A comprehensive TradeMax review – regulations, features and weaklings

TradeMax Forex broker is an Australian brokerage established in 2013. The broker is regulated by one of the most reputable regulators in the world ASIC. While having the regulations gives more credibility to the broker there are a lot of signs pointing out the possibility that it is a scam. After reviewing TradeMax you will see that the broker is not as good as it might seem from the beginning. The brokerage claims that the information is only for the residents of Australia, but at the same time, it targets traders from all around the world. The broker has a very high minimum deposit for the standard account, one can only start trading with the TradeMax when depositing 1000 USD. The leverage is high as well traders can use up to 1:400 leverage. Besides currency pairs, the broker offers CFDs on commodities and indices. This TradeMax review will reveal the scam behind the company and describe the features and services of the broker in details.

Is TradeMax Legit?

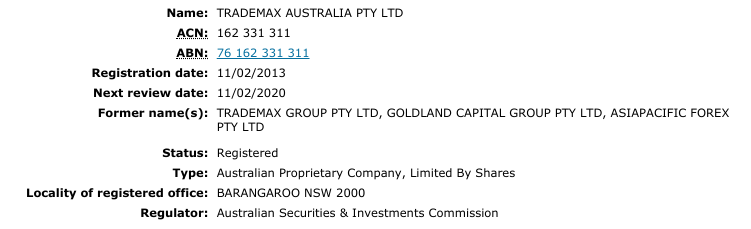

Sometimes scam brokers are claiming to be regulated and showcase the license number that is either revoked at that time or belongs to another brokerage. However, the license number indicated by TradeMax is actual. the broker is registered and regulated by the Australian Securities and Investments commissions with the license number 436416. The information about the license can be checked on the regulator’s website. The license is issued in 2013 and is still valid. ASIC provides a summary of the company as well, according to it the current name of the company that operates TradeMax Forex broker is TradeMax Australia PTY Ltd. The company has changed the name several times, previously it was TradeMax Group PTY Ltd, Goldland Capital Group PTY Ltd, and AsiaPacific Forex PTY Ltd. The brokerages operated by the company include FXUF.com; SuperTraderFX.com.au.

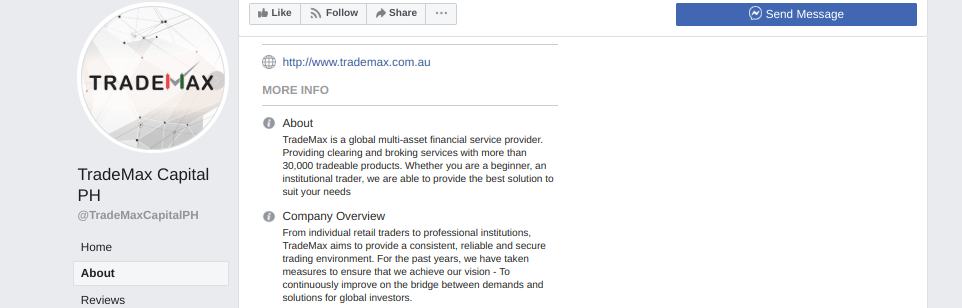

Apart from it seems the company is operating with the different name TradeMax Capital. There is a Facebook page of TradeMax Capital Philipines that shows the link of the TradeMax.com.au

TradeMax opinions

While making Trademax.com.au review I was unable to find any reviews made by the customers of the broker. However, there are a lot of opinions posted about TradeMax Capital, which as you can see is the same broker as TradeMax. All of the reviews are negative as they are stating that the broker connected to some scam scheme. TradeMax states that all the information provided on its website is directed only to the residents of Australia. However, the United States is the only country where the broker does not accept traders from. Seemingly, the brokerage is targeting Asian region a lot, for example, the Philippines as they have a Facebook page for it, and China, as there is some content available in Chinese on the website, even though the website is available only in English. Also, the broker has a WeChat account, which is the main social platform in China.

The scam scheme that TradeMax opinions reveal is connected to China. The majority of traders who made the reviews state that TradeMax is paying commissions to the people, mostly women who are contacting people via WeChat and after friendly talks for a while suggest them to trade with TradeMax. They lure people with the made up stories that they are trading and getting high profits. Apart from it, if they are successful they ask for the MT4 account ID as proof that a person has truly registered with TradeMax Capital. Needless to say, people who fall in this trap end up losing all their money and are unable to make any profits. Many other traders have accused TradeMax of manipulating with prices as the broker is a market maker.

