What are Best Days of Week for Forex Trading?

Many Forex traders have a question: Does it matter which day of the week one trades? When it comes to the Foreign exchange market, it is open for 24 hours from Monday to Friday. During the weekends days on Saturdays and Sundays, it is closed.

Generally speaking, traders can find some good trading opportunities every weekday. However, there are some patterns which one can notice if he or she analyses the past market data. Every experienced trader and financial commentators might have a different opinion on the subject. Despite those disagreements, most of them recognize the fact that everything else being equal, Mondays have the least amount of volume over the long term compared to other weekdays. Many experienced traders can also notice that, from Tuesdays, the number of trade contracts starts to pick up and reaches a peak by Thursdays and Fridays.

Also, we have currency pairs where one currency has a much higher yield and than the other one. In those cases very often the volume tends to slow down on Wednesdays. The reason behind this is that on this day triple rollovers are given to account for Saturdays and Sundays. Therefore, traders with those positions have more incentives to hold on to their trades and not close them fr that day. So this factor can also have some influence on volume dynamics.

Finally, it is useful to point out that some major events can easily disrupt normal trading patterns. As a result, there are many cases when the volume might be much higher on Mondays, because of some important announcement, or policy decision. So those statements above are just long term observations, rather than an analysis of one specific week.

Lower Volumes on Mondays

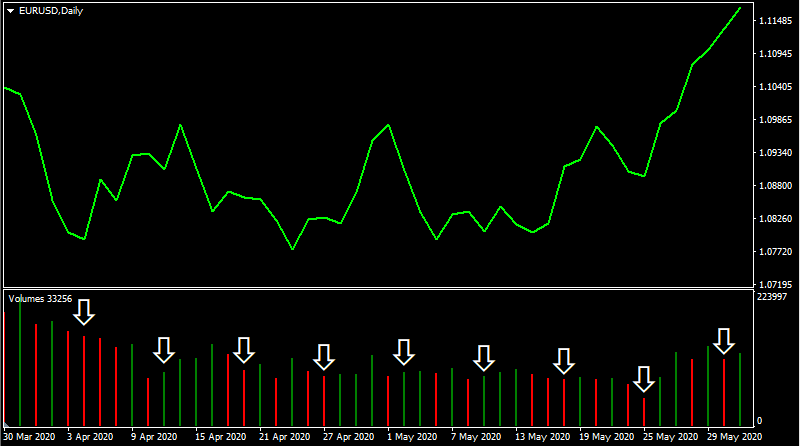

So how do Mondays compare with other trading days? In order to answer this question, let us take a look at this daily EUR/USD chart:

This currency pair represents the most liquid security in the Forex market. The upper section of this chart shows the recent price action of EUR/USD, including from March 30 until the beginning of June. The lower part of this diagram shows the daily volumes. The white arrows represent Mondays, in order to make it easier to come up with some conclusions. The main principle here is simple, higher bars denote large volumes. A green bar shows that the volume on that day was higher than in the previous one. At the same time, the red bar represents days where volumes were lower than on proceeding days.

As we can see from this chart, there were 9 Mondays during this period, which is represented in this diagram. Here we can make several observations. Firstly in 8 out of 9 cases, the bar, representing Monday was followed by the green line. This means that volumes on Mondays were typically lower than on Tuesdays. Here we can make another observation. 6 out of 9 of those bars are red. This means that in 2/3 of the cases the volumes on Mondays were lower than on previous Fridays.

So after conducting the analysis of the most liquid currency pair, we can see some evidence that Mondays can be indeed one of the least volatile days during the week. The main reason behind this is the fact that many traders are hesitant to open positions during this time. They prefer to wait for the market to show its latest trends and also explore some trading opportunities. Placing trades straight away, without knowing the latest dynamics of the market can be very risky and potentially could lead to some serious losses.

