How to Use Forex Economic Calendar in Trading?

Every major broker and Forex news website has an economic calendar. Many professional traders and analysts make use of this tool to come up with predictions and trading ideas. However, many beginners wonder what is the essence of the Forex economic calendar and how to utilize it properly. After all, if one can master the use of this tool, it can be a very helpful skill in trading.

The typical economic calendar essentially lists all of the major economic announcements during the week. It includes the exact date and time of releasing the scheduled news, the currency which will be affected, the name of the indicator, the previous release number, analyst consensus, and once it is published, the actual number. Some brokers and Forex news websites also the ‘expected volatility’ measure. This shows the degree of projected market fluctuations, after the release of that particular report.

Traders use economic calendars for several purposes. It helps them to identify times when the market will likely be more volatile. Also, it gives market participants to make predictions on these latest figures and then places traders accordingly. Finally, looking at the economic calendar regularly can give some ideas to traders about the recent economic trends in different countries.

Armed with this knowledge, traders can come up with predictions, how the central banks and other policymakers are likely to respond to current conditions. As a result, this helps them to predict which currencies are likely to gain strength and which ones are expected to depreciate against their peers. After conducting this analysis, market participants can come up with some potentially profitable trading ideas.

Finally, it is helpful to point out that the economic announcements are not the only things that can have a major impact on the currency exchange rates. General elections, referendums, public disorders, geopolitical developments, and other events can have a notable influence on the Forex market, despite the fact that those are not listed in most economic calendars.

Basics of Forex Economic Calendar

The next obvious question is: how does an economic calendar work in practice? Well, essentially it all comes down to analyzing and interpreting the latest announcements.

For example, one of the recent cases of such publication was the latest Swiss consumer price index figures for May 2020. The official report was scheduled to be published on June 4, at 2:30 am on US standard Eastern time. In the previous month, Swiss CPI stood at -1.1%. At the same time, the analyst consensus stood at -1.3%. It goes without saying that this announcement would only have any noticeable effect on the Swiss Franc. Consequently, this would affect the currency pairs like USD/CHF, EUR/CHF, and CHF/JPY. So, it is hard to imagine this news release having any effect on EUR/USD or AUD/CAD.

When the actual figure came out, the latest annual consumer price index in Switzerland was at -1.3%. So how can we interpret this result? What does this mean for CHF?

Here it is useful to note that the CPI figure was exactly in line with the analyst’s consensus. There was no big surprise, therefore, it is unlikely to trigger any serious volatility in the near term. However, this can have both short and long term implications. Firstly, we have a classic case of persistent deflation in Switzerland. As a result, this increases expectations that at some point, the Swiss National Bank might decide to take new easying measures in order to tackle the issue of falling prices. However, there is not much SNB can do here. The interest rates are already at -0.75%, further cuts could do little but simply make 1,000 CHF note more popular.

On the other hand, in the long term, this can be beneficial for the Swiss franc. According to the Purchasing Power Parity, theory, when the currency has consistently lower inflation than its peers, it makes good and service in the country cheaper. As a result, the demand for those increases. However, to purchase Swiss goods, people first have to convert their money to CHF. So, this is one of the reasons why the franc is appreciating against other currencies for years.

Minor Announcements

There are dozens of economic news releases every single day. Therefore, it is easy to get confused in this mass of reports. To address this concern, Most brokers and Forex news websites generally divided news announcements into three categories. They categorize them as low, moderate, or high expected volatility.

Let us begin with the first category. This includes such news releases such as short term treasury auctions, Producer Price Index (PPI), MBA mortgage rates, and many other minor announcements. In general, many analysts and professional traders believe that those news releases have a very small impact on currency exchange rates.

For example, very recently, there was a 3-month bill auction in the US. Previously the yield was at 0.13%. As the announcement suggested the current yield was slightly higher and has reached 0.15%. So how did the market respond to this news release?

