Find out the ins and outs of OspreyFX scam in this detailed review

There is a strong opinion between the traders that ECN brokers are more reliable simply because they are charging the commission. Some of the traders consider that since these kinds of brokers charge commissions they do not have any reason to scam them. While it might sound logical at first glance, there is little to no truth in this statement and the newly established OspreyFX Forex broker can be one of the examples. It is also an Electronic Communication Network broker, offering Forex, Crypto, and CFDs trading to customers all around the world. It promises low spreads, high leverage and lightning-fast execution. Since the brokerage was founded only this year and it has just started operating there are no OspreyFX opinions that would give us more insight into how the trading is like with the broker. However, the features, how the broker has designed its service and the regulatory side of it is enough to find out what kind of broker is it – trustworthy or a scam.

Can Osprey FX scam be real?

Some of the fact about the broker indicates that OspreyFX scam is possible. The broker is registered in Saint Vincent and the Grenadines. This is an offshore territory which became one of the havens for the scam brokerages alongside the places like Belize, Vanuatu, Marshal Islands and some more. It is easy to get a license in those countries simply because the regulatory requirements are loose than in European countries for example and it is also much cheaper, meaning that there is no customer compensation fund. Even though it is easy to get regulated there Osprey FX still does not have a license. However, speaking with all honesty the regulation from the Financial Services Authority of Saint Vincent and the Grenadines would not change much in the whole picture.

Another thing that should disturb the traders and make them think about OspreyFX fraud is the risk disclosure document. The broker is fully aware that traders are rarely reading this kind of documents thoroughly and has included some of the disturbing things. this is why it is important to check these kinds of documents before opening an account with the broker. Just imagine, you are trading with OspreyFX and there is a technical problem and the orders you have placed are not executed in a way you have instructed the broker or are not executed at all. You lose the money due to something that was not your fault. To solve the issue you contact the broker that tells you there’s nothing you can do about the money you have lost and shows you risk disclosure document. The document states the following:

- In case there will be a technical problem with the broker’s hardware or software and due to these problems, the broker fails to execute your trades properly the trader is accountable for the financial losses.

- It is also the trader’s own risk if the hardware or the software of the broker does not work properly, or even if it is misused!

- If there will be an internet connection problem with the brokerage or there will be a hacking attack, the broker is not responsible for the financial damages that you might obtain.

The fact that the broker makes traders accountable for its own problems already speaks very bad about it and points out that OspreyFX scam scheme can be based on interfering with the trades in a way to make traders lose money and blame it on the technical problems.

Last but not least, the broker is offering the services to the people in Europe, in the USA, and in other countries that have a very strong regulatory framework for the brokers. The services that Osprey FX offers are unauthorized and the broker itself is not regulated, hence it makes sense to think that it is leading some kind of scam.

Can OspreyFX be trusted?

After reading the regulatory part of the OspreyFX review I think It is clear that the broker is not the one you can trust with your money. The way the broker has designed the services to showcase the possibility of a scam as well. Seems like the broker itself does not know much about its own services. Most of the information provided on the website is not clear and instead of giving information to the visitors it makes them even more confused. The website itself is designed very poorly with bright red colour and very bad navigation system. It can only be viewed in English, which means the broker mostly targets English speaking countries and lures them with high leverage.

The minimum deposit, leverage and spreads

The broker has only one account type available for its customers. The minimum deposit is 10 USD, but not for all payment methods. For example, if someone is willing to use wire transfer the minimum deposit for him would be 100 USD that does not really make any sense. It is not indicated in the account type description and one needs to go through all the pages of the website to find this information in the FAQ section. The broker seems to be trying to lure the customers with a low minimum deposit. The leverage with OspreyFX Forex broker is 1:500 but it is only for currency pairs. For cryptocurrencies, leverage is limited to 1:100, for indices the leverage is 1:200 and for stocks 1:20. As for the spreads, the broker claims to have ultra-low spreads from 0.01 pips but fails to show how the spreads actually look like. The website does have a page for spreads, but it shows an error when someone tries to go there. Hence, we cannot be sure that the spreads are actually low.

OspreyFX withdrawal and other fees

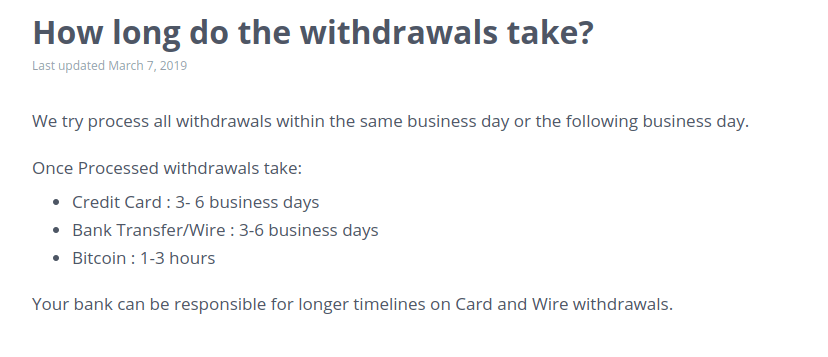

Let’s take a look at the OspreyFX withdrawal policy. The broker does not provide information on how the withdrawal process goes or what documents are required from the trader’s side to cash out money without any problem. According to broker withdrawals are processed on the same or on the next day but it takes from three to six business days to cash out the money with Wire transfer and credit or debit card. It is a pretty long time, considering that many brokers offer very fast withdrawals to their customers. Now let us talk about the fees. There are no fees for depositing money if you are using debit/card payment or if you are depositing Bitcoin, however, there is 25 USD fee for wire transfer. As for the withdrawal fees, you will not be charged if you want to take your funds back, however, you will be charged for cashing out profits. For wire transfer, the amount is the same – 25 USD, for other payment methods it can be up to 20 USD. The broker states that based on alternative payment methods the fees might be different but does not state what other alternative methods can be used or how much the fee might be. There is a commission of 7 USD per lot traded, it is a good offer but considering other indicators of OspreyFX scam, it might be another way to convince traders to open an account with the broker.

OspreyFX rating

You could already assume that the rating of the broker is very low. The broker does not provide clear information about its services, there are some inconsistencies between what the broker claims on the first page and what can be found when you spend some time on Ospreyfx.com review. The broker offers services that are not authorized, it does not have a license and at best can get a license of a regulatory body that does not have any regulatory requirements. Overall, the broker seems to be a scam that tries to look like a legit brokerage but is not very successful with it.

Comments (0 comment(s))