9 Top Dividend Stocks to Build Income Portfolio and Retire Early

In the environment of near-zero interest rates retirement investing becomes more difficult. It is indeed a challenging task to find such returns on Certificates of Deposit (CDs) or savings accounts to at least match the rate of inflation.

Fortunately, one place where investors can still turn to for building a decent income portfolio is dividend stocks. There are several companies in the US and in the rest of the world in general, why have a decent track record on dividend payments. Indeed some of them have consistently increased their payouts to shareholders for more than 40 years.

This category of stocks is not confined to just one or two sectors of the economy. There are consumer goods producers, Procter & Gamble (PG), Johnson & Johnson (JNJ), and Colgate-Palmolive (CL). We have retailers like Walmart (WMT), or restaurant chains, as in the case of McDonald’s Corp (MCD). In addition, there are foods and beverages producers, Coca-Cola Co (KO) and PepsiCo Inc (PEP). Finally, we have companies that are based outside the US and are constantly increasing their dividends in their respective currencies, Unilever (UL) and Nestle (NESN) are just two examples of such corporations.

For an effective dividend investing strategy, investors might consider creating their own list of solid stocks and then purchase the ones which are most undervalued and have decent dividend yields, on a regular basis. This approach can help them to maximize the long term returns and build a well-diversified portfolio that can produce growing income for their lifetimes and even for the next generations as well.

Top 9 Dividend Paying Stocks

In this article, we will discuss 9 companies. They all have a very solid track record of consistent dividend payments to shareholders:

- Coca-Cola Co (KO)

- McDonald’s Corp (MCD)

- Procter & Gamble (PG)

- Unilever (UL)

- Walmart (WMT)

- Johnson & Johnson (JNJ)

- PepsiCo Inc (PEP)

- Nestle (NESN)

- Colgate-Palmolive (CL)

Before moving on describing those companies in more detail, let us consider how a successful dividend investing can work in general. It goes without saying that creating an income portfolio that could cover one’s retirement expenses is hard work. It does require commitment and a significant investment of time and resources. So in order to achieve this, investors might consider the following steps.

Steps to Dividend Investing

- Setting aside specific amounts for investing on a regular basis. This does not have to be a large sum. In fact, some direct stock purchase plans let investors begin to invest from as little as $50 a month. The most important thing is to get started and form a habit. An investor can get started by opening a brokerage account or alternatively joining one of those direct stock purchase plans.

- Creating a list of solid dividend-paying stocks. This lets an individual know which securities to monitor on the market.

- Purchasing those shares which are most undervalued from the list. As the stock price falls, the dividend yield increases. An investor can also choose those companies which have lower Price to Earnings (P/E) ratios. Since an individual does this every month, most likely there will be opportunities to buy most of the stocks from the list at reasonable prices.

- Adjusting regular investment amounts. Doing this from time to time might be necessary. If the investor’s income increases, then he or she can also raise investment amounts incrementally. On the other hand, if an individual faces difficult financial circumstances, then it is possible to slow down on investing and reduce monthly contributions.

- Investing some portion of windfalls. This can range from a bonus from employment to tax refunds. This can certainly speed up the portfolio building process.

- Reinvesting dividends. Nearly all major corporations offer this option, this can increase accelerate the growth of the portfolio and also help investors to save money on trading commissions.

- Keeping track of net worth and total dividend income. This can have an important motivational value. When investors see their net worth and income growth, they are generally more likely to stay on track. So monthly updates on those can be helpful.

Coca-Cola Company (KO)

Based in Atlanta, Georgia, the nonalcoholic drinks giant has recorded $37.3 billion in revenues in 2019. Besides being one of the most famous brands in the world, it has a very solid track record of dividend payments.