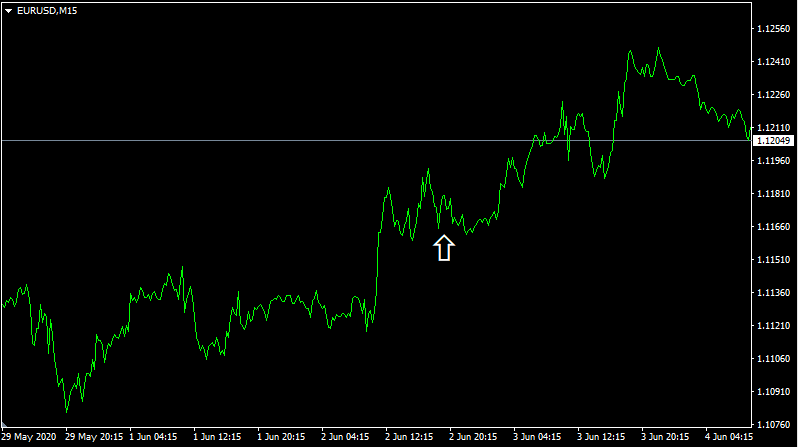

To answer this question, let us take a look at this 15-minute EUR/USD chart, showing the exchange rate movements before and after the announcement of the outcome of 3-month bill auction:

The white arrow in this diagram points at the time of the announcement. As we can see from the chart above, the EUR/USD pair was already engaged in the short term uptrend. Days before the actual numbers came out, the Euro has made some notable gains, rising from 1.1080 to 1.1160. After this announcement, there was very little volatility. The pair essentially fluctuated by 10-15 pips for a while, before resuming its upward moving trend.

This is not surprising, 3-month treasuries do not represent a large portion of the overall amount of US debt. So the interest rate on those assets does not have much effect on the American economy and by extension, on USD. In this regard, the rates on the 10-year US treasuries have more influence, so several brokers and Forex news websites mark those announcements as the medium expected volatility.

Events with Moderate Volatility

There are some events which are more important, than those minor news releases we discussed above. However, they do not really belong to the major announcement category either. Since they are somewhere in the middle of those two extremes, they are typically marked with moderate expected volatility.

This category includes events such as current account, trade balance, retail sales, industrial production, factory orders, and many others. For example, recently there was the global dairy price index announcement. Now, this might have very little significance for the heavy majority of currencies. However, in the case of New Zeeland, the country is one of the largest producers of dairy products. In fact, revenues coming out of exporting those goods make up a significant portion of both total exports and budget revenues. Therefore, the price changes of those commodities can have a significant impact on New Zealand’s economy and by extension on the NZD.

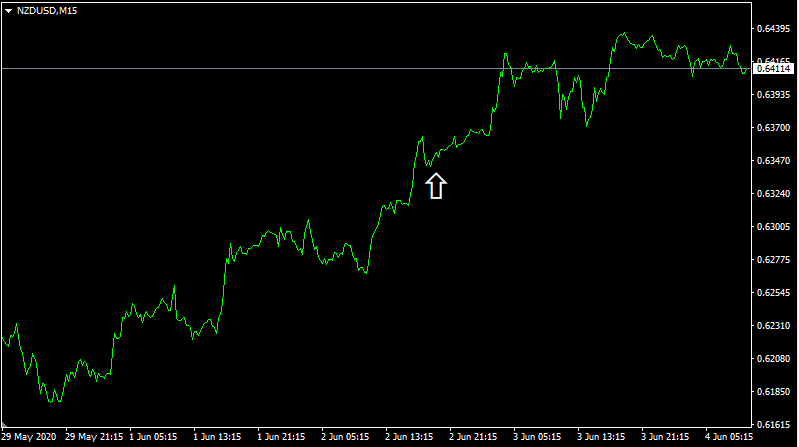

For the purpose of the better visualization, here, on this 15-minute NZD/USD chart, we can see the price action developing before and after the announcement of the latest dairy price index:

As we can see from the chart above, the New Zealand dollar was appreciating against the US dollar for several days. When the actual report came in it showed that global dairy prices have risen by 0.1%. So this was a piece of mildly positive news for NZD. Yet, as the diagram shows the price did respond to those announcements, with the New Zealand dollar rising from $0.6344 to $0.6425. After hours of rallying, the NZD/USD stabilized.

Important News Releases

There are several types of announcements, which typically have a major impact on currency exchange rates. This includes those types of news releases:

- Central bank key interest rate decisions

- Consumer Price Index (CPI)

- Gross Domestic Product (GDP) growth rate

- Unemployment rate

- Non-Farm Payroll (NFP)

- Initial Jobless Claims

- Central Bank Press Conferences

- Manufacturing PMI

- Employment change

- Crude Oil Inventories

- CB Consumer Confidence Index

Those indicators, mentioned above, can have a sizable effect on the country and currency in question. Consequently, such news releases are typically accompanied by high volatility. For example, recently there was a monetary policy meeting at the Reserve Bank of Australia (RBA). The analyst consensus was that the central bank would keep its cash rate unchanged at 0.25%. Their predictions were accurate since the RBA made no changes. The Reserve Bank of Australia had an option to cut rates further, for example to 0.1% as the Bank of England, or even go as far as to reduce them to zero, as the European Central Bank did.

