TV Markets Broker Review

When you want to start Forex trading online, you have to consider every little detail necessary to ensure a seamless trading experience. These details can range from market conditions and price points to political/economic developments in the world.

Choosing the right broker is also one of the most critical undertakings in the field. You have to be sure that your broker is trustworthy with its legal issues and has decent trading conditions that promise lucrative profits.

Tradeview Markets is yet another broker famous on the internet. With the positive TV Markets reviews on the web, as well as some negative ones, we’ve decided that we want to examine the broker ourselves. Under our scrutiny, we’ll better distinguish credible promotions from the fake ones.

So, without further ado, let’s get to the review.

First impressions

The TV Markets broker has been established in 2008 under the legal oversight of the Cayman Islands Monetary Authority. Now, we’re going to review each of these components in detail down below, but for now, we’ll just say that the CIMA license looks suspicious to us.

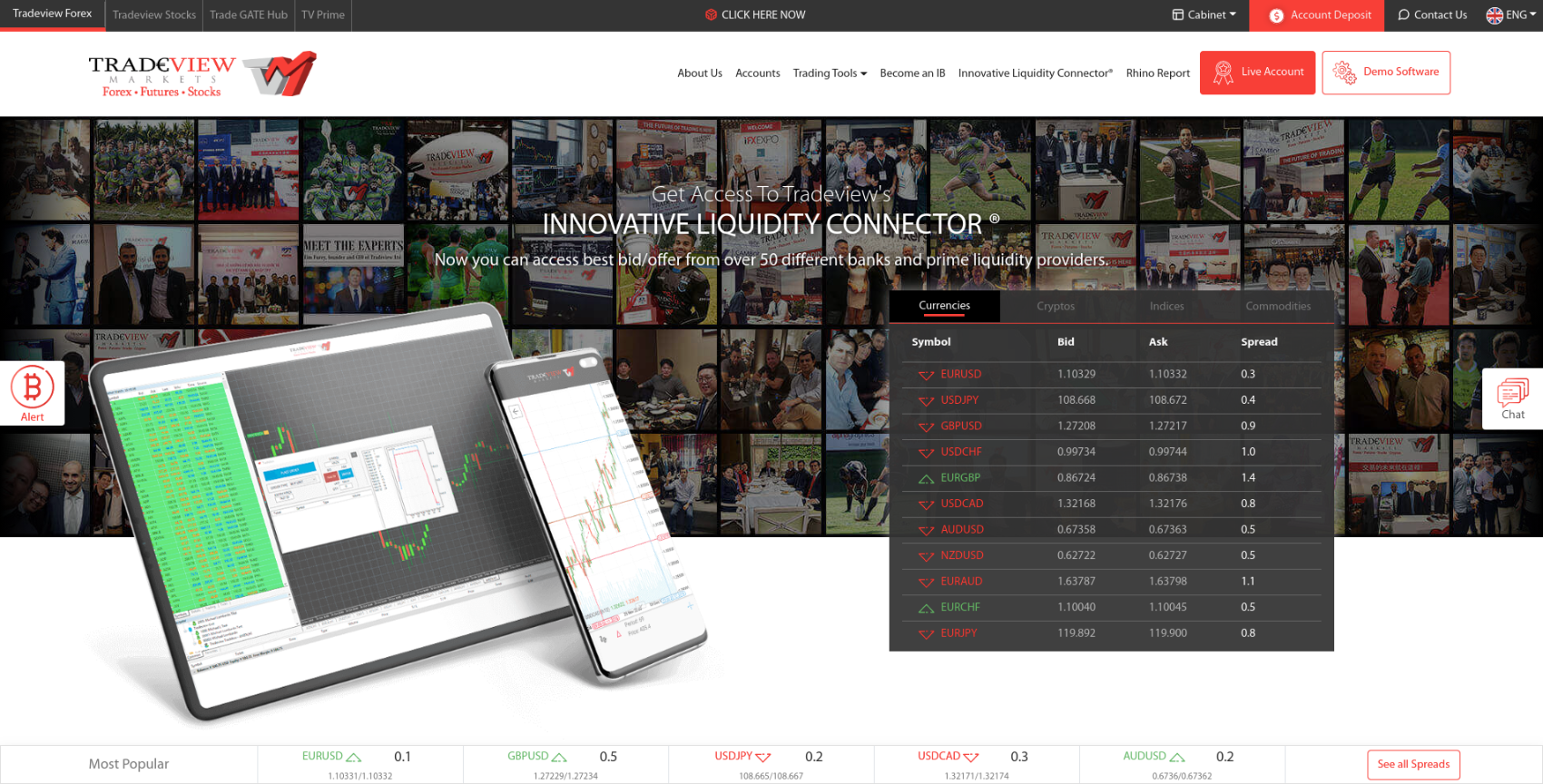

The broker has Forex, as well as commodities, stocks, and other market sectors featuring on its platform. The website contains every information necessary to make an impression of the broker. However, when it comes to comfort and simplicity, we’re not so sure the website provides those. The interface looks too complicated with unnecessary visual effects and rich colors.

The broker features several types of withdrawal/deposit platforms, such as credit cards, bank wired transfers, etc., however, these obsolete payment methods fall short when it comes to safe and fast transactions.

As for the trading accounts, the TV Markets Forex broker has three types of accounts based on the number of traders: Individual, Joint, and Corporate. This arrangement is somewhat strange considering how other brokers categorize their trading accounts. But more about that later.

