Navigating Success: Insights from Charlie Munger’s Long-Term Investment Wisdom

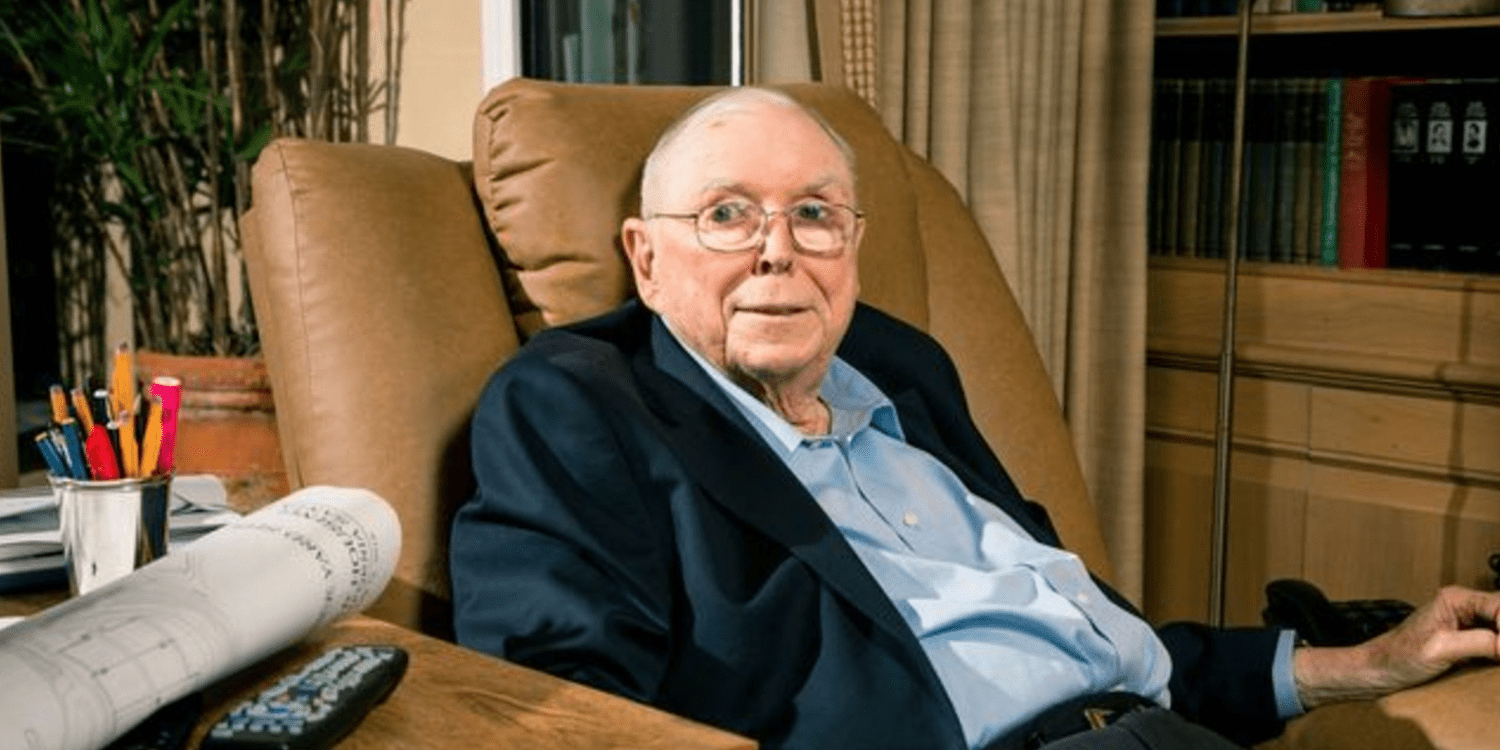

In the realm of finance and investment, the name Charlie Munger resonates as a stalwart figure, renowned for his unparalleled wisdom and strategic acumen. As the indispensable right-hand man to Warren Buffett, Munger played a pivotal role in shaping Berkshire Hathaway into an unparalleled powerhouse in the investment world. However, with profound sadness, the financial community mourns the passing of this investing luminary at the age of 99. Munger’s legacy extends far beyond his years, leaving an indelible mark on the principles of value investing and rational decision-making. This article delves into the extraordinary life of Charlie Munger, celebrating the enduring impact he leaves on the world of finance.

Charlie Munger: A Tribute to an Investing Luminary Whose Legacy Transcends Finance

The financial world bids farewell to an iconic figure, billionaire Charlie Munger, whose legacy as an investing sage transcends his role as Warren Buffett’s indispensable right-hand man at Berkshire Hathaway. Munger, who amassed a fortune long before joining forces with Buffett, passed away at the age of 99, leaving behind a profound impact on the principles of value investing. His strategic acumen and unwavering wisdom guided Berkshire Hathaway to its present stature. Beyond finance, Munger’s diverse pursuits included real estate law, chairmanship of the Daily Journal Corp., philanthropy, and architecture. This article explores the extraordinary life of Charlie Munger, commemorating his enduring contributions to the world of finance and beyond.

