Navigating the Treacherous Path: Understanding the Perils of Volatile Stocks and Their Impact on Trading Strategies

In the ever-changing realm of stock trading, where financial fates can swiftly shift, the temptation of volatile stocks frequently captivates investors in pursuit of rapid profits. However, behind the facade of potentially high returns lies a treacherous path filled with risks and uncertainties. This article delves into the realm of unstable stocks, shedding light on the perils they present and why they may not be the best avenue for trading. By exploring the inherent volatility, unpredictability, and lack of fundamental stability that characterizes such stocks, we aim to equip investors with a deeper understanding of the potential pitfalls they may encounter.

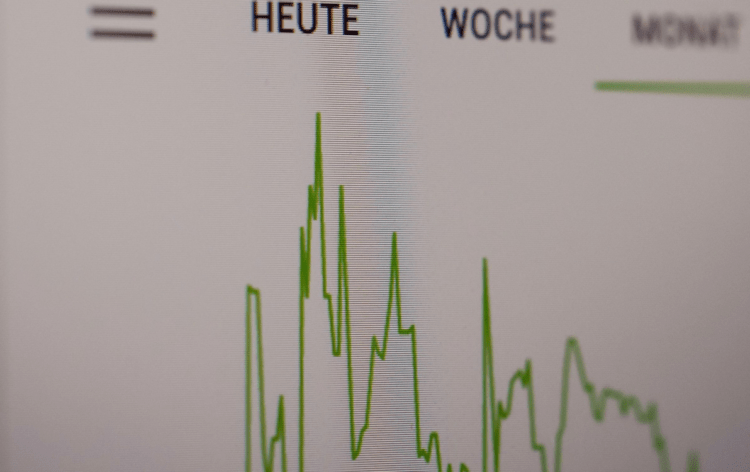

Top Unstable Stocks Today

Sun Pharma

Sun Pharma, a prominent pharmaceutical company, has gained notoriety as one of the most volatile stocks in the market. While its volatility may present opportunities for substantial gains, it also exposes investors to significant risks. Several factors contribute to the inherent instability of Sun Pharma’s stock. Firstly, the pharmaceutical industry is highly susceptible to regulatory changes, patent expirations, and clinical trial outcomes, which can trigger substantial price fluctuations.

Additionally, Sun Pharma operates in a global market, making it vulnerable to currency exchange rate fluctuations and geopolitical risks. Furthermore, the company’s financial performance and stock price can be influenced by drug approvals, litigation outcomes, and shifts in consumer demand. These factors, coupled with the inherent unpredictability of the healthcare sector, make investing in Sun Pharma a risky proposition.

Suzlon Energy Ltd

Suzlon Energy Ltd, a renewable energy company, is renowned for its highly unstable stocks. Several factors contribute to the volatility and inherent risks associated with investing in Suzlon Energy. Firstly, the company operates in the renewable energy sector, which is subject to rapid technological advancements, policy changes, and fluctuations in government incentives. Additionally, Suzlon Energy operates in a highly competitive market, facing challenges such as pricing pressures, supply chain disruptions, and intense competition from both domestic and international players.

Furthermore, the company has a significant debt burden, which adds to the uncertainty and amplifies the risks for investors. The combination of these factors, along with the inherent volatility of the renewable energy sector, makes Suzlon Energy stocks highly unpredictable and not suitable for risk-averse investors seeking stability in their investments. Thorough research and a high tolerance for risk are prerequisites for those considering investing in Suzlon Energy.

Garden Silk Mills

Garden Silk Mills, a textile company, has experienced a surge in volatility, making it an unattractive choice for many traders. Several factors contribute to its unpredictable stock performance. To begin with, the textile sector demonstrates significant sensitivity to a multitude of external influences, encompassing fluctuations in raw material costs, evolving consumer tastes, and the overall state of the global economy. Fluctuations in input costs, particularly in the case of cotton, directly impact Garden Silk Mills’ profitability, resulting in erratic stock movements. Additionally, the company’s financial health and market competitiveness have faced challenges due to increased competition from both domestic and international players.

