Trade.com Review

TRADE.com is a well known brand in the CFD industry. The firm which was launched in 2013, is best known for its offering of over 2,100+ assets to trade on its proprietary platform. However there is so much more to know about this company then just its CFD offering.

TRADE.com recently relaunched as a multi asset brokerage house. This means that while it still offers traders access to its CFD platform there are now a variety of other trading and investment types that can be found here. These include Direct Market Access, DMA to hundreds of thousands of global assets through its partnership with the cutting edge Interactive Brokers platform, IPO allocations, Asset Management services and Thematic Investing platform.

All of these are really interesting products and each deserves its own review however for the sake of this review we will focus on the CFD offering.

TRADE.com Review: First Impressions

When you first come to the TRADE.com website you will enter the newly launched website. It forms a kind of gateway to a series of financial products. Once you have selected the product you would most like to access you click on that section of the website.

Alternatively you can click on the OPEN ACCOUNT button on the top right hand corner of the screen and select your desired product from the dropdown list.

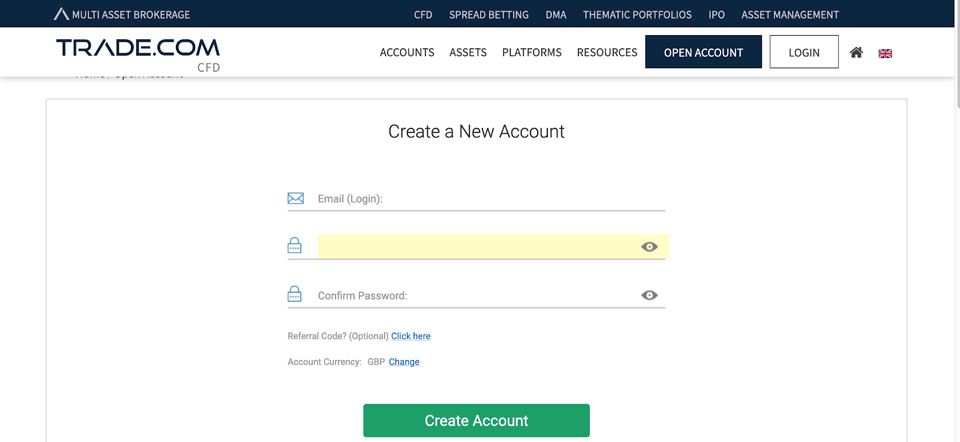

From here registering is very simple, especially if you want to start in demo mode.

It’s important to note that this firm is operated by a highly regulated company. It is regulated in Europe by FCA and CYSEC and in South Africa by the FSCA.That means as a trader your interests are protected and your funds too up to a certain limit with the investor compensation scheme (in the highly unlikely event that the company becomes insolvent).

This means that if you want to start trading or investing live, you will need to upload your identity documents. Otherwise if you’d like to test out the platform and product first in demo mode with virtual funds of $10,000, no need to upload documents.

It is clear to see why so many accounts have been opened with this broker. As well as being regulated, the customer service department are really excellent. They offer a whole host of different languages and they respond in a very quick time with really informed and helpful answers.

TRADE.com Platforms and Features

We mentioned a little earlier about the many types of investing you can access with TRADE.com. These feature a range of really innovative and interesting products.

