Turkish economy analysis and predictions for 2018

There were legitimate fears about the Turkish economy last year in light of political instability. However, the economic performance of the current financial year echoes their Deputy Prime Minister’s words. Mehmet Simsek said that the Turkish economy is ‘resistant to the shocks’, which might just be true.

How has the Turkish economy been doing so far?

The 2017/18 fiscal year for the Turkish economy started in April, and the GDP grew by 5.1% in the first quarter. Although this was lower than what the experts predicted, 5.3%, it was still remarkable. In fact, such growth was so impressive it was only surpassed by China and India. Among the G-20, only few economies managed to achieve GDP expansion above 5%. It was also thanks to an increase in investment at the highest pace since 2015 that the GDP expanded so.

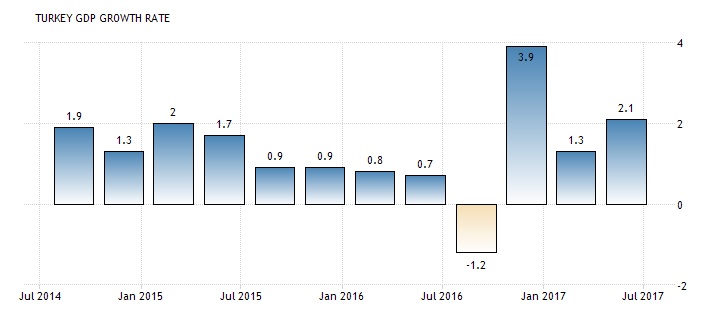

In the second quarter, GDP growth rate was at 2.1%, exceeding what the experts expected to be 1.8% growth. Considering that this is the same economy that had sunk into negative digit GDP growth in the previous fiscal year, the Turkish economy has truly weathered the shocks.

The expansion in Turkey’s GDP was slowed mainly due to reduced government spending. The Turkish government had sharply reduced its spending on goods and services from the first quarter of the fiscal year. Perhaps that was in an attempt to reduce the rate of inflation, which had risen double digits in the first quarter. In the first quarter, spending had grown by 9.7% through several projects including both the public and private sectors. Then in the second quarter the spending by government fell 4.3%.

Inflation remained above 10% for the entire first quarter, reaching a high of 11.87% in April. Even though the cuts in government spending helped to bring down inflation to 9.79% in July, increasing investment had an adverse effect. Gross capital formation rose by 9.5% compared to a year earlier, probably because of increasing political stability. Then as inflation rose, so did consumer spending, which grew by 3.2% compared to the previous period a year earlier. Meanwhile, unemployment rates were steady at 10.2% in June despite a steady decline from 13% in January.

How will the Turkish economy fare in 2018 and beyond?

In many ways, the Turkish economy has managed to bounce back from the previous year’s problems. However, one sector that may be in trouble is tourism. Capital inflows from foreign visitors to Turkey have been at a decade-low of $18.2 billion, yet the sector is crucial to Turkey’s economy. Turkey’s Culture and Tourism Ministry reported that European tourist numbers had yet to recover, but now American tourists numbers may drop through the floor. Both the US and Turkey have stopped processing non-settlement visas, which will hurt the tourism sector in Turkey further. This issue has rekindled a rivalry between the two countries that may have serious consequences. Nevertheless, it is possible the conflict will not drag on into 2018, but it has already affected Turkey’s economy negatively.

On trade, the customs union deal between Turkey and the EU helped the former raise its export figures and decreasing imports. Now an update to this deal is being proposed, which might strengthen the Turkish economy even further. The update will include agriculture and service sectors, and that may have a positive impact on their economy.

In September, the Central Bank of Turkey held interest rates at 8% just as the markets had expected. The next announcement is expected later this month, and again the markets anticipate the rates will stay at 8%. Despite the rising inflation rates, it is unlikely that interest rates will be raised further anytime soon, especially now in light of the positive GDP expansion.

Overall, the forecast for Turkey’s economy remains mixed, but that is not unlikely with Turkey. There are still several uncertainties here and there, but the positive outlook is still greater, and we should see further record growth in 2018. The recently launched Medium Term Program (MTP) will be essential for further growth.

Comments (0 comment(s))