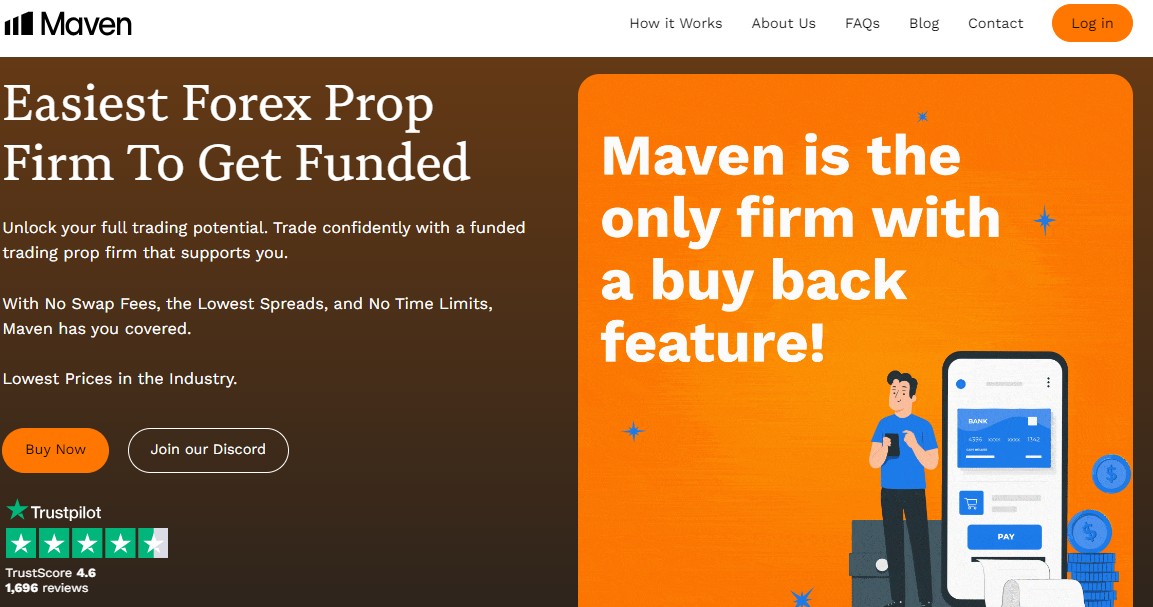

Maven Trading Forex prop firm review — Is this young prop firm reliable?

Maven Trading prop firm offers funded account challenges ranging from 2,000 dollars to up to 100k USD. The firm was established in 2023, which makes it a relatively young prop trading firm. The fees start from just 15 dollars and traders can choose between 1-step and 2-step funded challenges.

In this Maven Trading review, we are going to discuss the firm’s important features such as safety, fees, rules, funded options, scaling plan, support, platforms, and much more. After reading this review, you will decide whether Maven Trading can be trusted as your main prop firm.

Overall

Maven Trading prop trading seems above-average. It is young but has positive trader reviews. Funded options range from 2k to 100k and fees start from 15 dollars.

Pros & cons of Maven Trading prop firm

Pros

- ✅ Low entry fees starting from $15

- ✅ Offers both 1-step and 2-step challenges

- ✅ Comprehensive scaling plan up to $1 million

- ✅ Allows weekend holding and news trading

- ✅ Offers access to advanced platforms, cTrader, and Match-Trader

Cons

- 🚫 Only offers demo accounts, even for funded traders

- 🚫 Limited customer support with no live chat or phone options

- 🚫 Lack of educational tools and resources beyond a trading blog

Safety of Maven Trading

Maven Trading reviews are lacking on the ForexPeaceArmy platform, as the firm was launched recently. However, the reviews on Trustpilot are mostly positive, scoring 4.6 with only 6% of reviews being 1-star and 85% of traders evaluating the firm’s services with 5 score. The firm only offers simulated accounts which are demo trading, even after traders pass the challenge. This is common with prop firms these days, as the majority of them only offer monetized demo trading to all traders.