Economic Announcements

Starting to place positions on Tuesdays can be more convenient for many Forex traders. After all, they do have 24 hours of the latest price action to work with and come up with some trading ideas. Also, the volume starts to pick-up, which can present market participants with more potentially profitable opportunities. This is why many professional Forex traders do advise beginners to open their first positions on Tuesdays.

This is also the day when the latest inflation figures of the Eurozone and some other economies are announced. Sometimes the individual EU states report their Consumer Price Index (CPI) numbers. However, in some cases, Eurostat publishes its measure of the Harmonised Index of Consumer Prices (HICP).

So what influence does this have on the exchange rates? Well actually, this can have a significant impact on the Forex market. Here it is important to remember that the European Central Bank has only one mandate of price stability. The ECB defines this term as the inflation level below, but close to 2% in the medium term. Consequently, the latest HICP figures can give traders some valuable clues about the future direction of the central bank’s monetary policy.

For example, if the Eurozone inflation falls much lower than the desired target than this can be a very bearish sign for the single currency. This is because the ECB is more likely to reduce its key interest rate or simply expand the scale of quantitative easying if the HICP is in a terminal decline and moving away from the intended target.

On the other hand, if the Eurozone inflation moves much higher than 2%, this can certainly benefit the Euro. For example, back in 2011, when HICP surpassed 2.5% level and approached 3%, the ECB hiked rates twice to 1.5%. Higher-yielding currencies in general are more attractive to traders and investors. As a result, the single currency made significant gains against the Dollar and Pound.

Influence of Carry Trades

Wednesdays are unique in the sense that during this day brokers give triple rollovers to account for Saturdays and Sundays. So how this works? Well, let us suppose that after analyzing the recent price action, a trader decided to open a short EUR/RUB position. Currently, the key interest rate of the European Central Bank stands at 0%. At the same time, the Bank of Russia holds rates at 5.5%.

The main principle behind rollover dynamics is simple. If a trader buys a higher-yielding currency against the lower-yielding currency than the broker typically pays a daily interest to the client. This is also knowns as an interest swap. However, if the opposite is the case, then the trader has to pay daily amounts to the brokerage company.

In this example, for selling a EUR/RUB pair, the market participant can receive a 5.5% interest swap on a daily basis. So in case of one standard lot, $100,000 the trader should receive $5,500 annually. If we divide this amount to the number of days in a year, 365, then the result will be $15.07. So this means that for each day the trader keeps the short EUR/RUB position open, he or she will receive $15.07.

However, here it is helpful to remember that the market is closed for weekends, so traders will receive no interest swap payments during those days. Instead, to make up for this, brokers pay a triple amount of rollover on Wednesdays, in order to restore this imbalance.

This means that those traders who bought higher-yielding currency against the lower-yielding currency have a strong incentive to hold on to their positions on Wednesdays. Returning to our example, why would a market participant throw away the opportunity to earn an extra $45.21 for no apparent good reason? So the volumes in the case of those pairs tend to be slightly lower than on Tuesdays.

However, this principle only applies to those currency pairs where there is a meaningful difference in yields. So in the case of GBP/AUD, this factor might not have much influence. This is because GBP at the moment has a yield of 0.1% and AUD has 0.25%. So the 0.15% difference is too small to incentivize traders to hold on to their positions.

Central Bank Meetings

Several central banks choose Thursdays for their regular meetings and for making a major official announcement. For example, this includes the Bank of England, the European Central Bank, and the Swiss National Bank. Obviously, the interest rate decisions are always considered as high-risk events. The basic premise behind this is very simple: if the central bank raises rates, then traders and investors can earn higher returns by investing in the currency in question. As a result, it becomes more attractive and is likely to appreciate against its peers.

The opposite is also true. If a given central bank reduces interest rates, then this translates into lower returns for investors and traders. As a result, this can weaken the currency substantially.

Now, this does not mean that the market reaction after those major announcements is always predictable. Here it is helpful to point out that the market participants always try to guess the outcome of those monetary policy meetings beforehand. so there are many cases where those decisions can already be price into currency pairs. This is exactly where the old market maxim, ‘buy the rumor, sell the far’, comes from.

