Top 3 Solid Dividend Paying Stocks from Banking Sector

After the bankruptcy of Lehman Brothers and subsequent great recession, many investors perceive banking stocks as very risky investments. It is difficult to blame them, since Lehman shareholders lost all of their investments in the company, back in 2008.

Despite those reservations, there are several banks that successfully weather the 2008-2009 storm. They have no canceled dividend entirely and after this crisis kept increasing payouts to shareholders.

The first one on our list of such companies is Wells Fargo (WFC). the fourth largest bank in the world, by market capitalization. The firm has made many successful acquisitions over the years, including the purchase of Wachovia, back in 2008. For two years, in 2013 and 2014 the Wells Fargo was named as world’s most valuable brand in banking.

JP Morgan Chase (JPM) is another solid stock in this industry. it is the world’s largest bank by market capitalization. In 2008 the firm acquired Bear Sterns, fifth-largest US investment bank by that time. As of 2020, the JP Morgan Chase is one of the components of Dow Jones Industrial Average.

Toronto-Dominion Bank (TD) is the largest bank in Canada by total assets. Its subsidiary TD bank is the seventh-largest financial institution by deposits in the US. Rather surprisingly, the company managed to avoid cutting its dividend even during the hight of the 2008 financial crisis.

Top 3 Banking Stocks

The banking industry stocks have several characteristics. Firstly, it might be helpful to point out that they are typically experiencing more fluctuation than other securities. In general, the beta indicator of the majority of banking stocks is higher than 1.00. This means that they are more volatile than the stock market indexes.

So it is not surprising that during the economic downturn some of them fell dramatically. On the other hand, such sharp moves sometimes also create great undervalued opportunities as well. Very often during a recession or stock market decline, it is easy to find Banking stocks, which have Price to Earnings ratios below 15. Most investors consider such securities as cheap compared to its valuation.

The recent stock market decline, which was mostly a result of COVID-19 pandemic concerns also affected financial services stocks. As a consequence, the dividend yields for some of those securities have reached a 3% to 6% range. In the environment of near-zero interest rates, such potential returns might be very attractive for income investors.

Also on the upside during the bull market banking stock prices on average tend to rise faster, than most of their peers. Consequently, undervalued banking stocks might be interesting for growth and value investors as well.

Here is the list of top 3 banking stocks which we will discuss in this article:

- Wells Fargo (WFC)

- JPMorgan Chase & Co. (JPM)

- Toronto-Dominion Bank (TD)

Wells Fargo (WFC)

Wells Fargo (WFC) is a US multinational banking company. Its headquarters are located in San Francisco, California. It is also one of the largest banks in the world, with a market capitalization of more than $101 billion. According to the annual report, in 2019 the firm had total revenue of $85.063 billion and a net income of $19.549 billion.

WFC stock had experienced a very lengthy uptrend from 1995 to 2008, rising from $5 to $34. Just like other securities, Wells Fargo shares fell dramatically during the great recession, collapsing back to $12. This was followed by 10 years of appreciation, going as far as reaching $65 by 2018. Since then the stock price had some pullbacks and more or less remained stagnant. As COVID-19 concerns started to dominate the market, WFC fell sharply, and nowadays in May 2020, it trades near $25 mark.

According to cnbc.com, the beta indicator of this stock is 1.19. This means that WFC is 19% more volatile compared to the S&P 500 index. The Earnings per share of WFC stands at $2.83. So the current Price to Earnings (P/E) ratio is at 11.3. This points to the fact that Wells Fargo shares might be significantly undervalued. So essentially, the recent stock market crash has created a nice discount for WTF investors.

Wells Fargo Dividends and Current Valuations

Wells Fargo also has a long history of dividend payments. At the end of 1995, the company paid quarterly payments of 6 cents per share to shareholders. During subsequent years, the firm steadily increased the amount of those payouts and by 2008 it paid 34 cents per share. Because of serious losses incurred during a great recession, the firm cut dividends and kept them at 5 cents for 2009 and 2010. However, from the next year, the company resumed its policy of steady increases in its payouts to shareholders.

