ATFX Review – Award Winning Brokerage Firm

ATFX, or officially AT Global Markets Limited, is a UK based brokerage firm that was established in 2014. They offer their services globally and specialize in FX, Offering major, minor and exotic currency pairs, CFD, precious metal and commodity trading, with their main goal being to deliver the best trading experience to traders from all around the world.

However, some exceptions do exist to this as ATFX is not available in certain countries. These countries include, but are not limited to, the USA, Canada, Japan, Iraq, Iran, Syria and more. It is recommended to personally reach out to ATFX regarding this potential issue before attempting to open any accounts.

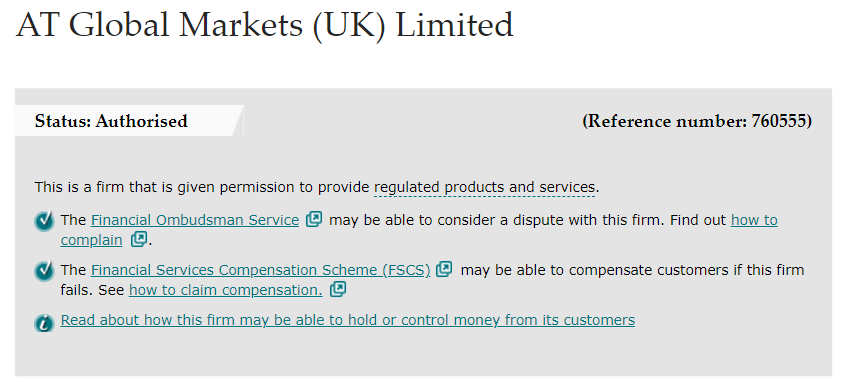

ATFX Regulations & security

Before even considering depositing your funds somewhere, it’s important to know how secure it is and what regulations they comply with.

In the case of ATFX, as a company based in London, it complies with the FCA regulations. All the necessary legal documentation is provided on their platform and can also be double-checked on the official FCA website by using their registration number – 760555, or simply the company name “ATFX” or “AT Global Markets (UK) Limited”.

Their regulations allow ATFX to be an FX and CFD broker, with permission to hold client funds.

Furthermore, ATFX is under CySec regulation. Meaning, they are provided permission to work with countries within the EU and EEA. So you know your funds are safe with them.

In addition to the FCA and CySec, ATFX also complies with the regulations of Markets in Financial Instruments Directive (MiFID).

MiFID is behind the regulations of financial instrument markets that provide investment services, including activities. As MiFID operates specifically in the European Economic Area (EEA), ATFX follows its regulations as a broker that works with clients from all over the world, especially in the relevant regions.

Documentation

As part of its transparency, ATFX provides all the necessary legal documents on their webpage, readily available for download and preview. These documents include:

- Standard Terms of Business

- Complaint Handling Procedures

- Conflict of Interest Policy

- Order Execution Policy

- Treating Customers Fairly Policy

- Cookies Policy

- Privacy Notice

So we can conclude that ATFX is following all the necessary guidelines to operate by holding funds and trading. But what about the trading process itself?

Services

ATFX provides their traders with numerous amounts of services that can be broken down into different categories

Trading software

ATFX uses MetaTrader4 for trading, Windows, iOS, and Android, as well as the web trader version of MT4.

Tools

In order to help traders maximize their profits while minimizing risks, ATFX provides a vast array of tools at the traders’ disposal.

These tools include:

- Buy limit

- Sell limit

- Buy stop

- Sell stop

- Take profit

- Stop loss

Assets

As mentioned before, ATFX specializes in FX trading, offering dozens of different currency pairs, while constantly reviewing its product range.

Their FX trading instruments are composed of majors, minors, and exotics, with a 24/5 availability.

While FX is their specialty, the range of assets traders are provided don’t stop there.

London gold and London silver are some of the additional tools available for trading, as well as crude oil.

Furthermore, traders have access to over a dozen indices, alongside stock CFDs and cryptocurrency CFDs.

Spread Betting

ATFX allows traders to do spread betting without any capital gains taxes or UK stamp duty, meaning the only sort of “payment” a trader will have to make during the process is the competitive 0.6 pip spread provided by the broker.