For example, during the last decade, there were plenty of examples, where the same scenario played out with the Euro. After declining Eurozone inflation and weak economic growth, many traders assumed that the European Central Bank would eventually respond to this by cutting the interest rates. As a result, many traders and investors across the globe sold large amounts of Euros, weakening the single currency in the process. However, when the actual rate cut came about, it was already priced in and the Euro remained stable or even made some gains. So it might be helpful to be aware, that such things also happen in the marketplace.

Profit Taking Factor

As we have discussed before, the volume on Fridays is typically higher than on Mondays. However, if we return to our previous chart, in 8 out of 9 cases, those days were represented by a red bar. This means that volumes on Fridays were lower compared to Thursdays. So why is this the case?

Well, here are several factors in play here. Firstly some traders are simply not comfortable with keeping their positions open over the weekends. So they are looking for opportunities to liquidate those positions and are much less likely to open new ones. So this factor has a negative effect on the overall volume.

As a Consequence, profit-taking becomes a major factor during Fridays. This makes trading on that day a bit riskier. For example, there can be a clear trend developing from Monday to Thursday, however by the end of the working week, due to profit-taking, there can be some unexpected moves and even reversals. This is essentially why any professional Forex traders do not recommend to beginners to place many trades on Friday.

Also, Non-Farm Payroll numbers are usually released on Fridays. This is one of the most important measures of the level of employment in the United States. This announcement usually triggers increasing volatility in the markets. This is especially true for those currency pairs which includes USD.

Emerging Market Currencies

So far we have discussed the volume patterns of EUR/USD, the most liquid currency pair in the Foreign Exchange market, as well as some other major pairs. However, one can wonder whether the emerging market currencies follow the same pattern, or have some other specific characteristics.

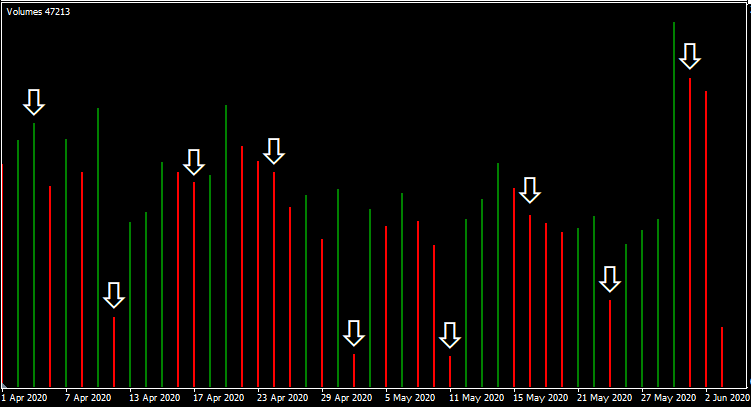

To answer this question, let us take a look at this daily USD/RUB volume chart:

As we can see from the diagram above, there are some distinct patterns. The first observation we can make here is the fact that 8 out of 9 bars, representing Monday trading is red. In our previous EUR/USD example, the number of such cases was at 6. So this suggests that in the case of USD/RUB, the volume tends to fall on Mondays more often than with Euro/Dollar pair. Here we can also notice that in 4 cases the trading volumes simply collapsed. For example, at the end of April, it fell by around 80% on Monday, compared to the previous Friday. Such extremities are rather rare with major currency pairs.

So what can be the possible reason behind this? Well, this can suggest that when it comes to emerging market currencies traders might be even more cautious with opening positions on Monday. This is because of the lack of uncertainty about the future direction of the currency pair during the week. This degree of hesitation makes sense, in general, emerging market currencies tend to be much more volatile than the major ones.

Traders, trading with those securities on a regular basis can achieve massive gains or suffer dramatic losses in a rather short space of time. So obviously, many market participants are not willing to take those risks without having some very recent market data to work with.

