Fresnillo plc (FRES) Shares are up 11% as Silver Price Surges

As the markets opened on Monday in London, the shares of Fresnillo PLC (FRES) are rising by more than 11%. They closed at 737.60p, however today they are all the way up to 820.60p. One of the possible reasons for this dramatic move is the rise in silver prices. Today on the commodities market, the price of this precious metal has risen by 4%, trading at $17.29 per ounce. This hardy just one movie in isolation. During the last 30 days, the silver price rose by more than 9%.

Fresnillo plc is well-positioned to benefit from this latest market trend. The company is the largest producer of silver from ore. The company owns and operates 3 gold and silver mines in Mexico. The name of the firms comes from the city of Fresnillo, which is located quite close to those production sites.

According to the 2019 official report, the company’s annual revenue was $2.270 billion, 1.2% higher than a year ago. At the same time, the Profit from continuing operations was near $171.7 million. This was problematic since this number was more than 66% lower than back in 2018. As the report states, this was mostly the result of higher production costs and depreciation.

The result of this decline was the management’s decision to cut payouts to shareholders. In 2019, the company paid 14.5p per share dividend, compared to 27.4p per share a year ago. So here we are dealing with a 47% cut in the payments to shareholders, which might be quite disappointing for investors.

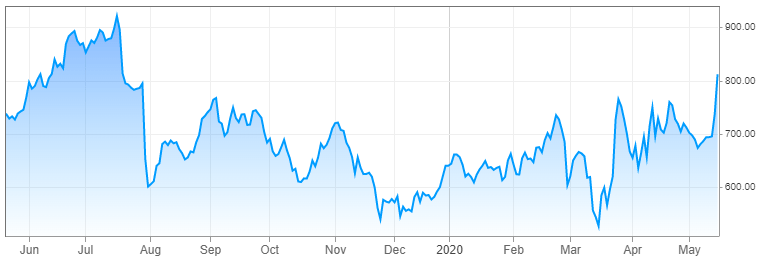

Recent Frensillo Stock Performance

source: cnbc.com

As we can see from this chart, FRES was very volatile during the last 12 months. The stock did reach get above 900p level back in July 2019. Yet, before the end of the year, it fell to near 540p. This was followed by several months of the recovery period. This process was disrupted by the stock market crash in March 2020. However, unlike many other components of FTSE 100, FRES was quick to regain its losses and resume the uptrend. Nowadays it has reached 820p.

This recent recovery seems quite encouraging. On the other hand, on the valuation side, things might not look as promising. The earnings per share of the company stand at 27.70p. Consequently, the price to earnings ratio is near 29.6. The current dividend yield is close to 1.8%. Both of those indicators suggest the stock might be overvalued at the moment.

The company did pay some decent payouts to shareholders over the years. However, it has to be mentioned, that dividend payments have been very volatile, rising, and falling in the line with the firm’s profitability. So this kind of instability might not be very attractive for income investors.

Despite those drawbacks, there are some positives as well. The price of silver has risen by more than 15% over the last 12 months. Consequently, if this trend on the commodities markets persists, then Fresnillo might have an easier time increasing its revenues and profits. So since physical precious metals do not pay any interest, mining stocks might be one alternative for investors interested in the commodities market.

Comments (0 comment(s))