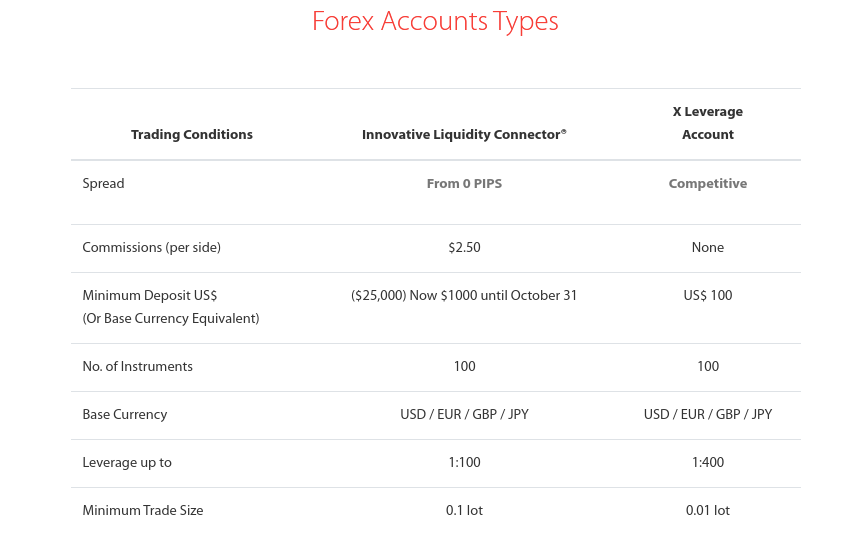

When it comes to the trading terms and conditions, TV Markets offers impressive numbers that create promising revenue possibilities. The leverage can reach 1:400, spreads can go as low as 0 pips, while the minimum deposit requirement is $100. And if you want to minimize risks associated with betting your own money on market conditions, you can place bets as low as 10 cents.

These numbers have two different connotations: on the one hand, they ensure that whoever’s trading under these conditions will receive large profits; on the other hand, however, the broker might be flashing them in order to attract new customers at whatever means necessary. We’ll find out which of these connotations are close to reality in the final part of this review.

Can TV Markets be trusted with the CIMA license?

As we’ve mentioned above, the broker has been established almost 11 years ago in the Cayman Islands. It received a license from the Island’s Monetary Authority which is the main financial institution in the country.

With the CIMA license, TV Market expects us to believe that its financial activities are in accordance with high financial standards and are being overseen by the Cayman’s high authorities. We’re not sure what they mean by these high standards, but here’s what we make of the CIMA license:

The Cayman Islands, with its insubstantial political power and influence, cannot possibly control the financial activities of a company that operates all around the world. The Island cannot even control the internal politics and economy and is dependent on the UK. So, we’re pretty sure TV Markets has no actual license overseeing its trading ventures.

The reason why companies like TV Markets FX Brokerage register, or even transfer their businesses in the countries like the Cayman Islands is that those countries are the so-called ‘safe havens’ for them. These businesses want to avoid taxes and hide their illegal activities from powerful countries like the US, UK, etc., and on the Cayman Islands, they can do exactly that.

