FXOpen Review – The Most Flexible Trading Conditions

It is interesting to see how long will Forex market maintain the rapid growth in popularity among international traders. While many people are still new to trading and there are some who don’t know about Forex, the number of Forex traders is huge. Amazingly, according to global statistics, some 10 million people trade Forex online. To simplify it further for you, there is one Forex trader in every 781 people worldwide. These people process an abundance of trades every day and the volume exceeds 6.6 trillion US dollars daily. It is also important to mention that more than 90% of all Forex trades involve brokerage companies as intermediaries. Therefore, we need to acknowledge the great significance that brokers play in the daily life of Forex traders.

Traders can choose among the thousands of Forex brokers registered officially. However, some firms operate unlawfully, without registration or regulations. Therefore, it is crucial to identify the non-legit Forex brokers and avoid trading with them. Our reviews carry the same purpose. We distinguish legit Forex brokers from the scams and provide an in-depth analysis of the trading environment that each of them offers. In our review on FXOpen Forex broker, you will find a detailed summary of the company, its trading conditions, available assets, and promotions.

Is FXOpen Legit?

The legitimacy of the broker depends on the official regulations and/or licenses that the firm holds. Many brokerage firms will claim that they operate within the official regulatory framework. However, the statement only is not enough proof. The database of regulatory bodies should contain some information on company licenses and the nature of the business that the firm conducts. Hence, we strongly recommend traders to check within the official databases if the broker is indeed regulated.

We found out that FXOpen holds regulations within several jurisdictions. The firm holds two licenses from two separate regulatory authorities. The entities that regulate the broker are ASIC (Australian Securities and Investments Commission) and FCA (Financial Conduct Authority). The corresponding license numbers of the broker are as follows: AFSL 412871 – ASIC registration number and FCA no. 579202 – FCA registration number.

Furthermore, the company operates in Nevis under the registration number C42235 as FXOpen Markets Limited brand name. FXOpen LP Limited has a branch in Auckland, New Zealand, too, with the registration number 55988665. In New Zealand, the FXOpen broker represents a limited partnership and provides a trading technology platform for the traders.

FXOpen Company Background

FXOpen brokerage firm history takes us back to 2003. Initially, the company was first operating as a technical analysis educational center. The primary location was set in Egypt. However, in 2005, the firm officially claimed its status as a brokerage and remains with that status till today. FXOpen is now a brand of a successful broker uniting multiple branches in various locations. In fact, the traders can find the main headquarters of the broker in Australia, Saint Kitts, and Nevis, and the United Kingdom. Nevertheless, FXOpen has many more representatives in various regions and countries.

FXOpen actively uses sponsorship within its promotional campaign of the company. The broker organized a number of eSports championships and events including the FXOpen Path of Ascension tournament of 2010. During 2010-2013, the broker acquired its own professional team of StarCrat II and sponsored the winning team on the tournament hold for the first time at Hong Kong eSports. Furthermore, the firm sponsored the FXOpen Drift competition of 2011.

FXOpen Forex broker review should highlight the trading platforms of MetaTrader 4 and MetaTrader 5 which are ECN-integrated and are compatible with algorithmic trading. Thanks to the features of this software, traders can apply different automated trading tools, such as Expert Advisors (EAs). Additionally, the broker offers its customers special One-click Trading Level 2 Plugin software, in short OCTL. The tool became available for use at the beginning of 2013, in February.

Live Trading Accounts

FXOpen works with different types of traders. Some of them are highly experienced but many are just beginning to enter the world of trading. Due to this reason, the broker provides various Forex trading accounts that suit the needs and requirements of traders with different skills and expertise. Traders can choose account types according to their trading strategies, budget, and risk tolerance. FXOpen clients can find a total of four live trading account types with different features. All of them allow freedom in trading strategies and support Expert Advisors (EAs) and hedging. The rest of the conditions vary from one account to another.

Micro Account

FXOpen opinion recommends Micro accounts to beginners in trading or experienced traders with the goal to try new strategies. The account is set in US cents. The reason why Micro accounts serve well to the mentioned types of traders is its minimal trading cost and minimal risk. The minimum deposit requirement is only 1 US dollar with a minimum transaction size of 0.1 micro-lots.

FXOpen opinion recommends Micro accounts to beginners in trading or experienced traders with the goal to try new strategies. The account is set in US cents. The reason why Micro accounts serve well to the mentioned types of traders is its minimal trading cost and minimal risk. The minimum deposit requirement is only 1 US dollar with a minimum transaction size of 0.1 micro-lots.

However, these accounts come with certain limitations, too. The traders can have a maximum balance of 3000 US dollars on Micro. The conditions also limit the maximum transaction size to 1 million US dollars. Demo Accounts do not operate on Micro account types. Even though traders have great freedom in choosing their trading strategies, with hedging, scalping and Expert Advisors all allowed, they cannot employ news trading on Micro accounts.

The trading assets portfolio for Micro Account includes 28 currency pairs along with gold and silver. The maximum leverage for this account type can go up to 1:500. The spreads are floating for Micro account trading assets. FXOpen broker determined margin call and stop out levels for Micro account traders to 20% and 10% respectively. The account operates without any additional commission fees. The order execution type is instant.