Born on January 1, 1924, in Omaha, Nebraska, Munger’s early years were shaped by the values of family, prudence, and moral duty. His journey took him from the University of Michigan to the Army Air Corps during World War II and eventually to Harvard Law School, where he graduated magna cum laude in 1948. Munger’s career in real estate law and the founding of Munger, Tolles & Olson in 1962 marked the beginning of his impressive entrepreneurial endeavors. Notably, he co-founded the hedge fund Wheeler, Munger & Co., managing investments while concurrently practicing law.

In the intricate tapestry of Munger’s life, his partnership with Warren Buffett in 1959 became a pivotal thread. The two like-minded individuals, thinking “so much alike that it’s spooky,” formed an unbreakable bond. Their melding of minds centered on the principles of value investing, fundamentally evaluating companies based on their long-term fundamentals. Munger’s influence on Buffett led to a shift from acquiring so-so companies at cheap prices to focusing on high-quality businesses at fair valuations.

One of Munger’s landmark moves was persuading Buffett to approve Berkshire’s acquisition of See’s Candies in 1972, a decision that proved immensely profitable. The shift in investment strategy showcased Munger’s belief in acquiring businesses with enduring value rather than relying on the hope of short-term profits. This shift, coined the “lollapalooza effect” by Munger, demonstrated the confluence of factors driving investment psychology.

Beyond his financial prowess, Munger was a notable philanthropist and architect. His multimillion-dollar donations to educational institutions, coupled with his insistence on incorporating his building designs, reflected a unique blend of generosity and architectural passion. Munger’s contributions extended to his role as a board member at the Harvard-Westlake prep school, where he advocated for practical considerations like larger bathrooms for women during construction.

Munger’s personal life, marked by two marriages and the tragic loss of a son to leukemia, showcased his resilience and commitment. His enduring 54-year marriage to Nancy Barry yielded a legacy of philanthropy, including a substantial contribution to Stanford University for the Munger Graduate Residence. Munger’s perspective on a long and happy life emphasized simplicity, advocating for principles such as avoiding envy, staying cheerful in the face of troubles, and dealing with reliable people.

As the financial world reflects on the passing of Charlie Munger, it celebrates a life rich in wisdom, innovation, and generosity. Munger’s imprint on the principles of value investing, his contributions to business, and his multifaceted pursuits make him an enduring figure in the annals of finance. This article pays tribute to the remarkable journey of Charlie Munger, an investing genius whose legacy extends far beyond the realm of numbers and portfolios.

Navigating Success: Lessons from Charlie Munger’s Long-Term Value Investing Legacy for Traders

Traders can glean invaluable lessons from the extraordinary success of investor Charlie Munger, a luminary in the world of finance. One paramount takeaway is the emphasis on long-term value investing over short-term gains. Munger’s influence on Warren Buffett shifted the focus from acquiring mediocre companies at rock-bottom prices to identifying and investing in high-quality businesses at reasonable valuations. This strategic pivot underscores the importance of patience and a comprehensive understanding of a company’s fundamentals.

Munger’s adept handling of See’s Candies acquisition in 1972 serves as a compelling example. By convincing Buffett to approve the purchase despite modest annual earnings, Munger demonstrated the wisdom of investing in businesses with enduring value. Traders can learn that success often lies in recognizing the intrinsic worth of a company, looking beyond immediate financial metrics to assess its long-term potential.

Furthermore, Munger’s commitment to continuous learning and intellectual curiosity stands out as a guiding principle. His partnership with Buffett was characterized by a shared commitment to expanding their knowledge base. Traders can adopt this approach by staying informed about market trends, economic indicators, and evolving investment strategies. In a dynamic market environment, a thirst for knowledge becomes a powerful tool for making informed decisions.

Munger’s resilience and ability to navigate through changing market conditions also offer critical lessons. His conservative approach during the 2020 pandemic, prioritizing liquidity over impulsive investments, underscores the importance of risk management and a disciplined investment strategy. Traders can benefit from this approach by maintaining a balanced portfolio, considering risk factors, and avoiding knee-jerk reactions to market fluctuations.

In essence, traders can draw inspiration from Charlie Munger’s success by embracing a long-term perspective, recognizing the value of continuous learning, and navigating markets with resilience and discipline. Munger’s legacy serves as a beacon for those seeking sustainable success in the complex and ever-evolving world of trading and investment.

Comments (0 comment(s))