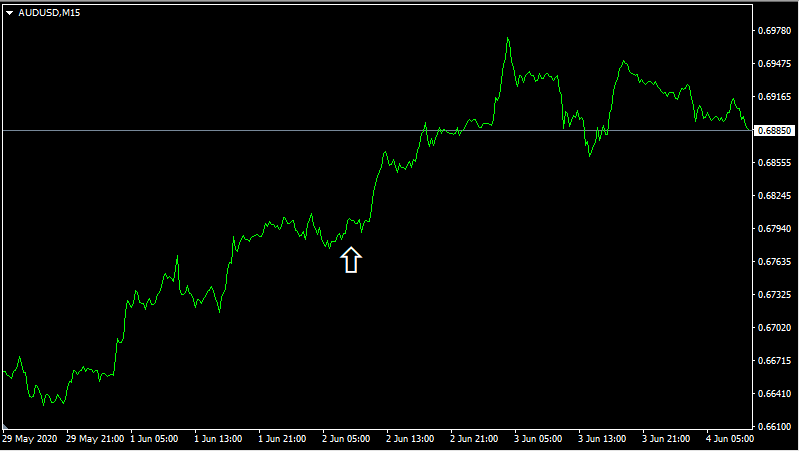

However, due to improving consumer sentiment, as well as rising inflation rates convinced the RBA policymakers to keep rates at current levels. So how did this affect the Australian dollar? Well, here Here were can take a look at the 15-minute AUD/USD chart, which shows the price action before and after the publishing of Reserve Bank of Australia’s rate decision and the official statement:

As we can see from the diagram above, the Australian dollar was already in an upward trajectory even before the announcement. After publishing this decision and subsequent statement the AUD has risen steadily. By the time of the news release the AUD/USD pair was trading close to $0.6800 level, however, just some hours after this event, it appreciated steadily and reached $0.6970. The price eventually moderated and stabilized around $0.6885 level. So as we can see this recent Reserve Bank of Australia’s statement, had a very positive impact on the value of AUD. This seems surprising, why did the Australian dollar appreciate, even when RBA has not hiked rates?

Well, in general, when central banks hike or reduce the interest rates, it typically triggers more market volatility, compared to when it keeps them unchanged. However, this does not mean that in the case of the latter scenario currencies do not fluctuate significantly. When the central bank makes no changes to the current policy, traders and investors usually look at the official statement to find some valuable clues about the future decision-making process. Here, in this case, the statement was somewhat hawkish, it recognized the improving consumer sentiment and acknowledges positive inflationary dynamics.

Here it is useful to mention, that according to its mandate, the Reserve Bank of Australia, aims to keep the annual Consumer Price Index (CPI) growth rate withing a 2% to 3% range. The latest report, on this indicator, has shown the inflation running at 2.2%, compared to 2.0% a month ago. This means that nowadays the Australian CPI is well within the intended range of RBA. So the central bank had no incentive to reduce already diminished interest rates even further. In fact, if this trend persists and inflation surpasses 3%, then at some point RBA might even consider raising rates again. After all, 0.25% is historically a very low rate, so those policymakers have plenty of space to adjust their monetary policy.

Other Influential Events

When discussing the Forex economic calendar, it is important to mention that there are many non-economic events, which still can have a massive impact on the exchange rates. So how can they influence the Forex market? Well, here is a list of some of those events with some explanations:

- General elections, such as US presidential elections, or UK parliamentary elections can have a major impact on the economies of those countries. Every political party has its own view on the future path of fiscal policy. This includes individual and corporate tax rates, spending levels on education, military, healthcare, welfare, and many other categories. Governments also get to determine future regulation policies, which can also have a significant impact on local businesses. So if as a result of the election, a new party comes into power, this can signal major policy changes across the board. Everything which affects the economy also influences the exchange rates, so it is useful for Forex traders to keep an eye on those type of events as well.

- Those types of events are not strictly confined to elections. Sometimes referendums can have an even larger impact on the markets. The most recent example of this was the EU membership referendum in the United Kingdom. Once the British people voted to leave the block, it led to the massive depreciation of the UK pound. Once the result became clear, GBP/USD fell from $1.50 to $1.33 level just in a matter of fewer than 24 hours. There are also growing calls for the second Scottish referendum. If this eventually takes place, the result can have a significant impact on the currency exchange rates. Obviously, if the United Kingdom breaks up it can easily pave the way for a massive depreciation of the pound.