Another major distinction between this chart and our previous diagram is the fact that in only 5 out of 9 cases the volume starts to pick up on Tuesday. This suggests that when it comes to some emerging market currencies, it might take more time for the volumes to recover and return to the previous Friday’s levels.

Volume Patterns of Commodities

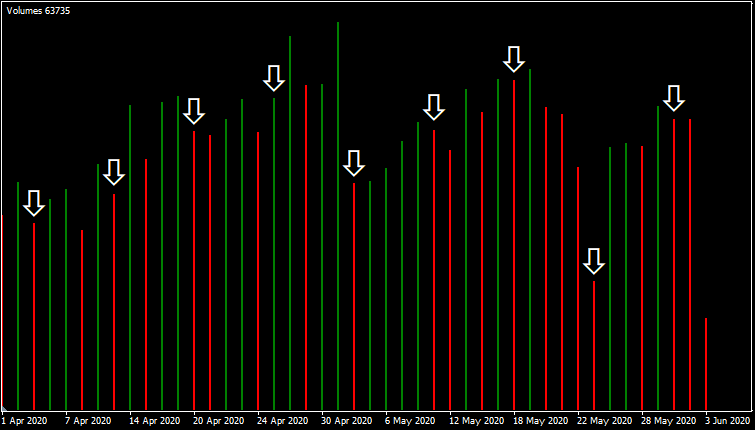

After going through the analysis of both major and exotic currency pairs, the next obvious stage would be to discuss the trading patterns commodities. In order to illustrate this better, let us check this daily Gold price chart:

As we can notice from this diagram, there are some similarities with commodities and emerging currency pair volumes. In approximately 89% of cases, the volume was lower on Mondays, compared to the previous Fridays. The price of commodities has in general higher degree of average volatility, compared to most of the major currencies. Many traders are aware of this fact, so they try to liquidate their positions during Fridays and are not in a hurry to start new trades on Mondays.

One difference between commodities and emerging market currency pairs is that in the first case the volume tends to pick up faster on Tuesdays. However, the curious thing here is the fact that in 2/3 of the cases Fridays have the highest volumes. This is in sharp contrast to major and exotic currency pairs, where usually Thursdays have the largest volumes among weekdays. So we can conclude that the trading patterns of commodities have their own unique characteristics, which have both similarities and differences with Forex currency pairs.

Risk Events

Any guide to the specifics of trading at different weekdays will not be complete without mentioning the exceptions to those typical patterns. Some major political, economic, and other events can significantly alter the course of those dynamics. There are many examples of this scenario playing out in the past.

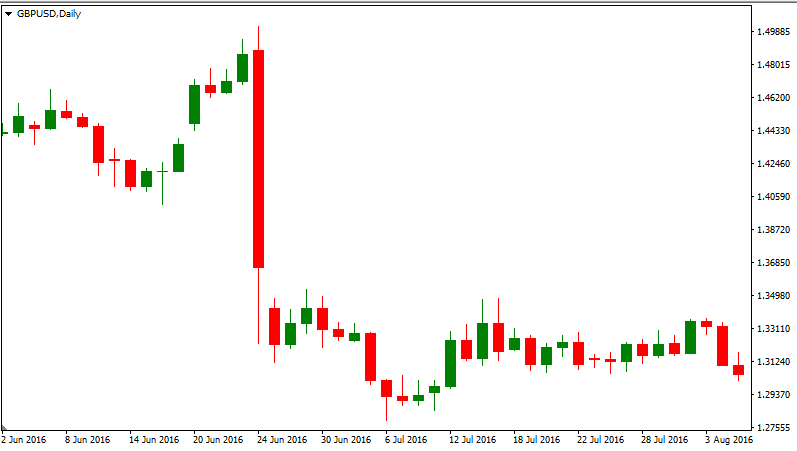

To visualize this better, let us take a look at this daily GBP/USD chart:

This diagram represents a price action of GBP/USD before and after the United Kingdom EU membership referendum. As the first results, came in from Gibraltar, the market was optimistic, since it seemed like that British people would vote to remain in the European Union. However, the Sunderland and other results demonstrated massive support to leave, the pound fell dramatically. In just one day of trading GBP/USD lost around 1,500 pips. it is not surprising that, during such important evens the price action, as well as volume levels, break out of their typical patterns.

