Intel Corp Down 10%, Data Center Sales Down More Than Forecasted

Recent movements on the market show that the prices of the shares of Intel Corp are down more than 10%. At the time of writing, the prices of the shares of the company stand at 48.20. Experts are talking about a number of reasons, one of them is the ongoing Covid-19 pandemic, which has affected many different industries around the world.

Experts are claiming that one of the main reasons for the downtrend of the shares of the company might be the fact that the sales of the data-center went down more than it was expected in the third quarter. It has resulted in the prices of the shares of the company coming down as much as 10%.

The company has reported a huge decline in profit and revenue, especially compared to the previous year. Although the full-year forecast of the company is slightly more positive, there are missing expectations for the fourth quarter. This has resulted in the situation that we see on the market today.

The company has also recently announced that they would be delaying the release of the next-generation 7-nanometer chips, the delay is until at least late 2022, which is very much far away. While Intel’s stocks are going down, its rivals are up. Both AMD and Nvidia were up slightly.

Some of the best Stocks Brokers on the market have reported that recently, investors have been having a very hard time deciding which stocks to buy and sell. This confusion is caused by the Covid-19 pandemic, which is making it very hard for investors to predict anything.

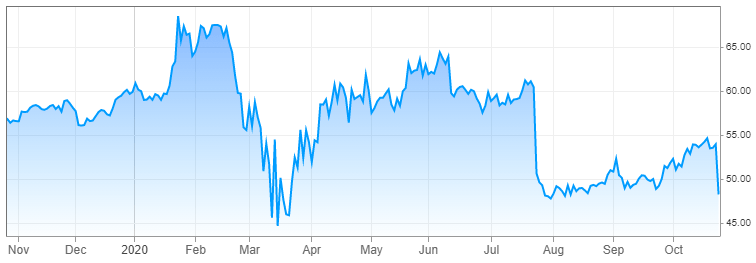

Changing Prices of Intel

The chart shown above indicates the price change of tech-giant, Intel. The chart shows the prices of the company from November of 2019 to today. As can be seen, the first month of 2020 was very much successful for the company, however, as the Covid-19 started spreading around the world and as different economies stopped, the prices of the shares of the company went down significantly.

The impact of Covid-19 is very well illustrated in the mountain charts shown above. It shows how the prices have been changing after the first hit of the pandemic as well. The company recovered from the damage of the virus very fast, but, after a few months of success, the prices of the shares of the company went down a lot in August. At the end of July, the prices of the shares of the company dropped as much as 20.2^, this news followed the report of the second-quarter earnings of the company. This was the time when the company announced the delay of its 7nanometer chips as well.

Today, the fall that the company is experiencing, experts are saying that is caused by the same thing. This time, the prices have been following very fast as well. For the past few downs, the prices of the shares of the company have shrunk a lot after a few days of the uptrend. Some experts on the market are claiming that the downtrend of the company might continue in the future as well.

The Covid-19 pandemic had a huge impact on many markets around the world. Currently, as the second wave of the pandemic is affecting most of the countries around the world, the prices of many companies are going down again. Many countries around the world have already announced to be adopting new restrictions to fight against the virus, but, on the other hand, there also are some countries that have decided to fight against the spread of the virus without any restrictions.

The prices of the shares of the company are down for the last five days as well. The change of the last five days of the shares of the company is as much as -11%. The Market Capitalization of the company is 204,994,592. The Price/Earnings ratio of the company stands at 10.15, which means that the prices of the company are considerably low. Generally, if the P/E ratio is below 20, the price of the shares are considered to be good. The company is also paying annual dividend and yield, which stands at 1.32, which equals 2.74%.

Intel Corporation is one of the biggest technology companies around the world. The company is based in California and is an American multinational corporation. It represents the largest and highest-valued chip manufacturer on the market, based on the revenue of the company. The company has been around for many decades now and has created many revolutionary products. Intel has invested a lot in new products for many decades, which has resulted in the rapid growth of the computer industry.

Comments (0 comment(s))