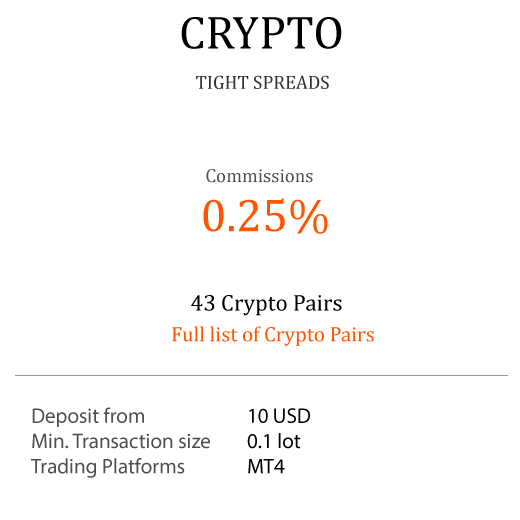

Crypto Account

The number of crypto enthusiasts in the Forex market is increasing day by day. As the demand for crypto trading assets grew, FXOpen designed a special Crypto account. It allows users to trade the most popular cryptocurrencies against the US dollar, Euro, and Russian Ruble in the form of CFDs.

The number of crypto enthusiasts in the Forex market is increasing day by day. As the demand for crypto trading assets grew, FXOpen designed a special Crypto account. It allows users to trade the most popular cryptocurrencies against the US dollar, Euro, and Russian Ruble in the form of CFDs.

With the minimum deposit requirement of 10 USD or equivalent in other base currencies, Crypto account holders can trade with a maximum leverage of 1:3. The base currencies include USD, EUR, GBP, RUB, JPY, ETC, Bitcoin (mBTC), and Litecoin (LTC). Clients can enjoy the tight spreads and low commission level, whereas the applicable fee is 0.5% half-turn.

The financial trading assets portfolio of the Crypto account contains 43 pairs with BTC, BCH, EOS, Ripple, Monero, LTC, etc. The account does not limit the traders in the choice of trading strategies. In addition, the margin calls and stop out come at 30% and 15% respectively. On the other hand, the Islamic account option does not come with a Crypto account type. However, traders can benefit from a swap from 5% per annum, whereas for overnight positions Swap is 10% per annum. On the night from Wednesday to Thursday triple SWAP is charged.

STP Account

STP account stands for Straight Through Processing execution account. For this account type, commission fees represent part of the spreads. The spreads are floating and variable with each order executed on the real market. This account type offers a great opportunity to enjoy the ECN trading environment with a low initial deposit of 10 US dollars. Traders can choose from the great variety of base currencies available: USD, EUR, GBP, JPY, RUB, CHF, and Gold.

Within the trading assets portfolio, STP account holders can access various instruments such as 50 currency pairs along with gold and silver. The leverage on these assets can go up to as high as 1:500. All trading strategies, be it scalping, hedging, or Expert Advisors (EAs), as well as news trading, are welcome on this account type. The order execution type is the market. FXOpen STP account also provides an option for applying Islamic account.

In addition, a special bonus program exists that is only applicable to STP account holders. The Forex free bonus money in the amount of 10 USD will be granted for opening the 1st STP trading account.

ECN Account

ECN is the most popular option among FXOpen traders. This account type is indeed a unique selling point of this broker and significantly boosts FXOpen rating. ECN acts as a linking communication network of various Forex players, such as brokerage firms, banks, investors, centralized brokers, and even organizations.

ECN is the most popular option among FXOpen traders. This account type is indeed a unique selling point of this broker and significantly boosts FXOpen rating. ECN acts as a linking communication network of various Forex players, such as brokerage firms, banks, investors, centralized brokers, and even organizations.

The obvious advantage of the ECN account is the most beneficial pricing for traders, its affordability, and the seamless order execution. FXOpen Forex broker provides real market spreads from 0 pips for trades on ECN account. Since there exists no dealing desk, the system automatically matches your trade with an opposite order of another trader on the ECN account. In this way, the broker does not trade against you, meaning that there exists no conflict of interest between traders and broker.

The spreads start from 0.0 pips and the leverage can go up to 1:500. The minimum deposit requirement is 100 USD with a commission fee starting at 1.5 USD per standard lot. The broker also allows all sorts of trading strategies on ECN including automated HFT and news trading.

FXOpen Bonuses

Apart from the 10 USD bonus for the STP account that we already mentioned in the article above, FXOpen runs multiple promotional programs. The programs target both existing customers and new clients registering on the FXOpen trading platform. The broker hosts performance-based trading contests and employs the Forex cashback campaign. The conditions for these two programs vary, as well as the rules. However, according to the eligibility criteria, a trader should be considered of the legal age in his or her country of residence in order to participate in any of the two promotions mentioned above.

FXOpen Trading Contests

Many of the top Forex brokers worldwide implement trading contests into their promotional programs. They are proven and highly successful methods for boosting the traders’ confidence and rewarding clients for their achievement. However, those contests usually occur on real trading accounts. On the other hand, FXOpen hosts the contests for demo account holders which means that no trader will actually lose the real money. Instead, the participants in the contested trade with virtual funds credited by the broker. Nevertheless, the winner receives an actual money prize for his or her superb performance. The contests are held on a weekly or monthly basis.

FXOpen Forex Cashbacks

Forex Cashbacks cannot be encountered frequently even with some of the most reliable Forex brokers as they are a bit costly to the brokerages. However, the cashback program succeeds at protecting the clients’ funds from significant losses and encourages beginner traders to bravely enter the trading realm. For instance, if the trader starts loss-making then the program will automatically credit extra refunds o the commission account of the client. The commission account needs no separate registration as the broker creates these accounts automatically for every trader upon registering on a real trading account. The minimum cashback amount is 5 USD, whereas it can go maximum up to 1,000 USD. However, the maximum amount of cashback per single trade is limited to 100 USD.

Comments (0 comment(s))