AstraZeneca Shares Surge 3% as Company Reaches Deal with EU

During the Tuesday trading session on the London stock exchange, AstraZeneca shares have climbed by 3%, rising from 8,281p to 8,539p.

The move came after the reports that the firm’s representatives have signed the deal with the European Union. According to the agreement, the company will provide for European countries 400 million vaccines of COVID-19. Here it is worthwhile to mention that the vaccine itself is still under the clinic trials. Therefore, it is very much subject to regulatory approval, before it can be distributed and applies to patients.

According to Proactive Investors, the British Pharmaceutical giant has increased its production capacity recently, as a result of which the company is able to produce 2 billion doses of vaccine. There are currently at least 10,000 volunteers who are participating in the trials, in order to speed up the process.

If the trial ends with success and regulators approve the vaccine, their delivery can begin by the end of 2020. As Proactive investors suggest, AstraZeneca is not intending to make any profit from the sale and distribution of those vaccines. However, just like in the case of the company’s deal with US and UK authorities, the governments will cover the research production costs of this vaccine.

Are AstraZeneca Shares Overvalued?

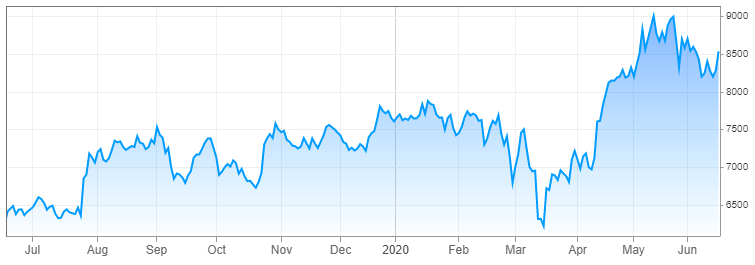

AstraZeneca shares have risen steadily during the second half of 2019. By July of that year, the stock traded near 6,400p. After 6 months of steady appreciation, the company shares reached 7,600p mark before the end of 2019.

source: cnbc.com

After the arrival of the COVID-19 pandemic, the stock market crashed during March 2020. This also had some noticeable effects on AstraZeneca shares as well. During the middle of the month, they were already down to 6,221p. However, despite this setback, during the next three months, the stock steadily regained the lost ground and incredibly, before the end of April, it has already surpassed February 2020 highs. By June the shares have reached 8,500p level.

Obviously, those recent moves turned out to be very profitable for AstraZeneca’s investors, since they achieved a significant capital appreciation. The only downside to this process is the fact that now company shares became quite expensive.

The latest Earnings per Share (EPS) indicator of the company stands at 115.7p. This means that the Price to Earnings (P/E) ratio of the firm is around 73.8. This clearly indicates that at current prices the shares are very overvalued. In fact, at current earnings, the stock price has to go all the way down to 2,314p, in order for it to become reasonably priced, with a P/E ratio at 20.

It goes without saying that this is not going to happen anytime soon, therefore it likely that the shares might remain deep into the overvalued territory for the foreseeable future. On the other hand, considering the current extreme overvaluation, AstraZeneca stock might not be the best choice for growth portfolios, since the upside potential of those shares is quite limited.

AstraZeneca as Dividend Income Investment

Despite being a British company, AstraZeneca determines its payouts to shareholders in US dollars. It is paid twice, during March and September. Since 2015 the company maintains an annual dividend of $2.80 per share, the equivalent of those payments in British Currency was £2.183 per share. Many income portfolio managers do include AstraZeneca stock in their portfolios. At current prices, the dividend yield of the stock is at 2.55%.

According to the stocknews.com, the payout ratio of the firm currently stands at 50.8%. This suggests that the company is well-positioned to maintain its payouts to shareholders. So at this stage, those payments are relatively safe, unless the management decides to reverse its entire dividend policy, which very unlikely, at least for the foreseeable future.

Despite this upside, at the moment this stock might not be the best choice for income investing. There are at least 3 arguments to support this line of reasoning:

- In any case, there is no guarantee for the security of the investment principal in the stock market. There is a distinct possibility that investors might lose a significant portion of their net worth due to the bear market. This is even more likely with AstraZeneca stocks, due to its current extreme overvaluation. The stocks of successful companies do tend to appreciate over time. However, in the case of this company, it might take several years, before the firm’s earnings could justify the purchasing of this stock at those elevated prices. Instead, by investing in AstraZeneca shares, investors might face sharp correction and face significant losses.

- Despite its payouts to shareholders, we can see that AstraZeneca does not have a progressive dividend policy. Instead, the management left the rate unchanged for 6 years now. This means that the company payouts are now losing their purchasing power. Obviously, this can be a serious long term problem for income investors, especially those who are looking forward to using stock market dividends for retirement purposes.

- The current dividend yield of 2.55% is not that impressive compared to some other dividend-paying stocks. Many companies with a solid track record of returning money to shareholders and increasing those payouts consistently for several decades, now have their shares with 3% to 5% dividend yields. Many of those stocks have their P/E ratios close to 20 and consequently are much more reasonably priced, than AstraZeneca shares. So it makes very little sense to invest in an overvalued stock with 2.55% yield, when one can easily find 3.5% dividend-yielding security, with plenty of potential on the upside.

In conclusion, we can say that AstraZeneca is indeed a successful dividend-paying company. Its stock has delivered an incredible level of capital appreciation for its investors. However, due to recent overvaluation, the upside potential of the AstraZeneca shares remain very limited. In fact, it is highly likely that at some stage the stock might experience a sharp correction and fall significantly from the current levels. Therefore, it might not be a good choice for growth portfolios. The current dividend yield of the stock is obviously better than near-zero interest rates, however the company payouts to shareholders remained stagnant for 6 years, so there is not much potential for the upside either.

Comments (0 comment(s))