What is Consumer Price Index (CPI) and How to Trade It?

The Consumer Price Index (CPI) is one of the most important economic indicators for the Forex market. This measure tracks the percentage change in the price of the basket of goods and services during the 12 month period. Every country in the world has its own list of those items which are included in the index, with different calculations methodologies and formulas.

Keeping track of the latest developments in the Consumer Price Index can be useful for traders and investors in several ways. Firstly, the heavy majority of central banks have some sort of inflation target, whether it be some specific rate of CPI or a range. If the growth rate of price levels moves substantially higher than the desired level than the policymakers usually raise interest rates in order to put some limit on it. On the other hand, if the CPI drops well below the target, then the Central Bank is more likely to cut rates to stimulate the economy and help the inflation to return to the intended level.

This means that in the short term, a rise in the rate of CPI above its target can help currencies since the investors and traders assume that eventually, the policymakers will respond to this trend by raising the interest rates and consequently make their currency more attractive. At the same time, the reduction of CPI below the target can hurt currency exchange rates in the short term, since in this case, it is more likely that the central bank will cut rates in response to those developments.

Finally, it must be pointed out that the long term effects of inflation on the currency exchange rates are very different. According to the famous Purchasing Power Parity theory, currencies with consistently lower CPI tend to appreciate against their peers over the years.

The reasoning behind this theory is that if a given country has a very low rate of inflation, over time its goods and services become cheaper compared to other nations. Consequently, its exports become more attractive. The result of this is that the demand for the currency increases since the foreign companies and individuals have to first exchange their money to local currency to purchase those goods and services. The outcome of this process is quite predictable. Over the long term, the currency with a low inflation rate tends to appreciate against its peers.

Basic of Consumer Price Index

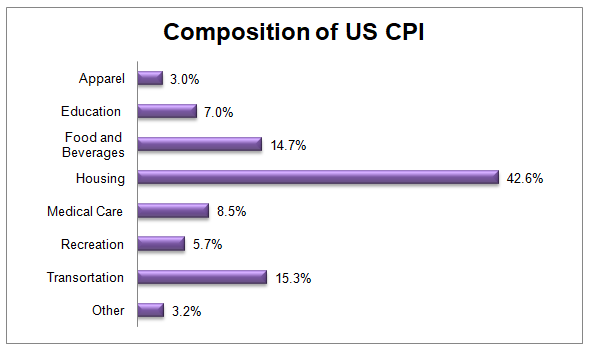

In the United States, the Consumer Price Index is calculated by the Bureau of Labor and Statistics and published regularly, on a monthly basis. This indicator takes into account the price changes of thousands of goods and services, which in turn are classified into several categories. For more details, we can take a look at the composition of the US Consumer Price Index:

As we can from the above diagram, housing is the largest category, making up more than 42% of the index. The reason behind this is that the Americans are spending a large portion of their income on rents and mortgages. In fact, the size of this category in percentages terms is much smaller with European countries. Consequently, in the case of the US, the price changes in the housing sector, including rents, can have a significant impact on the CPI.

The second-largest category here is the Transportation category, which makes up just above 15% of the index. So this suggests that even moderate variation in the fuel prices can notably alter the US inflation rate. It is not surprising that the third-largest category is represented by Food and Beverages. This includes some of the most basic and essential goods, essential for daily consumption. Its portion in the CPI basket is just below 15%.

Next in the list come medical care and education, making up 8.5% and 7% of the index respectively. Those are important components, yet since some consumers do not spend money on those items regularly, they were given lower percentages compared to the categories, we mentioned above.

They are followed by Recreation with a 5.7% share in the indicator and Apparel, which only represents 3% of the Consumer Price Index Basket. Finally, we have ‘other’ section, making up 3.2% of the index, which includes all those miscellaneous items, on which consumers do spend money on, but do not exactly fit into any other category. Each of the components, discussed above, is further divided into sub-categories as well.

The actual composition of the Consumer Price Index does not remain fixed for years. The weights of each component are updated regularly to reflect the changing consumer spending patterns. After making all of those calculations and adjustments, the current index is compared to the one, published 12 months ago. As a result, the actual headline CPI rate shows the difference between those two numbers. For example, if the index was at 100.0, in June 2019 and if in June 2020, it stands at 103.5, the actual CPI inflation rate will be 3.5%.