By 2014 the quarterly dividends have reached 35 cents per share, surpassing 2008 levels. In 2020, despite the economic challenges brought by a coronavirus, Wells Fargo still pays 51 cents per share to its shareholders with 3-month intervals. So despite temporary setbacks in 2009 and 2010, on average the company has increased its dividends by approximately 9% per year. This rate is 3 times larger than the long term average US inflation, so the firm managed to preserve and even increase the purchasing power of its payouts to shareholders.

So the total amount of dividend for 2020 most likely will be $0.51 x 4 = $2.04. Consequently, the dividend yield of WFC is 8.2%. This seems very impressive, especially in times when the majority of Certificates of Deposit (CDs) pay less than 2%.

It goes without saying that financial institutions will face challenging times because of the economic downturn. However, Wells Fargo shares offer one of the highest dividend yields in the market. The firm has a very long track record of returning money to its shareholders. Finally, on the P/E ratio basis, the current prices could offer quite a decent bargain as well. So WFC stock might be quite attractive for income and value investors.

JP Morgan Chase & Co. (JPM)

According to the S&P Global, the JP Morgan Chase & Co. (JPM) is the largest bank in the US by its total assets. It has headquarters in New York City. The firm had revenue of $115.6 billion in 2019. The current market capitalization of the company is above $274 billion.

JPM stock had a long bull market in the 90s, rising from $5 in 1991 to $60 in 2000. However, after this astonishing run, the JP Morgan Chase shares faced sharp correction and mostly moved sideways for the next 11 years. The bull market resumed from 2012, which took JPM to an all-time high of $137 by the end of December 2019. Just like many other banking stocks, it fell dramatically in February and March 2020, collapsing to $79. Since then the stock recovered some of its recent losses and nowadays it trades near $90 mark. The last time JMP was near those levels was way back in 2017.

The beta of JPM is 1.17, very similar to Wells Fargo shares. So this stock is slightly more volatile than the majority of its peers which compose the S&P 500 index. The latest earnings per share of the company stand at $8.85. Consequently, the price to earnings ratio of this stock is 90 / 8.85 = 10.2. This implies a significant undervaluation of JMP. In booming times sometimes it is difficult to find blue-chip stocks which have a P/E ratio of lower than 20. However, it seems that during this time, it is much easier to find some decent bargains.

How JP Morgan Chase Survived the Great Recession

The company had quite a successful run-up to the great recession of 2008-2009. 25 years ago, the firm paid 15 cents a share on a quarterly basis. The bank steadily increased its payouts to shareholders and by 2001 it reached 34 cents. The rate stayed on that level until 2007 when it was raised to 38 cents per share. Like so many other banks during 2009 the management has cut the dividend to just 5 cents per share and kept it there for the next 2 years.

However, unlike many of its peers, the firm was quick to increase payouts from 2011. By 2013, the bank restored its dividend to 38 cents per share. In 2020 the firm’s quarterly payments to shareholders have reached 90 cents a share. So despite the suffering severe losses during the great recession, the bank restored its profitability during the next 2 years and was able to share some of its revenues with its shareholders.

The recent downturn in the stock market made JPM shares more attractive to income investors. The current dividend yield is 4%. This is a much better return on investment than current near-zero interest rates on the savings accounts. The average dividend growth rate during the last 25 years is 7.4%.

The management of the firm has also proved many times the commitment to return money to shareholders. Something which is not always the case with some other banks. Clearly no stock is perfect, but JP Morgan shares can be a decent choice not only for growth investors but also for those individuals who are looking for building an income portfolio.

Toronto-Dominion Bank (TD)

The third company on our list is Toronto-Dominion Bank (TD) which has headquarters in Toronto, Ontario. The firm came into existence way back in 1955, as a result of a merger between the Bank of Toronto and the Dominion Bank. The group includes not only retail banks in Canada and the US but also asset management arm and TD insurance business. The latter covers a range of products, including Auto, Home, and Life insurance. According to the latest report, the Toronto-Dominion Bank employs more than 85,000 people worldwide and has more than 26 million customers and 6,000+ ATMs.

