InterContinental Hotels (IHG) Stock Jumps by 11% on Upbeat Forecasts

As the trading opened on the London Stock exchange, the shares of the InterContinental Hotel Group (IHG) have surged by 11%. It closed at 3,647p on Friday, however today it has reached 4,046p, a level not seen since March, 2020.

As several countries in the world lifted travel restrictions, the company is able to open more of its hotels and receive an increasing number of visitors. The Stock has also benefited from the upbeat analyst forecasts. According to Directors Talk, the consensus suggests that IHG has a 21.3% upside potential in the foreseeable future. If this prediction turns out to be true, the stock can surge all the way up to 4,900p. This would erase all of the losses of IHG after the outbreak of the COVID-19 pandemic. However, it goes without saying that all of this depends upon the financial performance of the company.

Speaking about this subject, in 2019 the group posted annual revenue of $4,627 million. The firm also reported a $630 million operating profit and paid a total of $1.285 per share dividend, 10% higher than a year ago.

Despite its success in 2019, the company is now facing very challenging times. According to the first-quarter report, the Revenue per Available room fell by 24.9%, in March this decline reached 55%. The management expects that this measure will be 80% lower in April, so this will have a negative effect on 2nd quarter results as well. In total the firm had to close 1,000 hotels during the hight of COVID-19 pandemic. Regardless of those setbacks, the group still managed to open 6,000 new rooms.

In response to those challenges, the board has withdrawn its recommendation of a final dividend of 85.9 cents per share. According to the official company website, this measure can save approximately $150 million.

Did Recent Surge in Price Made IHG Expensive?

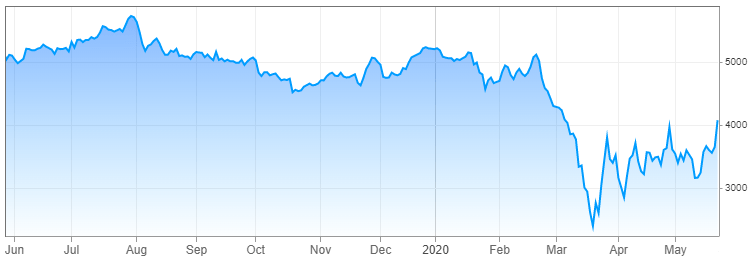

source: cnbc.com

The stock mostly fluctuated between 4,500p to 5,500p from June 2019 to February 2020. However, beginning from the end of the winter, IHG fell dramatically, at one point even going as low as 2,161p. Despite those setbacks, unlike many other hotel and airline stocks, the shares did eventually regain most of their losses, currently trading just above 4,000p mark. The stock still needs to rise by 20% in order to return to February levels.

According to CNBC, the current price to earnings ratio of the stock is near 25.3. This points to the fact that the recent surge in prices made IHG moderately overvalued. It is also unclear, whether the board would restore dividend payments in the foreseeable future. The recent challenging financial data, suggests that this might be unlikely. Consequently, at the moment this stock might not be the best option for income investors.

It is clear even from the company management itself, that the 2nd quarter results will show more losses in revenue. However, as more countries lift travel restrictions, the overall picture can improve over time. If the firm manages to restore its occupant rates back to 2019 levels, this can go a long way for improving the financial performance of the IHG. Still, nowadays it is to early to make those predictions, before the actual figures come out.

Comments (0 comment(s))