CPI vs Core CPI

During publishing the latest report of the Consumer Price Index, many countries also release Core CPI numbers alongside it as well. This measure excludes food and energy prices from the indicator. The rationale behind this is that the prices of goods in those two categories are very volatile and heavily dependent on the latest developments in the commodities markets. Therefore, core CPI is usually less volatile, than the regular Consumer Price Index.

This indicator is very popular with the US Federal Reserve. Here the policymakers take core inflation measures to account in preference to more traditional indicators. In fact, there have been many cases when the US Federal Reserve obtained from hiking interest rates, even when the headline CPI even exceeded 3%. One of the reasons for this, besides the weak economy and high unemployment, was the fact that core inflation measures were much lower.

Still, the majority of central banks, like the European Central Bank, Bank of England, and many others prefer targeting headline inflation rates. The reasoning behind this is very simple. People spend a significant portion of their income on such essentials as Food, Beverages, and Fuel, therefore it is unlikely to get an accurate picture of the latest inflation dynamics if one takes those items out of the Consumer Price Index.

Inflation Targeting

The first central bank which introduced inflation targeting was the Reserve Bank of New Zealand. The invention was quite a success since in just 2 years the local policymakers manage to reduce the annual CPI growth rate from 7.6% to 2%. Consequently, during the subsequent years, slowly but surely, many other central banks started to adopt similar policies.

Despite this tendency, not all policymakers define their target in the same way:

- The US Federal Reserve and Bank of England, as well as the Bank of Japan, have a mandate to keep CPI at 2%

- Both the Bank of Canada and Royal Bank of New Zealand have a target range from 1% to 3%

- The European Central Bank aims to keep inflation below, but close to 2% over the medium term

- The Bank of Australia has a CPI target range of 2% to 3%

- The Swiss National Bank simply aims to keep inflation below 2%

The essential principle of targeting includes raising interest rates when inflation is getting above the intended goal. This will make loans and mortgages less affordable, while at the same time making savings accounts and Certificates of Deposit (CDs) more lucrative options. This incentivizes people to borrow less money and save more. As a result, this puts pressure on inflation and can lead to a decrease in the CPI. Obviously, just one 0.25% rate increase might not be enough to achieve the desired result, rather the central bank might have to resort to several interest rate increases in order to bring the CPI back to the intended target.

If, on the other hand, inflation falls far below the intended goal, the policymakers can cut rates. As a result, the interest rates on loans and mortgages become cheaper, making it more affordable. On the flip side of the coin, savers are also getting lower returns. This incentivizes people to borrow more money and even spend or invest some portion of their savings. Consequently, this can help to push CPI higher, returning it to its intended destination.

Now some central banks having the 2% inflation, does not imply that they have to keep CPI at exactly 2% without any deviation. In general, the target is intended for the medium term, so for example, if for some period the inflation falls to 1.5% and then during some other months rises to 2.5%, that’s typically acceptable for policymakers. Central banks usually intervene when there is large divination from the target, such as CPI falling below 1% or getting above 3%.

Why 2% Target?

In their official definitions, many central banks state, that their mandate is ‘price stability’. However, the obvious question here is: Does not this term mean to always have stable prices with zero inflation, rather than the 2% annual rise in the price levels? Well, in a sense a strict interpretation of the term might have such meaning, however, there are two major reasons why most central banks set their CPI targets at 2%, rather than at 0%.

Firstly, if the policymakers tried to keep inflation at 0%, then for some months, CPI would also be into negative territories, like -0.1% or -0.5%. Now the basic principle of tackling high inflation is very simple: Central banks raise rates until they reach the desired result. If the situation calls for it, for example, the US Federal Reserve can increase rates to 5% or higher, for example back in 1980, the Fed Funds rate was as high as 15%.

On the other hand, tackling the problem of deflation is much more complicated. For example, if the US CPI falls to -1%, the Federal Reserve can not just cut rates to -2% or -5% and solve the issue. It is practically impossible to implement and enforce negative interest rates. Firstly, the commercial banks are not going to pay customers for the privilege of lending them money. Secondly, depositors do not have to pay interest on their savings, all they have to do is to just withdraw their funds to avoid those charges. As a result, those policies can achieve no tangible results, expect to make safes, and cash deposit boxes much more popular.

So instead of keeping the target range next to the deflation territory, central banks prefer 2% aim to have some sort of margin of safety to avoid those types of problems.

