India Surpasses Hong Kong, Becomes Seventh-Largest Stock Market: Unraveling the Dynamics and Implications

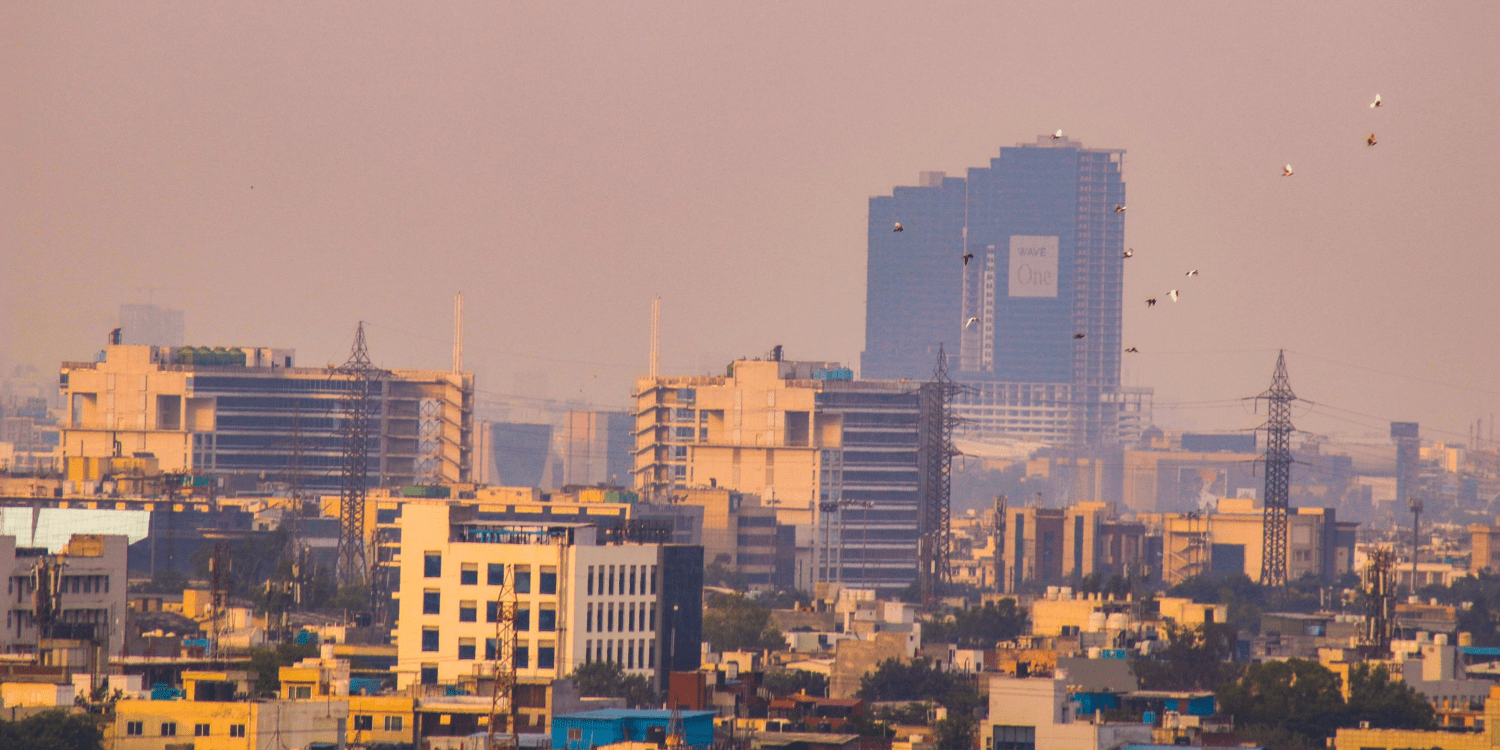

In a remarkable financial ascent, India has surpassed Hong Kong, securing its position as the world’s seventh-largest stock market. This pivotal milestone underscores India’s dynamic economic growth and the resilience of its financial sector. As the nation advances on the global stage, investors and analysts are closely monitoring the implications of this development. The burgeoning Indian stock market reflects the country’s robust economic policies, burgeoning industries, and increasing investor confidence. This article delves into the factors propelling India’s rise, analyzes the key sectors driving the market surge, and explores the potential ramifications for global investors navigating the evolving landscape of international finance.

