Are there any High-Quality Beverage Stocks to Invest?

Despite the recent decline in the stock market and signs of economic downturn, some industries still managed to hold on to most of their revenue. One of those sectors is represented by producers of beverages. Stocks from this industry, just like in the consumer goods securities, are typically less volatile than Dow Jones Industrial Average or S&P 500.

However, one difference between those two sectors is that beverage companies are able to operate on higher margins. This lets those firms to maintain their profitability and also consistently increase dividend payments over many years.

In this article, we will discuss some of the best performers in the industry. It is not surprising that the first stock in our list is Coca-Cola Co (KO). It goes without saying that the name itself is one of the most famous and well-recognized brands in the world. The firm also has a 134-year history going back all the way to the 19th century. Its products are sold in more than 200 countries and territories. According to its 2019 annual report, the firm owns more than 400 brands and 4,700 products. In 2018 the firm also acquired Costa Coffee, one of the largest chains of coffee shops in the world.

The second stock is PepsiCo Incorporated (PEP), the main competitor of Coca-Cola over several decades. Besides owning a large portfolio of soft drinks, including Pepsi, the firm also produces snack foods and refreshments. The firm also made several large acquisitions during the last couple of decades.

Finally, we have Diageo PLC (DGE), listed on the London Stock exchange. It is a British multinational alcoholic beverage company. The firm owns several famous vodkas, Beer, Whiskey, Liqueur, Tequilla, Gin, and Rum brands. The company sells its goods in more than 180 countries.

Exploring Top Beverage Stocks

When discussing the Beverage Stocks, the first question which comes to mind is this: What makes some companies in this sector so stable? How those firms still manage to increase their sales and raise dividends during a recession?

It is difficult to name one cause to explain this phenomenon. In order to give a complete answer to those questions, we need to state several reasons:

- Beverage companies are well-positioned to build customer loyalty to their brands. Many people are becoming accustomed to the tastes of their favorite drinks. As a result, they become loyal customers to those firms.

- It is relatively easier for those companies to expand, compared to retailers. Beverage companies have the ability to place their goods in several supermarket chains. They do not need to buy or rent large spaces for stores in order to sell their drinks.

- Most of beverage company products are quite affordable for customers. In times of recession, people are much more likely to cut back on luxury goods and expensive vocations, rather than let go of their favorite $1 or $2 soft drink brand.

- The majority of those beverage producing companies have well-diversified brand portfolios, not only by their sheer number of products by their presence in a large number of countries. So the success of those firms is not heavily dependent on the performance of one or two economies or sales of one brand.

After going through those possible reasons, now let us move on to the list of Beverage Stocks we will discuss in this article:

- Coca-Cola Co (KO)

- PepsiCo Inc. (PEP)

- Diageo PLC (DGE)

Coca-Cola Co (KO)

According to the annual report, by the end of 2019, the Coca-Cola company had a yearly revenue of $37.3 billion and market capitalization of $236.9 billion. The firm has 225 bottling partners across the globe. Together with those entities the company employes more than 700,000 people. Coca-Cola company also has more than 30 million retail customer outlets.

The business itself includes several categories of products. Firstly, sparkling soft drinks have more than 50% retail value share. During recent years the firm made more efforts to diversify into healthy drinks. For example, by 2019 the Juices and Dairy products have a 10% retail market share. Waters, Coffees, and Teas, as well as Energy drinks, each has a 15% value share.

According to the annual report, in 2019 alone, the firm has launched more than 1,000 products, 400 of which have low or no sugar content. Recently the company has also increased the production of small packaged drinks. As a result, nowadays approximately 42% of sparkling soft drink brands come in packages of no more than 250 ml. One of the possible reasons for this move is that in some countries, including the US, the sales growth rate for small cans is higher than 20%. The report also mentions that 2 billion servings of Coca-Cola products are consumed around the world on a daily basis.

The firm also has an impressive track record of returning money to shareholders. Back in 1990, the management paid a quarterly dividend of 2.5 cents per share. The company managed to increase those payments even during the 2008 great recession. By 2020, the quarterly dividend of Coca-Cola shares reached 41 cents per share. So the average annual growth of those payouts is 9.8%, more than 3 times higher than the long term average US inflation rate.