There is also another important reason for adopting a 2% inflation target. Nowadays the heavy majority of the economically developed countries have borrowed a substantial amount of money, with the US national debt now exceeding $25 trillion, with the Japanese government having an equivalent of more $10 trillion in liabilities. Now obviously, the last thing those governments want is for their debts to gain purchasing power with deflation. That will make the debt burden of those countries much heavier and most likely impossible to repay in the long term.

This is not just the problem of governments, but also a major concern of households. A significant portion of the world’s population has mortgages. If the central banks across the world simply set back and tolerated deflation, then those debts would gain more buying power over time, making those monthly payments more burdensome for consumers.

Therefore, having a 2% or 3% average inflation is much preferable to this scenario. In this case, the central bank can still maintain confidence in the currency, because it does maintain most of its purchasing power over many years. On the other hand, having their debts devalued by 2-3% is always very helpful to governments and households as well. So this is a very much practical and achievable target, which allows central banks to maintain a stable currency without putting the interest of its citizen in jeopardy.

Trading CPI Announcements

The regular CPI announcements are usually accompanied by a higher degree of volatility in the Forex markets. Since so many banks target inflation rates, the latest Consumer Price Index reports can have a major impact on their decision-making process. For some real-life example, we can check this 5-minute EUR/GBP charts, which shows the price action before and after the Eurozone inflation announcement:

The announcement came on May 29, 2020. The previous release showed the Eurozone Harmonized Index of Consumer Prices (HICP) at 0.3%. The analyst consensus was 0.1%. When the actual numbers came out, it turned out to be at 0.1%, in line with the market expectations.

As we can see from the chart above, the price action was quite volatile, with EUR/GBP eventually falling from 0.9034 to 0.8999. Now, this might be somewhat surprising, why would the Euro fall, when the actual release only confirmed the analysts’ expectations?

In order to answer this question, we have to return to the mandate of the European Central Bank, which states, that it aims to keep inflation below, but close to 2%. This means if the latest HICP figures were at 1.5% or 1.9%, there would be any serious reason for concern for ECB policymakers. However, the inflation standing at 0.1% is very far away from the intended target. In fact, if it falls further by 0.2%, it will already slip into the deflation territory.

The ECB has already reduced its key interest rate to 0%, so there not much to do on that front. Obviously here policymakers can take the example of the Bank of Japan or Swiss National Bank and resort to negative interest rates, but as explained above, it is usually not very effective and can have some unintended consequences.

On the other hand, the European Central Bank always has an option to make necessary adjustments to its quantitative easying, rising the amounts of monthly asset purchases. This can depress the European Bond yields further, increasing the size of the money supply sensationally, making investing in Euro-denominated fixed income assets less attractive, and putting pressure on the exchange rate of the single currency. This is why after digesting those latest releases, investors and traders sold the European currency. This led to a fall in EUR/USD, EUR/GBP, and other Euro-denominated securities.

Effects of Inflation Differentials in Long Term

As mentioned above, the Consumer Price Index can have a significant short term implication on the exchange rates. However, some traders might not be aware that it can also have notable long term effects on the Forex market.

According to the Purchasing Power Parity (PPP) theory, over the long term currencies with a low rate of inflation tend to appreciate against the ones with higher CPI growth rates. The basis of this principle is very logical. When a country has a lower inflation rate, compare to the other nations, over the years its goods and services become cheaper and consequently, more attractive for foreign importers, leading to higher demand for the currency in question.

So the inflation differentials can certainly lead to major adjustments in the exchange rates. When it comes to the most major currencies in the world, their long term average inflation rates tend to be quite similar, mostly falling within 2% to 3% range. However, there are some exceptions. For example, the Japanese yen had experienced decades of low inflation, sometimes followed by deflation as well.

Another case of this scenario is Swiss Franc, here the difference is even more extreme since in Japan the policymakers eventually managed to get close to a 2% inflation target. In Switzerland, the CPI is still well into the negative territory. As a result, JPY performed quite well for many years, while CHF is appreciating against most of its rivals for more than two decades.

Having a constantly low rate of inflation also makes the currency more attractive as a reliable store of value. This further increases the demand for the currency and supports its exchange rate.

This is well illustrated in this daily EUR/TRY chart:

As we can see from the chart above, the Euro steadily appreciated against the Turkish lira, rising from 4.10 level in July 2017 to 7.70 by the beginning of June 2020. This means that in a matter of less than 3 years, the EUR has gained 88% against TRY. Such a decisive move is rather, rare in the Forex market.