Furthermore, the overall decline in demand for traditional textiles and the growing popularity of synthetic alternatives have adversely affected Garden Silk Mills’ market position. The combination of these factors has made it a risky investment, prompting many traders to seek more stable options with better growth prospects. Given its volatile nature and uncertain market conditions, traders often opt for more reliable and less unpredictable stocks in order to minimize risk and enhance their trading strategies.

Madhucon Projects Limited

Madhucon Projects Limited, a prominent infrastructure development company, is known for its highly volatile stocks. The volatility can be attributed to various factors that make it a risky choice for traders. Firstly, Madhucon Projects operates in the construction and infrastructure sector, which is subject to uncertainties and fluctuations influenced by government policies, regulatory changes, and economic conditions. Any alteration in infrastructure development plans or delays in project execution can significantly impact the company’s financial performance and stock price.

Additionally, the company’s dependency on contracts and tendering processes exposes it to risks such as project cancellations, cost overruns, and liquidity constraints. Moreover, the capital-intensive nature of the industry, coupled with potential delays in project payments, adds to the unpredictability. The overall cyclicality of the infrastructure sector and its vulnerability to economic downturns further contribute to the volatility of Madhucon Projects’ stocks. Traders seeking stability and lower risk often choose more predictable sectors, making Madhucon Projects a less preferred option for trading.

KM Sugar Mills

The stock prices of KM Sugar Mills may be unstable due to several factors. Firstly, the sugar industry is influenced by various external factors such as government policies, weather conditions, and global market trends. Changes in government regulations, subsidies, or import/export policies can significantly impact the profitability and market demand for sugar companies like KM Sugar Mills.

Adverse weather events like droughts or excessive rainfall can affect crop yields, leading to fluctuations in sugar prices and subsequently impacting the stock prices of sugar mills. Furthermore, the overall volatility of the stock market can contribute to the instability of KM Sugar Mills’ stock prices. Investor sentiment, market speculation, and macroeconomic factors can cause rapid fluctuations in stock prices, especially for companies in industries sensitive to market conditions. It is important for investors to closely monitor these factors and conduct thorough analysis before making investment decisions in the sugar industry, considering the inherent volatility associated with such companies.

Why You Should Avoid Such Unstable Stocks to Trade

Investing in unstable stocks is generally considered risky and not the best idea for several reasons. Firstly, unstable stocks often exhibit high volatility, with their prices fluctuating significantly in short periods. The inherent instability in this scenario creates a challenging environment for anticipating future price fluctuations, resulting in heightened uncertainty for investors. Consequently, making well-informed investment choices becomes a formidable task, as it becomes arduous to rely on fundamental analysis or dependable indicators.

Furthermore, unstable stocks are more susceptible to market manipulation and speculation. Their prices can be easily influenced by rumors, news, or sudden market trends, which can result in sharp price swings unrelated to the company’s underlying fundamentals. Such unpredictable movements can lead to substantial financial losses for investors. To mitigate the risks associated with unstable stocks, investors can consider several strategies. Diversification is key: spreading investments across a range of stable and well-established companies from different industries can help balance the impact of volatility in individual stocks.

Conducting comprehensive research and analysis plays a pivotal role in this context. Prior to making any investments, it is imperative for investors to diligently assess the company’s financial stability, market positioning, competitive edge, and the expertise of its management team. Analyzing historical performance, growth prospects, and industry trends can provide valuable insights.

Setting clear investment goals and time horizons is also important. Investing in unstable stocks should be approached with a long-term perspective, as short-term fluctuations may be unpredictable. Additionally, setting stop-loss orders can help limit potential losses by automatically selling the stock if it reaches a specified price. Also, their knowledge and experience can assist in making more informed investment decisions and managing risk effectively.

Comments (0 comment(s))