Biogen Stock Rises by 5%, as Firm Makes Progress for Treatment of Alzheimer Disease

As the markets opened on Wednesday on the New York Stock exchange, the Biogen Incorporated shares have made some notable gains, rising by more than 5%. The shares closed at $268.35 by the end of Tuesday’s trading session. However, after today’s considerable gains, the stock has risen all the way up to $294 level.

According to Global Wire, the move came after the company has completed the submission of the Biologics license application to the US Food and Drug Administration (FDA) for Aducanumab. The main function of this medicine is the treatment of Alzheimer’s disease.

Obviously, the very fact that the submission procedure is complete does not necessarily mean that it will be approved by the US regulatory authorities. However, at this stage, one can argue that the company has a reasonable chance of success. It goes without saying that if this happens, it can certainly significantly increase the company revenues for the years to come.

So the approval of Aducanumab can definitely be a great relief for thousands of people affected by this disease, as well as for their family members. Consequently, it seems obvious that there will be a very high demand for this type of medicine. As a result, Biogen’s shareholders can also benefit from the capital appreciation of their investment, as well as from the possible rising amount of dividends.

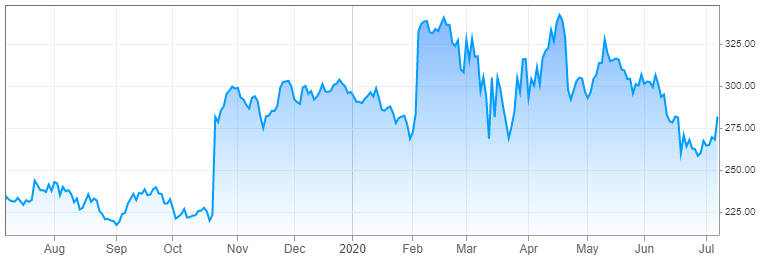

Stock Price Performance of Biogen Inc

source: cnbc.com

As we can see from the image above, the stock was trading close to $230 level from July until the middle of October, 2019. After this development, there was a massive surge in the share price, rising to $300 before the end of the month. This was followed by the second wave of large appreciation in February 2020, as a result of which, the Biogen shares were trading well above $331 level.

The March 2020 stock market crash also had a negative effect on Biogen’s share price, temporarily bringing it down to $269 level. Despite this setback, unlike with some other stocks, the shares swiftly recovered and eventually reached a new high of $339 before the end of April. After this period, the stock did face some correction and currently trades near $294 level.

As the data at CNBC.com suggests, the earnings per share (EPS) indicator of the company currently stands at $32.80. This means that the price to earnings (P/E) ratio of the firm is near 8.96. This clearly indicates that at current market prices, the stock might be considerably undervalued and it can still have a potential for further appreciation. Therefore, Biogen’s shares might be a decent addition to any growth portfolio.

One the other hand, this stock most likely will not be appealing to income investors. The company does not pay any dividends and so far has not announced any intention to start doing so in the foreseeable future. So when it comes to income investing, there are many better options available at the market.

Comments (0 comment(s))