- Political and economic events are not the only once which can influence the currency markets. As we have seen from the experience of the past few years, natural disasters, pandemic outbreaks, terrorist attacks, wars, as well as new important inventions can all have a sizable impact on the Foreign exchange rates. For example, the recent outbreak of COVID-19 pandemic and subsequent lockdowns led to the surge of risk-off trades. This latest trend of investors fleeing to safety mostly benefited such low-yielding currencies as the US dollar, the Japanese yen, and Swiss Franc. It seems like that in economically challenging times, people are more concerned about preserving their wealth, rather than hunting for higher returns.

Using Economic Calendar in Trading

So how can trade make use of the economic calendar on a daily basis? Actually, the process is rather straightforward. At the beginning of their trading day, many professional Forex traders take a look at the list of the important announcements. This usually helps them to come up with some trading ideas. For example, if during the day there is an interest rate decision announcement by the Reserve Bank of New Zealand, then market participants might start to analyze charts of NZD/USD, EUR/NZD, NZD/JPY and other New Zealand based Forex pairs.

The key interest rate decision coming out of the RBZ can have a significant impact on the currency of the country. If the policymakers raise rates, this will make New Zealand dollar more attractive for traders and investors. This is because in this case, they can earn higher yields from some NZD denominated securities. This can include New Zealand’s government bonds and Certificates of Deposits (CDs). Traders can also potentially benefit from carrying trading, choosing currency pairs where NZD is coupled with some low-yielding currency, like the Japanese yen or Swiss Franc.

On the other hand, interest rate cut typically weakens the currency in question. So returning to our example, if the Reserve Bank of New Zealand decided to reduce rates, this can lead to NZD’s depreciation against other major currencies. The reason behind this is the fact that investors will be earning lower returns on local bonds, CDs, and savings accounts. For traders, NZD-based carry trades become less profitable. All those things make the currency much less attractive.

Obviously, trading news events is not so simple. In many cases, the outcome of monetary policy decisions is already priced into the market, before the central banks make their actual announcements. This is why professional traders analyze several economic indicators, instead of just one, before placing their trades.

Why Some Trader Avoid Trading During Major News Releases?

There are a number of professional Forex traders who prefer simply not to trade during major news releases. The rationale behind this is the fact that markets are very often unpredictable. There is a phenomenon in Forex, which market participants call ‘buy the rumor sell the fact’. For example, if traders expect a rate cut coming out from the central bank, then they might start selling the currency in question in anticipation of this outcome.

However, when the actual decision is announced, the exchange rate recovers instead of falling further. As many professional Forex traders and commentators explain it, this happens because the outcome was already priced in. So, this means that the actual adjustment in exchange rates in response to the rate cut has already taken place, even before the decision is announced.

Therefore, sometimes it is very difficult to guess whether the market will react predictably on a given announcement. There is always a possibility that a given policy decision or the latest economic indicators are already priced in before they are published.

For example, on June 1, 2020, there was a release of the latest German manufacturing PMI figures. During the previous month, this indicator stood at 34.5, but now the analyst forecast projected it to be at 36.8. When the actual number came out, it turned out to be 36.6. Obviously, the missing expectation is typically bad for a currency pair. Manufacturing represents a large and vital part of the German economy. Consequently, the weak performance of the sector can have a very negative impact on the local economy. So, logically speaking the Euro should have fallen significantly in response to this announcement. Is this how things went?

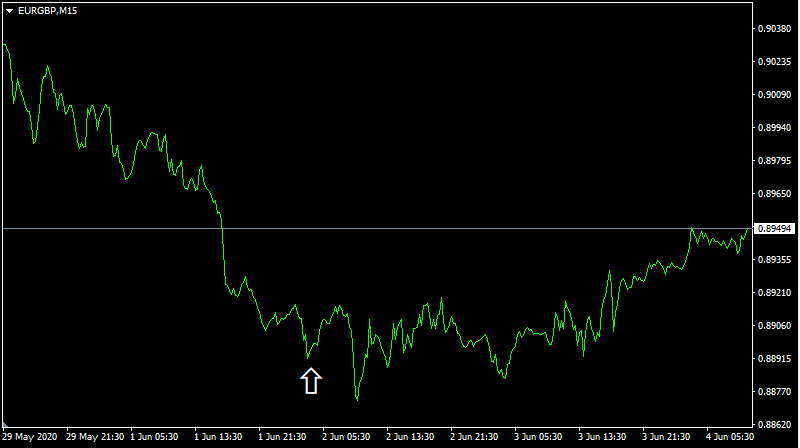

Well in order to answer this question, we need to take a look at this 15-minute chart, where we can check the price action of EUR/GBP, before and after the release of the latest German manufacturing PMI:

As we can see from the chart above, instead of making any decisive move, the Euro moved sideways for the entire trading session. It was only the next day when the market finally digested this information and the single currency appreciated. The possible reason for this was that although German manufacturing numbers missed the expectation, rising from 34.5 to 36.6 was still a notable improvement.