Coca-Cola Stock Performance and Recent Valuations

The Coca-Cola stock had an impressive run from 1994 onwards, rising from $10 to $42 by 1998. Despite such a fast-paced rise, during next year shares fell back and were mostly confined within $20 to $30 range. This stagnation has lasted for approximately 10 years. The new uptrend began in early spring 2009. The stock eventually surpassed a previous all-time high level and reached $60 by February 2020.

Coca-Cola shares were also affected by the massive Stock market decline due to increasing COVID-19 concerns. Before the end of March, the stock fell to $37.50. This was followed by a partial recovery, where KO regained some of its losses. Nowadays, in May 2020 the stock trades near $43 mark.

According to the latest reports, Coca-Cola’s earnings per share (EPS) stands at $2.32. Therefore, the current price to earnings (P/E) ratio is approximately 18.5. This suggests that at current prices the stock is not overvalued and is well within a fairly valued range.

The beta of Coca-Cola shares is 0.57, so they are significantly less volatile than the Dow Jones Industrial Average. The current dividend yield of the stock is near 3.8%. In times of near-zero interest rates, this might seem quite attractive for income investors.

Another key advantage of the company is its high net profit margin, which stands just above 27%. This indicator measures what percentage of revenue remains as profit, after covering all of the expenses. By comparison, the net profit margin of Proctor and Gamble (PG) is just 7.2%.

The recent first-quarter results have are still demonstrating the resistance of the business. Despite all of the recent economic disruptions, Coca-Cola’s net sales only fell by 1%, while the EPS is up by 65%. The company has also increased its quarterly dividend by 2.5%.

PepsiCo Inc. (PEP)

In 2019 Pepsico Incorporated (PEP) has posted $67.161 billion in revenue. This number was 4% higher than a year ago. The core operating profit has reached $10.602 billion. During the same year, the company spent $3 billion repurchasing its shares. Finally, the firm has also boosted its capital spending by 29%, raising it to $4.232 billion. The current market capitalization of PepsiCo is $182.8 billion.

The company owns Pepsi, Mirinda, 7up, and Tropicana drinks. One way this firm differs from some of its competitors is that a wide range of snacks in its portfolio of products. This includes such famous brands as Lays, Doritos, Rufflers, and many others.

According to the 2019 annual report, 54% of company sales come from food products, and the rest 46% came in from the beverages category. Still, 58% of the firm’s revenue is coming from US sales. So in terms of geography, the business might be less diversified than some of its competitors. The management of the firm did increase its spending on advertising by 12% in the previous year. This decision might help the company to increase its sales outside the US and diversify its income sources further.

PepsiCo also has a very decent track record of sharing its profits with shareholders. 25 years ago, one share of the company paid 10 cents worth of dividends with 3-month intervals. Over the next years, the management increased those payments significantly. Even in 2009 at the high of the global recession, the firm still managed to hike its quarterly payout by 5.9%. By 2020 Pepsico pays a dividend of 96 cents per share. So on average during this entire period, the company increased its payments to shareholders by 9.5%. The current dividend yield of the stock is close to 2.9%.

Is PepsiCo Inc. (PEP) Stock too Expensive?

Let us now move on to the performance of this stock. Since 1994 PEP was in steady long term bull market. It has risen from $15 in 1994 to above $71 mark, just before the outset of the great recession. During that economic downturn, the PepsiCo shares suffered from sharp correction, falling all the way back to $48. However, after March 2009, the uptrend resumed. Like so many other stocks, the high watermark of PEP shares was in February 2020. By that time, it reached an all-time high of $147.

During the stock market collapse of March 2020, PEP briefly lost approximately 1/3 of its value. However, the recovery was quite swift and by May 2020, PepsiCo shares regained most of those losses, nowadays trading at $132.

According to the most recent data available, earnings per share of the company is $5.18. Consequently, its price to earnings ratio stands near 25.5. So by this measure alone this stock might be slightly overvalued. However, if we take a look at recent reports we might see a different picture.