India Surpasses Hong Kong, Emerges as World’s Seventh-Largest Stock Market

In a significant shift, India has outpaced Hong Kong to claim the position of the world’s seventh-largest stock market, signaling growing optimism about the country’s economic trajectory. As per information provided by the World Federation of Exchanges, the market capitalization of the National Stock Exchange of India attained $3.989 trillion by the conclusion of November, surpassing that of Hong Kong, which stood at $3.984 trillion.

India’s Nifty 50 index has experienced a remarkable ascent, reaching record highs and posting a 16% increase year-to-date, poised for an eighth consecutive year of gains. In a notable disparity, the Hang Seng index in Hong Kong has experienced a 17% decrease this year, marking its fourth consecutive year of declines and positioning it as the least favorable performer among major Asia-Pacific equity markets.

The Indian market’s standout performance in the Asia-Pacific region can be attributed to increased liquidity, heightened domestic participation, and positive shifts in the global macro environment, characterized by falling U.S. Treasury yields. Anticipations among analysts suggest that in the upcoming general elections in India next year, there is a likelihood of the ruling nationalist Bharatiya Janata Party securing a victory. Such an outcome has the potential to instigate a positive market sentiment in the initial months of the year, driven by expectations of policy continuity.

HSBC strategists have identified banking, healthcare, and energy as the best-positioned sectors for the coming year. On the flip side, industries like automobiles, retail, real estate, and telecommunications appear to be in a favorable position for the year 2024. Meanwhile, fast-moving consumer goods, utilities, and chemicals are categorized as less favorable. In a differing scenario, Hong Kong’s economic prospects have encountered difficulties, as Moody’s downgraded its outlook from stable to negative. This downgrade was attributed to financial, political, institutional, and economic connections with mainland China. The Hang Seng index in the city is projected to register a fourth consecutive year of declines, solidifying its status as the weakest performer in the Asia-Pacific region.

The Hong Kong government has revised its GDP growth outlook for 2023 from the initial 4%-5% forecast to a more modest 3.2%. Geopolitical tensions and stringent financial conditions have continued to impact investments, exports, and consumer sentiment in the region, prompting economists at DBS to predict a soft landing for the economy in 2024, with a growth rate around 2%. China, on the other hand, has set a growth target of 5% for 2023, with hopes high following a 4.9% GDP growth in the third quarter. As the world’s second-largest economy, China’s performance remains a key factor influencing the broader economic landscape.

Navigating Opportunities: Implications of India’s Stock Market Surge Over Hong Kong for Traders

India’s ascent to becoming the world’s seventh-largest stock market, surpassing Hong Kong, holds profound implications for stock traders, presenting a spectrum of new opportunities and considerations. The shift in market dynamics creates an environment where astute traders can capitalize on emerging trends, sectoral shifts, and geopolitical factors.

Traders should closely monitor the sectors identified by HSBC as best-positioned in India for the coming year: banking, healthcare, and energy. For instance, banking stocks may experience heightened activity amid policy expectations tied to the upcoming general elections. Healthcare companies, buoyed by increased domestic participation and positive global macro dynamics, offer traders potential investment avenues. Similarly, energy stocks may see increased interest as India’s economic growth continues.

Conversely, the challenges faced by Hong Kong’s stock market, with Moody’s downgrade and economic headwinds, necessitate a cautious approach. Traders might consider reevaluating their portfolios, diversifying away from sectors facing headwinds, and exploring opportunities in more resilient industries. Moreover, the soft landing predicted for Hong Kong in 2024 offers traders an opportunity to strategically position themselves for potential market rebounds, especially in sectors linked to mainland tourism, such as retail and catering.

As India’s market takes center stage, traders should remain agile, adapting to evolving scenarios and leveraging information about the political landscape, economic policies, and global trends to make informed decisions. The juxtaposition of India’s ascent and Hong Kong’s challenges provides a nuanced backdrop for traders to navigate, offering both risks and opportunities in the dynamic world of international finance.

Comments (0 comment(s))