Overall, Maven Trading presents an interesting case for safety with positive trader reviews, lack of experience, and only offering a virtual trading environment.

Maven Trading Funding and maximum capital allocation

Maven Trading funded programs consist of 1-step and 2-step funded challenges. The 1-step funded challenge requires traders to hit the profit target once to get funded, while the Maven 2-step account requires traders to go through additional phases before they can become funded and trade on the monetized demo account.

Maven Trading funding options are diverse and include 2k, 5k, 10k, 20k, 50k, and 100k USD amounts for both 1-step and 2-step challenges. The 2,000 USD starting option for Maven Trading challenges makes the firm very beginner-friendly and allows novices to start low, which is always good. The firm also offers a comprehensive scaling plan, allowing traders to grow their accounts.

Maven Trading scaling plan requires traders to reach a 10% profit target in four months, which is 2.5% per month. Traders should also get one payment each month. The account will grow by 25%. The trader can increase their account size using scaling to up to 1 million dollars. Overall, when it comes to funding, Maven Trading offers options for both beginners and seasoned pros and allows them to use a scaling plan of up to 1 million funding.

Maven Trading Assets

Maven Trading prop trading is possible by speculating on diverse financial markets, such as Forex pairs, commodities, indices, and digital ETFs (cryptos). The firm allows traders to use leverage for all of these assets including 1:75 on Forex pairs, 1:20 for commodities, 1:2 for digital ETFs, and 1:20 for indices. There are trading commissions of 2 USD per lot per side, which is a 4 USD round turn. If traders use other currency, it is converted to USD. Crypto, Indices, and Commodities have $0 commissions, there are also zero swaps across all accounts. Spreads are close to raw, meaning they should be low.

Overall, Maven Trading offers popular Forex trading pairs and requires low commissions.

Maven Trading Trading rules and limitations

Maven Trading rules are slightly different for each phase of the 2-step account, but overall both 1-step and 2-step accounts have similar rules for phase 1.

Maven Trading 1-step account has an 8% profit target, a 5% trailing drawdown from the highest equity, and a 3% daily drawdown. The 2-step account has an 8% profit target on Phase 1, and 5% on Phase 2. The maximum drawdown is 8% and the daily risk limit is 4%. Weekend holding is allowed and traders can also trade during the news but can not open new trading positions during news.

Maven Trading Fees

Maven Trading fees are one-time and refundable. No matter the challenge type, the fees are the same:

- Funded amount: 2k USD — one-time fee: 15 USD

- 5k USD — 19 USD

- 10k USD — 38 USD

- 20k USD — 76 USD

- 50k USD — 190 USD

- 100k USD — 379 USD

Maven Trading free trial is not available at the moment, although its fees are refundable after traders get funded. Maven Trading free repeat is not offered at the moment, which is a minor downside for the firm.

Maven Trading Platforms

Maven offers two trading platforms, Match-Trader, and cTrader. Match-Trader is popular among prop trading firms, while cTrader is an advanced platform allowing users to trade with custom indicators and cBots with highly customizable charts. Mobile trading is also possible using the cTrader mobile app. Overall, Maven Trading offers advanced platforms, but all funded accounts are demo accounts.

Maven Trading Profit-Sharing

Maven Trading profit split is 80% and the maximum withdrawal cap is 10,000 dollars. The maximum withdrawal limit is 100,000 USD, after which traders can increase it by using the scaling plan.

Education and trading tools at Maven Trading

Maven Trading has a trading blog where all educational content is concentrated. There are posts about market news and there is educational content as well. There are no other tools or resources available at the moment.

Customer Support at Maven Trading

Customer support is where Maven Trading falls short. The firm only has an online form, which is a form of email support. There is no live chat or phone support offered. Both the support and website are only available in the English language, which is also a downside.