PipFarm Review — Young Forex Prop Firm with Flexible Conditions

Let’s have a comprehensive PipFarm review and define if this prop firm is worthy of consideration as your main prop trading partner. PipFarm is a Forex proprietary trading firm that allows traders to pass the evaluation period and start trading using the firm’s capital. These accounts are funded and allow traders to speculate on various financial markets using much larger capital than most traders can afford. Since the firm provides trading capital, it has several risk rules to protect its money and does not allow traders to blow up the account easily. There are daily and maximum drawdown limits, as well as stop-loss order requirements. The profit target for PipFarm prop traders is set at 12% for all accounts and funding options. Traders pay a small fee depending on the funding amount, seed funding, and then start on an evaluation account. After passing the evaluation, they can start trading on a funded account and making profits. The profit share is 90%, meaning traders can keep 90% of their profits.

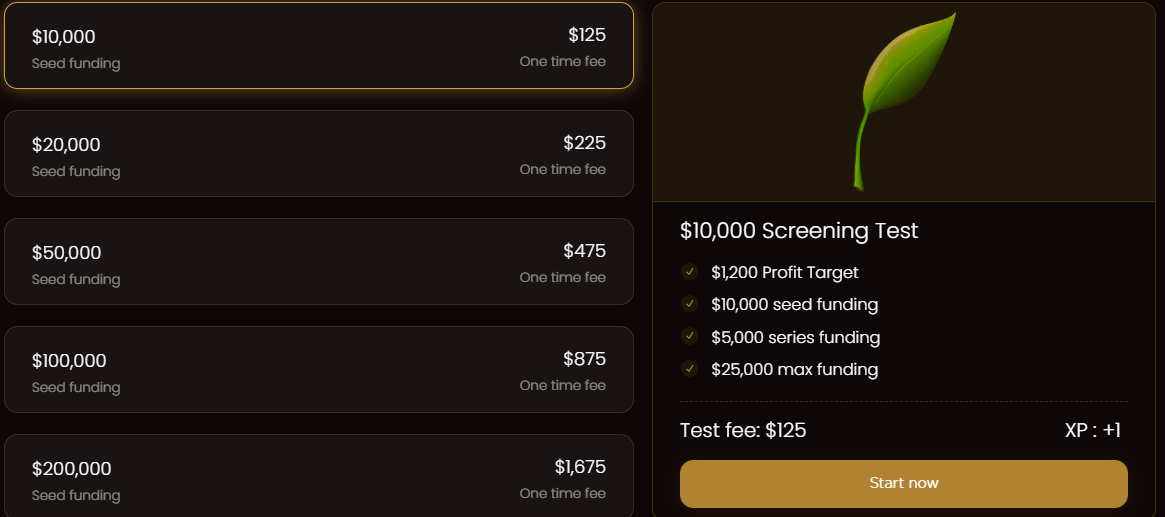

Here are PipFarm funding amounts and corresponding fees list:

- 10,000 USD — 125 USD

- 20,000 USD — 225 USD

- 50,000 USD — 475 USD

- 100,000 USD — 875 USD

- 200,000 USD — 1675 USD

PipFarm Safety

Before we can continue our PipFarm review, we have to answer a simple question: is PipFarm legit? The answer will dictate if the PipFarm scam is likely or not. There are no PipFarm reviews on the FPA platform because the firm was launched in 2024. The feedback on Trustpilot from traders is positive and indicates that PipFarm is a legitimate prop trading firm. To gain more insights, our team even contacted the support, and we found out that PipFarm offers trading through several regulated brokers who provide liquidity and price data. Partnering with regulated brokers is always critical when evaluating a prop firm, as it indicates a healthy practice of the firm. Despite being young, PipFarm has been trying to offer transparent rules and there are no hidden rules except what the trader sees on the website. All the positive pipfarm.com reviews on Trustpilot coupled with the few rules to follow make us believe, PipFarm is a legit and reliable Forex prop trading firm.

PipFarm Rules and Risk Limitations

PipFarm rules are simple, as the firm only sets a few guidelines that must be followed strictly. There is a daily loss limit, preventing traders from losing more than 4% of their funded account. The maximum drawdown limit is 8% meaning traders can have at maximum two consecutive losing trading days. If a trader is inactive for 14 days or is not able to achieve the profit target within 365 days, they get disqualified for being inactive. Crypto markets can be traded 24/7. All trading strategies are allowed, except trade copiers and HFT (high-frequency trading) robots. News trading is allowed, and holding positions overnight and over the weekends is also possible. Overall, PipFarm has very forgiving rules. PipFarm reviews on Trustpilot indicate there are no hidden rules and all the risk limits are simple to follow according to trader feedback.

PipFarm Trading Assets

PipFarm allows access to popular asset classes such as Forex pairs, cryptos, metals, energies, and indices. The exact number of each asset is:

- 10+ Forex pairs

- 6 popular cryptos

- 3 energies including oil

- 6 metals including XAUUSD (Gold)

- 14 major indices

The leverage for FX pairs is set at 1:30. If it was a Forex broker we would say this leverage is very low, but in the case of prop firms, this is more than enough to speculate on various markets with large trading accounts. The spreads for Forex major pairs are between 0.1–0.2 pips (EURUSD) and there is a trading commission of 6 USD per lot round turn. These specs are super appealing for scalpers as they need low spreads and are ready to pay small commissions.

PipFarm Trading Platforms

PipFarm prop trading firm provides its traders cTrader, an advanced trading platform with automated trading capabilities. The platform allows traders to use almost all trading strategies and has a multitude of inbuilt technical indicators. PipFarm cTrader will not allow traders to open trading positions without the stop-loss order. The firm restricts HFT and trade copiers but allows cBots which are cTrader automated trading algorithms. PipFarm cTrader is available for both mobile and desktop together with the trader’s dashboard to monitor trader’s performance. PipFarm reviews on Trustpilot mention how useful cTrader is, allowing them to deploy multiple trading strategies and trading robots.

PipFarm Funded Account Types

PipFarm funded program provides traders with access to large capital ranging from 10k to 200k USD with a scaling plan of up to 500k. PipFarm challenge comes with several simple rules and traders can also open a demo account to test all the trading conditions. The scaling plan for each of the offered funding amounts is different, with 10k accounts calling up to 200,000 USD while 25k accounts scaling up to 500,000 USD. The scaling plan is activated every 30 days and requires traders to hit a 12% profit target.

PipFarm Promotions

PipFarm offers a 25% discount for traders for the first purchase, allowing them to get into any challenge cheaper than its competitors. There are no other promos at this point launched by PipFarm.

Conclusion

PipFarm rating is positive on Trustpilot but lacking on the FPA. Despite being a young prop trading firm, PipFarm has established itself as a reliable company offering few rules and limits and an advanced trading platform, cTrader. Available assets include Forex, cryptos, commodities, and indices, and the firm offers a 25% discount for the first purchase. The minimum fee starts from 125 USD for a 10k account and the maximum funding is set at 200k with the scaling plan ceiling being 500k for 25k funded accounts. Overall, PipFarm provides very attractive trading conditions for prop traders with its initial discounts and simple risk rules.

Comments (0 comment(s))