Minimum deposit, leverage, and spreads

The features of the broker do not look attractive as well and make the TradeMax rating even worse. The minimum deposit required is 1000 USD, which is very high compared to other brokers. Most of them offer low minimum deposits for the standard account, from 5USD to 250 USD as usual.

The broker states that spreads start from 1.6 pips which is also very high. You need to consider that if the minimum spread is 1.6 most probably it is for the major currency pairs such as EUR/USD which usually has the lowest spread. With good brokers, you can have spread from 0 pip, and the average spread for the EUR/USD is often 0.8 pips.

As for the leverage, the broker offers 1:400. The brokers regulated by ASIC do not have any restrictions on leverage offerings, however, 1:400 is very high and traders must be careful with it.

Account types

TradeMax account types are not very well design and are somewhat confusing. TradeMax FX brokerage offers Standard, Premium, Pro, and Raw spread accounts.

The standard account and premium one has the same features, both of them have 1:400 leverage available and a dedicated account manager. However, the minimum deposit for the standard account is 1,000 USD, and for premium 50,000 USD. The difference is too high and logically, premium account should have additional value, however, there is no information about it.

Pro and raw spread accounts are also the same. Both of them require a minimum deposit of 100,000 USD, have the leverage of 1:200, dedicated account manager, VIP desk, Free VPS, and MAMM service. The difference between these accounts is not indicated as well. One can see in FAQ Section that raw standard account has spread from 0 pips and there is commission per lot traded. The commission is 7 USD or 9 AUD per lot.

TradeMax deposit and withdrawal

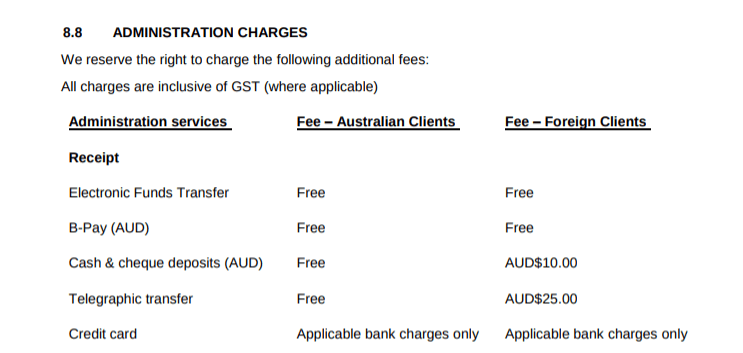

With TradeMax account funding methods are limited to wire transfer, Visa, MasterCard, FasaPay, and Poli. TThe broker charges 10 AUD, and 25 AUD if the deposit is made with Cash and cheque deposits and Telegraph transfer by the foreign customers. there is TradeMax withdrawal fee for foreign customers as well, which is 25 AUD.

Apart from deposit and withdrawal charges, there are commissions and fees that are not indicated anywhere on the website. Information about it can be seen on the legal documents that the broker has uploaded on the website. Unfortunately, there are not many details in there, TradeMax simply states that there might be charges for different services, but does not state in which case they can be applied on trading account or how much they are.

TradeMax rating

As you could already guess TradeMax rating is very low. The only positive thing that can be said about the brokerage is that it is regulated by the ASIC. However, there have been a lot of cases when the regulated broker was a scam. It must be well understood by the foreigner customers that the broker has obligations towards Australian traders only. If you live outside Australia, you cannot do anything if you will end up being a victim of TradeMax scam. The broker might have a good service for the residents of Australia and scam traders from other countries, as the reviews suggested. However, even if you are a resident of Australia, you cannot get good service from TradeMax simply because the service and features of the broker are pretty bad. There is a very high minimum deposit compared to the well-established international brokers, the spreads are also too high and there are commissions that you cannot be aware of. Moreover, the company operating the brokerage has been operating other brokerages as well that are also considered to be scams. Based on it, our final TradeMax opinion is very bad. The broker is clearly leading a scam scheme and traders, especially outside Australia should avoid TradeMax.

Comments (0 comment(s))