Capital Street FX – Are They Worth Your Time?

Capital Street FX has nearly two decades of experience in the Forex market. We decided to write a Capital Street FX Review to talk about a variety of topics related to the company. including their qualifications, defying features, and other factors that play a crucial role for this firm which was created in the year 2002.

Firstly let’s discuss the site’s qualifications. The company appears to be FSC certified. Mauritius, an island country where this brokerage firm is headquartered, is one of the jurisdictions that the regulatory agency of FSC oversees.

For any type of trader, leverage and Spreads are important trading tools. The maximum leverage ratio at Capital Street FX is 10000:1

AS for the spreads, they are in a floating position and fluctuate depending on the asset type. The minimum spread amount on the platform is 0.1 pips. Webtrader is a trading platform that the company offers to its consumers. Capital Street FX Broker also has a mobile trading app. It’s important to emphasize that all of the available trading platforms on the site are web-based. They seem to be diverging from the industry-standard MetaTrader, as they provide neither MT4 nor MT5.

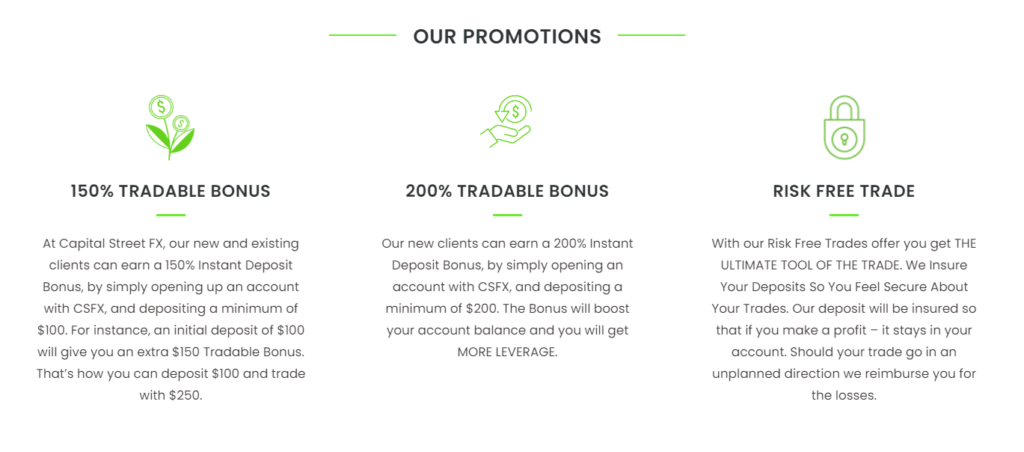

The minimum deposit on the site is $1000. It’s worth noting that, aside from the minimum deposit, there is no limit on how much money can be deposited on the site. As for the promotional offers, there seem to be three categories of bonuses. Each of them has an unusual name. The available bonus types are a Cashback Rebate bonus, a Radable Bonus, and a Risk-Free Capital Street FX bonus.

There are just four live and demo trading accounts available on the site. The four account kinds are basic, classic, professional, and VIP. In terms of the assets they provide, we can say that they provide the conventional options such as Forex Trading, Commodities, Bonds, Indices, and Cryptocurrencies. This list may seem quite diverse at first glance however when compared to counterpart brokers it doesn’t offer as much of a variety.

License and Security – Is Capital Street FX Legit?

Capital Street Intermarkets is the owner and the operator of the site. We have already mentioned the fact that this is a regulated Forex brokerage firm. in this section of the review, we will be discussing this topic in greater detail. The broker is regulated by the Financial Services Commission of Mauritius. the registration number is 108039.

Regarding the security of the Capital Street FX Broker site, we have found that the site uses SSL encryption to keep its customer’s data safe and sound. None of it will be disclosed to any third parties, according to the terms and conditions of the site. As for all kinds of accounts on the site, one can use a two-factor authentification process, as it is in place for the very reason of client confidentiality, to make sure one’s personal inf0ormation is safeguarded at all times.

Capital Street FX Review – Trading Features

A forex broker is only as good as its trading features. That’s what every trader is looking at first while looking for a suitable firm. No matter if the client is a novice or an experienced trader, they will be interested in getting detailed information about trading tools like leverage and spread. One can benefit from a promotional offer, therefore having it on the Capital Street FX Broker site is crucial.

