Bitcoin price predictions for the rest of 2018

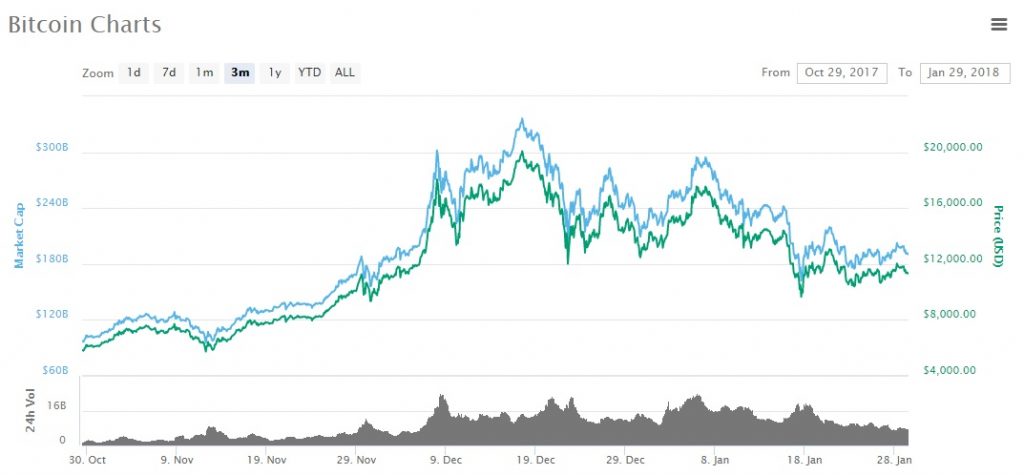

The recent decline in Bitcoin price has made many investors wary of investing in it, but there’s still hope. From highs above $20,000 toward the end of 2017, bitcoin has now shed more than 40% of its value to trade at current prices just above $11,000. It has even lost its dominance in the cryptocurrency market, from around 37% to the current 33.5% according to CoinMarketCap. However, recent price predictions from trusted experts should inspire bitcoin holders to remain patient as another upsurge may be coming.

What is behind the recent decline in Bitcoin price?

Before going into the price predictions, it is important to understand what is going on first. The main cause of the decline can be attributed to a market correction that was actually foreseen. On the 20th of December, Dan Morehead told CNBC’s Squawk Box that Bitcoin price would fall by 50% in the following weeks. That is just about what happened as bitcoin price dropped from above $17,000 to the current prices. Dan Morehead is the CEO of Pantera Capital, which now focuses on cryptocurrencies. Since its first venture into crypto in 2013 by buying bitcoin at $72, the fund has since then grew by 12,000%.

Ever since the sharp rise in bitcoin price since mid-November, many technical analysts had anticipated a market correction. On the 17th of November, the price of bitcoin was about $7,700 and a month later it had topped $20,000. Such a sharp spike in value would have eventually led to a market correction, which is what we are observing now. Even Andreas Antonopoulos had the same to say about bitcoin’s price dip saying it is all “Just a bunch of new drama”.

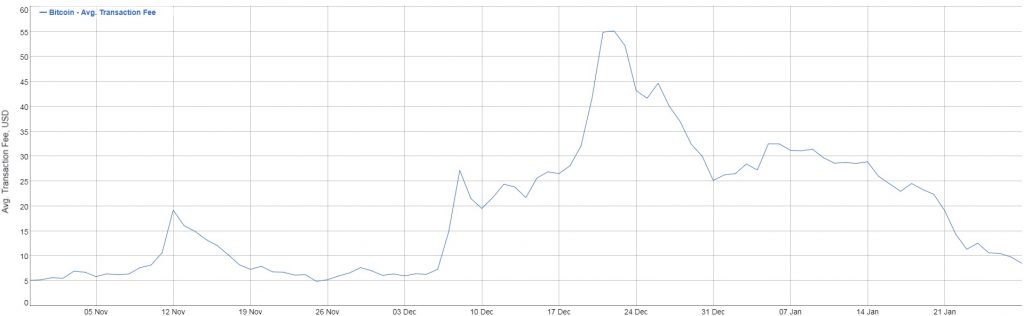

Besides the eventual price correction that follows a bull run, bitcoin’s value was also hurt by rising transaction fees. Around the 19th of December, bitcoin transactions could cost users about $28 on average. One Twitter user even reported that he had been charged $16 in fees to send just $25, a 40% transaction fee. These unbelievably high transaction costs also had a huge impact on Bitcoin price. Many cryptocurrency users had opted to go with other coins like Ripple, Litecoin and Bitcoin cash. By observing the charts, it is clear that these cryptocurrencies had been rising in value as bitcoin price was going down.

Finally, there had been a general selloff in the entire cryptocurrency market in January. This had been triggered by negative news out of South Korea and China, two of the world’s largest cryptocurrency markets. South Korean Minister of Finance had announced that the country was considering a shutdown of all cryptocurrency exchanges. Meanwhile, Chinese authorities wanted to crack down even further on the already banned cryptocurrency exchanges.

What does all this mean for Bitcoin in 2018?

Based on all the above reasons, it is clear that the decline in Bitcoin price is only temporary. You might even consider this a good opportunity to buy now that the value has gone down. We had previously predicted that bitcoin could hit $50,000 in 2018, and we still stand by that prediction. Several other prominent experts have also predicted the same, claiming the price decline to be only a price correction. Besides, there are a lot of improvements coming to the Bitcoin network in 2018 that will solve the various problems facing the cryptocurrency. All in all, the outlook for bitcoin still remains very high and optimistic.

The recent decline in Bitcoin price has made many investors wary of investing in it, but there’s still hope. From highs above $20,000 toward the end of 2017, bitcoin has now shed more than 40% of its value to trade at current prices just above $11,000. It has even lost its dominance in the cryptocurrency market, from around 37% to the current 33.5% according to CoinMarketCap. However, recent price predictions from trusted experts should inspire bitcoin holders to remain patient as another upsurge may be coming.

Comments (0 comment(s))