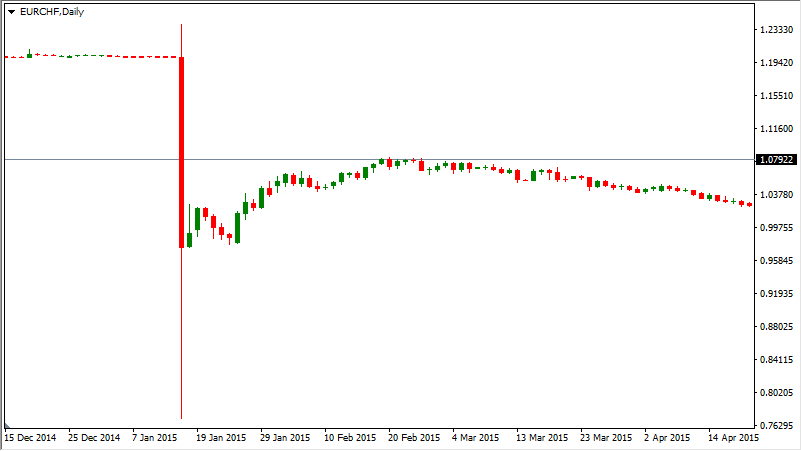

Another important example would be the cancelation of the 1.20 floor by the Swiss National bank. To illustrate this let us take a look at this daily EUR/CHF chart:

We rarely see such extreme moves among major currency pairs. For several years, the Swiss franc was consistently appreciating against other important currencies. This trend became even stronger after the 2008 great recession. Many Swiss economists and policymakers were concerned about this. After all, Switzerland is surrounded by Eurozone countries and 80% of Swiss exports are destined for those member states. In order to address those concerns, the Swiss National Bank (SNB) has introduced a floor on EUR/CHF exchange rates at the 1.20 level.

This policy persisted for more than 3.5 years. However, by the beginning of 2015, as the European Central Bank was considering further rate cuts and quantitative easing policies, it became more difficult for SNB to maintain this floor. Consequently, on January 15th, the Swiss National Bank abandoned this policy. As a result, the Swiss franc gained thousands of pips against the Euro and other major currencies in a single day. The move was so sudden and decisive, that this even put some brokerage companies on the verge of bankruptcy.

Such extreme cases are rather rare, but such important announcements as interest rate decisions, economic growth reports, consumer price index numbers can significantly increase the volume and volatility of currency pairs. Sometimes such political events as important referendums and general elections can also have a massive effect on the market price dynamics.

Best Days of Week for Trading – Key Takeaways

- There is no such thing as the best weekday for Forex trading. Each of them has its own specific characteristics. Most of the time, the trading volumes on Mondays are typically lower than during other weekdays. The overall direction of the currency pairs is not yet very clear. Consequently, some traders prefer to hold back and open positions on Tuesday, when they have 24 hours worth of fresh market data to analyze. in most cases, this holds true for not only Major currencies but also for exotic currency pairs and commodity markets as well.

- Everything else being equal, Thursdays are typically the days with the highest trading volumes. It usually starts to pick up from Tuesday and reaches its peak on Thursday. In many cases, the volume tends to decline on Fridays. The possible reason behind this is the fact that some traders are simply not comfortable with leaving positions open over the weekends. Consequently, they try to close down all of their trades and look for new trading opportunities during the next week. This triggers many profit-taking trades, so it becomes more difficult to predict market moves.

- The typical trading patterns of commodity markets differ from Forex in several ways. Firstly, the prices of commodities like Gold and Oil are usually much more volatile, than major currency pairs. Also, on Mondays, the trading volume on the commodity markets very often tend to drop sharply, compared to previous Fridays.

Comments (0 comment(s))