AdroFX Review – Are they trustworthy ?

AdroFX is a newly established Forex broker that only has about three years of experience within the trading industry. The site itself functions smoothly and has a very minimalistic design. The broker offers low spreads, no commissions, and low-cost trading. At least that is what they have chosen to display on the site. We could say the same about the licenses – AdroFX says that they have which are qualifications from VFSC and St. Vincent and the Grenadines. However how legitimate this information is up for debate.

Regarding trading platforms, there are two options for the consumers of the website to choose from which are the MetaTrader 4 and allPips. MT4 is a trading platform known for its multifunctionality and easy accessibility. At this point, it’s an industry standard to provide it for the traders but the “allPips” software is something new and innovative that has distinctive and exclusive features, unlike MT4 it is a web-based platform.

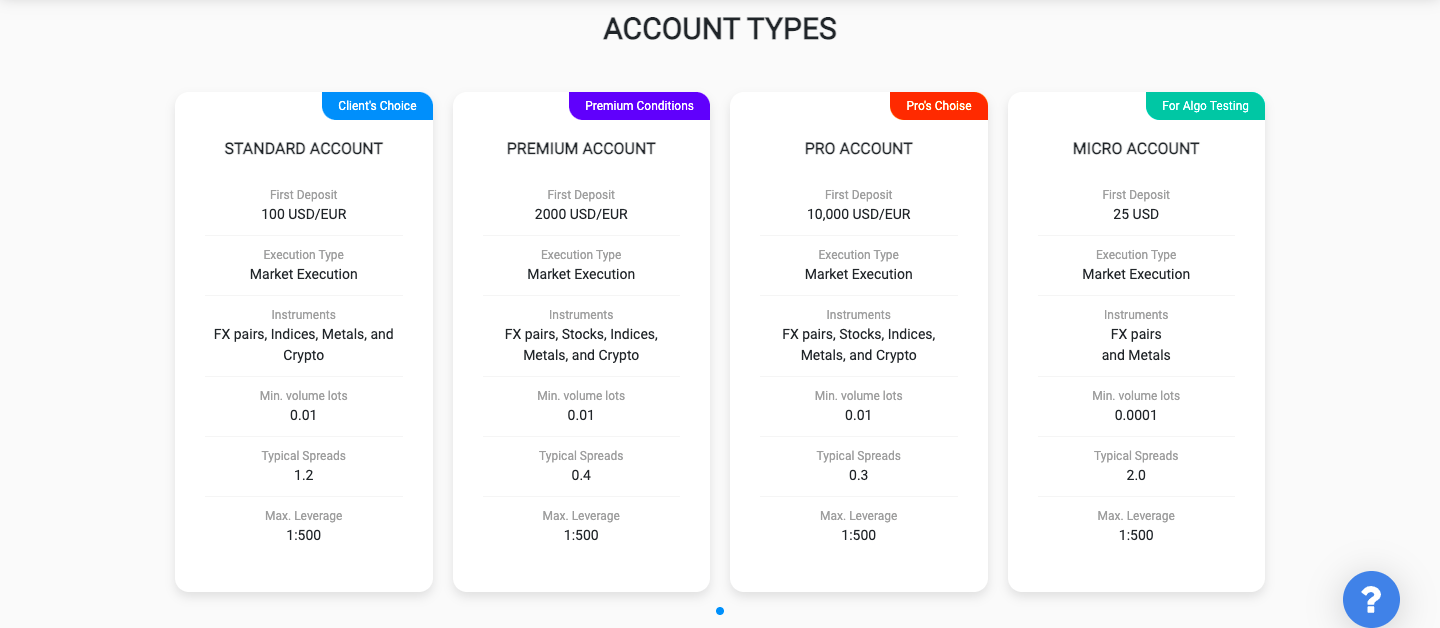

AdroFx broker offers four different accounts to its wide range of consumers. One can make standard, premium, pro, and Micro accounts. Each of them has its signifiers which we will discuss in great detail in one of the sections of our review.