In this section of our review, we will be discussing all of the trading features mentioned above in detail. We want to find out how adequate the products and services of the company really are and if they can withstand against their counterparts or the industry standard in general.

Account Types

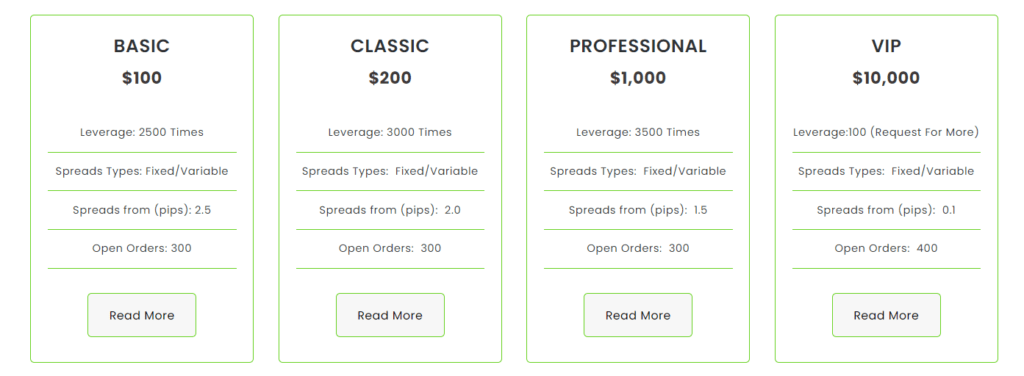

Firstly let’s talk about the available account types on the site. each of the accounts should be offering ba distinctive features and benefits. As we can assume by the very titles of each account, they are meant for traders with drastically different incomes and capital. Let’s find out how they compare to one another and what do they have to offer to the common trader. The site offers Basic, Classic, Professional, and VIP accounts.

According to our Capital Street FX Review, the Basic account has a stop-out level of 0.1 and the margin call amount for it is 0.5. These are the highest numbers among all of the accounts. One doesn’t get an account manager or the option to trade over the phone. In addition, there are no variable bonus options for basic accounts. So to sum it up you get the bare minimum with this account type.

Users with a standard account do not have access to benefits such as an account manager, telephone trading, or flexible bonus programs. The margin call is identical to the basic accounts as well. The level of stop-out is 0.2. Again even with the Classic Account type one is getting the bare minimum from the firm. Virtually there is not much distinction even with numbers when it comes to the classic account.

The only clear difference we could find between the two Capital Street FX Broker accounts that were crucial to the trading experience was the available maximum leverage ratio for each of the accounts and the minimum deposit required for each to even start trading with the said account.

The margin call and stop-out levels on the Professional account are the same as on the Classic account. One would think that there would be a clear conceptual separation between the professional account when compared to the basic and classic account types but this is not the case.

In many ways, they are the same. The mere distinction we could find that has some crucial value is that the Professional users, on the other hand, get access to a dedicated account manager, flexible bonus programs, and telephone trading. The VIP account is the only one with any useful features or advantages that set it apart from other accounts.

Leverage

After reading countless Capital Street FX reviews and doing research firsthand we have found a clear pattern of differentiation among the account types which goes further as well and encompasses the leverage ratios as well. We know that the maximum leverage ratio available on the site is 1:10000. However one would be wrong if one thinks that this is true for all types of account users. In fact, the 1:10000 leverage ratio is only for the VIP account owners. The Basic, Classic, and professional account users all have a limit when it comes to an available leverage ratio which is very restrictive, to say the least.

- The maximum leverage ratio for the basic accounts is 1:2500.

- The maximum leverage ratio for classic accounts is 1:3000.

- The maximum leverage ratio for professional accounts is 1:3500

We find this incredibly allusive as the written content on the homepage of the Capital Street FX Broker site alludes to the idea that all account users have the same access to the maximum amount of leverage ratio which is 1:10000. Only when one specifically looks at each account type and compares them, one can see the clear picture where the notion of equality for all is not true.

