Simon Property Group dips as Fitch downgrades ratings to A-

Simon Property Group is one of the leading American commercial real estate companies. The company stands to be one of the largest retail real estate investment trusts in the country and the largest shopping mall operator in the United States.

The movements in the chart show that the shares of the company were among the biggest fallers of the S&P 500, the prices were down 4.83% down, selling at $89.37. The shares of the company opened at 93.70 and high a high of $93.80 during the trading day, however, it quickly came down to a low of $89.00.

The company is the second-largest real estate investment trust in the United States. The portfolio of the company includes an interest in 207 properties, such as 106 traditional malls, 69 premium outlets, 14 Mills centers, four lifestyle centers, and 14 other retail properties. The portfolio of the company averaged $693 in sales per square foot over the past 12 months.

The company is also known to be owning a 21% interest in Klepierre, which is a European retail company that has investments in shopping centers in 16 countries. Although the shares of the company were down during the trading day, the five-day change of the prices of the shares shows an 8.24% increase.

The market capitalization of the company is at $27,346,328K, and outstanding shares of the company are at 305,990K. Also, the Price/Earnings ratio of the company is 9.48, which means that it is a very good price to buy. Generally, the good P/E ratio is around 20. For annual dividend and yield paid by the company, it stands at 5.54%, which is a very good number.

However, before making any decisions, make sure to use some indicators to make sure that you are doing everything right.

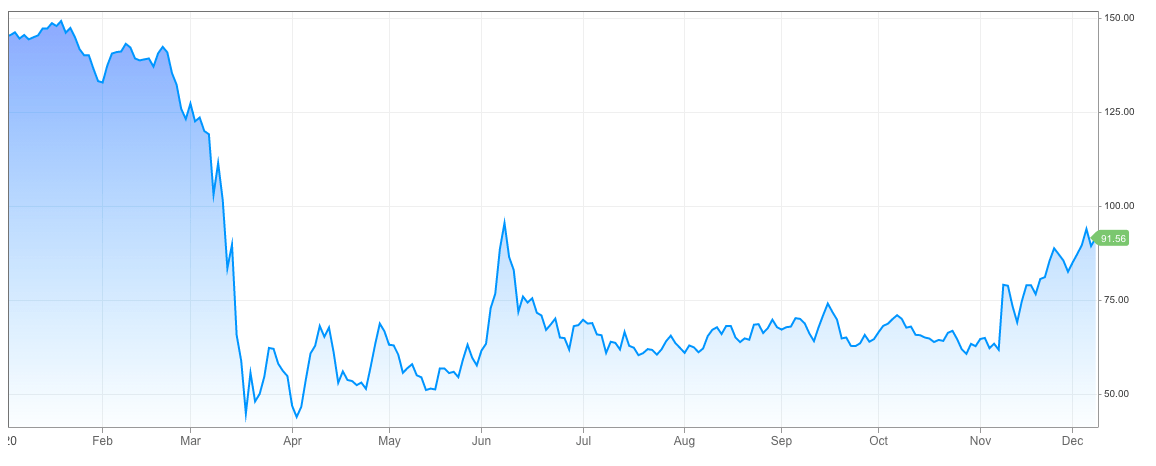

Price changes of Simon Property Group

The mountain chart shown above indicates the price changes of the shares of the leading retail company in the United States, Simon Property Group. As you can see from the chart above, the prices of the shares of the company started to go down during the first wave of the coronavirus pandemic.

In the middle of March, you can see that the prices of the shares were lower than the third of what it was before the pandemic. As a result of the spread of the coronavirus, shares of many companies went down significantly in March. This period is called the 2020 Stock Market Crash, because, prices of every stock decreased significantly.

The prices of the shares of Simon Property Group increased a little bit in March and April, however, it would quickly go down. In June, the prices hit the highest point since the pandemic started. However, over the summer, the prices were not that high. During the end of November, the prices started dropping again.

Soon after, thanks to the hopes for the Covid-19 pandemic, the prices started increasing. Recently, Fitch rating downgraded the rating of Simon Property Group from A to A-. Fitch also said that the outlook of the company was negative. The main driver of the decision of Fitch was the pandemic, which has affected the industry very much.

Fitch also noted that it expects that the company’s tenant improvement costs and recurring capex will increase. It also noted that the company will invest more than $1 billion every year in redevelopment activity, which will start in 2021.

The Covid-19 had a huge impact on many markets around the world. When the virus first started spreading, stocks of the majority of companies started decreasing very fast. Even today, most of the companies are struggling to get back to pre-Covid-19 conditions.

Recently, the hopes for the Covid-19 vaccine have increased very much around the world. The UK has already approved the vaccine and people already started receiving it. Several companies are waiting for the EU to approve the vaccine as well. Many experts are saying that the vaccine will help the situation of the stocks.

As of today, because of the second wave of the pandemic, most of the countries have still announced the restrictions on movements and are in lockdowns. This is further affected the situation that different industries were in. Because of the second wave of Covid-19, the shares of many companies around the world dropped.

As of today, the number of Covid-19 infected people is increasing very fast around the world and the vaccine could be a huge help for today’s situation.

Simon Property Group is a very famous company which was formed in 1993. The company operates five retail real estate platforms, regional malls, premium outlet centers, The Mills, community/lifestyle centers, and international properties. The company mostly operates in North America and Asia but also has representatives in Europe. It employs more than 5,000 people.

Comments (0 comment(s))