Analyzing Economic Trends

Before moving on to concluding remarks, it is important to mention that it is not only the latest economic figures which determine the exchange rates but also long term trends. Some moves in Forex simply make no sense if we only look at it from the limited view of the latest news. However, if we step away from this and look at the larger economic picture, we can see that with some currencies factors such as changes in commodity prices can have a significant impact.

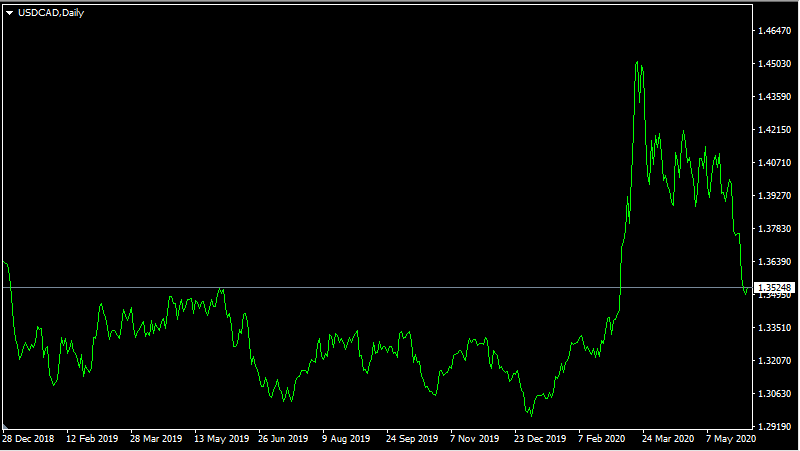

To illustrate one example, let us take a look at this daily USD/CAD chart:

Here we can see some dramatic moves and they were not caused by just one or two economic news releases. USD/CAD pair mostly moved sideways from late December 2018 to January 2019, with the Canadian dollar still making some modest gains. By that time the oil price was just above $60. However, after those developments, the price of this commodity fell sharply, at one point it even went negative, before stabilizing near $20 level.

Obviously, this was very harmful to the Canadian economy, with both local firms and government losing revenue. As a result, the USD/CAD rate has risen from $1.30 to $1.45. However, after some months of struggling the oil prices started to recover, eventually surpassing $36. This was not the ideal price for the Canadian oil industry, but it was much better to deal than in the case of $10 or $20. As a result, after some weeks of indecisive fluctuations, the CAD recovered from some of its losses and now USD/CAD fell back to $1.35. If the current bull market for the oil persists, then the Canadian dollar will be well-positioned to erase all of its recent losses and USD/CAD to return to 1.30 at some point in the future.

Therefore, instead of only focusing on Forex economic calendar, many traders also take a look at the prices of commodities, likes gold, silver, oil, and dairy products in order to conduct thorough and potentially more accurate currency analysis.

Trading with Forex Economic Calendar – Key Takeaways

- News announcements that are marked with ‘low expected volatility’ usually do not have any noticeable influence on the exchange rates. It is still useful to take a look at those, but it is not realistic to expect some sudden moves in response to those publications. Experience trades pay more attention to those announcements which are designated as ‘moderate’ or ‘high expected volatility’. Those economic indicators have more influence on the economy and by extension, on the relevant currency.

- News releases such as the unemployment rate, the consumer price index, the gross domestic product growth rate, non-farm payroll numbers, and key interest rate decisions are usually marked with ‘high expected volatility’. The reason behind this is that those indicators represent the most important measures of the economic performance of a given country. Low rate of economic growth and high unemployment are signs of a weak economy. This most likely can lead to the weakening of the currency, as investors anticipate more easying measures from central banks in response to those challenges.

- Several professional traders try to avoid trading during major economic announcements because very often during those times the market becomes very volatile and unpredictable. For example, some central bank interest rate decisions might be already priced into the currency pair, so when the outcome is finally announced, there is not much change, or the market goes the opposite way. Therefore many professionals prefer to wait for it to settle down so that it becomes easier to identify the latest trends.

Comments (0 comment(s))