Spreads

Spreads are an important trading tool for any type of trader. With spreads starting at 2.5 pips, the Basic account has the biggest beginning spread on the platform. For the classic account, the spread starts at 2 pips, 1.5 pips for the professional account, and 0.1 pips for all VIP users. The spreads are constantly fluctuating, the above-mentioned numbers are the starting point of the spread amount. Once again we see that only the VIP account users reap any benefits of the Capital Street FX Broker. All other accounts seem to perish in obscurity, offering very little variance from one another in regards to spread amounts as well.

The Minimum Deposit

Capital Street FX has the same exact approach to the minimum depositing amount as they have for their leverages. There’s a clear differentiation happening with the minimum amount necessary for a deposit on the site with each account type. The lowest minimum deposit amount on the site is $100 and it’s only for the Basic account, which doesn’t have many features in the first place other than having the least expensive depositing amount. The site alludes to the fact that $100 is the minimum depositing amount for all types of accounts available with this Forex broker.

- The minimum deposit amount for classic account customers is $200.

- A minimum deposit of $1000 is required for professional users.

- VIP members of Capital Street Forex Broker are required to pay a minimum donation of $10000.

The misconception of information seems to be a very clear method and strategy that the site actively uses to attract customers to its platform. This was true for the leverage ratios and it’s accurate regarding the minimum depositing amount as well.

Available Bonuses

There are three different categories of bonuses available on the platform but before we dive into each category and the amount of available promotional offers it’s important to emphasize that the site uses unorthodox terminology. There is a clear industry standard when it comes to describing any type of promotional offers, one can slightly deviate from the norm, however, what Capital Street FX has done doesn’t make any sense regarding clarity and meaning. They basically mashed up common terms into keywords.

A cashback rebate incentive, three distinct tradable bonuses, and a risk-free trade incentive are all on the Capital Street FX Broker list of available promotional offers. These titles are deliberately constructed in a manner that causes confusion among the readers of the written content of the site. In fact, even the description of each bonus is very vague and they don’t give any insight on what the bonus actually is or what each initiative can provide to the consumer. This is a case where we can clearly see that the company isn’t as transparent and straightforward as they like one to think they are.

There is no such thing as a Cashback rebate in the industry. Although a Cashback and a rebate bonus seem very similar they are not. On the contrary, they could not be different from each other. One can not simply take these distinctive terms and mash them up without anyone noticing it. This seems like suspicious behavior on the part of the Capital Street Forex Broker.

This odd rebranding of the promotional titles is evident in tradable bonuses as well. which by the looks of it is the site’s version of a deposit bonus. in fact, they have three of these varying in percentage. And lastly, there is also a promotion called risk-free trade bonus which seems to be a modified version of a welcome bonus.

Capital Street FX – Final Thoughts

overall we have concluded that the site’s advertised features and promotional offers are subpar and do not correspond to industry standards when compared to its counterparts. Even though this broker offers wildly bigger amounts when it comes to trading tools and other distinguishing features it’s not likely the regulatory policy is in line with the actions of the brokerage firm. Capital Street FX has even been seen to not be following some of the guidelines implemented by the FSC.

The interface of the Capital Street FX Broker webpage is quite nice and alluring. We can’t say the same about the site’s written content. The implications of each post or informational article available on the site are unclear. They seem to be vague by choice, not by accident. Once you see through all the carefully curated visual stimuli and widgets, you start to notice a few red flags.

Additionally, the FAQ section, on the Capital Street Forex Broker site which should be very informative and easy to understand, objectively is not any of those two things. They are subpar and don’t offer direct answers. in fact, the written content in the FAQ section of the platform is no less easy to understand than the bonus scheme which as we have already discussed in great length has a lot of faults.

A live Chat widget is available on the site at the bottom right corner of one’s window. After conducting research and using it firsthand we can say that it is clearly a bot and even if you get an answer, it will take too much. We had to wait up to 15 minutes just to clarify the basic information on the site. When asked specific, detail-oriented questions there seems to be radio silence from the customer service team.

All in all, our final verdict is that Capital Street FX is not the most trustworthy brokerage firm as they seem to have few red flags. The information on the site is not clear enough and the account typoes offer practically no variance. We think that your time and resources can be better fitted to some other brokerage firm.

Comments (0 comment(s))