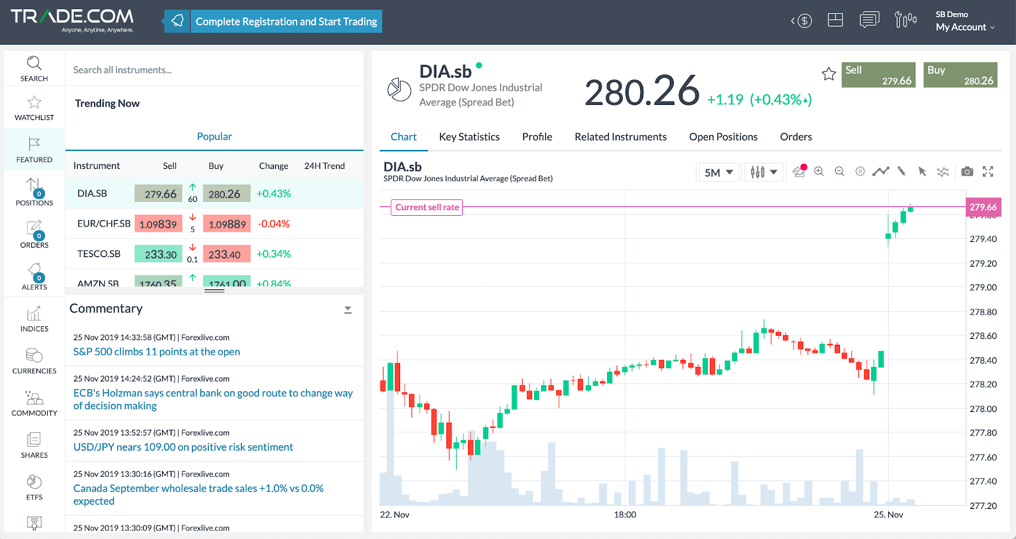

When you log in from the UK and Ireland you will be directed to the spread betting platform. This is a great way to trade the markets and not have to pay any taxes on your gains. From outside these regions you will be directed to trade through CFDs on the proprietary platform that was built in house. The proprietary platform is a pleasure to use. It is easy to understand for a beginner, yet contains all the features an intermediate might need for his or her day trading.

When you first access it, you will be directed through a short tutorial to help you understand the basic principles of the platform.

Far left are all the options you can choose for trading including asset types, orders, open and closed positions. You can also set up your watch list from here. To the right of this is the Trending Now widget, which features all the most popular assets available to trade currently. Below that you will find an updating news stream, for those traders that like to trade the news. Then to the right is the chart and the key stats on the asset of your choice. This is a really great feature, where most platforms simply give you the current price of the asset, TRADE.com platform goes above and beyond to give you loads of updating information on the asset.

Plus, you have a range parameter you can change on the chart and a huge selection of indicators. This is certainly a dream platform for a trader, in our opinion.

The broker requires a minimum deposit of $100, and offers the industry approved leverage of 1:30 or higher for professional traders. The spreads are very generous here too with the lowest offered at 0.4 pips.

Can TRADE.com be trusted?

The short answer is absolutely. This is an excellent and well-respected brokerage house that is a firm favourite with both beginners and more experienced traders. The broker is regulated in a variety of jurisdictions and is completely transparent in its dealings.

TRADE.com review conclusion

TRADE.com offers CFDs, Spread Betting, Direct Market Access, IPO and Thematic Investing to a wide variety of investors. The technology offered by TRADE.com is excellent, the trading conditions are advantageous to all kinds of traders and the customer support is second to none. The brokerage firm also has physical offices across Europe where it welcomes its clients to attend meetings. A firm yes on every count for this company.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The value of your investments can fall as well as rise, which could mean getting back less than you originally put in. Past performance may not be indicative of future results. All trading involves risk.

Options and Warrants are complex financial instruments and are not suitable for all investors.

The Company provides no investment advice of any kind, nor gives advice or offers any opinion with respect to the nature, potential value or suitability of any particular securities transaction or investment strategy.

Professional clients can lose more than they deposit.

TRADE.COM is a trade name operated by Trade Capital Markets (TCM) Ltd (ex. Leadcapital Markets Limited) and Livemarkets Limited. Trade Capital Markets (TCM) Ltd is authorized and regulated in Cyprus by the Cyprus Securities and Exchange Commission (license number 227/14), and authorized in South Africa by the Financial Sector Conduct Authority (FSP number 47857). Livemarkets Limited is authorized and regulated in the United Kingdom by the Financial Conduct Authority (Firm Reference Number 738538).

Comments (0 comment(s))