The maximum amount of leverage that a trader can get from this broker is 1:500. which is true for all account types. As for the spreads they are in a variable position which means that they constantly fluctuate depending on the asset type this could be quite a drastic trading tool. Usually, brokers with high spreads get huge profits by doing so.

The minimum deposit amount on the site varies by account type. The lowest minimum deposition requirement is $25 for the Micro account. The customer support team on the website is not as good as one might think. The service operators seem rude and very obnoxious. They work 24/5 and one can get in touch with them via the live chat widget, email, or a phone call.

As far as promotional initiatives go there are three different offers for the consumers of the site. Two of them are deposit bonuses one of them is a 30% bonus and the other is a 100% bonus. The third offer is a refer a friend program which can be rewarding in some scenarios.

There are many aspects of the brokerage firm that display false advertisements. No surprise that the AdroFx broker has a horrible reputation among the traders. The site itself is available in only English and Russian. which says a lot about the target demographic of the broker.

License and regulations – Is AdroFx Legit?

According to the firm’s website, AdroFx has qualifications from two different regulatory agencies are displayed on the website. The Vanuatu Financial Services Commission is one, and a license from St. Vincent and the Grenadines is the other.

However, the very information that must be disclosed always is simply just alluded to on the site. No additional information like a registration or an identification number. While doing the research for the review we had to manually look for the firm in the databases of the upper mentioned regulatory organizations. unfortunately, we could not find AdroFx anywhere.

The vagueness alludes to the fact that the broker might be simply lying about being regulated. May we remind you that it has barely been three years since the inception of the firm? The sight of fraudulent claims is a very common trend among newly established brokers.

Overall we can surely say that the legitimacy of Adrofx is under question due to the misinformation on their website to create a false narrative. This is a shaky start for a newly established broker but a great red flag of fraudulent behavior.

Trading Features

Trading features are the first aspect of any broker that a trader pays attention to, this is why it’s highly important to pay attention to the details in regards to the trading tools, promotions, minimum deposits, and many additional features as well. These are the aspect of the firm that the broker tries to sell you, the features are the product that the brokers want you to buy, even though they like to make you think the contrary it’s less about selling services and more about selling the trader a product in form of the trading features.

Account types

There are four different accounts available on the site including the standard, premium, pro, and micro-accounts. This is a healthy amount of accounts to choose from, however, after taking a close look the positive impression one might get about these accounts slowly starts to fade into obscurity. Demo accounts are available on the site which is nice as it’s a terrific tool for the traders to strategize firsthand before making an actual trade.

The minimum volume lot for the standard, premium, pro accounts is 0.01. The stop-out level for these account types is 5% whereas the margin call is 10%. The same features for the Micro account are drastically different as the stop-out level is 20% and the margin call is 55%. Only standard, premium and pro accounts have access to swap-free accounts and priority execution.

all type of accounts has access to the following features which are a personal manager, educational materials, negative balance protection, and expert advisors. Additionally, all of the account users can and are able to request a virtual private server. For the standard, premium, and micro-accounts this service is not free. That is a privilege only the Pro account users can take advantage of.

Leverage

The maximum amount of leverage on the site is 1:500 for all of the account-type users. No regulated broker could afford to provide such a high leverage ratio to their consumers. for an untrained eye, all of the emphasis on small details might seem tiresome. however, the devil is in detail.

In fact, when a firm has such a high leverage ratio they are obligated by their regulatory bodies to make a warning for the dangers of it. We could not find any such thing on the website of the AdroFx broker. This is yet another piece of evidence that makes us think the broker is involved in a pattern of fraudulent behavior.

Spreads

spreads are an important trading tool for the consumers of the website. They are in a variable position which means that they change a lot. each of the account types has a certain amount that their available spread starts from. The available spreads on these accounts are quite high.

- For the standard account, the typical spread starts at 1.2 pips.

- For the premium account, the normal spread starts at 0.4 pips.

- The spreads for the Pro account start at 0.3 pips and go up from there.

