically have lower beta and are less volatile than some of their peers.

- Several US retail companies not only managed to keep up with their payments to shareholders during the 2008 crisis, but they have also increased dividends consistently during this period. This makes them an attractive choice for income investors.

- Another benefit of investing in some large-cap retail stocks is their global presence. This automatically brings in the currency and geographical diversification into the portfolio. This means that company sales are not only dependent upon the economic conditions of one particular country.

FAQ: Picking Retail Stocks

What are some possible reasons for the poor performance of UK retail stocks during the last few years?

One of the key reasons for the struggling retail sector in the UK is Brexit. This event created 3 problems for companies involved in this industry:

- Brexit led to significant Pound appreciation, falling from $1.50 to below $1.25 against the dollar and also declining from €1.30 to €1.15 against the Euro. The tendency may also persist in the future years as well. This makes imported goods significantly more expensive. Yet it is not easy to simply pass on those increased costs to customers, without losing the market share.

- The result of the referendum had a significantly negative effect on UK economic growth. According to Bloomberg, the British economy has already lost £130 billion, and £70 billion might be added during this year. This also had a negative effect on retail sales as well.

- The absence of trade agreement between the UK and EU does imply the possibility of tariffs and hard borders. All those factors have created a great deal of uncertainty, which is always bad for consumer and business spending.

- Brexit led to increased demands for the 2nd Scottish Referendum as well as the Reunification referendum in Northern Ireland. It is difficult to predict how those issues will be resolved. However, a very real threat of UK breakup creates an atmosphere of uncertainty and yet another factor that can lead to the weak performance of the British economy.

Why some dividend-paying retail stocks also experience a long term capital appreciation?

More than a decade long history of consistently increasing dividends is can be a sign of stability and financial strength of the company. If the firm pays no dividends, then the only way investors can earn money from their investment is to sell shares at profit. However, companies that share their profits with their owners are more likely to attract long term investors.

The successful global expansion of some of those companies could represent another reason for the significant capital appreciation of their stocks. This tendency made those businesses more diversified in terms of currency exchange rates as well as geography.

Why some beverages and consumer goods stocks performed better than ones from the retail sector?

By its very nature, it might be slightly more difficult to run a retail business than beverages or consumer goods companies. The latter ones do not have to worry about renting or purchasing space for the supermarket. They also have the ability to distribute their merchandise in several competing stores across the globe. Consumer goods and beverage companies are also much more likely to build brand loyalty among consumers.

Finally, they have much stronger pricing power than retailers. If the negotiations with one supermarket chain do not bring satisfactory results, they can just turn to their competitor. Many customers are attached to their favorite products rather than just one chain of stores. So this gives such businesses a significant advantage in negotiations.

Comments (0 comment(s))