Shining a Light on Palladium: Exploring the Dynamics and Future of Commodity Trading

In the vast realm of commodity trading, palladium stands as a unique and intriguing asset. As a precious metal with diverse industrial applications, the trading of palladium has garnered considerable attention from investors and traders alike. This article delves into the world of palladium commodity trading, shedding light on its market dynamics, price drivers, and the opportunities it presents. From its pivotal role in automotive catalytic converters to its limited global supply, we explore the factors that contribute to the high value and frequent trading of palladium. With a focus on profitability, risk factors, and the overall market landscape, this article provides a comprehensive overview of the captivating world of palladium commodity trading.

What You Should Know About Palladium Commodity Market

Palladium has gained significant popularity on the commodity market, particularly due to its unique properties and wide-ranging industrial applications.

Palladium finds its primary trading platforms in major commodity exchanges, including renowned institutions like the New York Mercantile Exchange (NYMEX) and the London Metal Exchange (LME). These prominent exchanges serve as hubs for global traders and investors to engage in the trading of palladium, taking advantage of the well-established infrastructure and liquidity offered by these platforms.

These exchanges provide a platform for global traders and investors to participate in palladium trading and capitalize on its price movements. The increasing demand for palladium stems from its critical role in catalytic converters, which help reduce emissions in automobiles. Stricter environmental regulations worldwide have propelled the need for palladium, as automakers seek to comply with emission standards. This heightened demand has led to a surge in trading activity surrounding palladium contracts.

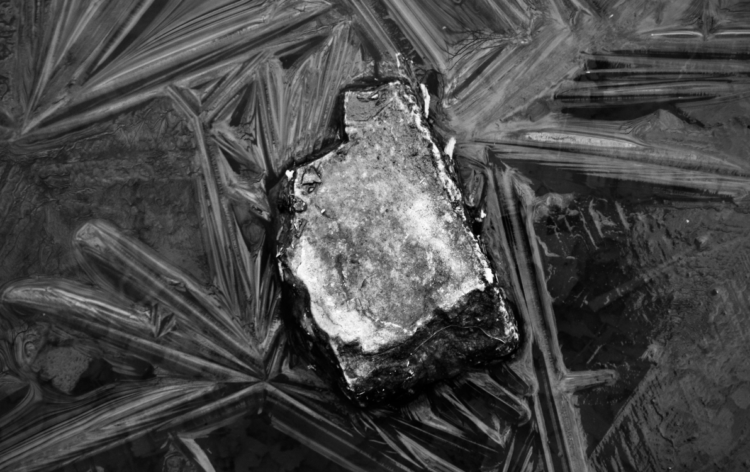

Palladium’s reputation as both profitable and expensive is rooted in its limited global supply and strong market demand. Palladium production is concentrated in a few countries, with Russia and South Africa being the primary sources. The scarcity of palladium, coupled with its high demand from industries such as automotive, electronics, and jewelry, contributes to its elevated price.

In recent years, the palladium commodity market has witnessed notable trends. One trend is the sustained increase in palladium prices, driven by supply constraints and robust demand. For example, in 2020, palladium prices reached record highs, surpassing even the price of gold. This upward trend has attracted the attention of investors looking to capitalize on potential profits.

Additionally, the palladium market has experienced volatility, influenced by factors such as geopolitical tensions, mining disruptions, and shifts in automotive regulations. Traders monitor these factors closely to identify trading opportunities and mitigate risks.

Another noteworthy trend in the palladium market is the emergence of exchange-traded funds (ETFs) focused on palladium. These investment instruments enable investors to access palladium price movements without the need for direct ownership of the physical metal. The popularity of palladium ETFs has grown as investors seek diversification and a convenient way to participate in the palladium market.

Furthermore, sustainability and environmental concerns have become prominent trends in the palladium market. As the demand for cleaner energy and emission reduction intensifies, there is increasing emphasis on responsible sourcing and sustainable practices within the industry. Traders and investors are paying attention to the ethical and environmental aspects of palladium production, and this trend is likely to shape the future dynamics of the market.

In conclusion, palladium has gained popularity on the commodity market, driven by its industrial applications and limited supply. It is predominantly traded on major exchanges, with increasing demand from industries such as automotive driving its market activity. The profitability of palladium stems from its scarcity and strong market demand. The market has experienced price surges, volatility, and the emergence of palladium-focused ETFs. Additionally, sustainability concerns are becoming a significant trend in the palladium market. These factors combine to make palladium a captivating and dynamic commodity for traders and investors alike.

Future of Palladium Commodity Trading

The future of palladium commodity trading holds both opportunities and challenges. The metal’s popularity is expected to remain high, driven by various factors influencing its demand and market dynamics.

One significant factor is the ongoing push for stricter emissions standards and environmental regulations globally. As governments continue to prioritize reducing pollution and carbon emissions, the demand for palladium in catalytic converters is likely to persist. The increasing adoption of electric vehicles, which still require palladium in their catalytic converters, further underscores the long-term demand for the metal.

Furthermore, palladium’s role in other industries, such as electronics and jewelry, contributes to its continued popularity. The expanding middle class in emerging economies, particularly in Asia, drives the demand for consumer goods that utilize palladium, such as smartphones and high-end jewelry.

In terms of market trends, volatility is expected to remain a characteristic of palladium trading. Factors such as geopolitical tensions, supply disruptions, and shifts in automotive regulations can significantly impact the metal’s price. Traders will continue to monitor these factors closely and seek opportunities to capitalize on price movements.

Additionally, the development of sustainable practices and responsible sourcing in the palladium mining industry is likely to influence the future of palladium commodity trading. As environmental and ethical concerns become more prominent, both investors and consumers are placing heightened importance on responsibly sourced commodities. Palladium producers who prioritize sustainability and ethical practices may find themselves in a favorable position, gaining a competitive edge in the market.

It is important to note that unforeseen developments, such as advancements in alternative technologies or changes in market dynamics, can influence the future of palladium commodity trading. For example, the emergence of new catalyst materials or shifts towards hydrogen fuel cell vehicles could potentially impact the long-term demand for palladium.

In conclusion, the future of palladium commodity trading appears promising due to sustained demand from automotive, electronics, and jewelry industries, as well as ongoing environmental regulations. While challenges and uncertainties exist, the metal’s unique properties and diverse applications are expected to maintain its popularity and relevance in the commodity market. Traders and investors will need to stay attuned to market trends, regulatory changes, and sustainability practices to navigate the evolving landscape of palladium commodity trading successfully.

Comments (0 comment(s))