- The Micro account’s spreads begin at 2.0 pips.

however, regarding cryptocurrency trading, the viable spreads are different for each digital coin that is available for trading on the site. The minimum spread amount varies by cryptocurrency. for bitcoin it is 35, for Litecoin it’s 55 as for Ethreum and Ripple it’s 3.

The spreads for popular spot metals are different for account types. Pro and premium account owners get the minimum spread of 3 for Gold and 5 for silver. As for the other two account types which are the Micro and standard accounts, the minimum spread is 3.8 for gold and 5.8 for silver. The available spread amounts for stocks are pretty much fixed.

Minimum deposit

The minimum depositing amount varies by account type. This is a common practice within the industry as brokers use it to make the distinctions seem evident when they structure their account types. We already know that AdroFx has four different accounts and much like its counterparts caters to bother high and low-end consumers. the lowest minimum deposit on the site is $25 and it is for the Micro account.

- The Micro account has a $25 minimum deposit requirement.

- The Standard account requires a minimum deposit of $100.

- The minimum deposit amount for the Premium account is $2,000

- The Pro account categories have a $10,000 minimum deposit requirement.

Bonuses

AdroFx has few bonus offers for its c0nsumers. There are 30% and 100% deposit bonuses ready to be given to newcomers to the site. however, oddly there is no specific information on any of the promotional offers of the site, even with the bonuses where it’s necessary to be clear and direct to not cause any confusion among the traders.

However, we have already discussed the fact that the firm has been underwriting its content on purpose. we think the same could be true for how they have structured their bonus and the information about it they have chosen to disclose.

refer a friend program is also an interesting offer the site has for its consumers. much like the description of the bonuses, the information about this promotion is very vague as well. however, it does imply that one gets an additional bonus if one refers the firm to another person or a friend for that matter.

AdroFX review – Our Final thoughts

all in all, we do not recommend one to start trading with AdroFx as they are a newly established broker that may not even be regulated and one that deliberately lies and tries to confuse their clientele.

Withdrawal policies and fees are very fair on the site. AdroFx also offers some extremely unfavorable withdrawal terms. one can’t withdraw one’s funds until they have met a trading volume requirement made up by the firm. This is an extremely hostile situation, as no broker has the authority to restrict you from withdrawing your own funds.

In addition, if you have not traded for more than 14 days, you will be charged a $500 monthly administrative fee or 20% of your account amount. The decision will be based on which sum is bigger. This is a very bad requirement as most brokers charge the same type of fee after at least 12 months of inactivity.

The site’s SSL encryption software is somewhat old, and the lack of a two-factor authentication method raises a few concerns about the site’s overall security. The site claims that they don’t share their data with anybody else, however after digging deeper into the film’s history, this appears to be a fairly conflicting claim.

The list of payment options on the site is very odd. One can use Bitcoin and Ethereum as far as cryptocurrencies go and Visa and MasterCard for fiat depositing purposes. however the additional payment options are where we see a problem as the rest of the options are very insecure and relatively unknown, We are talking about Payeer, PM, and Load.

The site doesn’t have any educational material, for the illusion of caring about this topic they do have a market analysis page where they write blogs on very common subjects. however, most of them are unreadable and oversimplistic. In an age where information is a key component of the trading process, AdroFx wants nothing to do with it. Much like the site’s early 2000 design pattern, the firm’s strategies differ from the same type of outdated ideas about the trading process.

There is no FAQ section on the website which further emphasizes the fact that the lack of educational material and written content is intentional. This is a big disadvantage as the site itself is quite vague when it comes to delivering information about trading or extra features. However, take in mind that the site wasn’t designed to help the consumer in fact it does the opposite.

Overall to conclude our final thoughts on the broker we think that the firm has very little experience in the industry. The site itself is extremely outdated, the verbal content on the site is very underwritten and might we add it is on purpose to confuse the traders. The qualifications which the broker has can’t be proved and is basically illegitimate.

Comments (0 comment(s))