To further help their traders with minimizing risks and maximizing profits, ATFX provides stop loss and balance protection tools in a very popular approach to trading. Such tools can be considered a must for those that choose to trade with leverage.

Leverage

ATFX allows the use of the leverage of up to 1:400 for those with professional accounts. However, given that most traders will not be qualified for one, they can make use of the 1:30 leverage instead that is provided with different account types.

Accounts

Traders can choose from 4 different trading account types, 5 including the demo account, all with their pros and cons.

Note: Each account (other than the demo) has a required amount as a minimum deposit/funds. If the funds go below the designated level, the account can be downgraded to the previous level. This doesn’t apply to the standard account.

Demo. This account is purely for testing purposes. When creating a demo account, you can select the amount of “funds” the account will have available to it. This is a great way to test the waters with the broker.

Beginners can make use of this tool to get practical experience of trading on the financial market without putting their funds at risk, while professionals can use it to test out strategies.

Standard. As the name suggests, this is the most basic account type. It allows clients to start trading and make profits from it. Unlike other account types, the standard has a minimum investment of only $500. You are provided a dedicated account manager and newsletters from the Trading Central. However, traders with this account type have higher spreads, starting at 1 pip, leverage of 1:30, with lot sizes of 0.01 and aren’t eligible for receiving other services. You can also gain access to a virtual private server, but for a monthly fee.

Edge. The next one in line after the standard account is Edge. The minimum deposit/fund for it is $5,000. Provides you with the same benefits as standard, as well as the following:

It decreases the minimum spread on trades from 1 to 0.6 pips.

Access to the Virtual private server for free.

Education on your trading allowance and 1 on 1 Skype sessions with the Chief Market Analyst, as well as access to the trading signal site. It also replaces the dedicated account manager with a premium one.

Premium. The minimum deposit/funds for premium is $10,000. Alongside the previously mentioned benefits, Premium account grants quarterly catch-ups with the chief market analyst, MT4 indicators and invitations to ATFX events. Reduces the spread to do 0 pips for a $25 per mio per side commission.

Professional. An account that provides you with the same benefits as premium with some differences. Leverage of 1:400, the spread of 0.6 instead of the $25 per mio per side commission. For a minimum deposit/criteria of $5000. However, professional account holders are elective and to qualify you’ll need to be able to meet ESMA (European Securities and Markets Authority) qualifications and provide appropriate evidence.

VPS Service

Depending on the account you have, you may be eligible to use ATFX’s Virtual Private Server (VPS). A VPS can lead to a more responsive and reliable process in the execution of Expert Advisors.

Trading Central

Trading Central is one of the leading technical analysis providers in the industry. They are a certified member of three Independent Research Providers associations: Investorside Research, Euro IRP and Asia IRP. It is also a Registered Investment Adviser (RIA) with the U.S. Securities and Exchange Commission (SEC).

Trading Central is one of the leading technical analysis providers in the industry. They are a certified member of three Independent Research Providers associations: Investorside Research, Euro IRP and Asia IRP. It is also a Registered Investment Adviser (RIA) with the U.S. Securities and Exchange Commission (SEC).

It is well respected worldwide and is accessible to clients of ATFX.

Access to the Trading Central provides data analysis and technical strategies for a plethora of trading instruments, such as currencies, commodities, indices and precious metals.

In the fast-moving world of financial markets, traders can struggle to find ways to optimize their trading performance. This is where Trading Central steps in to help beginners and professionals alike by offering access to automated analytical tools such as pattern recognition scanners, actionable technical analysis of different financial instruments and up to date trading ideas.

Education

Firstly, ATFX’s website features an FAQ that contains answers to questions all beginners will need to know. Answers regarding trading hours, liquidation policy, a specific amount of leverage for different trades and more.

Clients have the option to register for ATFX’s eBook, which will help them understand trading and learn how to enter the financial markets, free of charge. The free educational eBooks provided by ATFX will help clients overcome the struggles of trading by building on existing knowledge of the financial markets.

Additionally, with the provided free eBooks, ATFX has a Forex Education Center on its website where traders can access additional trading courses.

These include:

- Economics

- MetaTrader tutorials

- Trading Strategies

- Capital Management

- Social Trading

- Cryptocurrencies

Moreover, while other brokerage firms tend to offer a lot of e-books, ATFXs’ main source of education is through webinars. Clients will receive access to the webinars after registration.