In 2019 the total revenues exceeded 41 billion Canadian dollars. During the same year, the company’s earnings have reached C$11.7 billion. The market capitalization of the firm is C$73.9 billion. One of the key advantages of the firm is its impressive track record of consistent dividend increases.

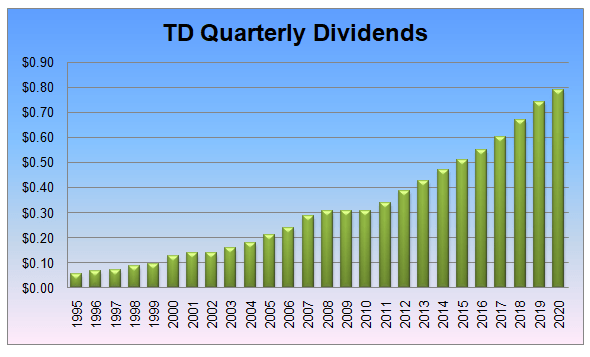

As we can see from the above the company has significantly increased its payouts to shareholders over the years. Raising it from 5.5 Canadian cents per share to back in 1995 to 79 Canadian cents per share by 2020. There were only two instances, during 2002-2003 and 2009-2010 when Toronto-Dominion Bank held dividend steady. However, considering that during those periods many banks reduced their payouts to 5 cents or canceled entirely, this result seems quite good in comparison. The average rate of dividend growth over the last 25 years is 11.3%. According to the annual report, the firm boasts 163 years of history of sharing its profits with shareholders.

The recent stock market downturn has pushed the dividend yield of TD higher, getting above 7% by May 2020. This can be a very attractive rate of return for investors.

Performance of Toronto-Dominion Bank Stock

The TD stock was mostly moving sideways in the late 90s. However, since 2002 it entered a six-year uptrend, rising from $8 to $37 by 2008. The financial crisis has reduced the value of TD shares by a massive 60%. However, compared to its peers TD was quick to recover the lost ground. The new bull market for TD shares started in Spring 2009 and continued for the next 9 years until reaching $60 in the middle of 2018. For the next 18 months, the stock price remains relatively flat most of the time.

As the COVID-19 concerns led to the stock market collapse, Toronto-Dominion Bank shares also fell dramatically. Nowadays the stock trades near $41 mark, it is roughly 1/3 cheaper compared to its 2018 all-time hights.

The latest earnings per share of the company stand at C$4.98, with the P/E ratio running at 8.2. This shows that TD stock might be even more undervalued than that of two banks discussed above. However, one big difference is that the Toronto-Dominion Bank has never cut dividends for the last two decades.

Another interesting fact about this stock is that its beta indicator is 0.83. This points to the fact that TD shares are much less volatile than many other banking stocks. So this might be a piece of good news for those investors, who are very concerned about capital preservation.

In conclusion, Toronto-Dominion Bank stock has a very low P/E valuation, as well as quite a high dividend yield. Consequently, TD might represent a good bargain for growth investors, as well as for those individuals who are interested in building passive income streams.

Best Banking Stocks – Key Takeaways

- Due to the 2008 global financial crisis, the heavy majority of banks suffered heavy losses and were forced to cut their payouts to shareholders dramatically. However, several financial institutions did manage to recover in several years and to even increase dividends well above to pre-2008 levels. There are also stocks, which weathered this storm without such dramatic cuts to their payouts to shareholders.

- Most of the banking stocks tend to be more volatile than Dow Jones Industrial Average and S&P 500 indexes. So they tend to do better during a bull market and may perform worse than some other stocks during the economic downturn. In times of recession, those financial institutions might experience higher default rates on loans, which can translate into significant losses to banks as well.

- As a result of the outbreak of COVID-19 pandemic and subsequent lockdown across the globe, the equity prices fell significantly. Obviously, this event will reduce the net worth of many individuals. However, on the positive side, this process pushes P/E ratios of several blue-chip bank stocks well below 15, and some of them even below 10. This gives opportunities for investors to buy high-quality securities at discounted prices.

FAQ: Investing in Banking Sector

How do banking stocks differ from the shares of consumer goods companies?