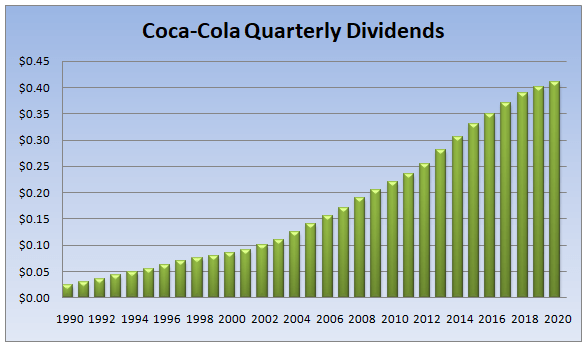

As we can see from the chart above the company has consistently increased its payouts to shareholders for at least the last 30 years. In order to get a clearer picture, all quarterly dividend amounts have been adjusted for stock splits. The actual growth rate of dividends is also impressive, rising from 2.5 cents in 1990 to 41 cents per quarter in 2020. This represents more than 16 fold increase in payouts. During this 30-year period, on average Coca-Cola increased its dividends by 9.7% per year. This figure is 3 times larger than the average US inflation during those 3 decades.

It is not surprising that Warren Buffet’s Berkshire Hathaway is the largest shareholders of the Coca-Cola company, owning more than 9% of the shares. World’s one of the top investors also stated publicly that he is not going to sell a single Coca-Cola stock during his lifetime.

As for the share price itself, the stock had an impressive run in the 90s. The market capitalization increased by more than 6 times by the end of the decade. This was followed by stagnation for the next 9 years, however, the company still kept raising its dividends on an annual basis. This policy, as well as the resistance of the company’s sales, eventually paid off and stock resumes its uptrend from 2009. By 2020 the Coca Cola stock trades withing $38 to $60 range. According to Gurufocus.com, the median dividend yield of Coca-Cola shares during the last 10 years stands at 3%.

McDonald’s Corporation (MCD)

The international restaurant chain earned $20.84 billion in revenue during the fiscal year, which ended on 31 March 2020. Mcdonald’s has also increased its dividend for several decades. Adjusting for the stock splits the company paid a quarterly dividend of 3 cents per share, back in 1995. By 2020, Mcdonald’s is paying $1.25 per share on a quarterly basis to its shareholders.

This represents an average 16% annual increase in the company’s payouts to shareholders. This clearly shows the company’s commitment to return some of its profits to the owners. However, recently due to the effects of COVID-19 and subsequent lockdown across the world had a negative effect on the company’s earnings. Consequently, we can not rule out that at some point McDonald’s might have to slow down the growth rate of its dividends.

Procter & Gamble (PG)

One of the world’s largest consumer goods producers boasts $67.68 in revenue. P&G is another dividend aristocrat, with a very solid track record. Just to bring one example, back in 1995, the company paid a quarterly dividend of 10 cents per share. By 2020, this payout has increased to 79.07 cents per share. So on average, the company has hiked its dividends by 8.6%.

P&G and other consumer goods sector companies have shown their resistance during the COVID-19 outbreak as well. Many airlines, hotels, restaurant chains, and many other businesses were hit hard by the pandemic. People in lockdown still need to purchase those goods in order to meet their daily needs. In fact, in April 2020, the Proctor & Gamble reported that its revenues have increased by 10%, as consumers stocked up their shelves with products in light of COVID-19 outbreak. So going forward, the company can be still well-positioned to deliver consistent dividend increases to its shareholders.

Unilever (UL)

There are many investors who want to build a decent income-producing portfolio, however, they are also concerned about the exchange rate risk. After experiencing the long term dollar downtrend from 2002 to 2008, several financial experts stressed the importance of currency diversification. The idea behind this is for investors to purchase some of their income-producing assets outside the US, in order to protect themselves in case of USD depreciation.

One option to achieve this might be the purchase of Unilever shares. The company had €52 billion in annual revenue in 2019 and increased its payouts to shareholders every year since 1995. From 2010 Unilever started paying its dividends on a quarterly basis. By that time the payment was 19.50 euro cents per share. Just in a space of 10 years, the company managed to increase its quarterly payouts to 41.07 euro cents per share. This points to the fact that on average Unilever was hiking dividends by 7.7%. So this company can definitely be a part of any solid income portfolio, with an additional benefit of currency diversification.