The main goal of the webinars provided by ATFX is to provide traders with an understanding of trading concepts to develop trading skills that they will be using during the trading process, with webinars for all range of skills, including beginners and professionals.

Webinars will be listed alongside relevant dates, languages, start times and durations, providing much comfort to their clients. Additionally, a description of the webinar will be available to help customers decide if they wish to register for them.

Additionally, ATFX provides traders with the latest financial market news and overviews for the financial instruments that are available for trading on their platform.

What’s included in the webinars?

Regular ATFX Daily Market Updates several times a week. They can be found in different languages such as English, German, Spanish, and more. Some of the examples of the topics discussed in the webinars would be moving average, Relative Strength Index (RSI) and Fibonacci trading.

One to one sessions

ATFX provides its traders with one to one sessions with their chief market analyst for users with the appropriate account types (accounts are discussed further down).

ATFX Bonus Promotions

ATFX, at the time of writing this review, is offering two promotions. However, keep in mind that certain countries are not eligible for promotions due to EU laws. Be sure to check in with ATFX regarding this to avoid any misunderstandings.

$100 Welcome Credit

Traders can deposit $200 within 14 days of registration and receive $100.

Traders can deposit $200 within 14 days of registration and receive $100.

If they complete 6 trading lots within the same time period the $100 will be withdrawable funds.

ATFX Rebate Promotion

Through this promotion, traders can be rewarded continually when they start participating in the promotion and trade during the promotion period.

The reward is cashback rather than reward points or virtual dollars. This Rebate Promotion works with five levels.

Depending on the amount of your net deposit, you will get a cashback rebate according to your deposit level.

The table below shows the amount of rebate per trading lot and the maximum payout in the 5 different levels:

Affiliate program

ATFX provides its users with an affiliate program that is simple and easy to use without any complications, which helps boost both their business as well as their clients. Through this, you’re able to refer new traders to their platform and receive rebate type rewards for it.

To make use of this program, users first have to register as an ATFX partner. Upon approval of their websites, they can then start earning a commission in the form of CPA, commissions starting once the client(s) reach the minimum threshold. ATFX also provides various marketing materials to help users increase their number of affiliates.

Furthermore, they feature an Introducing Broker Partnership Program, designed for partners to earn rebates for clients they refer, without the need for an upfront investment. As the name suggests, partners of the program simply have to introduce clients to ATFX, after which they take control over the matter and handle it from there, while paying out commissions to the referees.

To further promote the program ATFX provides a multi-level commission plan, to encourage partners to bring in more clients, as more clients equal more commission. Additionally, partners receive other forms of benefits as well such as free access to trading central and other trading tools.

Moreover, just like traders, partners will have a dedicated account manager to assist them throughout their recruiting process, as well as training to improve profits.

Payment methods

ATFX offers a multitude of payment methods for traders to choose from, all with appropriate currencies, fees and transaction times.

Note: ATFX doesn’t charge a fee for deposits themselves. However, you could incur fees or charges from your bank or card provider.

Credit/debit cards

- Visa

Currency: USD

Fees: None

Min. deposit: $100

Time: Instant - Mastercard

Currency: USD

Fees: None

Min. deposit: $100

Time: Instant

Electronic Wallets

- Neteller

Currency: USD

Fees: None

Min. deposit: $100

Time: Instant - Skrill

Currency: USD

Fees: None

Min. deposit: $100

Time: Instant - NganLuong

Currency: VND

Fees: None

Min. deposit: VND 2,300,000 {Near equivalent of $100}

Time: Instant

Bank Transfers

- Local Transfer

Currency: THB, VND, MYR, IDR

Fees: None

Min. deposit: THB 3300, VND 2,300,000, MYR 400 or IDR 1,500,000 {Near equivalents of $100}

Time: Instant - Wire Transfer

Currency: USD, EUR

Fees: No fees over $1000

Min. deposit: None

Time: 3-7 business days, subject to bank processing

Important: ATFX does not accept third-party payments, meaning the funds must come from your own account(s).

