OneBid Review

OneBid is a forex brokerage firm founded in 2022 and based in Saint Vincent and the Grenadines, where it is also licensed by the SVGFSA. This is the only license held by the firm, which is a major issue, as the SVGFSA is not considered to be a reputable financial regulatory agency.

The official OneBid website claims to offer over 1,000 instruments to clients, while the primary trading platform is MetaTrader 5.

Thanks to the firm being relatively inexperienced and unregulated, clients will be wondering if it is worth their time and money at all.

Security and history of OneBid

OneBid is a forex brokerage firm founded in 2022 and based in Saint Vincent and the Grenadines and is licensed by the SVGFSA. However, this is the only license OneBid has, which could be a major security concern for the firm, as clients typically look for Tier-1 licenses from firms they are planning to have a long-term partnership with.

The official OneBid website also does not provide much information regarding the founders and background of the firm.

While OneBid is a forex brokerage firm, it also offers a range of other instruments for trading, such as equity indices, cryptocurrencies, energies, metals, etc.

We will discuss the various features and spreads offered by Onebid in greater detail in the coming sections.

Features offered by OneBid

When evaluating a forex brokerage firm, several important factors need to be considered, such as: trading fees and spreads, instruments, platforms, as well as additional resources.

Most FX brokers offer similar core instruments and the main difference lies in the platforms and trading fees, as well as additional features that make it easier for traders to interact with the platform and get ahead on the market.

Tradable instruments

While the official OneBid website does not provide a full breakdown of every instrument tradable at the firm, it does state that the total number of assets is over 1,000 and includes the following asset classes:

- Currency pairs – majors, minors and exotics

- Energies – WTI Crude Oil, Brent Oil, natural gas, etc

- Metals – Gold and silver

- CFD-s on shares

- Equity indices – GER40, NASDAQ100, etc

- Crypto – BTC, ETH

It is worth noting that while the selection of instruments is not unfavorable, there are multiple competing brokerage firms that offer a much wider range of instruments and real shares instead of CFD-s.

For this reason, clients who only want to choose a broker for the instruments they provided, are better off looking for alternatives elsewhere.

Spreads and fees

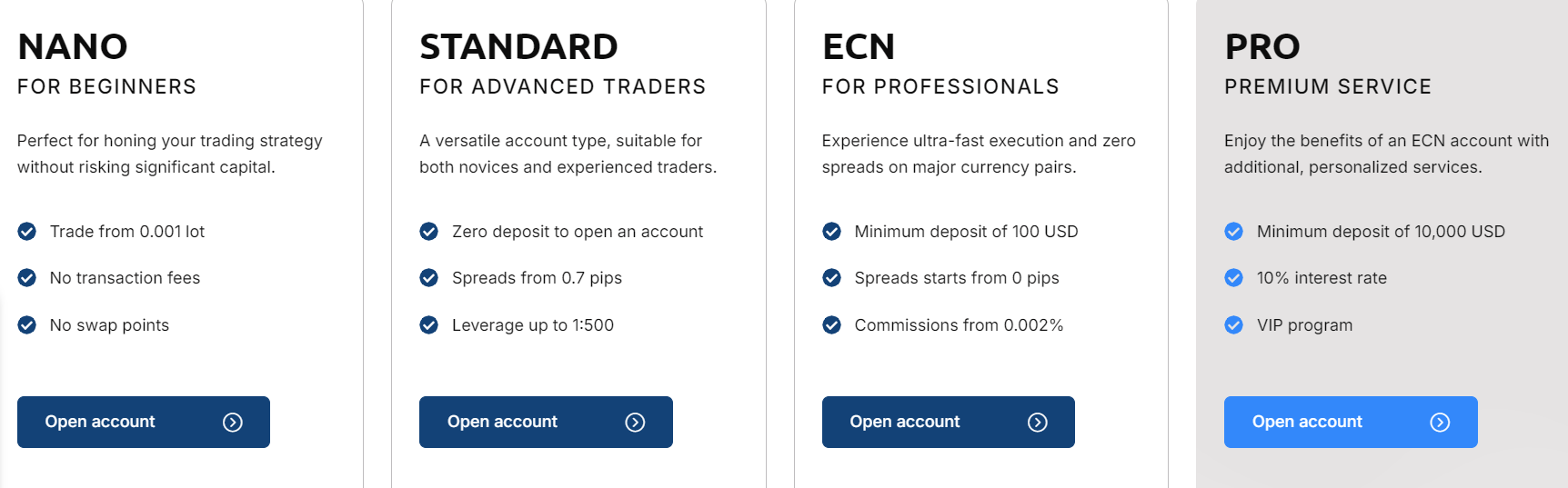

When it comes to the trading spreads and accounts fees, OneBid is generally quite competitive, as a 0 pip spread is available for EUR/USD on the ECN and Pro account tiers.

The commissions on these two accounts are also reasonable at 0.002%, while the Nano and Standard accounts have no such fees.

On the other hand, the minimum deposit requirement for the Pro account is quite high at $10,000, while the ECN account requires only $100.

The fact that the Standard account is the most popular among OneBid clients is understandable, as the account comes with zero fees apart from trading spreads, with the only caveat being the 0.7 pip spread on EUR/USD.

