Shares of Ford Company up following Biden’s vehicle push

The shares of an industry-leading company, Ford Motor Company, are up. This follows the news from last week regarding the breakout of the General Motors Company. According to the market experts, the stock has entered the first uptrend since 2013. The shares of the company are selling at a more than a two-year high. On Thursday, experts highlighted the electric vehicle investment push from the new administration of President Joe Biden.

Experts are saying that the clean-energy focus of Biden will support changes in the car industry. This change was already coming, but the recent moves in the USA will further support it. In mid-day trading Thursday, the prices of the shares of Ford were selling 6.6% higher to change hands at $11.58 each.

This stands as the highest price in more than two years and it amounts to a total of 75% increase in the last six months. Biden recently promised to build as many as 550,000 electric vehicles charging stations in the country, saying that it would create as much as 1 million new jobs through investment in clean energy research.

According to the data from leading stock brokers, the company’s market share is about 14.1% in the United States and about 7% in Europe. The company was among the biggest risers of the S&P 500 on Tuesday, Wednesday, and Thursday.

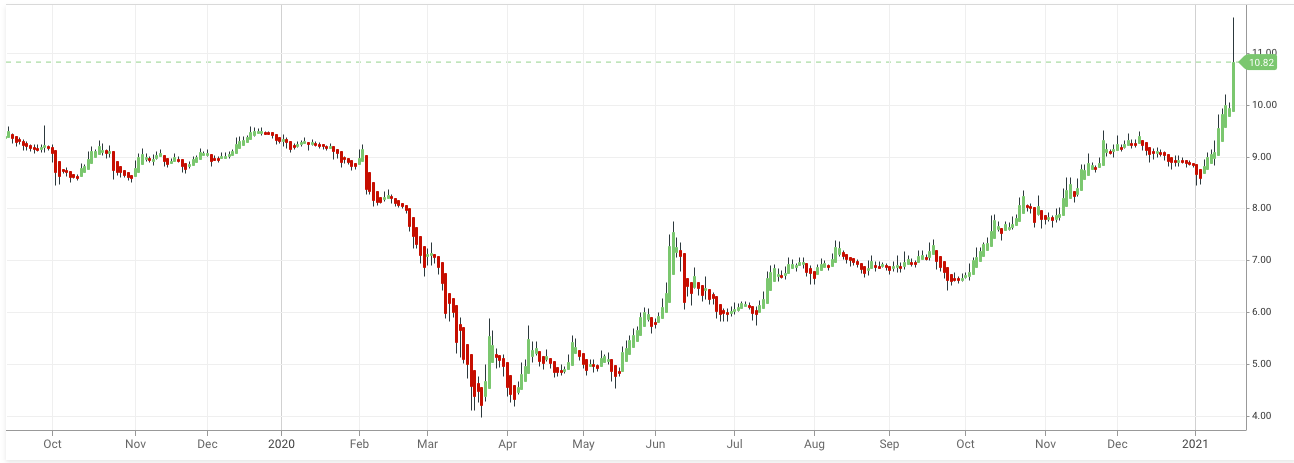

Prices of Ford’s shares

The Heiken Ashi chart shown above indicates the price changes of the shares of the company starting from October 2019 to today. As you can see from the chart, the prices of Ford’s stocks dropped significantly in early 2020. It was a period when the Covid-19 first spread around the world.

The prices continued dropping in March as well, hitting all-time lows in the middle and near the end of the month. This period is known as the Stock Market Crash 2020, which was caused by the Covid-19 pandemic. The shares of many companies dropped significantly during this period.

While there are some companies that managed to get back to the pre-pandemic prices, others failed to do so. One of them was the Ford Motors Company. The company struggled throughout 2020, having a very unstable year. In recent years, many things have affected the increasing prices of the shares of the company.

One of the reasons for this is the last week’s news from General Motors Company’s breakout. Also, Ford holds a stake in electric vehicle start-up, which just raised $2.65 billion in funding, which has added to this uptrend.

Another reason is the recent decision of President Joe Biden regarding the electric vehicle push. The President, as we have already noted, has pushed for the clean-energy. This new project will largely focus on the accelerated changes in the auto industry, resulting in creating many new jobs and supporting the companies in the field.

At the time of writing, the shares of the company are selling for about $11,73, which is about a 7.09% increase. The total market capitalization of the company in $K stands at 43,205,716, while annual sales are around $155,900 M. As for the Price/Earnings ratio of the company, it is 52,74, which indicates slightly overpriced shares. Generally, it is much better to buy stocks that have a P/E ratio of around 20.

Ford Motor Company manufactures automobiles under its Ford and Lincoln brands. The company is headquartered in Dearborn and employs more than 190,000 people. It represents an American multination automaker and was founded by Henry Ford. It sells automobiles and commercial vehicles. It was founded 117 years ago, in 1903.

Comments (0 comment(s))