Withdrawals

ATFX’s withdrawal methods act similarly to the deposit system:

Credit/debit cards

- VisaCurrency: USD

Fees: None

Time: Subject to bank processing - MastercardCurrency: USD

Fees: None

Time: Subject to bank processing

Electronic Wallets

- NetellerCurrency: USD

Fees: None

Time: Instant - SkrillCurrency: USD

Fees: None

Time: Instant - NganLuongCurrency: VND

Fees: None

Time: Instant

Bank Transfers

- Local TransferCurrency: THB, VND, MYR, IDR

Fees: None

Time: 2 business days, subject to bank processing - Wire TransferCurrency: USD, EUR

Fees: None

Time: 3-7 business days, subject to bank processing

Important notes about the withdrawals from ATFX:

Funds will be returned to clients with the same payment methods used to deposit. For example, if a deposit is made by credit card, funds will be returned to the same credit card.

Only the funds used for credit card funding are fully returned before other payment methods can be used for withdrawal.

Deposits are processed instantly in case there is no need for additional verification.

Protection of Funds

In order to ensure the utmost security when it comes to the funds of their clients, ATFX has separate dedicated bank accounts for the said funds in collaboration with Barclays Bank PLC. Meaning, in an unlikely case of insolvency the funds of their clients remain untouchable for creditors.

ATFX also provides an additional layer of protection in the form of The Financial Services Compensation Scheme (FSCS) coverage. The FSCS service is available to clients from organizations that are regulated by the FCA to protect them in the aforementioned rare case of insolvency by providing up to £50,000 of compensation per person for every eligible investment.

To add to the previous methods of protection, ATFX is also partnered with EY, a professional audit organization, for added financial security and transparency.

Last, but not least, ATFX also runs an automatic accounting system that matches the identity of the client to the information of the account for secure withdrawals.

Awards

ATFX has received numerous awards during its years of service. Ranging from excellence to growth, ATFX has a diversified portfolio in global awards.

They started off with humble beginnings as the “Most Influential Forex Broker” in the FX 1314 awards of 2017. Followed by “Best Forex Customer Services” in The Entrepreneur JFEX Awards in the same year, alongside being named as the “Fastest Growing Forex Broker, Europe” in the 2017 Forex Awards.

2018 was an even better year for ATFX as they took home 6 awards, such as “Creativity and Excellence Award in Financial Markets” in the CIE Awards, “FX Broker of the Year, UK” in The European Business Awards 2018 Global Banking & Finance, “Best NDD Forex Broker” in Online Personal Wealth Awards 2018, and more.

They were no strangers when it came to winning awards in the following year of 2019 either. However, this year all of their awards had been customer service related.

“#1 Best Client Support” in OnlineBroker-Portal Award 2019

“Best Customer Service” in ADVFN International Financial Awards 2019

And lastly, “Best Forex Customer Service” in World Finance Forex Awards 2019

Customer Support

ATFX offers multilingual customer support 24/5, consisting of 13 languages including English, German, Spanish, Arabic, Mandarin, Italian and more. No surprise from an award-winning firm.

Clients can reach out to them via phone, email or live chat on their website. On the weekends, the live chat becomes temporarily unavailable but allows you to leave a message with your contact details and issue/inquiry for them to get back to you afterward.

Complaints

As a regulated firm, ATFX’s staff undergoes special training for handling complaints. Their customer service includes a comprehensive complaint handling procedure that includes a full response with an explanation. As such, ATFX tends to handle complaints very well and resolve issues fairly shortly.

Contact

ATFX features multiple hotlines from different countries along with multilingual staff to ensure quality customer support. Their contact details are listed alongside the appropriate countries on their web page.

Furthermore, they have emails dedicated to the specific needs of the customer, such as general support, dispute/complaints, and partnerships.

Summary

To recap, ATFX is a London based brokerage firm that is certified and regulated by multiple firms as FCA. The trading instruments they offer include currency pairs, CFDs, commodities and precious metals.

They have multiple types of accounts that are available for traders, including a demo for trying out strategies and a professional account. However, professional account holders are elective and to qualify you’ll need to be able to meet ESMA (European Securities and Markets Authority) qualifications and provide evidence.

The platform they use for trading is MetaTrader 4 with support for Windows, iOS, and Android, as well as a WebTrader.

Important to keep in mind:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67.67% of retail investor accounts lose money when trading CFDs / Spread betting with this provider. You should consider whether you understand how CFDs / Spread betting work and whether you can afford to take the high risk of losing your money.

Comments (0 comment(s))