One apparent possible reason behind this development is considerable inflation differentials between the two currencies. The average HICP in the Eurozone over the last 25 years is well below 2%. In comparison, Turkey’s annual inflation rates fluctuated between 6% to 16%. Therefore, it is logical that over the years, those differentials started to add up, significantly impacting the exchange rates.

Obviously, this was not the only factor, affecting the Forex market, economic growth rates, unemployment indicators, central bank policies all have their influence on the price action. However, when dealing with inflation differentials, most likely sooner or later it is going to manifest itself in the exchange rates.

Major vs Emerging Markets Currencies

For the sake of accuracy, it has to be mentioned that, not all central banks in the world target a 2% inflation rate. This is especially true for the emerging markets, where the average inflation rates are usually much higher compared to the developed countries.

Under normal circumstances, the developing countries typically have significantly higher GDP growth rates, than in other nations. Consequently, pursuing a 2% inflation target in those regions might not be a very realistic goal. Most likely the central bank will only succeed in expressing the economic growth, rather than reducing the CPI to its intended target. This is why many such institutions in the emerging market economies set their inflation goals from 3% to 6%. It is much easier to achieve those goals without harming the growth of the Gross Domestic Product.

High inflation rates also mean that central banks in the emerging market economies usually have higher interest rates, compared to developed countries. The reason here is that lenders and investors have to be properly compensated for the decline in the purchasing power of the currency. After all, earning a 1% interest is not useful, when the headline annual inflation rate is running at 6%. Therefore, if central banks in those countries reduced their interest rates to 1% or to 0% then most likely this will lead to massive withdrawals of deposits from the commercials banks, bringing their solvency into question in the process.

Alternative Measures of Inflation

Despite its popularity and widespread use, the Consumer Price Index does have its critics. Many people, as well as some financial experts, like Peter Schiff, believe that it understates inflation and does not fully reflect the realities of everyday life.

So some investors and traders also use some alternative measures of price changes, alongside CPI. One of them is called the ‘Billion Prices Project’, which tracks the prices of goods from more than 1,000 retailers. According to this indicator, on an annual basis, the inflation was approximately 0.25% higher compared to the official CPI index.

Some other financial experts, including Peter Schiff, sometimes refer to the Big Mac Index. The British Financial magazine ‘Economist’ publishes this indicator since 1986. It essentially tracks the average price of Big Mac in several countries. The main aim of the index is to give investors and trades some guidance on overvalued and undervalued currencies. However, since it tracks price changes on a regular basis, it also can be used as some indicator of inflation.

The rationale behind this is very simple. The price of Big Mac itself represents a basket of goods and services. It includes the cost of bread, cheese, lettuce, cucumber, beef, sesame seeds, transportation, labor, and rent. So it turns out to be a quite a well-diversified basket, which is very easy to calculate and can not be easily manipulated by the statistics agencies.

According to this measure, the 34 years average US inflation rate is 3.78%, in the Eurozone, this number is at 1.9% and in the UK this indicator is at 3.37%. So in each case, it is 0.1% to 1.5% higher than the official data.

Trading Consumer Price Index – Key Takeaways

- Consumer Price Index (CPI) publications can have major effects on the currency exchange rates. The reason behind this is the fact that the heavy majority of the central banks around the globe target either a specific rate of inflation or a pre-defined range. As a result, if the CPI rates deviate significantly from the intended aim than policymakers are very likely to respond to those developments with changes in the interest rates and other monetary policy measures. This also has its implications on the exchange rates, since everything else being equal, the higher-yielding currency is more attractive to investors than its lower-yielding counterpart.

- Most central banks of developed countries have their inflation targets within a 2% to 3% range. The reasoning behind this is that if they aimed at 0% CPI, then very often the economy will face deflation, which can be very problematic for the nations with large debts as well as for households with mortgages. Therefore 2% or 3% inflation target can ensure some degree of price stability and at the same time can help to protect the interests of governments and citizens of the country.

- The inflation differentials can have a major long term impact on the currency exchange rates. According to the Purchasing Power Parity (PPP) theory, currencies with lower inflation tend to appreciate against the ones with higher CPI growth rates. This can be one of the realistic explanations for the long term appreciation of the Japanese Yen and the Swiss Franc during the last 20 years.

Comments (0 comment(s))