As the first-quarter results suggest, despite very challenging economic times, the company sales are up by 7.7%. If this trend continues, then the firm will be well-positioned to increase its EPS. This, in turn, will reduce the P/E ratio of the stock to lower levels.

The beta of this security if 0.60. This points to the fact that in general, it fluctuates much less than the rest of the S&P 500 index. So if the market falls by 10%, PepsiCo shares on average might only decline by 6%. This might be attractive to those investors who want to minimize their losses during the times of economic downturn.

Diageo PLC (DGE)

Diageo PLC is a British Alcoholic Beverage company with its headquarters in London, United Kingdom. As the company’s official reports suggest, the firm had annual revenue of £12.867 billion in 2019. This was 5.8% higher compared to the previous year. The operating profit has also expanded by 9.5%, reaching £4.042 billion. Diageo’s earnings per share have also increased by 7.4% to £1.307. During the same period, the volume growth rate was 2.3%. This suggests that the company has strong pricing power since the firm was able to raise the average prices of its products by approximately 3.5%.

The firm owns more than 200 brands, including Guinness, Harp Lager, Smirnoff, Capital Morgan, Don Julio, Baileys, and Sheridans. The company sells its products in more than 180 countries. At the same time, Diageo owns 150 production sites and employs more than 28,000 employees.

The company also regularly publishes the total shareholder return percentage each year. This includes the capital appreciation of the stock and dividend payments. In 2019, this indicator has reached 27%, which was 23% higher than a year ago.

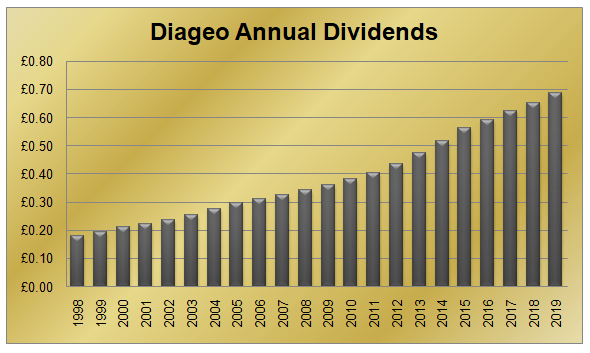

One of the reasons behind such impressive returns is the company’s policy of steadily increasing its payouts to shareholders. Back in 1998, Diageo’s annual dividend was 18p (£0.18) per share. The company has steadily increased the size of those payments over the years, including during the great recession. By 2019, the annual dividend has reached 68.57p per share. So during this 22 year period, on average Diageo hiked its payments to shareholders by 6.3%. The current dividend yield of the stock is approximately 2.5%. With the key Bank of England interest rate at 0.1%, DGE stocks might be a more attractive option than putting money in UK Pound Savings accounts.

Diageo Stock Valuations

Diageo shares were trading near £4.50 back in 1995. In the course of the next 7 years, the stock price doubled and went well above £9.00 in 2002. At this point DGE did experience a sharp correction, losing 1/3 of its value in less than a year. However, from Spring 2003, the long term uptrend resumed. The stock did face some temporary pullbacks during 2008-2009, but it quickly regained its ground. Diageo shares reached an all-time high of £35.00 in August 2019.

The stock price started to moderate even several months before the outbreak of the COVID-19 pandemic. By May 2020 the company shares are trading near £27.00.

As official reports suggest, earnings per share of the company stand at £1.30. So the price to earnings ratio is 20.8. This is just slightly above the threshold of 20. However, considering more than a 7% rate of expanding sales, the company EPS can easily reach £1.35 or even £1.40 by the end of 2020.

It might be helpful to point out another advantage of the firm: In terms of geography, company sales are well diversified. According to the latest numbers, the largest portions of the firm’s revenues come from America (34.9%), Europe (22.9%), and the Asia Pacific (21%).

The beta of the stock is 0.70. So it is comparatively more volatile than in the case of Coca-Cola and PepsiCo shares. One of the possible explanations for this could be that some of Diageo’s products are considerably more expensive than that of those two companies, mentioned above. The firm does produce relatively cheap beer products. However, some expensive Vodka, Liquor, and other brands might be less affordable for some consumers during the economic downturn. Still, DGE fluctuates by less degree than other FTSE 100 stocks.