Trading platforms

MetaTrader 5 is the main trading platform of OneBid and is also one of the most advanced and popular platforms among forex traders.

The platform comes equipped with dozens of technical indicators and tools to help traders customize charts and analyze market data to make informed decisions.

MT5 also has a mobile app, which is available on Android and iOS devices and gives users the convenience to trade on the go.

Overall, the platforms offered by OneBid are quite standard and also available at many competing firms.

Educational resources

Beginner forex traders that sign up at a brokerage firm often require additional training and educational resources in order to learn as they trade and learn how to formulate new strategies.

OneBid’s educational content offerings are rather limited and only include a blog and some trading terms, while some competing firms even have trading courses and mentorship programs with webinars and video guides.

Due to the fact that education is not a top priority for OneBid, complete beginners will be better off looking at alternatives on the market – preferably those that have some organized trading courses on their platform.

Account types at OneBid

There are four types of accounts clients can access at OneBid and each of them offer different minimum deposit requirements and fees.

However, it must be noted that there are not too many differences between OneBid’s accounts, which is a worthy consideration for those seeking to sign up at OneBid for the long term.

OneBid Nano

The OneBid Nano is the entry-level trading account offered to beginner traders that sign up at OneBid. The platform offers metals and indices to clients, with a maximum leverage of 1:1000 available.

The general terms and features of the OneBid Nano account can be broken down as follows:

- $0 minimum deposit requirement

- 0 commissions per lot traded

- Minimum lot size is 0.001 lots

- MetaTrader 5

- EUR/USD spread from 0.7 pips

As we can see, the main advantage of the Nano account is the smaller lot size, which starts at 0.001 lots, as well as the 0 account fees. However, the list of available instruments is also limited, which is a significant trade-off for beginner traders.

OneBid Standard

The OneBid Standard account is the most frequently used account type and offers similar terms as the Nano account, with the core differences being the smallest lot size and maximum leverage available. Other than these two features, the Standard account also has access to every tradable instrument that is available at OneBid.

There is no minimum deposit requirement or commissions per lot traded, while the maximum leverage is 1:500, as opposed to the 1:1000 offered to Nano account holders.

OneBid ECN

The OneBid ECN account is designed with scalping strategies in mind, as it offers the lowest possible spreads available to OneBid clients, starting at 0 pips for the EUR/USD pair.

The ECN account also comes with some fees, as well as a $100 minimum deposit requirement, which is not particularly high. As for the fees, the commission charged per lot traded is 0.002%, while the lot size is 0.01 – similarly to the Standard account.

This makes the ECN account attractive to scalpers, as they require the tightest spreads in order for their strategies to work and deliver returns.

Overall, the ECN account is still an affordable account tier for some of the most active forex traders on the market.

OneBid Pro

The OneBid Pro account is reserved for the VIP clients of the firm and comes with a hefty minimum deposit requirement of $10,000. While the general trading terms on the Pro account are the same as the ECN account, there is one major point of difference.

The Pro account allows holders to use personalized services, such as a dedicated account manager. The interest rate for client funds is also exceptionally high at 10%, which provides clients with advantages that are otherwise unavailable to most OneBid traders.

Customer support at OneBid

The customer support suite of OneBid consists of a support email and live chat, while a hotline is not available, which is worth considering, as clients will not be able to reach out to a real customer representative of the firm, unless they hold a Pro account.

The official OneBid website is available in multiple languages – making it accessible to millions of traders worldwide, with a particular focus on the Asian markets.

The official website also includes a FAQ section that answers all the basic questions and inquiries prospective and new clients may have about the firm and its services.

Summary

OneBid is a largely unregulated forex brokerage firm, which is a major disadvantage and cause for security concerns for prospective clients. The firm also has a limited operational history – having been founded in 2022.

Clients who sign up at the firm have access to MetaTrader 5 to trade over 1,000 instruments via four different types of accounts.

However, there are a few important factors to consider when deciding whether to sign up at OneBid:

- The number of instruments available for trading is not particularly high when compared to some competing firms

- The spreads on major currencies are generally competitive

- MetaTrader 5 is available, which is considered to be a standard feature by forex traders

- The firm only holds a valid licensed from the Saint Vincent and the Grenadines Financial Services Authority

- The Pro account comes with a very high minimum deposit requirement ($10,000)

The biggest concern with OneBid is the lack of reputable licenses, which can dissuade many safety-conscious traders from signing up at the firm, as there are alternatives on the market with considerably better security features.

FAQ on OneBid forex broker

Is OneBid a good forex broker?

OneBid is a largely unregulated and inexperienced forex brokerage firm and offers over 1,000 instruments for trading via MetaTrader 5. The lack of regulations, coupled with little differences between account types, may raise some questions regarding the legitimacy of the firm.

What can I trade at OneBid broker?

Clients who sign up at OneBid have access to multiple asset classes, which includes: currency pairs, indices, commodities, energies, metals, and cryptocurrencies.

The firm claims that it offers over 1,000 different instruments for trading, with a maximum leverage of 1:1000 on forex pairs.

Is OneBid regulated?

OneBid is only regulated by the Saint Vincent and the Grenadines Financial Services Authority, or the SVGFSA, which is not a Tier-1 regulatory agency.

For this reason, it is safe to consider the firm as unregulated, which is a major security concern.

Comments (0 comment(s))