Navigating Nasdaq’s Rollercoaster: Analyzing August 2023 and What It Means for Investors

In the fast-paced world of financial markets, the Nasdaq Composite Index managed to eke out a modest gain on Thursday, providing a glimmer of hope for investors after a tumultuous month. However, the relief was short-lived as the index wrapped up what has been a challenging August. Throughout the month, the Nasdaq experienced its most significant losses of the year, sending shockwaves through the investment landscape. In this article, we delve into the live updates and analysis of Nasdaq’s recent performance, exploring the key factors driving these fluctuations and what they may signify for the broader economic landscape in the months ahead.

Navigating the Storm: Nasdaq’s August Rollercoaster Ride and Investor Hopes

The Nasdaq Composite Index managed to secure its fifth consecutive day of gains, providing a ray of hope for investors amidst its tumultuous journey in August 2023. However, it couldn’t escape the fact that this particular month marked its most significant monthly loss this year.

On Thursday, the tech-heavy Nasdaq index eked out a slight increase of 0.11%, concluding the trading session at 14,034.97. In contrast, the Dow Jones Industrial Average witnessed a dip of 0.48%, losing 168.33 points to finish at 34,721.91, and the S&P 500 experienced a marginal decline of 0.16%, closing at 4,507.66.

While the recent positive streak led to a partial recovery, it couldn’t fully offset the losses incurred during August. The broad-market S&P 500, for instance, ended the month with a 1.77% loss, while the Nasdaq endured a more substantial setback of 2.17%. The Dow, consisting of 30 prominent stocks, faced a significant decline of 2.36%.

Investors closely monitored the release of new U.S. inflation data on Thursday. The core personal consumption expenditures (PCE) index reported a 0.2% month-over-month increase in July, with a year-over-year rise of 4.2%, aligning with economist forecasts. This core PCE index holds immense significance for the Federal Reserve as a key inflation indicator.

Joseph Cusick, Senior Vice President at Calamos Investments, highlighted the role of U.S. Treasury yields in influencing equity markets, emphasizing that declining yields could propel stocks upward, at least in the short term.

Salesforce, however, offered some relief amid Dow’s losses, as its shares surged by nearly 3% following the announcement of robust fiscal second-quarter results and impressive third-quarter guidance, surpassing analysts’ expectations.

Investor attention now pivots towards the eagerly awaited non-farm payroll data, scheduled for release on Friday. Economists surveyed by Dow Jones anticipate an addition of 170,000 jobs, with traders hoping the report will signal a meaningful slowdown in the economy, possibly leading to a pause in the central bank’s benchmark interest rate hikes.

August proved to be a challenging period for technology stocks, with both the Nasdaq Composite and Nasdaq-100 enduring their most challenging months since December 2022. The Nasdaq Composite concluded the month with a 2.2% slump, while the Nasdaq-100 wrapped up with a 1.6% decline, reflecting the sector’s struggles throughout this turbulent period.

How does the Nasdaq Rollercoaster Impact Traders?

The recent performance of the Nasdaq Composite Index and the broader technology sector has significant implications for traders who operate within the Nasdaq market. Here are some examples of how these developments can impact traders:

- Volatility and Risk Management: Traders on the Nasdaq need to be especially vigilant in times of heightened volatility. The recent fluctuations and monthly losses serve as a reminder that tech stocks can be prone to sharp price swings. Traders may reconsider their risk management strategies, possibly tightening stop-loss orders or reducing position sizes to protect their capital in uncertain markets.

- Sector Rotation: The Nasdaq is heavily weighted towards technology and growth-oriented stocks. When the index faces headwinds, traders might opt for sector rotation strategies. They may shift their focus to sectors that are less impacted by Nasdaq’s performance, such as utilities, consumer staples, or healthcare, to diversify their portfolios and reduce exposure to tech-related risks.

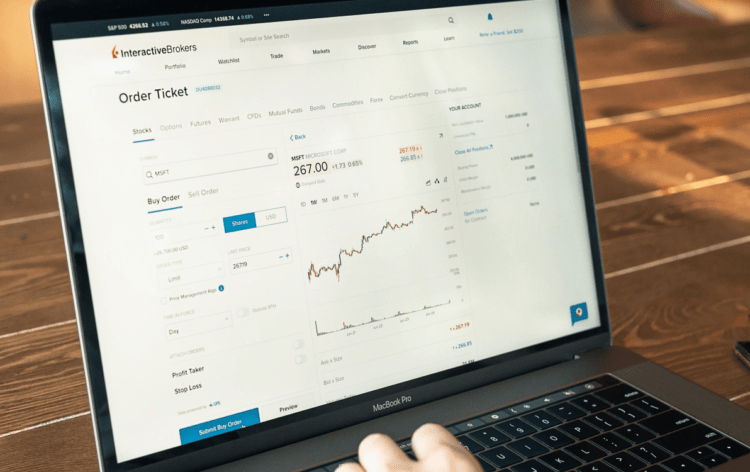

- Earnings Reports: Individual stock performances within the Nasdaq can be highly influenced by quarterly earnings reports. Traders should pay close attention to earnings releases and guidance from tech giants like Apple, Amazon, and Microsoft, as these can have a ripple effect on the entire index. Positive surprises or disappointments in earnings can trigger significant price movements.

- Interest Rate Sensitivity: The relationship between tech stocks and interest rates is crucial. If the Federal Reserve continues to raise interest rates to combat inflation, traders in the Nasdaq may experience pressure on high-growth, high-valuation tech stocks. They should closely monitor central bank policies and be prepared to adjust their trading strategies accordingly.

- Opportunities in Oversold Stocks: Amidst the market turbulence, traders can also seek opportunities in oversold stocks. Some tech companies with strong fundamentals may be unfairly affected by broad market sentiment. Value-oriented traders might look for bargains and potential rebounds in these beaten-down stocks.

In summary, Nasdaq’s recent performance underscores the importance of adaptability and risk management for traders. It encourages them to diversify their portfolios, stay informed about macroeconomic factors, and remain vigilant in an ever-changing market environment. By carefully navigating the challenges and opportunities presented by the Nasdaq, traders can strive to achieve their financial objectives while minimizing potential risks.

Comments (0 comment(s))