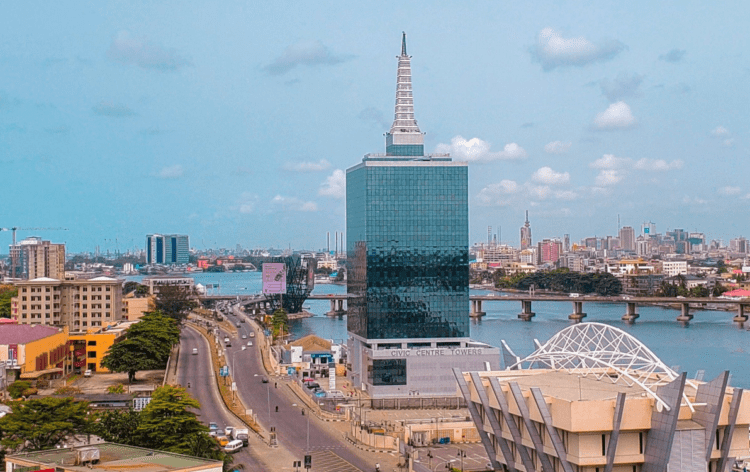

Unlocking Profit Potential: Exploring the Top Traded Stocks in Nigeria’s Stock Market

In recent years, the Nigerian stock market has witnessed a remarkable transformation, reflecting the country’s evolving economic landscape. As Africa’s largest economy and home to a vibrant business community, Nigeria has become a captivating hub for investors seeking profitable opportunities. With a diverse range of sectors, including banking, telecommunications, energy, and agriculture, the Nigerian stock market offers a vast array of investment choices. This article serves as an introductory guide to understanding the Nigerian stock market, exploring its unique characteristics, key players, regulatory framework, and the factors that influence stock prices.

TOP Traded Stocks to Consider in Nigeria

Three of the most traded stocks in Nigeria are Dangote Cement, Guaranty Trust Bank (GTBank), and Nigerian Breweries. These stocks have gained significant popularity and consistently attract high trading volumes for several reasons.

Dangote Cement

Dangote Cements’ popularity stems from its dominant market position, extensive production capacity, and strong financial performance. With Nigeria’s rapidly growing population and infrastructure development, the demand for cement is consistently high, ensuring a steady revenue stream for the company. Dangote Cement’s reputation for quality, efficient operations, and the visionary leadership of its founder, Aliko Dangote, have further bolstered investor confidence, making it a favored choice among traders.

Guaranty Trust Bank (GTBank)

GTBank is one of Nigeria’s leading financial institutions, renowned for its innovative banking services, robust risk management, and customer-centric approach. The bank has consistently delivered impressive financial results, demonstrating resilience and stability in a volatile market. GTBank’s popularity among investors can be attributed to its strong track record of profitability, solid corporate governance, and commitment to technological advancements in the banking sector. Its stock is known for its liquidity, attracting both local and international investors.

Nigerian Breweries

Nigerian Breweries is the pioneer and largest brewing company in Nigeria, responsible for popular brands like Star Lager, Gulder, and Amstel Malta. The stock’s popularity stems from Nigeria’s vibrant consumer market and the country’s deep-rooted culture of socializing and celebration. Nigerian Breweries’ consistent dividend payments, strong brand recognition, and wide distribution network have made it a preferred choice for long-term investors seeking steady returns. Additionally, the company’s ability to adapt to changing consumer preferences and introduce innovative products has contributed to its enduring popularity.

These three stocks offer investors exposure to key sectors driving Nigeria’s economy, including construction, finance, and consumer goods. Their popularity can be attributed to a combination of factors, including market dominance, solid financial performance, brand recognition, and the overall growth potential of the sectors they operate in. However, it’s important for investors to conduct thorough research, consider risk factors, and consult with financial advisors before making investment decisions in these or any other stocks.

Considerable Trends on the Nigerian Stock Market

The Nigerian stock market has experienced several notable trends in recent years, shaping its dynamics and influencing investor sentiment. Here are some of the main trends observed in the Nigerian stock market along with prospects for the future:

- Increased Market Participation: The Nigerian stock market has witnessed a surge in market participation, with both domestic and foreign investors showing growing interest. This trend can be attributed to the improving business environment, regulatory reforms, and increased transparency. Furthermore, technological advancements have made it easier for investors to access the market, contributing to increased trading volumes.

- Sectoral Performance: The performance of different sectors in the Nigerian stock market has varied. Sectors such as banking, consumer goods, and telecommunications have remained resilient, benefiting from the country’s growing population, increasing consumer spending, and expanding digital infrastructure. Conversely, sectors like oil and gas have faced challenges due to volatile oil prices and regulatory uncertainties. Going forward, sectors aligned with Nigeria’s economic diversification efforts, such as agriculture, renewable energy, and technology, hold promising prospects.

- Foreign Investor Sentiment: Foreign investor sentiment has been a significant driver of the Nigerian stock market. While the market experienced a decline in foreign portfolio inflows during periods of economic volatility, recent reforms and improved macroeconomic stability have attracted renewed interest. Ongoing efforts to enhance investor protection, deepen market liquidity, and improve corporate governance are expected to bolster foreign investor confidence in the future.

- Regulatory Reforms: The Nigerian stock market has undergone significant regulatory reforms aimed at improving transparency, investor protection, and market efficiency. The Securities and Exchange Commission (SEC) has implemented measures to enforce stricter compliance standards, enhance market surveillance, and streamline listing processes. These reforms are expected to attract more issuers and investors, promoting the growth and stability of the market.

Looking ahead, the Nigerian stock market holds promising prospects. The country’s robust economic growth potential, increasing diversification efforts, and favorable demographics provide a solid foundation for long-term investment opportunities. Continued infrastructure development, expanding consumer markets, and favorable government policies aimed at attracting foreign direct investment are expected to drive future market growth. However, risks such as political instability, regulatory uncertainties, and global market volatilities should also be considered when assessing the prospects of the Nigerian stock market.

Comments (0 comment(s))