Analysis of The Impact of Geopolitical Events on Commodity Prices

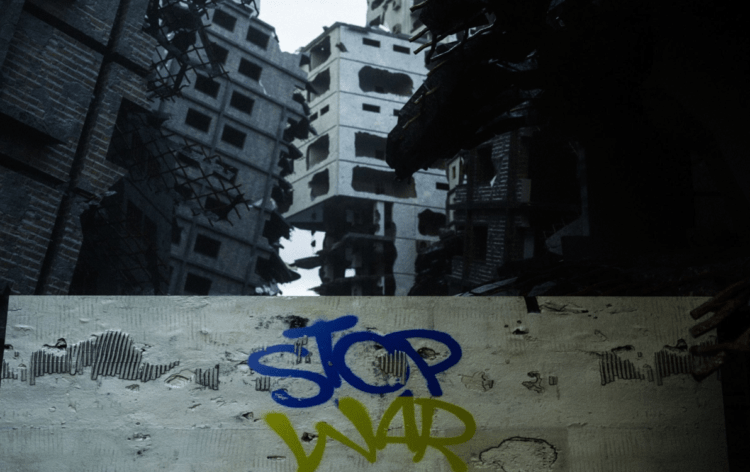

Geopolitical events are crucial factors that can significantly impact financial markets and traders, especially in the commodities sector. Geopolitical events refer to political, social, and economic events that occur within a country or between countries that can affect the markets’ performance. These events can range from geopolitical tensions, wars, trade agreements, political instability, or natural disasters.

For traders, keeping up with geopolitical events and their potential impact on financial markets is critical for making informed investment decisions. In the commodities market, geopolitical events can cause supply chain disruptions, price volatility, and changes in demand for certain commodities. Therefore, traders need to stay informed about global geopolitical events that can influence commodity prices.

In this essay, we will focus on the impact of geopolitical events on the commodities market, discussing how these events affect supply and demand, and the measures traders can take to mitigate the risks.

Geopolitical Events and Their Impact on Commodities

Geopolitical events can have a significant impact on the commodities market, as they can affect supply and demand, leading to price volatility and supply chain disruptions. In this section, we will discuss how geopolitical events impact commodities and provide examples of three significant geopolitical events that have recently impacted the commodities market.

Geopolitical events can cause supply chain disruptions and lead to a decrease in supply and an increase in prices. For example, political instability or civil unrest in a country can disrupt production and transportation, leading to a decrease in supply and an increase in prices. Similarly, natural disasters, such as floods, hurricanes, or wildfires, can damage production facilities and transportation infrastructure, leading to a decrease in supply and an increase in prices.

Such events also determine changes in demand. For example, trade tensions or the imposition of tariffs can reduce demand for commodities, leading to a decrease in prices. On the other hand, changes in regulations can cause raising demand as well as prices on the specific type of assets.

Three significant geopolitical events that have recently impacted the commodities market include the US-China trade war, the COVID-19 pandemic, and the unrest in the Middle East.

The US-China trade war began in 2018 when the US imposed tariffs on Chinese goods, leading to a decrease in demand for commodities such as soybeans and oil. China retaliated by imposing tariffs on US goods, leading to a decrease in demand for US agricultural products. The trade tensions between the two countries caused significant price volatility in the commodities market, leading to losses for traders who were not adequately hedged.

The COVID-19 pandemic had a significant impact on the commodities market, causing supply chain disruptions and a decrease in demand for certain commodities. Lockdowns and travel restrictions disrupted production and transportation, leading to a decrease in supply and an increase in prices for some commodities such as copper and iron ore. Conversely, the decrease in demand for crude oil due to reduced travel and industrial activity led to a significant drop in oil prices, causing losses for traders who were not adequately hedged.

The unrest in the Middle East has also had a significant impact on the commodities market, particularly oil prices. This was a long process which meantime disrupt oil production and transportation, leading to a decrease in supply and an increase in prices. For example, tensions between the US and Iran in 2019 led to a temporary disruption in oil supply from the Middle East, causing a significant increase in oil prices.

In conclusion, geopolitical events can significantly impact the commodities market, leading to price volatility and supply chain disruptions. Traders need to stay informed about global geopolitical events to make informed investment decisions and mitigate the risks posed by these events. The US-China trade war, the COVID-19 pandemic, and the unrest in the Middle East are just a few examples of significant geopolitical events that have impacted the commodities market.

What Commodities Traders Can Do with Geopolitical Risks?

Commodities traders can take advantage of geopolitical events and their impacts by staying informed and taking timely actions. By keeping track of global geopolitical events, traders can identify potential opportunities and take advantage of market volatility caused by these events. For example, if there is an imminent supply disruption due to geopolitical tensions, traders can buy the affected commodity futures or options before the price spikes, and then sell them later at a profit when the supply disruption occurs.

Traders can also mitigate and reduce risks posed by geopolitical events by diversifying their portfolios and using risk management strategies. Diversification can help traders spread their risks across different commodities, reducing their exposure to any single commodity or region. Risk management strategies such as stop-loss orders and hedging can also help traders minimize losses and protect their investments in the event of unexpected price movements.

Small steps that traders can take to stay informed and mitigate risks include setting up news alerts for relevant geopolitical events, using technical analysis tools to monitor price movements, and staying up to date with industry reports and analyses. Additionally, traders can utilize risk management tools provided by their brokers, such as stop-loss orders and limit orders, to manage their risk exposure.

In conclusion, commodities traders can take advantage of the impact of geopolitical events by staying informed and taking timely actions. By diversifying their portfolios and using risk management strategies, traders can mitigate and reduce the risks posed by these events. Small steps such as setting up news alerts, using technical analysis tools, and utilizing risk management tools provided by brokers can help traders stay informed and protect their investments.

Comments (0 comment(s))