In general, most consumer goods securities are deemed as ‘defensive stock’. This term means that they tend to lose less value during the economic downturn than most of its peers. This is not necessarily the case with the banking sector.

The main reason behind this is simple. In economically challenging times the majority of consumers are more focused on reducing their debts and cut back on spending. Also, some of them may even default on their loans, because of financial hardship. So getting a brand new credit card or taking out a new mortgage might not be on the priority list for many people during the recession. As a result of this eventually, banks earn less money from interest payments and service fees.

On the other hand, regardless of their financial circumstances, individuals have to still meet their nutritional and hygiene needs. Many consumer goods companies also enjoy the brand loyalty of their regular customers. In the case of banking, customers might be quick to switch to other financial institution which offers lower rates on loans and better returns on savings. However, consumers might carry on buying their favorite brands for years.

In fact, some consumer goods companies even benefit from economically challenging times. The reason behind this is that many individuals might cut back on eating out and start stockpiling food and hygiene items. This process, in turn, increases the revenue of those companies.

As a result of all of those factors, in booming years, bank shares tend to rise faster than defensive stocks. However, in times of recession, consumer goods companies are better positioned to minimize their losses. It is also easier for them to steadily increase their dividends. The stability of sales gives them the opportunity to do so.

How did Lehman Brothers (LEH) Stock Performed Prior to Bank’s Bunkrapsy?

In the year prior to Lehman Bunkrapsy, there was very little evidence for the upcoming downfall of the company. In fact, in February 2007 the stock has reached an all-time high of $85.95. There was some pullback during this year and by January 2008, the price moderated towards $65. Surprisingly, during the same month, the firm’s management has raised its quarterly dividend by 13% from 60 cents per share to 68 cents per share. The company has also announced a share buyback program worth $100 million.

Despite those developments, the bank’s solvency was in danger. According to the BBC, the average amount of leverage the company used was 42:1. This means that for every dollar Lehman Brothers owned, it borrowed $42 to play property market and trade with other securities. The majority of the firm’s main competitors have kept their leverage levels to 20 to 35 range. So they had a better chance to survive the economic downturn. But for their management, it was still an uphill battle.

When it came to Lehman Brothers, it became increasingly clear that the company had to be sold to some other private institution survive. However, the negotiations with Korean investors, Bank of America, and Barclays failed. This was a deathblow to the company’s survival prospects.

The breakdown came in May 2008, as the stock decisively broke below $40 mark, followed by a collapse below $20 just in 5 weeks’ time. On September 12th, during the last day before the bank’s failure, the LEH stock has closed at $3.65. Few days after the declaration of bankruptcy the Lehman Brothers shares traded between 5 to 10 cent range. As a result of bank failure, more than 26,000 employees lost their jobs.

Which banking stock investors suffered heaviest losses during the 2008 financial crisis?

Besides Lehman Brothers shareholders, there were many investors who lost a significant amount of their net worth during the crisis. The first obvious example of this is the Royal Bank of Scotland. Adjusting for the share splits, in March 2007, the RBS stock has surpassed £60.00 (6,000p). During the same year, the bank paid 33.2 pence per share in the form of dividends. This was a 10% higher rate than a year ago.

According to the annual report of 2007, the annual profit of the group have risen by 19% and reached £7.7 billion. The Earnings per share have also increased by 18% to 78.7p.

After all those results it is very difficult to come with terms with that just a year later RBS posted a £24.1 billion loss. This is up to this day the largest loss in British corporate history. Eventually, to avoid the bankruptcy of this bank and likely collapse of the entire UK economy, the government took over 80% of the company as a result bailout worth of £45.5 billion.

So how much did the RBS shareholders lose? After the government bailout, the RBS shares fluctuated between 100p to 500p. So the long term average of the stock after this event would be around 300p (£3.00). This suggests that those who bought RBS shares at £60.00 for example, lost 95% of their money. Interestingly, some patient shareholders did manage to collect 27p per share in the form of special and ordinary dividends during 2018 and 2019. However, this was very little comfort to those investors who lost more 9/10 of their net worth in this stock.

Comments (0 comment(s))