Walmart (WMT)

The retail giant also has one of the largest revenues in the world. By the end of 2019, the company’s annual earnings reached $524 billion. According to the annual report. during the same year, Walmart has returned $11.8 billion to its shareholders.

The company also has a decent track record of consistent dividend increases over the years. The firm has raised its annual payouts to shareholders from $0.30 per share in 2002 to $2.12 per share in 2019. This represents an average 11.5% increase per annum. The only concern some commentators have is the fact that since 2014 the firm has slowed down on those increases and only raised its dividend by 1 cent per quarter, 4 cents per year. However, as long as Walmart keeps hiking payouts every year, its stock remains a very attractive option for any income portfolio.

Johnson & Johnson (JNJ)

Another one of the world’s largest pharmaceutical and consumer goods companies has $82.73 billion in sales. Shares of this firm are also widely represented in the pension funds, because of its solid track record of dividend payments. According to the website of the company, Johnson & Johnson has increased payout to its shareholders every single year since 1972.

Adjusting for stock splits, back in 1992 the firm paid a quarterly dividend of 5 cents per share. Despite recent COVID-19 concerns, in April 2020 the management still decided to raise its payout to shareholders to $1.01. This represents an average annual increase of 11.3%. Here again, just like in the case of McDonald’s, Johnson & Johnson might not be able to maintain such a high growth rate. However, the company might be still well-positioned to deliver decent returns to shareholders for the years to come.

Nestle (NESN)

For those investors looking for some currency diversification for their dividend portfolios, Nestle might be another good option. The Swiss giant is one of the world’s largest food and drink producers, boasting annual sales worth of 92.6 billion Swiss Francs. According to the official website, the firm has never cut its dividend since 1959. By 1990 Nestle’s annual payout to its shareholders has amounted to 0.20 Swiss Francs per share. For the next 30 years, the company hikes dividends every year and by 2019, this has reached 2.70 Swiss Francs per share. This points at the fact that on average Nestle increased its payouts by 9%.

The firm might be well positions for further growth since regardless of the economic circumstances people will always need to feed their families and their children. In fact. during 2009 at the hight of the great recession, the company was able to increase its dividend by more than 14%.

Another major advantage this firm has from an investor’s point of view is the currency, in which Nestle determines its payouts to shareholders. Most major currencies in the world have average annual inflation from 2 to 3%. However, this is not the case with CHF. In fact, according to the official data, consumer prices in Switzerland are approximately at the same level as in 2008. This can be one of the reasons behind the long term appreciation of Swiss Franc against other major currencies. It is not surprising that many investors consider CHF as a reliable store of value.

Therefore, Nestle’s stock is not only a decent addition to any income-generating portfolio but also in the long term, it can be a very effective hedge against inflation.

PepsiCo Inc (PEP)

Another major non-alcoholic beverage producer reported $67.16 billion in sales in 2019. The company might not have such a large history of dividend increases as some other firms on this list, yet it is still quite solid. According to the official website, PepsiCo was paying a quarterly dividend of $0.14 per share. This indicator increased over the next years and by 2020 it reached $0.955. The average 10% annual increase in dividends over two decades is still quite impressive.

Unlike its largest competitor, besides drinks, PepsiCo also has a well-diversified portfolio of foods and snacks. This segment has grown to $33.9 billion by 2018. The average annual growth in foods and snacks have exceeded 4%, which is slightly higher than in the drinks category. Therefore the company might be well-positioned to deliver higher dividends to shareholders and stand its ground against the major competitors.

Colgate-Palmolive (CL)

Finally, no dividend stock list will be complete without mentioning Colgate-Palmolive. The consumer goods giant has recorded $15.69 billion in revenue in 2019. So the market share of the company might be smaller than some of its larger competitors. Despite those differences, the firm still has a solid track record of dividend payments.

Just 19 years ago, the firm paid 9 cents per share on a quarterly basis. Nowadays the company pays a 44 cent dividend every 3 months. So on average, Colgate-Palmolive has hiked its payouts to shareholders by 8.7%. This might not seem as impressive as some other companies listed here. However, still, this stock might be a good addition to the income-producing portfolio.