Since we’ve mentioned the United States, it’s fair to add that the broker is not allowed to provide its service to the US citizens. With stricter regulations and limitations, the US controls these financial businesses to ensure that there are no machinations or deceptions going on. And with TV Markets, there’s clearly something inherently wrong. This, coupled with the faulty licensing, further proves our suspicions.

What’s it like to trade with TV Markets?

We said earlier, that the TV Markets promotions, on their own, are come of the most competitive numbers on the market. They promise large profits and have somewhat modest requirements. Let’s take a look at those numbers first and then think about what they actually represent.

The broker requires its customers to deposit no less than $100. Considering the market average varies somewhere around $200, this number is pretty modest. However, when it comes to those traders with no actual experience in the field, even $100 is too much to risk. Lucky for them, the broker allows the minimum bets of just 10 cents, however, they’re still required to deposit $100.

As for the leverages, it can go as high as 1:400. It ensures that for every $100 you deposit, the actual trading amount will be 400 times more – $40,000. And with this amount of money, you’ll be able to harvest far greater amounts of profits from trading endeavors.

Spreads are also pretty impressive, to be honest. 0 pips on some occasions means that when it comes to currency or other types of pairs, there will be no slippage and you’ll be able to buy them at the exact price that you’re selling them. This also promises lucrative opportunities.

The broker features 3 types of trading accounts: Individual, Joint, and Corporate. As you can see, these accounts are based on the number of individuals involved in trading. This is somewhat weird, considering that other brokers categorize these accounts based on the trading experience of customers.

Overall, these conditions might be lucrative on their own, as we said earlier, but when coupled with deceiving regulatory claims, we believe that they’re being used to trick new customers. TV Markets opinions might be positively charged on the internet but we have a different position: we think that the broker doesn’t really care about sincerity, as long as they’re able to attract as many customers as possible.

The tvmarkets.com review

When it comes to the website, we have mixed feelings about it. On the one hand, the platform contains almost every detail about the broker. You might have to conduct thorough research to find what you’re looking for but still, you can find it.

Besides, TV Markets features the most recent version of MetaTrader 5, as well as some other platforms like Sterling Trader Pro, Rhino Trader, etc. One thing to keep in mind, though, is that the TV Markets MT5 is a very complicated platform that is difficult to comprehend for novice traders, as well as for some experienced ones. Its predecessor, MT4, is much simpler and easy-to-use and would be better if the broker featured it instead of MT5.

On the other hand, the interface is overloaded with unnecessary visual effects and imagery. The combination of rich reds and blank whites creates an unbearable visual experience that easily wears off the eyes.

Plus, tvmarkets.com, which is a default website, contains only the stock trading platform, while completely omitting the important information about leverages, spreads, etc. If you want to know what the trading conditions are, you have to switch over to the separate Forex trading website, which is located in the top-right corner of the first page.

Another downside is found in the withdrawal/deposit area. The broker offers pretty obsolete and ill-secured payment methods like bank wire and credit card, as well as some other insubstantial platforms (e.g. Skrill, Uphold, Neteller, etc.). These methods are more susceptible to security breaches and slow transaction speeds, compared to the more secure and fast platforms like PayPal or Bitcoin.

Overall, the website and online platform further demonstrate that there’s something wrong with the broker. With its 11-year-old experience in the field, one might think that the broker should have been able to create a simplistic and sophisticated website. However, reality shows a different picture.

What do we make of the broker?

In conclusion, we suspect that those TV Markets rating articles on the internet are paid promotions that don’t really show what’s hidden behind the curtains.

In this review, we tried to lift those curtains and uncover some of the details. For example, we found out that the CIMA licensing doesn’t really mean anything and in reality, the broker is able to do whatever it wants without any legal implications.

As for the trading conditions, these numbers and requirements might look like they promise a bright future, but when combined with faulty regulatory claims, they also add up to this fraudulence hypothesis of ours.

The same goes for the website. With its overloaded interface and counterintuitive indicators, it goes to show that 11 years of existence doesn’t always lead to professionalism.

Overall, we don’t think that it’s a good idea to associate yourselves with Tradeview Markets. But if you’re still not convinced, be extremely careful when using their service.

We wish you safe trading!

Comments (0 comment(s))