After Days of Selloff Boeing (BA) Stock Rise by 7%

As the markets open on Thursday, the shares of Boeing corporation (BA) are rising by more than 7%. After several days of the selloff, the stock recovered and reached $130.26. In the previous months, the company was considering acquiring Embraer, a Brazilian aircraft producer.

However, once the COVID-19 pandemic arrived, it changes the entire dynamic in the sector. Nowadays, instead of planning for expansion, the company has dropped those plans. Instead, the recent reports suggest that Boeing is planning to sell some portion of its shares to Mitsubishi. As some financial commentators believe this can help the business to raise much-needed cash and survive in the long term.

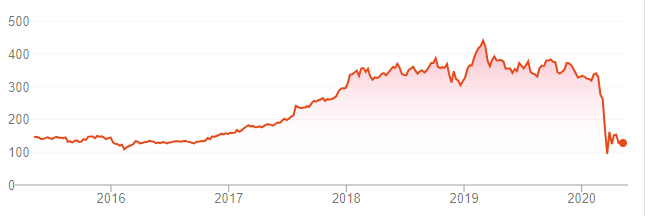

Source: google.com

As we can see from this chart, the BA stock has made substantial gains in recent years. The shares of this firm increased from $145 at be beginning of 2016 to reach an all-time high of $440 in May 2019. interestingly enough the stock has faced some pullbacks even before the COVID-19 concerns started to dominate the market. Despite those setbacks, Boeing shares were still holding on to $340 during mid-February 2020.

However, as travel restrictions and lockdown came into effect across the world, the company started to run into serious problems. By the end of April, the management published the first-quarter report. According to those latest numbers, the company has posted a $641 million loss. This is in sharp contrast to the previous year’s results when the firm posted a $2.15 billion profit. The report also underlined the fact, that Boeing’s revenues fell by 26% compared to a year earlier.

Boeing’s Response to Pandemic

In response to those challenging times for the industry, the company announced plans to cut payroll by 10%, by voluntary salary reductions and layoffs as well. The management also discussed the plans for a 15% spending reduction on commercial aircraft and other business expenditures.

In the previous years, Boeing consistently raised its payout to shareholders. Increasing it incrementally from 14 cents per quarter in 2000 to $2.055 by 2019. It was not surprising that in response to those challenges, the company has canceled its payments to shareholders. In fact, as financial times commented, the Boeing investors might have to wait for years, for a dividend to return.

As a result of the pandemic, air travel in the US has fallen by 95% than a year ago. In his address to shareholders, the Boeing CEO Dave Calhoun commented on this reality, saying that it might take 2 to 3 years for travel demand to return to 2019 levels. The head of the company also mentioned that most likely 3 to 5 years will be needed for the firm to be able to restore dividend payments.

According to the latest forecasts, the total amount of damage to the airline industry from the COVID-19 outbreak might reach as high as $314 billion. This sector did receive a $25 billion US government bailout, which might be handy for some of those cash-strapped companies. However, it goes without saying that this amount alone will not cover their losses. Consequently, companies like Boeing have to resort to further comprehensive cost-cutting in order for their business to survive.

Comments (0 comment(s))