Building Dividend Portfolio – Key Takeaways

- The first essential step for building any dividend portfolio is to set aside a specified amount of money on a regular monthly basis. Investors do not necessarily need thousands of dollars to get started. Many brokers and direct stock purchase plans allow individuals to begin investing from as little as $50 per month. This can help investors to build a habit and discipline, which is so vital to succeed in this journey.

- There are many companies that currently offer attractive dividends. However, what matters most is their track record and current performance. Those corporations who increased their payouts to shareholders for several decades are more likely to deliver. Based on this research investors can create a list of dividend-paying companies they are willing to invest.

- Keeping track of the size of one’s portfolio is helpful in two ways. Firstly, it lets investors measure their progress and help with future investing decisions. This can also have a significant motivational value. As the market participants see their net worth rise, they will be more encouraged to keep up with their investing journey and not give up prematurely.

FAQ: Dividend Investing

Is investing in high dividend-yielding stocks a good way to build a solid income portfolio?

Investing in stocks just for the sake of high-dividend yields can be very risky. It might be the case that the company’s sales and profitability are in a decline leading to the fall of the share prices. The fact that at the moment the stock of the company has an attractive dividend yield, does not mean that this will always remain the case. At some point, the management might decide to cut it’s payouts to shareholders.

For example, by the end of 2019, the American Depositary Shares (ADS) of Royal Dutch Shell was trading at $56.70. During this year each ADS paid $3.76 dividend to its owners. So the dividend yield was quite attractive: $3.76/$56.70 = 6.6%. This was much higher than some other blue-chip stocks. However, because of the collapse of oil prices and economic effects of COVID-19 pandemic the company cut its quarterly dividend from $0.94 to $0.32. So nowadays the amount of payout for shareholders is just 1/3 of what it was originally.

Therefore, making judgments solely on the dividend yield can be very misleading. This is why it is important to research the past track record of the firm, as well as its recent financial performance. Obviously, those companies which have a decades-long history of consistent dividend increases are in general less likely to cut their payouts to shareholders.

What role does Price to Earning ratio play when selecting stocks for dividend investing?

The formula of the Price to Earnings (P/E) ratio is very simple. We calculate this indicator, by dividing the current price of a stock to the company’s earning per share. For example, on May 6th, 2020 the Coca-Cola (KO) has closed at $45.40. The latest earning per share of the company was $2.32. So the P/E ratio of this stock would be $45.40/$2.32 = 19.57. This means that with this market price, investors have to pay $19.57 for each dollar of the company’s annual earnings.

Every commentator and financial expert might have his or her opinion on the subject. However, the general consensus seems to be that if the P/E ratio is higher than 20, then the stock is too expensive. This does not necessarily mean that investors will always lose money if they purchase a relatively overvalued shares.

Basically, after composing a list of solid dividend-paying companies, an investor can buy those stocks which have the lowest P/E ratios. This might be a helpful method to identify and purchase undervalued securities and potentially achieve higher long term returns.

Are regular dividend increases the only way income investors can benefit from building such a portfolio?

Consistent dividend payments are just one side of the coin. Another important consideration is the long term capital appreciation. Clearly in the short and medium-term stocks can fluctuate wildly and even lose a significant portion of their value. However, those companies which delivered increasing payouts to shareholders performed well on that front.

For example, in 2000 Mcdonalds stock was mostly trading within $30 to $40 range. Indeed its shares have gone through bad times. At one point in 2003, the stock even fell below $14. However, at the beginning of May 2020, one MCD was worth approximately $180. This represents at least 4.5 times increase over the last 20 years, which is quite impressive.

So for short term trading, stocks can be very unpredictable. However, if a company has decent growth prospects and consistently increases dividends, it is likely that its shares will become more valuable over the years.

Some blue-chip firms also have share so-called buyback programs, where they purchase their own stocks. This reduces the overall number of outstanding shares. This might not have much of an effect in the short term. However, the basic law of supply and demand dictates that’s when there are fewer shares available in the market, in the long term it is more likely that they will become much more valuable.

Comments (0 comment(s))