Investing in Beverage Stocks – Key Takeaways

- Stocks of beverage companies typically fluctuate less. Revenues of those firms also tend to be more resilient to economic shocks. The reasons behind this include the fact that those companies sell mostly affordable products for daily consumption. They also enjoy the loyalty of its customers, who purchase their favorite drinks on a daily or weekly basis. Finally, many such organizations have a global presence, selling their produce in many countries. Consequently, their financial performance is not solely dependent on the economy of one nation or region.

- Stocks of Beverage companies and consumer goods firms are both generally considered to be ‘defensive’ in nature. This means that in times of economic downturn they usually tend to fall by less, than the majority of other securities. However, one difference between those two categories is that very often Beverage companies can earn higher net profit margins. This makes easier for those firms to maintain profitability and consistently increase their dividends.

- Price to earnings (P/E) ratio is an important indicator in stock analysis. The general consensus on the market is that if this indicator surpasses 20 then the security might be overhauled. However, relying solely on this measure and ignoring other metrics can be sometimes very misleading. Other indicators can play an important role in the analysis. This includes such measures, as growth rate of Revenue and Earnings per share (EPS), dividend yield, net profit margin, beta, free cash flow, payout ratio, and others.

FAQ: Best Beverage Stocks

How does the change in the central bank key interest rates affect beverage stocks and equities in general?

Everything else being equal, rising interest rates are generally considered bad for equities and falling rates are deemed beneficial for stocks. The possible reasons for this are as follows:

- Falling interest rates make loans cheaper for companies. As a result, firms spend less money on interest expense and can use those sums to invest in the business. Also at low rates, servicing the company’s liabilities is much easier. Many firms might take advantage of those cheap loans and expand their business with even greater speed, than in the environment of higher interest rates.

- In the environment of falling interest rates, savings accounts, and certificates of deposits (CDs) are becoming less attractive. Nowadays, many of them pay just 0.1%. So people turn to the stock market and other investments to earn better returns on their capital. This increases the demand for stocks and pushed their price up. This scenario can be even more beneficial for the shares of dividend-paying beverage companies. The reason for this is that stocks that pay an increasing amount of payouts are in high demand.

- Everything else being equal, lower interest rates do support economic growth. As consumers have more income at their disposal, it is more likely that they will spend more money on goods and services. This can certainly benefit beverage producers and other firms as well.

Who are the largest shareholders of Coca-Cola, Pepsico, and Diageo?

The largest shareholder of Coca-Cola is Berkshire Hathaway. This company led by Warren Buffet. The firm owns 400 million KO shares. This is the equivalent of 9.3% of the entire corporation. As a result, Warren Buffet’s organization receives $164 million in dividends from the Coca-Cola company. Warren Buffet purchased KO shares back in 1988. Adjusting for stock splits, by that time the price of one share was fluctuating withing $2 to $3 range.

Vanguard Group, one of the largest providers of the mutual funds owns more than 114 million PepsiCo shares. This represents 8.27% of the entire company.

The largest shareholder of Diageo is Brown Brothers Harriman & Co, one of the largest private banks in the US. The company owns 0.43% of Diageo’s shares, worth more than $348 million.

Do the currency exchange rates have a major effect on those companies discussed in this article?

In general for US-based companies if USD strengthens considerably against other major currencies, in the short term it might have a negative impact on the reported earnings in dollar terms. This scenario can also have some benefits for those firms. A stronger dollar makes the price of imports cheaper, which can be very helpful sometimes.

As for the investors, it makes less of a difference. The firms we discussed in this article all have a major global presence. So they have revenues coming in from dozens of different currencies. As a result, investors are well protected from possible dollar appreciation. If USD falls against other major currencies, those companies can just increase dividends by higher percentages to offset those potential losses to investors. On the other hand, if the US dollar appreciates, then the quarterly payments shareholders receive, will have a stronger global buying power to begging with. So as we can see those beverage companies are well positions to protect the interests of their shareholders under both scenarios.

Comments (0 comment(s))